Forex Trading Strategies for Using the Bullish Engulfing Pattern: Approaches for Trading with Bullish Engulfing Candlestick Patterns

In the world of forex trading, where volatility and uncertainty are the norm, traders are constantly on the lookout for reliable and effective strategies to gain an edge. One such strategy that has stood the test of time is trading with candlestick patterns. Among these patterns, the Bullish Engulfing pattern has earned a reputation for its potential to signal significant market reversals. In this article, we will delve into the intricacies of the Bullish Engulfing pattern and explore various approaches for trading with this powerful candlestick formation.

Table Content

I. Understanding the Bullish Engulfing Pattern

II. Approaches for Trading with Bullish Engulfing Patterns

1. Confirmation through Support Levels

2. Fibonacci Retracement

3. Using Oscillators

4. Wait for Confirmation

5. Combining Candlestick Patterns

6. Risk Management and Position Sizing

III. Footnote

Understanding the Bullish Engulfing Pattern:

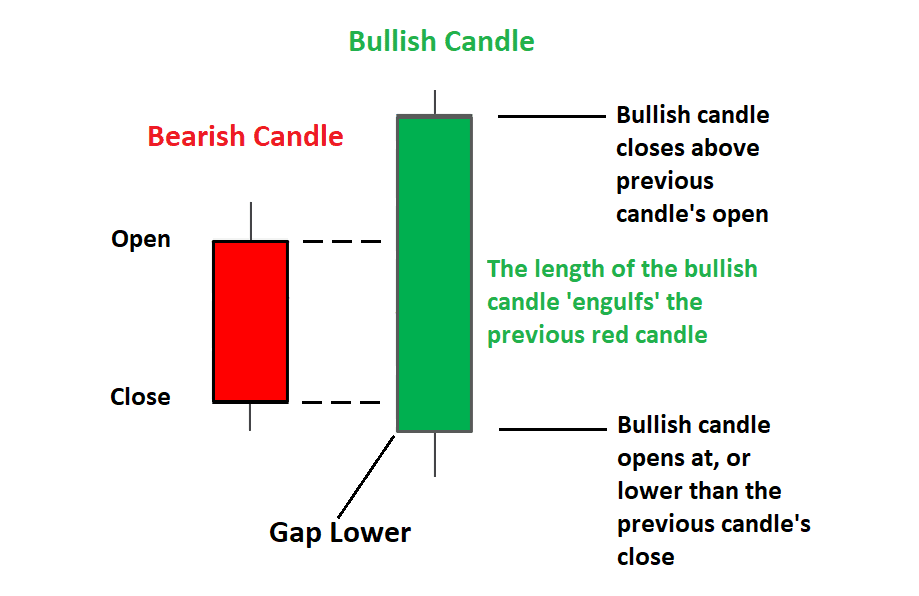

The Bullish Engulfing pattern is a two-candlestick formation that typically occurs after a downtrend. It signals a potential reversal of the trend, indicating a shift from bearish sentiment to bullish sentiment. This pattern is characterized by two candles: the first is a smaller bearish candle, followed by a larger bullish candle that completely engulfs the previous candle's body. The significance of the engulfing candle's size lies in its ability to overshadow and "engulf" the preceding candle, showcasing a sudden shift in market sentiment.

Approaches for Trading with Bullish Engulfing Patterns:

Trading with Bullish Engulfing patterns requires a combination of technical analysis, risk management, and an understanding of market context. Here are some approaches traders can consider when incorporating this pattern into their forex trading strategies:

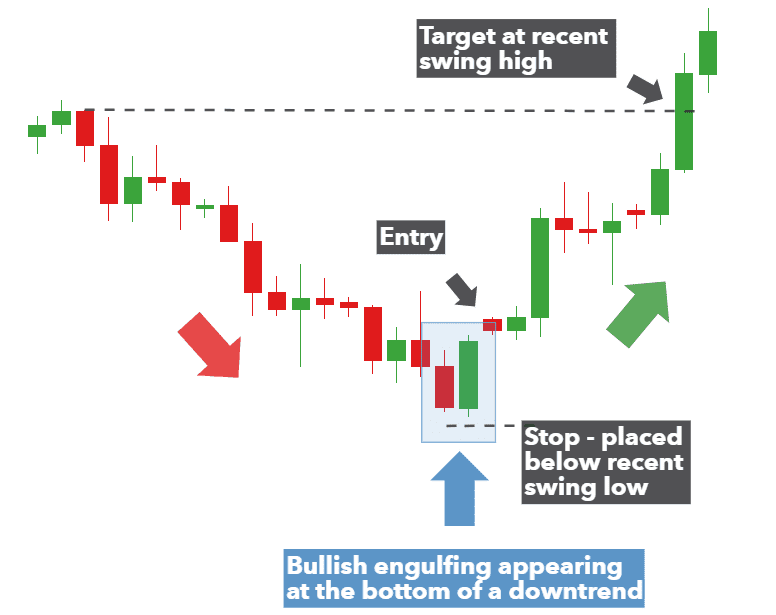

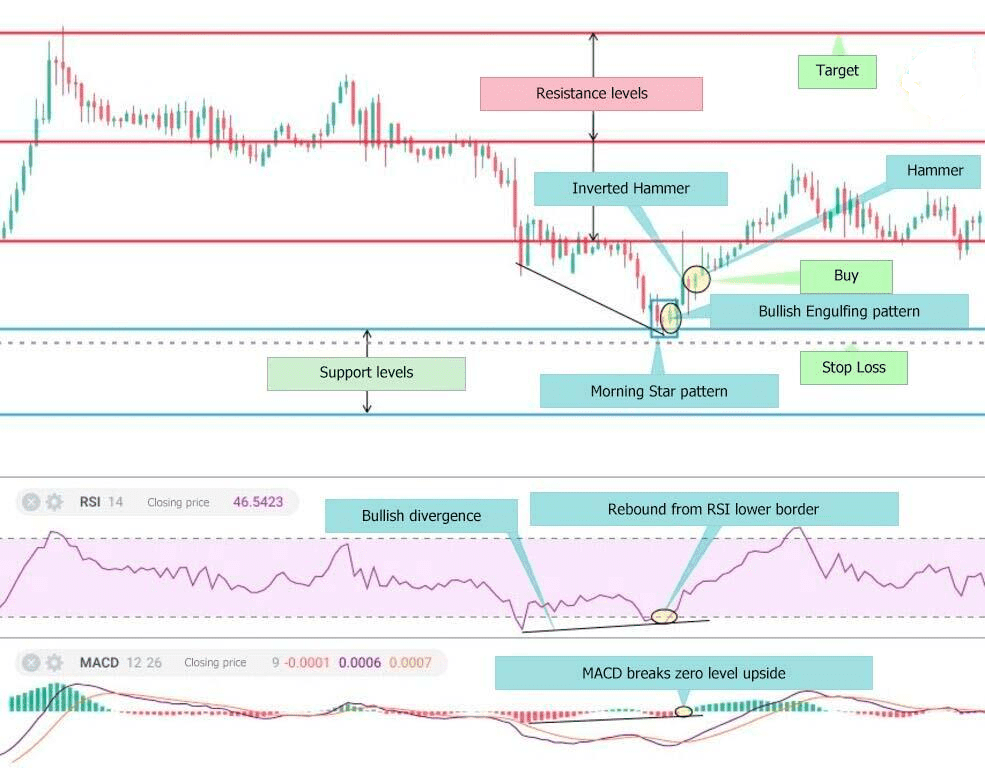

1. Confirmation through Support Levels: One approach is to combine the Bullish Engulfing pattern with support levels. After identifying a Bullish Engulfing pattern, traders can look for a strong support level nearby. This confluence of signals adds weight to the potential reversal. The logic behind this strategy is that the Bullish Engulfing pattern, combined with a support level, increases the probability of a bounce back upwards.

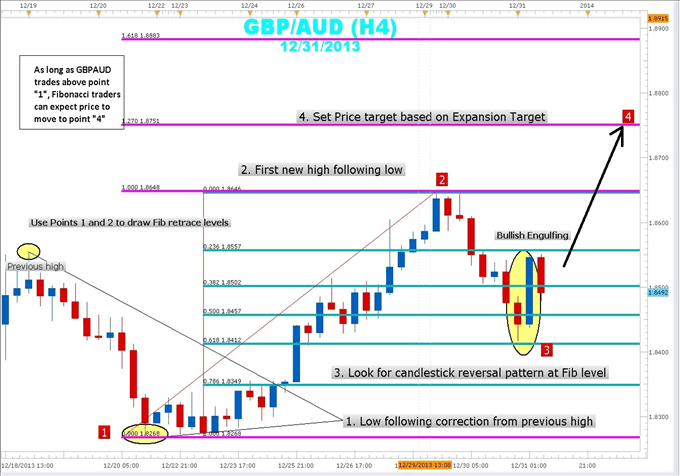

2. Fibonacci Retracement: Another effective strategy involves combining the Bullish Engulfing pattern with Fibonacci retracement levels. Following a downtrend, traders can apply Fibonacci retracement tools to identify potential levels of support and resistance. If a Bullish Engulfing pattern forms near a key Fibonacci retracement level, it provides traders with an additional confirmation of a potential trend reversal.

3. Using Oscillators: Oscillators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can complement the Bullish Engulfing pattern. When a Bullish Engulfing pattern forms, traders can look for signs of positive divergence on the oscillators. Positive divergence occurs when the price makes a lower low but the oscillator makes a higher low. This can indicate a potential reversal in momentum, reinforcing the signal provided by the Bullish Engulfing pattern.

4. Wait for Confirmation: While the Bullish Engulfing pattern itself is a strong signal, some traders prefer to wait for additional confirmation before entering a trade. This can involve waiting for the next candle to close above the engulfing candle's high or waiting for a certain percentage gain before committing to a trade. This cautious approach aims to filter out false signals and reduce the risk of entering premature trades.

5. Combining Candlestick Patterns: To enhance the accuracy of their trades, some traders combine the Bullish Engulfing pattern with other candlestick patterns. For example, the Bullish Engulfing pattern followed by a Morning Star pattern can provide a stronger indication of a trend reversal. This combination strategy can help traders capitalize on more significant market shifts.

6. Risk Management and Position Sizing: Regardless of the strategy used, effective risk management is paramount. Traders should determine their risk tolerance and set appropriate stop-loss levels. Since no trading strategy is foolproof, managing potential losses is crucial to long-term success. Position sizing should be calculated based on the trader's risk-reward ratio and overall account size.

Footnote:

The Bullish Engulfing pattern stands as a prominent candlestick formation that holds the potential to offer traders valuable insights into market reversals. However, like any trading strategy, it is not without its limitations. False signals can still occur, and market conditions may vary. Therefore, traders should exercise caution, conduct thorough analysis, and consider incorporating additional tools and strategies to enhance the accuracy of their trades.

Trading with the Bullish Engulfing pattern requires more than just the ability to recognize the pattern itself. It demands a comprehensive understanding of technical analysis, risk management, and market psychology. As with any trading approach, continuous learning, practice, and adaptability are key to mastering the art of trading with Bullish Engulfing patterns. By combining these elements and tailoring strategies to individual trading styles, traders can potentially harness the power of this pattern to make informed decisions and navigate the dynamic landscape of the forex market.

Discussion