Forex trading strategies for using the Cypher pattern: Approaches for trading with the Cypher pattern.

The world of forex trading is a dynamic and fast-paced environment that requires traders to stay ahead of the curve with innovative strategies and patterns. One such pattern that has gained attention among traders is the Cypher pattern. The Cypher pattern is a harmonic trading pattern that aims to identify potential reversal points in the market. In this article, we will delve into the intricacies of the Cypher pattern and explore various trading approaches to effectively capitalize on its potential.

Table Content

I. Understanding the Cypher Pattern

II. Trading Approaches with the Cypher Pattern

1. Pattern Completion Strategy

2. Fibonacci Confluence

3. Support and Resistance Confirmation

4. Combining Cypher with Oscillators

5. Multiple Timeframe Analysis

6. Risk Management and Trade Execution

III. Challenges and Considerations

1. Market Conditions

2. Confirmation

3. Patience

IV. Footnote

Understanding the Cypher Pattern

The Cypher pattern is a relatively newer addition to the harmonic pattern family, which also includes patterns like the Gartley, Bat, and Butterfly. It was introduced by Scott Carney in his book "Harmonic Trading, Volume One." The pattern's distinctive characteristic lies in its unique shape and Fibonacci-based measurements that help traders identify potential entry and exit points in the market.

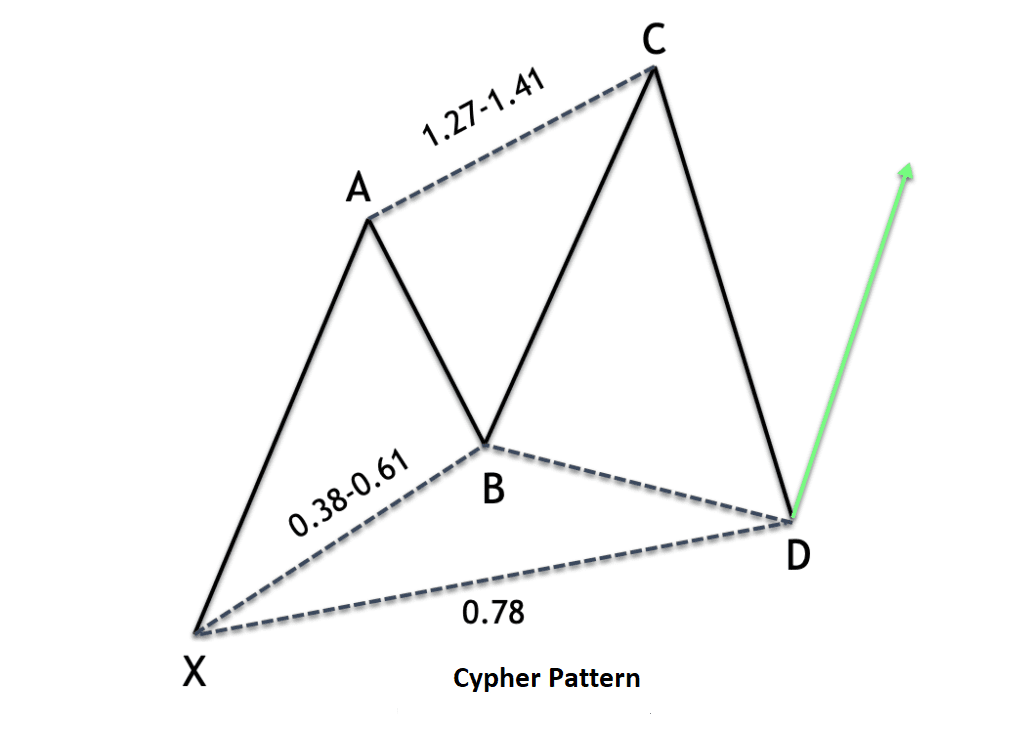

The Cypher pattern consists of four main points:

1. X: The starting point of the pattern, representing the initial price movement.

2. A: The point where the initial price movement ends, typically due to a retracement.

3. B: The retracement point where the pattern starts to take shape. It is usually around the 38.2% to 61.8% Fibonacci retracement level of the XA leg.

4. C: The critical point where the pattern confirms its validity. This point is around the 38.2% retracement of the AB leg.

