Forex trading strategies for using the Harmonic Bullish Butterfly pattern: Techniques for trading with the Harmonic Bullish Butterfly pattern.

In the ever-evolving world of forex trading, traders continuously seek effective strategies to gain an edge in the market. One such powerful tool is the Harmonic Bullish Butterfly pattern. This pattern, a subset of harmonic trading, is a fusion of art and science, combining mathematical ratios with market psychology. In this article, we delve into the intricacies of the Harmonic Bullish Butterfly pattern and provide techniques for harnessing its potential in the forex market.

Table Content

I. Understanding the Harmonic Bullish Butterfly Pattern

II. Techniques for Trading with the Harmonic Bullish Butterfly Pattern

1. Pattern Recognition and Confirmation

2. Fibonacci Confluence

3. Entry and Stop-loss Placement

4. Target Profits with Fibonacci Extensions

5. Risk Management and Position Sizing

6. Combine with Other Indicators

7. Practice Patience and Discipline

III. Real-world Example: Putting it All Together

IV. Footnote

Understanding the Harmonic Bullish Butterfly Pattern

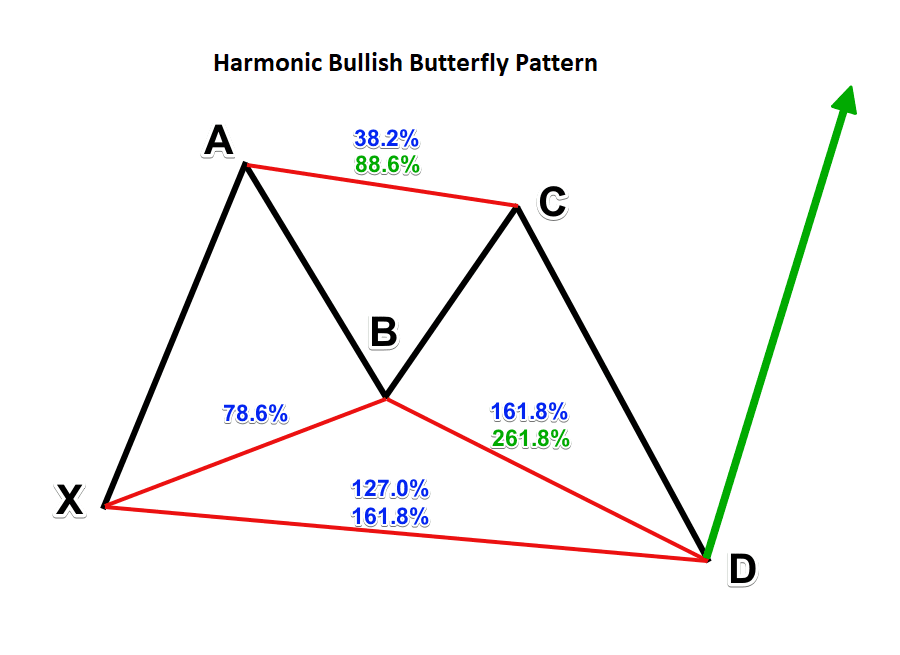

The Harmonic Bullish Butterfly pattern is a distinct formation that signals potential trend reversals. It is characterized by five pivot points, labeled X, A, B, C, and D. These pivot points align with Fibonacci retracement and extension levels, forming the foundation of the pattern. Here's a breakdown of each point:

- X: The starting point of the pattern, representing the initial high (for a bearish pattern) or low (for a bullish pattern) in the market.

- A: This point follows a retracement from X and corresponds to the 38.2% Fibonacci level.

- B: The next pivot after A, aligning with the 78.6% retracement of the XA leg.

- C: Positioned after B, C coincides with the 38.2% retracement of the AB leg.

- D: The terminal point of the pattern, D aligns with the 127.0% extension of the XA leg.

The completion of the Bullish Butterfly pattern at point D suggests a potential bullish reversal in the market. The pattern's effectiveness lies in the convergence of these key points, which forms a geometric shape resembling a butterfly.

