Forex trading strategies for using the Harmonic Bullish Bat 5-0 pattern: Techniques for trading with the Harmonic Bullish Bat 5-0 pattern.

In the fast-paced world of forex trading, traders are constantly seeking effective strategies to maximize their profits while minimizing their risks. One such strategy that has gained popularity among experienced traders is the Harmonic Bullish Bat 5-0 pattern. This pattern, derived from the larger field of harmonic patterns, offers traders a structured way to identify potential market reversals and capture favorable trading opportunities. In this article, we will delve into the intricacies of the Harmonic Bullish Bat 5-0 pattern and explore techniques for effectively trading using this pattern.

Table Content

I. Understanding Harmonic Patterns

II. Trading Techniques with the Harmonic Bullish Bat 5-0 Pattern

1. Accurate Pattern Identification

2. Confirmation with Additional Indicators

3. Risk Management

4. Entry and Exit Strategies

5. Practice and Back testing

6. Patience and Discipline

7. Stay Informed

III. Footnote

Understanding Harmonic Patterns

Harmonic patterns are a type of technical analysis technique used to predict potential price reversals based on geometric structures found in price charts. These patterns are formed by specific price relationships that adhere to Fibonacci ratios and are believed to indicate potential support and resistance levels.

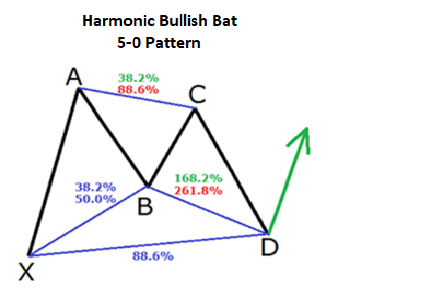

The Harmonic Bullish Bat 5-0 pattern is one such harmonic pattern that provides traders with insights into potential bullish reversals. This pattern is composed of five distinct points: X, A, B, C, and D. It is important to note that precision is crucial when identifying these points to ensure the validity of the pattern.

- X Point: This is the starting point of the pattern, representing a significant high or low in price movement.

- A Point: This point marks the first move from X and signifies the first leg of the pattern.

- B Point: The B point represents a retracement from the XA leg. It is crucial for the B point to adhere to specific Fibonacci ratios, typically the 38.2% or 50% retracement of the XA leg.

- C Point: The C point marks the extension of the AB leg and usually adheres to the 38.2% or 88.6% retracement of the XA leg.

- D Point: The final point, D, completes the pattern. It is the extension of the XA leg and is usually found at the 88.6% retracement of the XA leg.

Trading Techniques with the Harmonic Bullish Bat 5-0 Pattern

Successfully trading the Harmonic Bullish Bat 5-0 pattern requires a combination of technical analysis, risk management, and disciplined execution. Here are some techniques to consider when incorporating this pattern into your trading strategy:

1. Accurate Pattern Identification:

Before placing any trades, it's crucial to accurately identify the Harmonic Bullish Bat 5-0 pattern on the price chart. Using charting software that offers pattern recognition tools can greatly assist in this process. Traders should confirm that the points X, A, B, C, and D align with the specific Fibonacci retracement levels to validate the pattern's presence.

2. Confirmation with Additional Indicators:

While the pattern itself is a powerful tool, it's prudent to use additional technical indicators to confirm potential trade opportunities. Common indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can provide supplementary insights into the market's momentum and trend direction.

3. Risk Management:

As with any trading strategy, effective risk management is essential. Determine your risk tolerance and set appropriate stop-loss orders to limit potential losses in case the market doesn't move as expected. Risk-to-reward ratios should also be carefully considered to ensure that potential profits justify the risks taken.

4. Entry and Exit Strategies:

Timing your entry and exit points is crucial in forex trading. Consider entering the trade once the D point has been confirmed, ideally with a candlestick pattern or a reversal signal. Traders can place entry orders slightly above the D point's high to ensure confirmation of the bullish reversal. When it comes to exiting the trade, setting profit targets based on previous resistance levels or Fibonacci extensions can help secure gains.

5. Practice and Back testing:

Before implementing the Harmonic Bullish Bat 5-0 pattern in live trading, it's recommended to practice and back test your strategy on historical price data. This helps you understand how the pattern behaves under different market conditions and allows you to refine your trading plan.

6. Patience and Discipline:

Successful trading requires patience and discipline. Not every potential pattern will result in a profitable trade, so it's important to stick to your trading plan and avoid impulsive decisions. Avoid overtrading and only take positions when all the necessary criteria are met.

7. Stay Informed:

Market conditions can change rapidly, and news events can significantly impact currency prices. Stay informed about economic data releases, geopolitical events, and other factors that can influence the forex market. Being aware of potential market-moving events can help you make informed trading decisions.

Footnote

The Harmonic Bullish Bat 5-0 pattern offers forex traders a structured approach to identifying potential bullish reversals in the market. By understanding the key points of the pattern and incorporating the techniques mentioned above, traders can enhance their trading strategies and increase their chances of success. However, it's important to remember that no trading strategy is foolproof, and losses are an inherent part of trading. Therefore, thorough analysis, risk management, and disciplined execution remain paramount for traders aiming to capitalize on the potential of the Harmonic Bullish Bat 5-0 pattern. As with any trading strategy, continuous learning, adaptation, and practice are essential for long-term success in the dynamic forex market.

Discussion