Once these four points are established, the pattern's completion relies on the final leg:

5. D: The terminal point of the pattern, often coinciding with the 78.6% Fibonacci retracement of the XA leg. This point signals the potential reversal zone and offers an opportunity for traders to enter the market.

Trading Approaches with the Cypher Pattern

1. Pattern Completion Strategy:

The simplest approach is to wait for the Cypher pattern to complete by reaching the D point. Once the price touches the 78.6% retracement level of the XA leg, traders can consider entering a trade in anticipation of a reversal. It's essential to combine this strategy with other technical indicators or price action analysis to confirm the potential reversal.

2. Fibonacci Confluence:

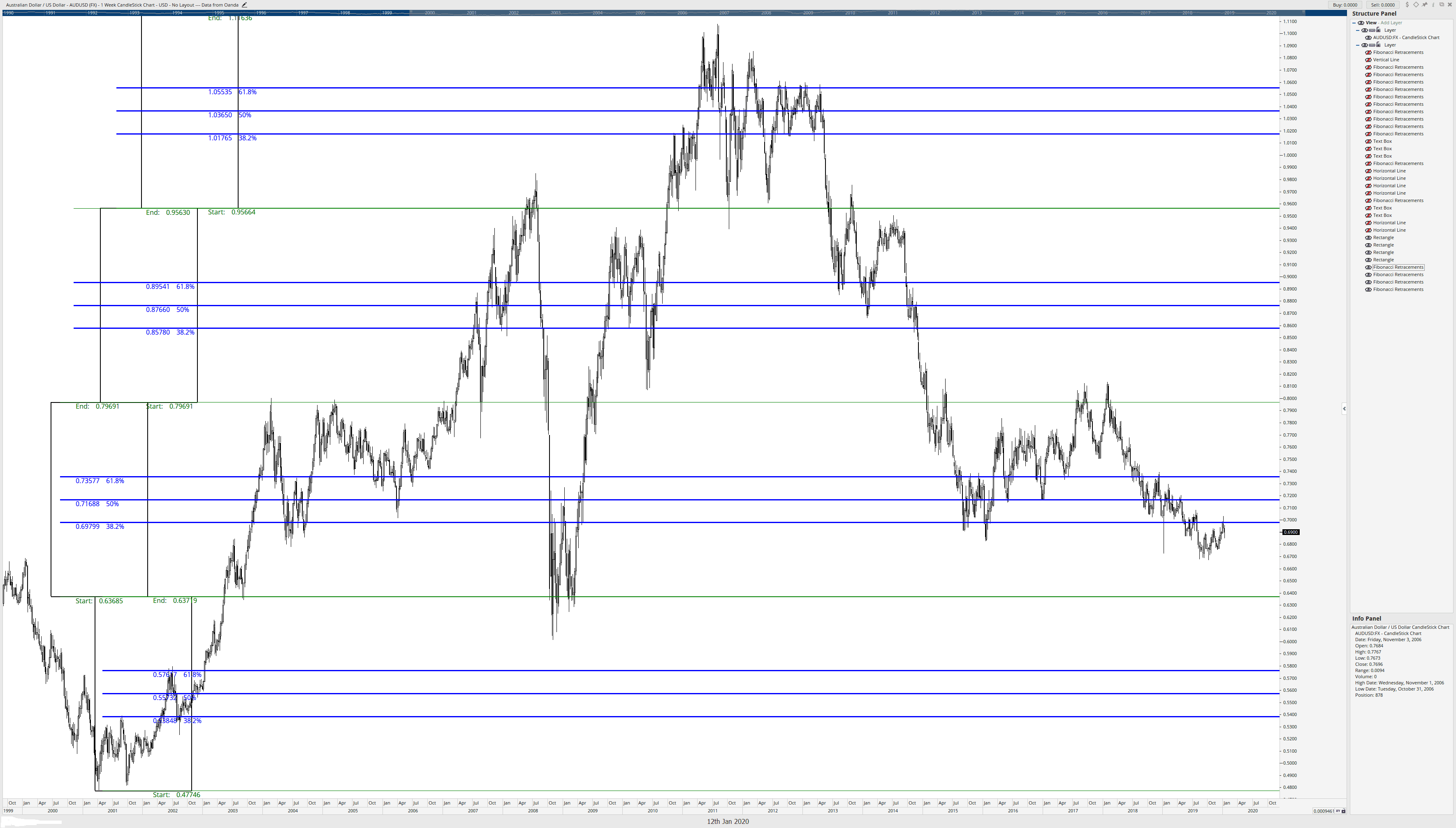

To increase the probability of a successful trade, traders often look for additional confluence factors. Combining the Cypher pattern with other Fibonacci retracement levels or extensions can provide a stronger signal. For instance, if the D point of the Cypher pattern aligns with a key Fibonacci extension level from a previous swing, it enhances the pattern's validity.

