Forex Trading Strategies for Using the Bullish Flag Pattern: Techniques for Trading with the Bullish Flag Chart Pattern

In the world of forex trading, understanding chart patterns can significantly enhance a trader's ability to identify potential price movements and make informed decisions. One such pattern is the Bullish Flag, a continuation pattern that often indicates a temporary pause in an uptrend before the price resumes its upward movement. In this article, we will delve into the intricacies of the Bullish Flag pattern and explore effective trading strategies to capitalize on its potential.

Table Content

I. Understanding the Bullish Flag Pattern

II. Trading Strategies for the Bullish Flag Pattern

1. Confirmation of the Pattern

2. Entry and Stop-Loss Placement

3. Measuring Target

4. Volume Confirmation

5. Multiple Timeframes

6. Combining with Other Indicators

7. Practice Risk Management

III. Footnote

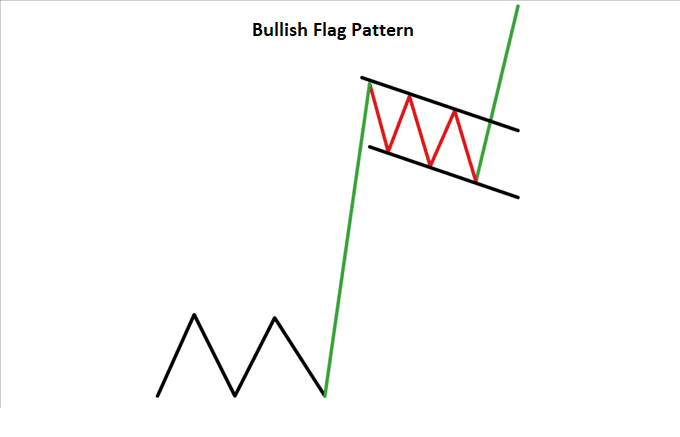

Understanding the Bullish Flag Pattern

The Bullish Flag pattern is characterized by two main components: a strong, steep upward price movement (the flagpole) followed by a consolidation phase represented by a rectangular flag-like formation. The flag formation is typically slanted in the opposite direction of the initial trend, indicating a brief period of profit-taking and market consolidation.

