Forex Trading Strategies for Using the Butterfly Pattern: Approaches for Trading with the Butterfly Pattern

In the world of forex trading, success is often the outcome of employing effective strategies that capitalize on market patterns. One such pattern that traders frequently utilize is the Butterfly pattern. This pattern is a powerful tool for identifying potential reversals and trade opportunities. In this article, we will delve into the intricacies of the Butterfly pattern and explore various approaches for trading with it.

Table Content

I. Understanding the Butterfly Pattern

II. Trading Approaches Using the Butterfly Pattern

1. Pattern Completion Strategy

2. Fibonacci Confluence Strategy

3. Price Action Confirmation

4. Advanced Pattern Projection

5. Risk Management and Trade Setup

III. Footnote

Understanding the Butterfly Pattern

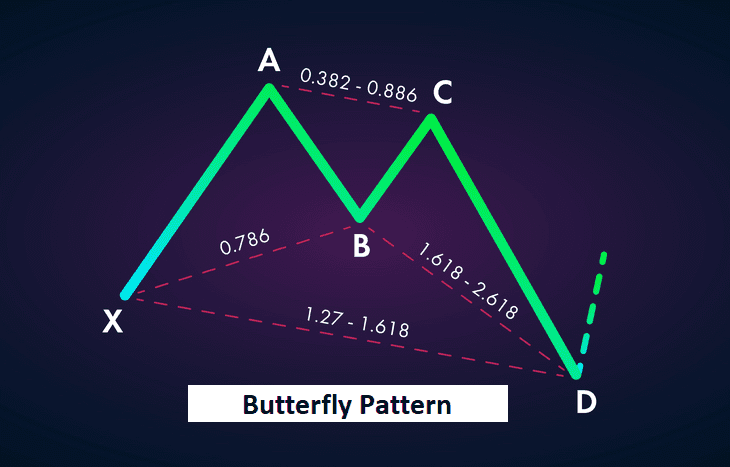

The Butterfly pattern is a harmonic trading pattern that helps traders spot potential trend reversals and turning points in the forex market. It is defined by its distinct shape, which resembles the wings of a butterfly. The pattern consists of five points: X, A, B, C, and D. These points are plotted on the price chart based on Fibonacci ratios derived from the previous price movement.

- X: The starting point and represents the initial high or low point where the pattern begins.

- A: The first price move from point X, usually a significant move in the opposite direction.

- B: A retracement from point A, typically around 0.786 Fibonacci retracement level of the XA leg.

- C: Another significant move in the direction of the initial move (XA), forming an extension of the AB leg.

- D: The point where the pattern completes, usually at around a 1.618 Fibonacci extension of the XA leg. This point signifies the potential reversal zone.

The Butterfly pattern is considered valid when the CD leg retraces to around 0.786 Fibonacci level of the XA leg. This level acts as a confirmation that the pattern is forming accurately. Traders often use this pattern to identify potential entry and exit points for their trades.

Trading Approaches Using the Butterfly Pattern

1. Pattern Completion Strategy

The most straightforward approach to trading the Butterfly pattern is to wait for its completion at point D. Once the price reaches the potential reversal zone at point D, traders can look for additional confirming signals before entering a trade. These confirming signals could include candlestick patterns, momentum indicators, or trendline breaks.

For instance, if the Butterfly pattern completes with a bearish candlestick pattern and is aligned with a resistance level, it could be a strong indication to place a short trade. Conversely, if the pattern completes with a bullish candlestick pattern near a support level, a long trade might be more favorable.

