Forex Trading Strategies for Using the Bearish Pennant Pattern: Approaches for Trading with the Bearish Pennant Chart Pattern

The world of forex trading is an intricate landscape where traders utilize a myriad of tools and patterns to decipher market movements and make informed decisions. One such pattern that has gained significant attention is the Bearish Pennant pattern. This pattern is characterized by its distinct shape resembling a small symmetrical triangle, signaling a potential continuation of a downward trend after a brief consolidation. In this article, we will delve into the intricacies of the Bearish Pennant pattern and explore effective trading strategies for leveraging its potential.

Table Content

I. Understanding the Bearish Pennant Pattern

1. Flagpole

2. Pennant

II. Trading Strategies for the Bearish Pennant Pattern

1. Confirmation is Key

2. Shorting the Breakout

3. Measuring the Target

4. Using Indicators

5. Risk Management

6. Practice and Patience

7. Market Context

III. Footnote

Understanding the Bearish Pennant Pattern

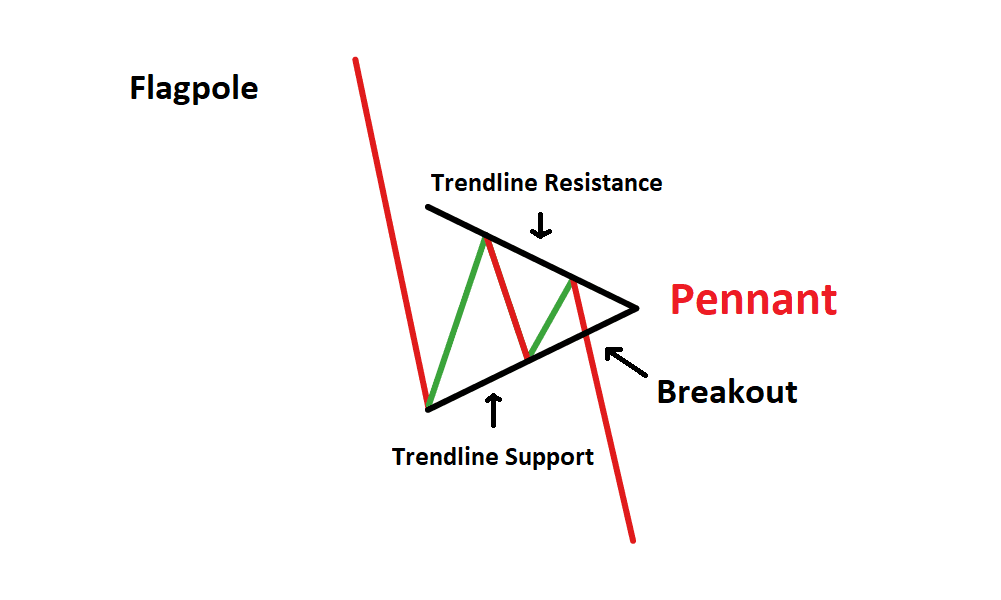

Before delving into trading strategies, it's crucial to understand the Bearish Pennant pattern and its components. The Bearish Pennant is a continuation pattern that forms after a sharp price decline, indicating a brief consolidation before the market's downward momentum resumes. The pattern is formed by two main components:

1. Flagpole: This is the initial sharp decline in price that resembles a flagpole. It represents a strong bearish sentiment in the market.

2. Pennant: The flagpole is followed by a period of consolidation, where the price forms a symmetrical triangle or a small pennant. This triangle is formed by two converging trendlines – an upper trendline connecting lower highs and a lower trendline connecting higher lows.

The pattern suggests that traders are taking a breather after the initial bearish move, and as the price consolidates within the pennant, it often indicates that the bears are gathering strength for another potential downward push.

Trading Strategies for the Bearish Pennant Pattern

Trading with the Bearish Pennant pattern requires a well-defined strategy and a keen understanding of market dynamics. Here are some approaches that traders can consider when dealing with this pattern:

1. Confirmation is Key: Before entering a trade based on the Bearish Pennant pattern, it's crucial to wait for confirmation. This can come in the form of a breakout below the lower trendline of the pennant. The breakout should be accompanied by a surge in trading volume, indicating strong selling pressure and a potential continuation of the downward trend. Trading without confirmation could lead to false signals, resulting in losses.

2. Shorting the Breakout: Once the confirmation is in place, traders can consider shorting the currency pair. This involves placing a sell order as soon as the price breaks below the lower trendline of the pennant. The initial stop-loss can be set just above the upper trendline of the pennant. This way, if the price unexpectedly reverses, the losses can be minimized. As the price continues its downward movement, traders can consider trailing their stop-loss to lock in profits.

3. Measuring the Target: To estimate the potential price movement following the breakout, traders can use a measuring technique. Measure the height of the flagpole – the distance from the initial sharp decline to the start of the pennant formation. This distance can then be projected downward from the breakout point to provide an approximate target for the downward move. However, it's important to note that not all patterns will reach their projected targets, so monitoring the price action and adjusting the target accordingly is essential.

4. Using Indicators: Traders can combine the Bearish Pennant pattern with technical indicators to enhance their trading decisions. For instance, the Moving Average Convergence Divergence (MACD) indicator can help identify the strength of the bearish momentum. A bearish crossover on the MACD histogram after the breakout can provide additional confirmation for short trades.

5. Risk Management: As with any trading strategy, effective risk management is crucial when trading the Bearish Pennant pattern. Traders should never risk more than a small percentage of their trading capital on a single trade. Setting a stop-loss is essential to limit potential losses if the trade goes against expectations. Additionally, consider adjusting the position size based on the distance between the entry point and the stop-loss level.

6. Practice and Patience: Mastering the art of trading the Bearish Pennant pattern, like any other strategy, requires practice and patience. Traders should demo trade this strategy to gain a better understanding of how the pattern behaves in different market conditions. Learning to identify false breakouts and fine-tuning entry and exit points takes time, so it's important not to rush into live trading until consistent success is achieved in a simulated environment.

7. Market Context: It's essential to consider the broader market context when trading the Bearish Pennant pattern. Fundamental factors, geopolitical events, and economic data releases can significantly impact the effectiveness of the pattern. Avoid trading during major news announcements and be aware of any potential catalysts that could lead to sudden price reversals.

Footnote:

In summary, the Bearish Pennant pattern is a valuable tool in a forex trader's arsenal for identifying potential continuation of downward trends. However, successful trading with this pattern requires a combination of technical analysis, risk management, and a deep understanding of market dynamics. Traders should exercise caution, wait for confirmation, and consider using additional indicators to enhance their decision-making process. Remember that no trading strategy guarantees success, and losses are part of the trading journey. Therefore, always trade responsibly and never risk more than you can afford to lose.

Discussion