Forex trading strategies for using the Harmonic Bullish Butterfly 5-0 pattern: Techniques for trading with the Harmonic Bullish Butterfly 5-0 pattern.

In the ever-evolving landscape of forex trading, traders are constantly seeking ways to identify reliable patterns that can guide their decision-making processes. One such powerful tool is the Harmonic Bullish Butterfly 5-0 pattern, which has gained popularity among both novice and experienced traders for its ability to provide actionable insights into market trends. This article delves into the intricacies of the Harmonic Bullish Butterfly 5-0 pattern and offers techniques for effectively incorporating it into your forex trading strategy.

Table Content

I. Understanding the Harmonic Bullish Butterfly 5-0 Pattern

II. Techniques for Trading with the Harmonic Bullish Butterfly 5-0 Pattern

1. Identify the Key Points

2. Confirming Fibonacci Levels

3. Utilize Additional Confluence

4. Wait for Price Action Confirmation

5. Set Risk Management Parameters

6. Practice Patience

7. Back testing and Paper Trading

8. Stay Informed and Adapt

III. Footnote

Understanding the Harmonic Bullish Butterfly 5-0 Pattern

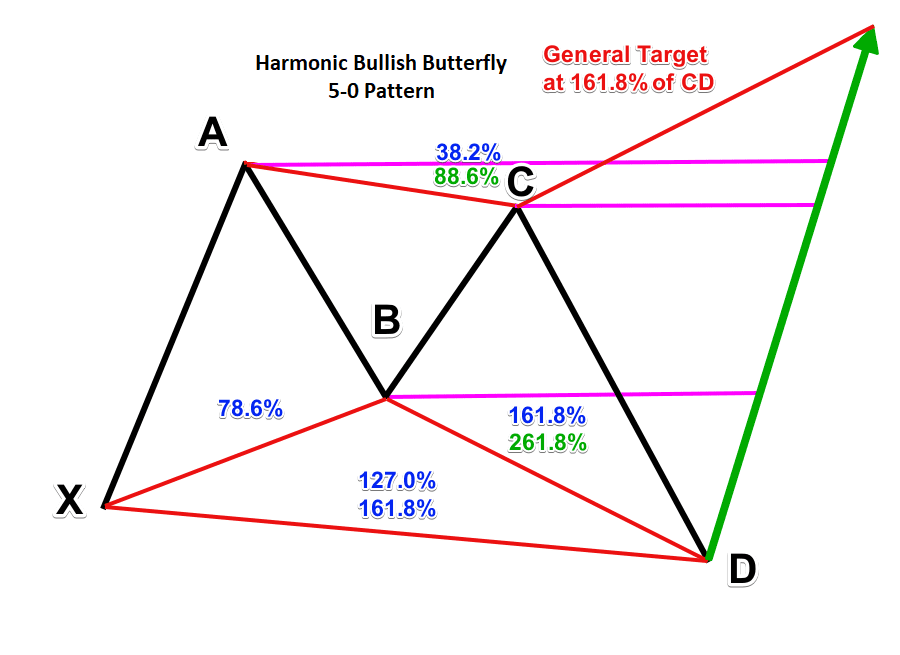

The Harmonic Bullish Butterfly 5-0 pattern is a unique blend of Fibonacci retracement and extension levels, geometric patterns, and wave analysis. This pattern identifies potential reversal points within the forex market, particularly during times of trend exhaustion or impending trend reversal. The pattern comprises a series of price swings and retracements that ultimately form a distinct shape resembling a butterfly, signaling a potential bullish reversal.

The five points that define the Harmonic Bullish Butterfly 5-0 pattern are labeled X, A, B, C, and D. The pattern typically begins with a strong price movement, followed by retracements that correspond to key Fibonacci levels. These retracements, labeled XA, AB, and BC, help traders identify potential entry points for their trades. The pattern concludes with a final move from point D, representing the potential reversal zone.

Techniques for Trading with the Harmonic Bullish Butterfly 5-0 Pattern

1. Identify the Key Points: The first step in trading the Harmonic Bullish Butterfly 5-0 pattern is accurately identifying the key points (X, A, B, C, D) on the price chart. This can be accomplished using charting software equipped with drawing tools and Fibonacci retracement and extension tools. Precision is crucial at this stage to ensure that the pattern is valid.

2. Confirming Fibonacci Levels: Once the key points are established, overlay Fibonacci retracement and extension levels on the price chart. These levels act as guidelines for assessing potential reversal zones. The pattern is confirmed when the retracement levels of XA, AB, and BC align with significant Fibonacci levels, indicating the potential reversal point at D.

3. Utilize Additional Confluence: To enhance the accuracy of your trading decisions, consider incorporating other technical indicators or patterns that align with the Harmonic Bullish Butterfly 5-0 pattern. These could include trendlines, moving averages, or other harmonic patterns. When multiple indicators converge, it strengthens the validity of the pattern.

4. Wait for Price Action Confirmation: It's crucial to avoid premature entries. Wait for clear price action confirmation at point D before entering a trade. Look for bullish candlestick patterns, such as hammer, engulfing, or morning star patterns, that signal a potential reversal. This confirmation helps mitigate false signals and increases the probability of successful trades.

5. Set Risk Management Parameters: Like any trading strategy, risk management is paramount. Determine your entry, stop-loss, and take-profit levels based on your risk tolerance and the characteristics of the pattern. Utilizing trailing stops or moving your stop-loss to breakeven once the trade moves in your favor can help protect your capital.

6. Practice Patience: Not every potential Harmonic Bullish Butterfly 5-0 pattern will result in a successful trade. Exercise patience and discipline, and only execute trades that meet all your criteria. Overtrading or forcing trades can lead to losses.

7. Back testing and Paper Trading: Before deploying the Harmonic Bullish Butterfly 5-0 pattern in a live trading environment, consider back testing and paper trading. Back testing involves applying the pattern to historical price data to evaluate its effectiveness. Paper trading allows you to simulate trades without risking real capital, helping you refine your strategy.

8. Stay Informed and Adapt: The forex market is dynamic, influenced by economic events, geopolitical developments, and other factors. Stay informed about market news and adapt your trading strategy accordingly. If market conditions change, be prepared to adjust your approach.

Footnote

The Harmonic Bullish Butterfly 5-0 pattern is a versatile tool that offers traders the potential to identify bullish reversal opportunities in the forex market. By mastering the art of recognizing and trading this pattern, traders can enhance their decision-making process and potentially increase their trading success. However, it's essential to remember that no trading strategy is foolproof. The harmonic pattern should be used in conjunction with sound risk management practices and a comprehensive understanding of market dynamics. As you gain experience and refine your skills, the Harmonic Bullish Butterfly 5-0 pattern can become a valuable addition to your forex trading arsenal.

Discussion