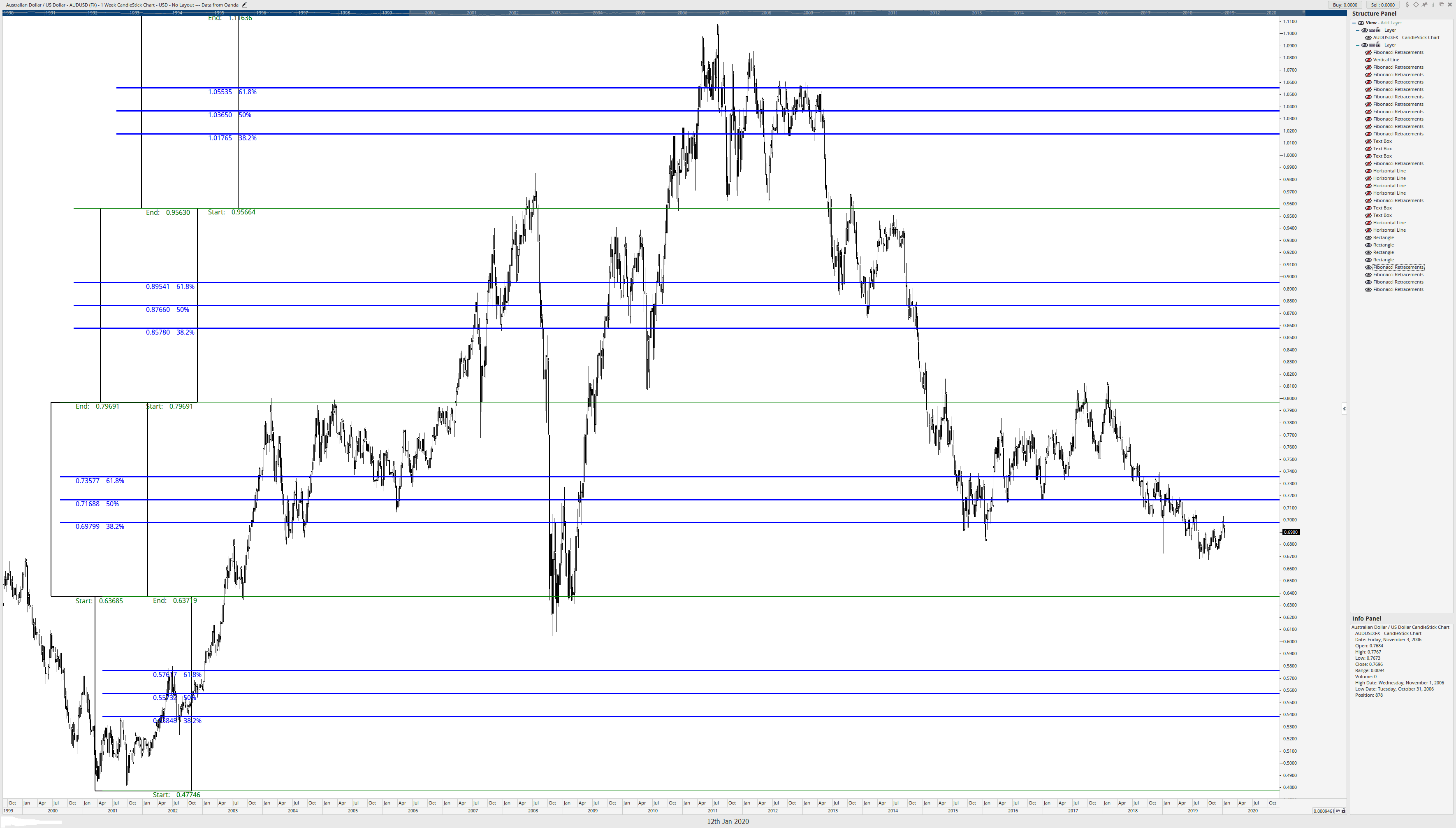

2. Fibonacci Confluence Strategy

Another approach to enhance the accuracy of trading with the Butterfly pattern is to identify confluence zones where multiple Fibonacci levels coincide. These levels could include retracement levels from different price swings, extension levels, or even moving averages.

When the potential reversal zone of the Butterfly pattern aligns with other key Fibonacci levels or technical indicators, it increases the probability of a successful trade. Traders can use this approach to filter out trades that do not have strong confluence and focus on those that provide a higher level of confirmation.

3. Price Action Confirmation

Price action analysis is a fundamental aspect of forex trading. Traders who prefer a more discretionary approach can combine the Butterfly pattern with price action confirmation techniques. These techniques involve studying the behavior of price movements, candlestick patterns, and support/resistance levels to validate the potential trade setups.

For instance, if the Butterfly pattern forms at a major support level and is accompanied by a bullish engulfing candlestick pattern, it could signal a potential bullish reversal. Similarly, a bearish pin bar forming at the completion of the pattern could indicate a possible bearish reversal.

4. Advanced Pattern Projection

Advanced traders often integrate the Butterfly pattern with other harmonic patterns or technical tools to project potential price movements beyond the completion of the pattern. By doing so, they aim to capture extended price swings that could lead to more significant profits.

Traders can use techniques like measuring the projected move from point D to set potential target levels, or they can combine the Butterfly pattern with patterns like the Gartley or Bat pattern to identify even more comprehensive trading opportunities.

5. Risk Management and Trade Setup

Regardless of the trading approach chosen, proper risk management is crucial in forex trading. Traders should always determine their entry, stop-loss, and take-profit levels before entering a trade. The Butterfly pattern, like any trading strategy, is not immune to false signals, so having a well-defined risk management plan can help minimize losses and protect trading capital.

Additionally, traders can consider waiting for a pullback after the completion of the pattern before entering a trade. This pullback can provide a better entry price and improve the risk-reward ratio of the trade.

Footnote

The Butterfly pattern is a versatile tool that forex traders can use to identify potential trend reversals and turning points in the market. By understanding its structure and the various trading approaches, traders can enhance their decision-making process and increase the likelihood of successful trades.

Whether one chooses to trade the pattern upon completion, combine it with other technical tools, or integrate it into a price action strategy, the key lies in practice and gaining experience. As with any trading strategy, mastering the Butterfly pattern requires patience, discipline, and continuous learning. Traders should always back test their strategies, adapt to market conditions, and refine their approach over time.

Remember, no trading strategy guarantees success in every trade, and there is always an inherent risk involved in forex trading. It's essential to use proper risk management techniques and trade responsibly. The Butterfly pattern, when used in conjunction with other analytical methods and proper risk management, can become a valuable asset in a trader's toolkit.

Discussion