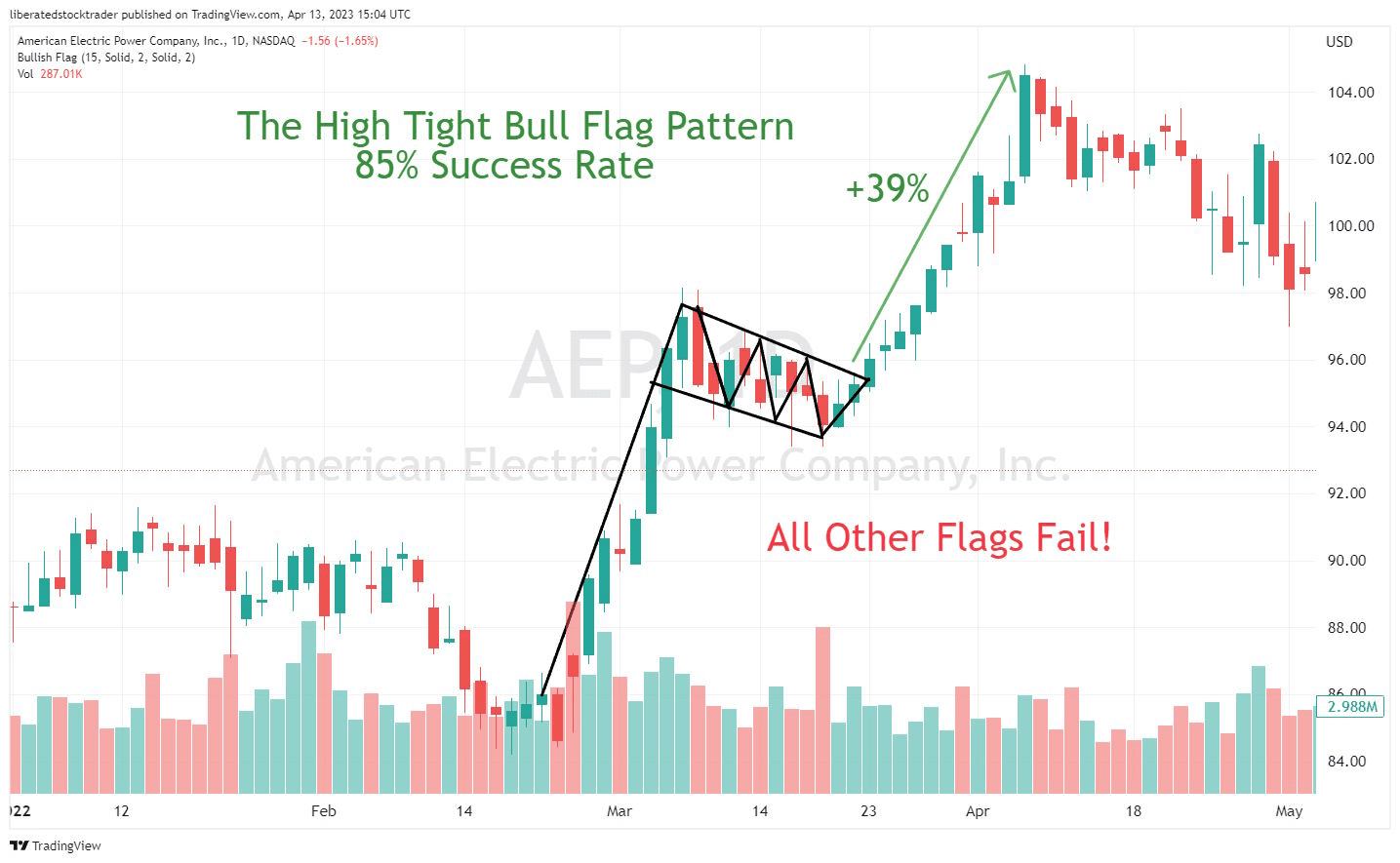

Sources from TradingView

The psychology behind the Bullish Flag pattern is that while some traders take profits during the consolidation, the overall sentiment remains bullish. As the consolidation phase unfolds, traders are waiting for an opportune moment to re-enter the market and continue riding the trend. Once the price breaks out of the upper boundary of the flag pattern, it often resumes its upward trajectory, providing traders with a potential entry point.

Trading Strategies for the Bullish Flag Pattern

1. Confirmation of the Pattern: Before entering a trade based on the Bullish Flag pattern, it's essential to ensure that the pattern is valid. Look for the initial strong upward price movement (flagpole) followed by the flag formation. The flag should be a relatively tight range with clear support and resistance lines. Once you've confirmed the pattern, consider the following strategies.

2. Entry and Stop-Loss Placement: The breakout from the upper boundary of the flag is a potential entry point. However, it's crucial to wait for a confirmation candlestick that closes above the flag's upper resistance line. This candlestick can act as a trigger for your entry. To manage risk, place a stop-loss order slightly below the lower boundary of the flag. This helps protect your capital in case the pattern doesn't play out as anticipated.

3. Measuring Target: To estimate the potential price move after the breakout, measure the length of the flagpole (the distance between the start of the flagpole and the highest point) and project it upward from the point of the breakout. This can provide a rough target for where the price might reach. Keep in mind that while this projection can be a helpful guideline, actual market conditions may vary.

4. Volume Confirmation: Pay attention to trading volume during the consolidation phase and the breakout. A breakout accompanied by higher trading volume is often considered a more robust signal. Increased volume indicates strong market participation and conviction among traders, increasing the likelihood of a sustained upward move.

5. Multiple Timeframes: Analyzing the Bullish Flag pattern across multiple timeframes can provide a more comprehensive view of its potential. For instance, if you identify a Bullish Flag pattern on the daily chart, zoom in to lower timeframes like the 4-hour or 1-hour chart to fine-tune your entry point. Aligning patterns across different timeframes can enhance the accuracy of your trades.

6. Combining with Other Indicators: While the Bullish Flag pattern can be effective on its own, combining it with other technical indicators can reinforce your trading decisions. Indicators like moving averages, relative strength index (RSI), or MACD can provide additional insights into the strength of the trend and potential reversals.

7. Practice Risk Management: As with any trading strategy, risk management is paramount. Avoid risking a significant portion of your capital on a single trade. Consider using only a portion of your available trading funds for each Bullish Flag trade. Additionally, never neglect the importance of setting both stop-loss and take-profit levels to safeguard your investments.

Footnote:

The Bullish Flag pattern is a valuable tool in a forex trader's arsenal, offering opportunities to capitalize on the continuation of an uptrend following a brief consolidation phase. By mastering the techniques outlined in this article, traders can enhance their ability to identify and trade the Bullish Flag pattern effectively. Remember that successful trading requires a combination of technical analysis, risk management, and a deep understanding of market psychology. As you gain experience, refine your strategies and remain adaptable to changing market conditions. Always practice in a risk-controlled environment, and consider seeking advice from experienced traders or financial professionals before making any significant trading decisions.

Discussion