Techniques for Trading with the Harmonic Bullish Butterfly Pattern

Mastering the Harmonic Bullish Butterfly pattern involves a combination of technical analysis, risk management, and psychological discipline. Here are some techniques to consider when incorporating this pattern into your forex trading strategy:

1. Pattern Recognition and Confirmation

The first step is to identify the formation of the Harmonic Bullish Butterfly pattern. Utilize charting software to locate the pivot points and draw the pattern. However, it's crucial not to jump the gun. Wait for confirmation through candlestick patterns, trendline analysis, or other technical indicators that suggest a potential reversal at point D.

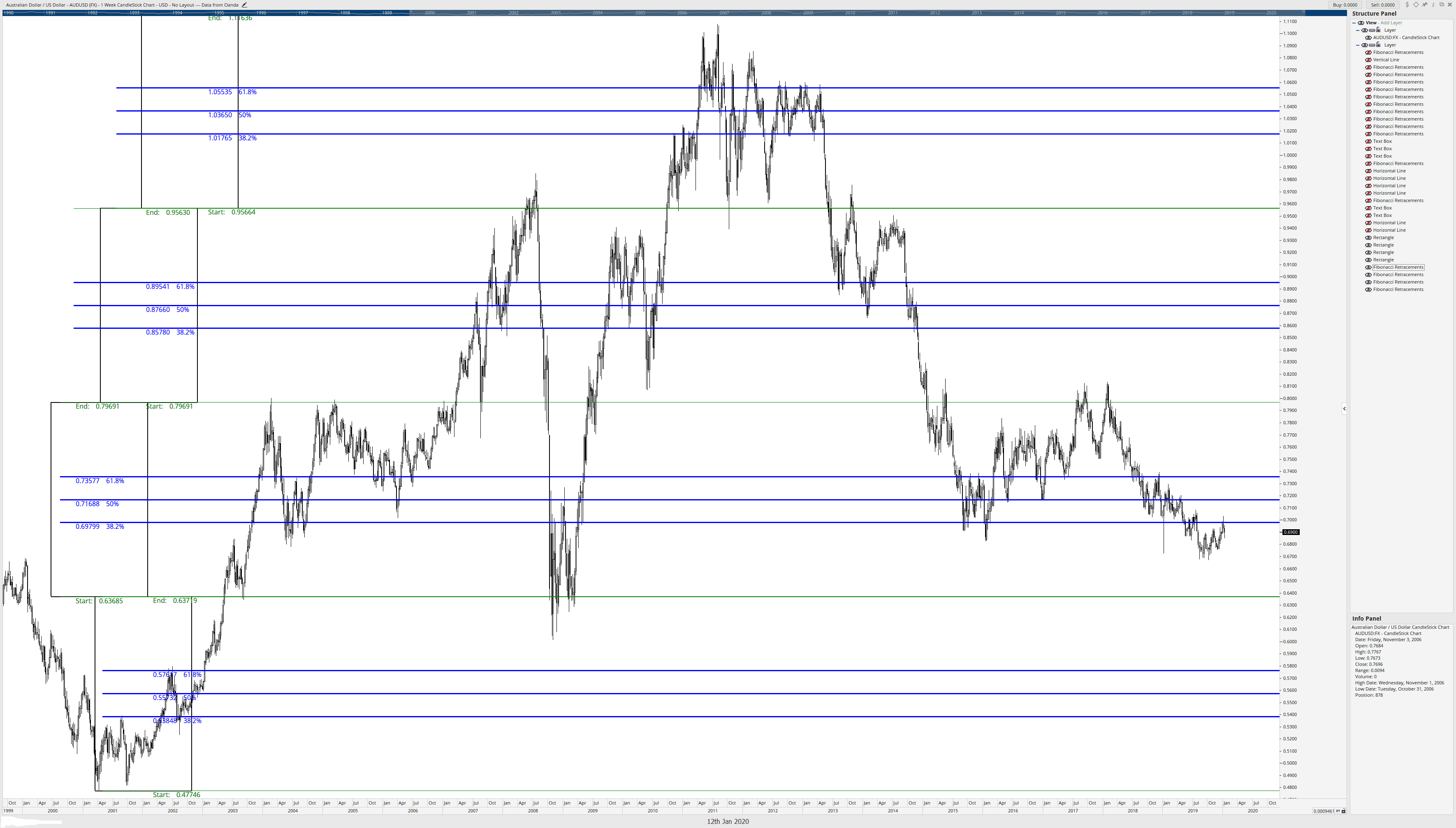

2. Fibonacci Confluence

The magic of the Harmonic Bullish Butterfly pattern is in the Fibonacci ratios. When the pattern's pivot points align with other Fibonacci levels (such as those from previous swings or trendlines), it adds strength to the trade setup. Look for these confluence zones to enhance your confidence in the pattern's potential success.

3. Entry and Stop-loss Placement

Determining entry and stop-loss levels is pivotal for managing risk. Consider placing your entry slightly above point D, confirming that price action validates the reversal. Your stop-loss should be positioned below point X or an appropriate support level, safeguarding your capital in case the trade goes against you.

4. Target Profits with Fibonacci Extensions

Fibonacci extensions offer valuable guidance for setting profit targets. The 1.618 and 2.618 extensions of the XA leg are common choices. However, some traders also employ a trailing stop strategy, allowing profits to accumulate as the trend develops.

5. Risk Management and Position Sizing

No strategy is complete without effective risk management. Never commit more than a reasonable portion of your trading capital to a single trade. Position sizing techniques, such as the 2% rule, can help ensure your longevity in the market, even if a trade doesn't go as planned.

