Forex trading strategies for using the Cup and Handle pattern: Approaches for trading with the Cup and Handle chart pattern.

In the world of forex trading, mastering various chart patterns is a crucial skill for traders seeking consistent profits. Among the plethora of chart patterns, the Cup and Handle pattern stands out as a reliable tool for identifying potential trend reversals and continuation patterns. Traders who understand how to effectively utilize this pattern can gain a competitive edge in the forex market. In this article, we will delve into the intricacies of the Cup and Handle pattern and explore different trading strategies that can be employed to leverage its potential.

Table Content

I. Understanding the Cup and Handle Pattern

II. Components of the Pattern

1. Cup Formation

2. Handle Formation

III. Psychology Behind the Pattern

IV. Approaches for Trading with the Cup and Handle Pattern

1. Classic Breakout Strategy

2. Aggressive Entry Strategy

3. Wait for Pullback Strategy

4. Combining with Other Indicators

V. Risk Management

VI. Footnote

Understanding the Cup and Handle Pattern

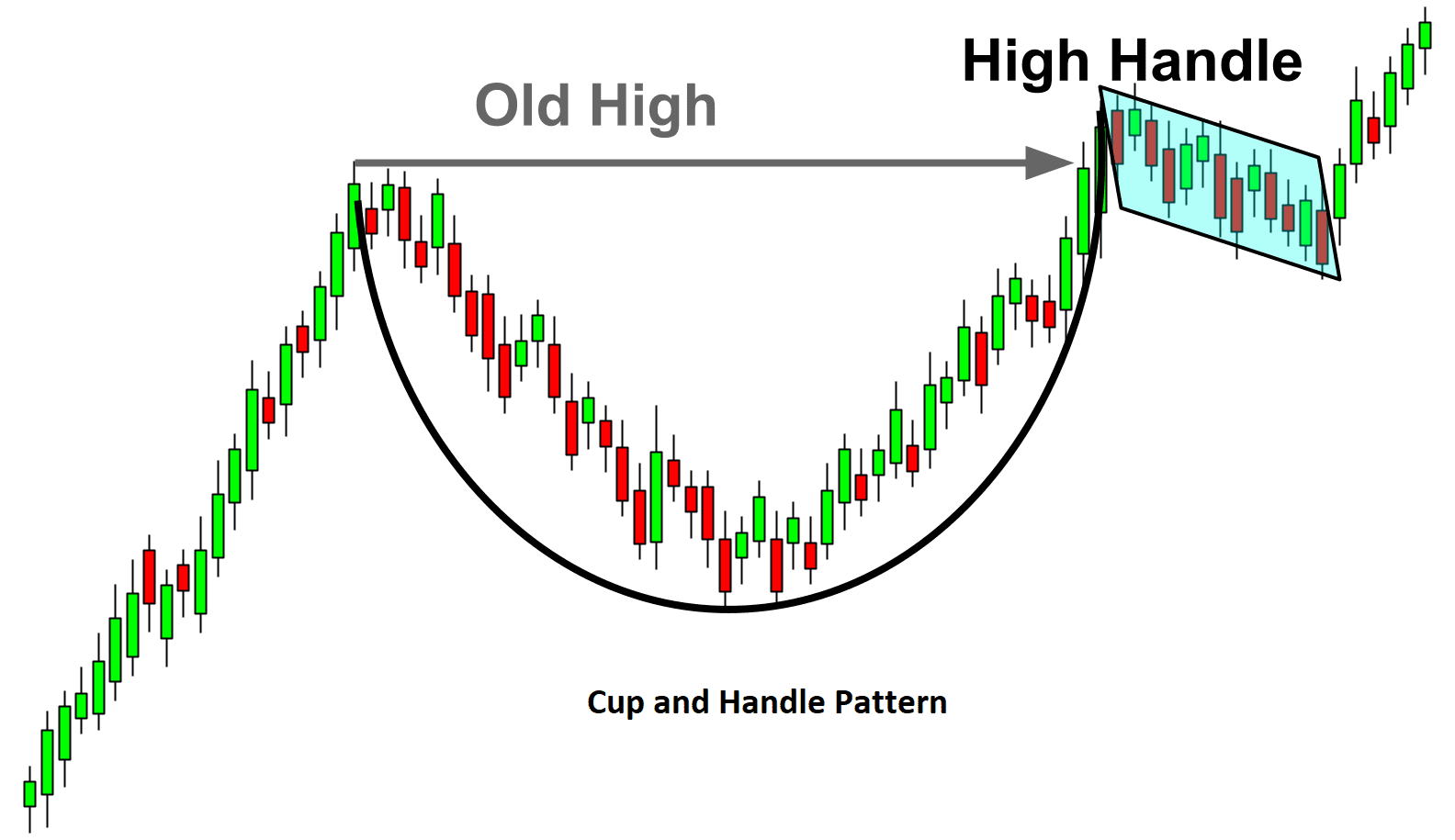

The Cup and Handle pattern is a technical analysis formation that signals a bullish continuation or reversal pattern. It is typically found in longer timeframes and is considered a reliable indicator of potential price movements. The pattern resembles the shape of a teacup with a handle attached to it, hence the name.

Components of the Pattern

1. Cup Formation: The "cup" part of the pattern is characterized by a rounded bottom, where the price action creates a semi-circular curve. This curve is formed as the price gradually falls, reaches a bottom, and then rises again.

2. Handle Formation: Following the completion of the cup formation, there is a slight downward consolidation known as the "handle." This part of the pattern looks like a small flag or pennant, where the price trades within a narrow range before breaking out.

Psychology Behind the Pattern

The Cup and Handle pattern reflects a shift in market sentiment. During the cup formation, the initial downtrend indicates a period of selling pressure. As the price reaches its lowest point and begins to rise, it signifies a potential change in sentiment. The handle formation represents a temporary pullback as traders take profits from the earlier rise. Once the handle is complete and the price breaks above the handle's resistance level, it confirms a bullish sentiment and potential upward continuation.

Approaches for Trading with the Cup and Handle Pattern

Trading using the Cup and Handle pattern involves careful analysis of price movements and employing appropriate strategies to capitalize on potential opportunities. Here are a few approaches that traders can consider:

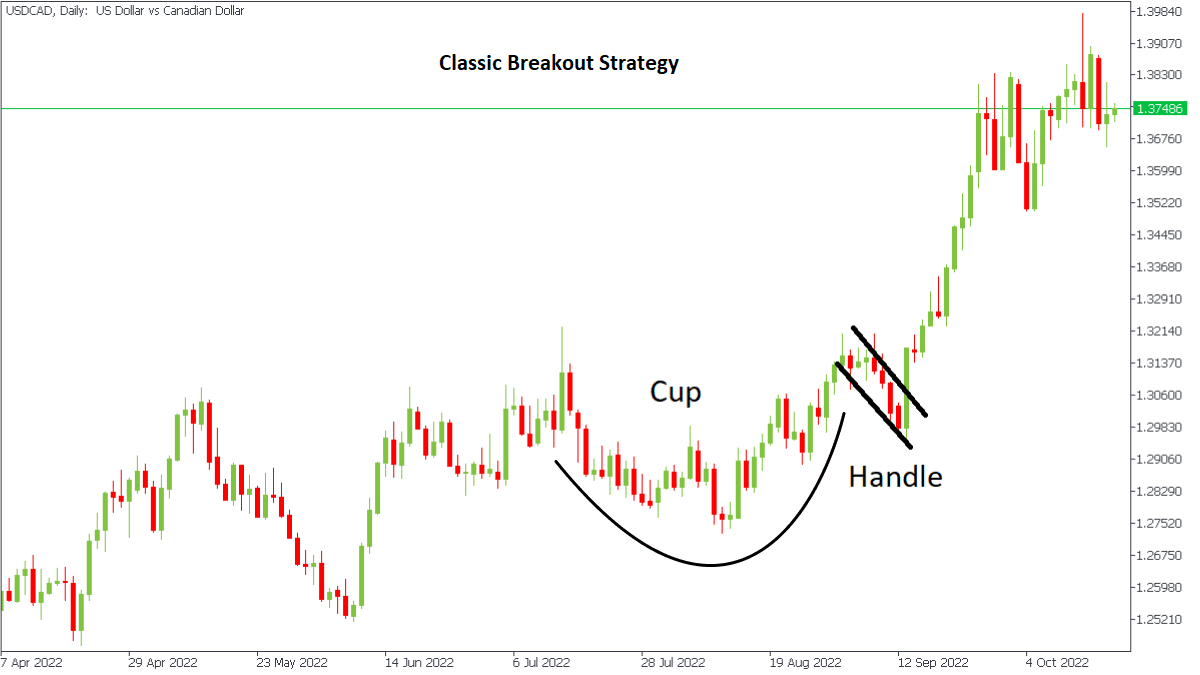

1. Classic Breakout Strategy:

This is one of the most common strategies employed by traders when using the Cup and Handle pattern. The key idea is to wait for a breakout to occur after the handle formation. Traders enter the market when the price breaks above the resistance level of the handle. The breakout is often accompanied by increased trading volume, further confirming the validity of the pattern.

Steps:

a) Identify the Cup and Handle Pattern: Draw trendlines to identify the cup and handle formation accurately.

b) Wait for Breakout Confirmation: Monitor the price as it approaches the handle's resistance level. Once the price breaks above this level, enter a long (buy) position.

c) Set Stop-Loss: Place a stop-loss order below the handle's resistance level to mitigate potential losses.

d) Determine Take-Profit: Calculate a reasonable target based on the pattern's height or use other technical indicators to identify potential resistance levels.

2. Aggressive Entry Strategy:

For traders comfortable with higher risk, an aggressive entry strategy can be employed. This involves entering the market before the breakout occurs, often during the handle formation. The idea is to capitalize on the potential breakout momentum while accepting the increased risk of a false breakout.

Steps:

a) Identify Handle Formation: Once the cup formation is complete, focus on the handle's consolidation.

b) Enter Early: Enter a long position when the price starts showing signs of upward movement within the handle, but before the breakout occurs.

c) Use Tight Stop-Loss: Given the higher risk, set a tight stop-loss order just below the handle's support level.

d) Monitor Closely: Keep a close eye on the price action, and if the breakout fails to materialize, be prepared to exit quickly.

3. Wait for Pullback Strategy:

This strategy involves waiting for a pullback to the cup's rim after a successful breakout. It allows traders to potentially enter the market at a better price while minimizing risk.

Steps:

a) Identify Successful Breakout: Confirm a valid breakout by observing sustained price movement above the handle's resistance level.

b) Wait for Pullback: After the breakout, wait for the price to retrace back to the cup's rim (previous resistance level).

c) Enter Position: Once the pullback shows signs of reversal, enter a long position.

d) Set Stop-Loss: Place a stop-loss order below the cup's rim to guard against a deeper pullback.

e) Set Take-Profit: Determine a suitable target based on the pattern's height or other technical factors.

4. Combining with Other Indicators:

To enhance the accuracy of trading decisions, traders often combine the Cup and Handle pattern with other technical indicators. This approach can help confirm potential breakouts or reversals and provide additional insights into market conditions.

a) Moving Averages: Using moving averages can help confirm the trend direction and provide entry and exit signals in conjunction with the pattern.

b) Relative Strength Index (RSI): RSI can indicate overbought or oversold conditions, helping traders time their entries more accurately.

c) Volume Analysis: Monitoring trading volume during the pattern formation and breakout can validate the strength of the price movement.

Risk Management:

While the Cup and Handle pattern is a powerful tool for identifying potential price movements, it's essential to remember that no trading strategy is foolproof. Risk management is paramount to success in forex trading. Always use appropriate position sizing, set stop-loss orders, and never risk more than you can afford to lose on a single trade.

Footnote:

In summary, the Cup and Handle pattern is a valuable addition to a trader's toolkit. Its distinctive shape and clear breakout points make it relatively easy to identify and act upon. By understanding the psychology behind the pattern and employing various trading strategies, traders can potentially capitalize on profitable opportunities in the forex market. However, diligent practice, continuous learning, and disciplined risk management are crucial for translating this knowledge into consistent trading success.

Discussion