3. Support and Resistance Confirmation:

Another effective strategy involves confirming the Cypher pattern's potential reversal zone with existing support or resistance levels. If the D point aligns with a significant historical support level or a resistance-turned-support level, it adds weight to the trade setup. This strategy provides traders with more confidence in their entries and reduces the risk of false signals.

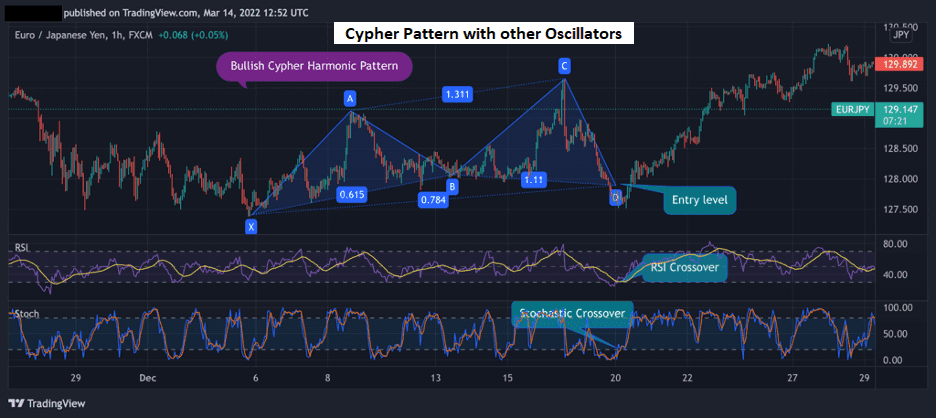

4. Combining Cypher with Oscillators:

Traders can also integrate momentum oscillators like the Relative Strength Index (RSI) or the Stochastic Oscillator to validate the potential reversal indicated by the Cypher pattern. If the pattern completes near an oversold area on the RSI or shows bullish divergence on the Stochastic, it adds an extra layer of confirmation to the trade setup.

5. Multiple Timeframe Analysis:

Employing multiple timeframe analysis can significantly enhance the accuracy of Cypher pattern trades. For example, if a potential Cypher pattern is forming on the daily chart, switching to lower timeframes like the 4-hour or 1-hour chart can help pinpoint more precise entry points. This approach also aids in assessing the overall trend and identifying potential conflicting signals.

6. Risk Management and Trade Execution:

No trading strategy is complete without proper risk management. Traders should determine their entry, stop-loss, and take-profit levels before entering a Cypher pattern trade. As with any trading strategy, it's crucial to avoid risking more than a predetermined percentage of the trading capital on a single trade. Additionally, using a trailing stop-loss strategy can allow traders to ride potential trends while protecting profits.

Challenges and Considerations

While the Cypher pattern offers valuable insights into potential market reversals, it's essential to acknowledge that not all patterns will result in successful trades. Traders should be cautious of false signals and consider the following factors:

1. Market Conditions: High-impact news events or sudden market shifts can invalidate the Cypher pattern. Always be aware of the current market environment before placing trades.

2. Confirmation: Relying solely on the Cypher pattern may lead to false signals. Combining it with other technical indicators or price action analysis can provide more robust trade setups.

3. Patience: Waiting for the pattern to complete and ensuring all criteria are met requires patience. Impulsive trading based on incomplete patterns can lead to losses.

Footnote

The Cypher pattern is a potent tool in a forex trader's arsenal, offering insights into potential reversals with well-defined entry and exit points. By understanding its components and integrating it with complementary trading strategies, traders can increase their odds of success. However, like all trading methodologies, the Cypher pattern is not foolproof and requires prudent risk management, continuous learning, and adaptability to the ever-changing forex market. As traders gain experience and refine their skills, they can harness the power of the Cypher pattern to make informed trading decisions.

Discussion