6. Combine with Other Indicators

Enhance your trading strategy by complementing the Harmonic Bullish Butterfly pattern with other technical indicators. Moving averages, RSI, MACD, and trendlines can provide additional insights to confirm or filter potential trade opportunities.

7. Practice Patience and Discipline

Impulsiveness has no place in trading. Be patient and wait for a complete pattern and confirming signals before entering a trade. Moreover, adhere to your trading plan, avoiding emotional decisions that can lead to losses.

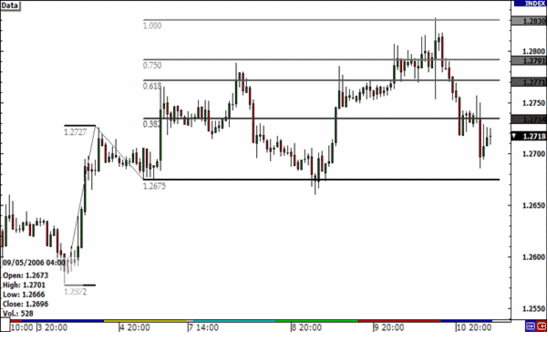

Real-world Example: Putting it All Together

Imagine you're observing the EUR/USD currency pair, and you identify a potential Harmonic Bullish Butterfly pattern forming. After thorough analysis, you decide to enter the trade at 1.1200 (slightly above point D), with a stop-loss at 1.1150 (below point X).

Your analysis also indicates a Fibonacci confluence zone around the 1.1200 level, adding to your confidence. To manage your profits, you set a target at the 1.618 extension of the XA leg, which aligns with a significant resistance level.

As the trade progresses, you keep a watchful eye on the price action and consider trailing your stop to lock in profits as the market moves in your favor.

Footnote

The Harmonic Bullish Butterfly pattern offers traders a comprehensive approach to identifying potential bullish reversals in the forex market. By merging mathematical ratios with market psychology, this pattern equips traders with a well-defined structure for making informed trading decisions. Remember, no strategy guarantees success, and thorough practice, back testing, and continuous learning are essential to master this intricate pattern. As with any trading strategy, exercise caution, and always prioritize risk management to navigate the dynamic landscape of forex trading.

Discussion