Forex Trading Strategies for Using the Bearish Harami Pattern: Approaches for Trading with the Bearish Harami Candlestick Pattern

In the world of forex trading, candlestick patterns play a vital role in helping traders predict price movements and make informed trading decisions. One such powerful pattern is the bearish harami. The bearish harami pattern is a two-candlestick pattern that signals a potential reversal of an uptrend. It signifies a shift in market sentiment from bullish to bearish, offering traders an opportunity to capitalize on impending downward price movements. In this article, we will delve into various strategies for effectively utilizing the bearish harami pattern in forex trading.

Table Content

I. Understanding the Bearish Harami Pattern

1: Bearish Harami Confirmation with Indicators

2: Bearish Harami in Confluence with Resistance

3: Bearish Harami in Trendline Context

4: Bearish Harami as Part of a Candlestick Pattern Sequence

5: Using Bearish Harami for Scalping

6: Employing Bearish Harami for Swing Trading

7: Implementing Proper Risk Management

II. Footnote

Understanding the Bearish Harami Pattern:

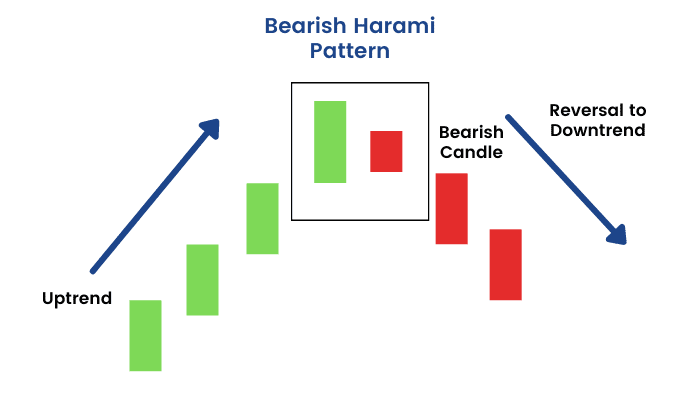

Before delving into trading strategies, it's essential to comprehend the structure of the bearish harami pattern. The pattern consists of two candles: a larger bullish candle followed by a smaller bearish candle. The bearish candle is contained within the range of the preceding bullish candle. This juxtaposition of candles represents a tug-of-war between buyers and sellers, with the bears gaining traction and indicating a potential trend reversal.

1: Bearish Harami Confirmation with Indicators:

To enhance the reliability of the bearish harami pattern, traders often look for confirmation from technical indicators. One widely used indicator is the Relative Strength Index (RSI). If the RSI has been in overbought territory and starts to show signs of weakening momentum, this can align with the bearish harami's reversal signal. When the smaller bearish candle of the pattern forms after a bullish trend and the RSI confirms a potential overbought scenario, traders might consider entering a short position.

2: Bearish Harami in Confluence with Resistance:

The bearish harami pattern's potency can be amplified when it coincides with a key resistance level. A resistance level is a price point where the market has historically struggled to break above. When the smaller bearish candle forms within the range of the preceding bullish candle near a significant resistance level, it strengthens the bearish signal. Traders can use this confluence as a basis for initiating short positions with the expectation that the resistance will hold and the price will reverse.

3: Bearish Harami in Trendline Context:

Trendlines are invaluable tools in technical analysis, aiding in the identification of trends and potential trend reversals. When the bearish harami pattern occurs near a well-established trendline, it serves as a powerful indication that the prevailing trend might be losing steam. If the smaller bearish candle breaches the trendline, it could signal a shift from an uptrend to a downtrend. Traders can then consider entering short positions, anticipating further price declines.

4: Bearish Harami as Part of a Candlestick Pattern Sequence:

Candlestick patterns often appear in sequences, creating more complex signals. The bearish harami can be part of such sequences. For instance, when a bearish harami follows a shooting star candle (a candle with a small body and a long upper wick), it can create a stronger bearish signal. This sequence suggests that the market initially attempted to push higher but encountered resistance, followed by the bearish harami's indication of impending reversal. Traders might interpret this sequence as a higher probability setup for entering short positions.

5: Using Bearish Harami for Scalping:

Scalping is a short-term trading strategy that aims to capitalize on small price movements. Traders employing this strategy often use the bearish harami pattern as a signal to enter quick trades. In scalping, traders might wait for the bearish harami to form, enter a short position, and aim to capture a small portion of the impending downward price movement. This strategy requires precision timing and discipline, as traders need to closely monitor their positions and exit quickly to lock in profits.

6: Employing Bearish Harami for Swing Trading:

Swing trading involves capturing medium-term price movements that can last from a few days to a few weeks. Traders employing the bearish harami pattern for swing trading might wait for additional confirmation, such as a bearish crossover on the Moving Average Convergence Divergence (MACD) indicator or a break below a short-term support level. This cautious approach helps filter out false signals and increases the probability of successful trades.

7: Implementing Proper Risk Management:

No trading strategy is complete without a robust risk management plan. When trading using the bearish harami pattern, it's crucial to set stop-loss orders to limit potential losses if the trade goes against your prediction. The placement of the stop-loss should be strategic – it should allow for some price fluctuation while also preventing excessive losses. Additionally, traders should avoid risking a significant portion of their trading capital on a single trade, adhering to a responsible position sizing strategy.

Footnote:

The bearish harami pattern is a versatile tool in a forex trader's arsenal, offering valuable insights into potential trend reversals. By combining this pattern with technical indicators, support and resistance levels, trendlines, and other candlestick patterns, traders can create comprehensive strategies for different trading styles – whether they're scalping for quick gains or swing trading for more extended periods. However, it's important to note that no trading strategy is foolproof, and risk management should always be a top priority. As with any trading approach, practicing in a demo account and continuously educating oneself about the forex market can contribute to more successful trading outcomes.

Discussion