Forex trading strategies for using the Harmonic Bearish Three Drives 5-0 pattern: Techniques for trading with the Harmonic Bearish Three Drives 5-0 pattern.

In the realm of forex trading, success is often driven by the ability to identify and effectively utilize patterns that indicate potential price movements. One such pattern that has gained popularity among traders is the Harmonic Bearish Three Drives 5-0 pattern. This unique pattern combines Fibonacci ratios with market psychology to provide traders with valuable insights into potential price reversals. In this article, we will delve into the intricacies of the Harmonic Bearish Three Drives 5-0 pattern, exploring techniques and strategies to maximize its potential for successful forex trading.

Table Content

I. Understanding the Harmonic Bearish Three Drives 5-0 Pattern

II. Trading Techniques for the Harmonic Bearish Three Drives 5-0 Pattern

1. Pattern Recognition

2. Confirming Fibonacci Ratios

3. Combining with Other Indicators

4. Waiting for Confirmation

5. Risk Management

6. Back-testing and Practice

7. Adapting to Market Conditions

III. Footnote

Understanding the Harmonic Bearish Three Drives 5-0 Pattern

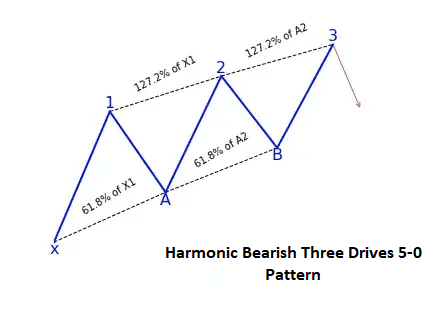

The Harmonic Bearish Three Drives 5-0 pattern is a fusion of the Bearish Three Drives pattern and the 5-0 pattern. It is a harmonic pattern that indicates a potential reversal of an uptrend, suggesting that the price is likely to change direction and start moving downward. This pattern is characterized by a specific sequence of price movements and Fibonacci ratios.

The pattern consists of three drives or legs, where each leg represents a distinct price movement. These drives follow the Fibonacci ratios closely – typically, the first and third drives should be equal in length, while the second drive should be shorter. The fourth point of the pattern is where the price starts to reverse, ideally retracing around 78.6% of the third drive. Finally, the fifth point, known as the "completion point," confirms the pattern and serves as a potential entry point for traders.

Trading Techniques for the Harmonic Bearish Three Drives 5-0 Pattern

1. Pattern Recognition: The first step in utilizing the Harmonic Bearish Three Drives 5-0 pattern is to identify it accurately on a price chart. Utilizing specialized harmonic pattern recognition tools available on various trading platforms can help traders spot this pattern more efficiently. However, it's essential to understand the pattern's construction and the logic behind it to verify its authenticity manually.

2. Confirming Fibonacci Ratios: As with other harmonic patterns, the Fibonacci ratios play a crucial role in the Harmonic Bearish Three Drives 5-0 pattern. Traders should use retracement and extension tools to validate the ratios between the drives. The adherence to these ratios enhances the pattern's reliability and potential for predicting price reversals.

3. Combining with Other Indicators: To increase the accuracy of your trades, consider complementing the Harmonic Bearish Three Drives 5-0 pattern with other technical indicators. Oscillators like the Relative Strength Index (RSI) and Moving Averages can provide additional insights into the strength of the potential reversal.

4. Waiting for Confirmation: It's important not to jump into a trade solely based on the completion of the pattern. Waiting for additional confirmation, such as a bearish candlestick formation or a divergence in momentum indicators, can help reduce false signals and increase the probability of a successful trade.

5. Risk Management: Like any trading strategy, risk management is crucial when trading the Harmonic Bearish Three Drives 5-0 pattern. Determine your risk-reward ratio before entering a trade and set stop-loss and take-profit levels to protect your capital.

6. Back-testing and Practice: Before applying this pattern in live trading, it's wise to conduct thorough back testing on historical data to understand its effectiveness in different market conditions. Additionally, consider practicing in a demo account to gain confidence and refine your execution.

7. Adapting to Market Conditions: Market conditions are dynamic, and no pattern works 100% of the time. Be prepared to adapt your strategy based on changing trends, news events, and overall market sentiment.

Footnote

The Harmonic Bearish Three Drives 5-0 pattern is a valuable tool in a forex trader's arsenal, offering insights into potential price reversals during uptrends. By mastering the art of pattern recognition, confirming Fibonacci ratios, and implementing effective risk management, traders can enhance their ability to capitalize on this unique pattern.

However, it's important to note that no trading strategy is foolproof. The Harmonic Bearish Three Drives 5-0 pattern, like all trading strategies, carries inherent risks. To mitigate these risks, traders must invest time in understanding the pattern, practicing in controlled environments, and continuously adapting their approach to changing market dynamics.

Remember, successful trading requires a combination of skill, discipline, and a deep understanding of the market. The Harmonic Bearish Three Drives 5-0 pattern is a powerful tool that, when used with care and diligence, can contribute to a trader's overall success in the exciting world of forex trading.

Discussion