Forex trading strategies for using the Harmonic Bearish Bat pattern: Approaches for trading with the Harmonic Bearish Bat pattern.

The world of forex trading is dynamic and intricate, offering a multitude of strategies for traders to capitalize on market movements. One such strategy that has gained prominence in recent years is the Harmonic Bat pattern. Specifically, the Harmonic Bearish Bat pattern is a powerful tool for traders seeking to identify potential reversals in the market. In this article, we will delve into the intricacies of the Harmonic Bearish Bat pattern and explore various approaches to effectively trade using this pattern.

Table Content

I. Understanding the Harmonic Bearish Bat Pattern

II. Approaches for Trading with the Harmonic Bearish Bat Pattern

1. Pattern Confirmation

2. Confluence with Other Indicators

3. Risk Management and Stop-Loss Orders

4. Target Profits and Take-Profit Orders

5. Combining Fundamental Analysis

6. Practice and Back testing

7. Patience and Discipline

III. Footnote

Understanding the Harmonic Bearish Bat Pattern

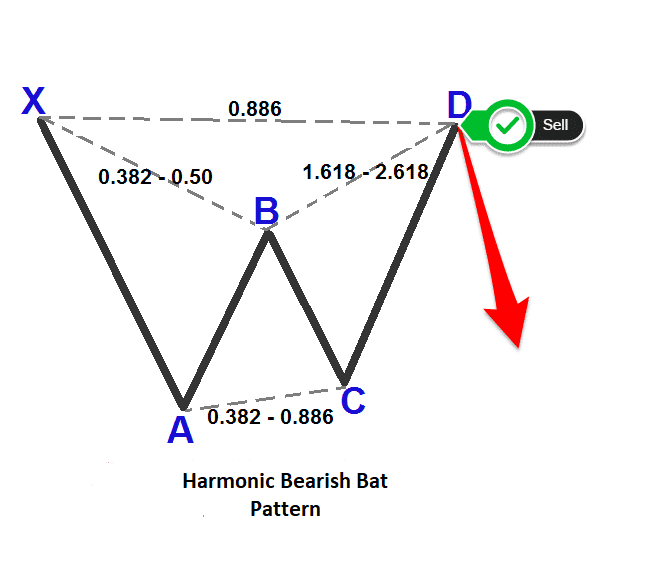

Before diving into trading strategies, let's grasp the fundamentals of the Harmonic Bearish Bat pattern. This pattern is part of the Harmonic trading approach, which seeks to identify specific price patterns that indicate potential reversal zones. The Harmonic Bearish Bat pattern is characterized by its distinct shape, which resembles a bat's wingspan. It consists of five key points:

- X Point: The pattern begins with a significant high (X) in an uptrend or a low in a downtrend.

- A Point: A retracement from the X point leads to the A point, forming a moderate low (in an uptrend) or high (in a downtrend).

- B Point: From the A point, a rally occurs to the B point. This rally usually retraces a portion of the XA leg. The B point is significant as it confirms the potential formation of the Bat pattern.

- C Point: After the B point, the market retraces again, forming the C point. This point should ideally retrace around 38.2% of the XA leg. It's important to note that the C point should be lower than the X point in an uptrend and higher in a downtrend.

- D Point: The final move from the C point leads to the D point, which is the potential reversal zone of the pattern. The D point is around 88.6% retracement of the XA leg. It is the level where traders look for potential short opportunities in an uptrend or long opportunities in a downtrend.

Approaches for Trading with the Harmonic Bearish Bat Pattern

Trading using the Harmonic Bearish Bat pattern requires a combination of technical analysis, risk management, and disciplined execution. Here are some approaches that traders can consider:

1. Pattern Confirmation

Before entering a trade, it's crucial to wait for confirmation that the Harmonic Bearish Bat pattern is indeed forming. This includes ensuring that the points X, A, B, C, and D align as described. The retracement levels at points C and D are of particular significance, and traders should use additional technical tools, such as Fibonacci retracement levels, to validate the pattern.

2. Confluence with Other Indicators

To enhance the probability of a successful trade, traders can seek confluence with other technical indicators. This might include trendlines, moving averages, or support and resistance levels that coincide with the potential reversal zone (D point). The convergence of multiple indicators can provide stronger confirmation of a potential reversal.

3. Risk Management and Stop-Loss Orders

Effective risk management is paramount in forex trading. Traders should determine an appropriate position size based on their risk tolerance and the distance between the entry point and the stop-loss order. Placing the stop-loss order just beyond the D point can help protect the trader from substantial losses if the pattern doesn't play out as expected.

4. Target Profits and Take-Profit Orders

Having a clear target for profit-taking is essential. Traders can use various methods to set their take-profit levels, such as identifying nearby support or resistance levels, utilizing Fibonacci extensions, or employing a risk-to-reward ratio of, for example, 1:2 or 1:3.

5. Combining Fundamental Analysis

While the Harmonic Bearish Bat pattern primarily relies on technical analysis, incorporating fundamental analysis can provide a more comprehensive view of the market. Economic news releases, geopolitical events, and central bank decisions can significantly impact currency prices. Traders should be aware of potential market-moving events that might coincide with their trading timeframe.

6. Practice and Back testing

As with any trading strategy, practice and back testing are invaluable. Before committing real capital, traders should engage in paper trading or use demo accounts to refine their approach. Back testing historical data helps traders assess the pattern's effectiveness under different market conditions.

7. Patience and Discipline

Patience and discipline are virtues in forex trading. Not every potential Harmonic Bearish Bat pattern will result in a successful trade. Traders should wait for high-probability setups and avoid overtrading. Emotional control is also vital; adhering to the predetermined trading plan regardless of market fluctuations is key to long-term success.

Footnote

The Harmonic Bearish Bat pattern is a valuable addition to a trader's toolkit, offering the potential to identify reversals in the forex market. Through a combination of technical analysis, pattern confirmation, risk management, and discipline, traders can harness the power of this pattern to make informed trading decisions. However, it's important to remember that no strategy is foolproof, and losses are a part of trading. As such, continuous learning, adaptation, and a commitment to self-improvement are essential for traders looking to master the art of trading with the Harmonic Bearish Bat pattern.

Discussion