Forex Trading Strategies for Using the Bearish Flag Pattern: Approaches for Trading with the Bearish Flag Chart Pattern

In the dynamic world of forex trading, technical analysis plays a pivotal role in identifying potential trading opportunities. One powerful chart pattern that traders often encounter is the Bearish Flag pattern. The Bearish Flag is a continuation pattern that can provide valuable insights into potential price movements. In this article, we will delve into the intricacies of the Bearish Flag pattern and explore effective trading strategies to capitalize on its signals.

Table Content

I. Understanding the Bearish Flag Pattern

II. Trading Strategies with the Bearish Flag Pattern

1. Confirmation is Key

2. Entry Point and Stop Loss Placement

3. Measuring Flagpole Length for Price Targets

4. Using Technical Indicators

5. Risk Management and Position Sizing

6. Consider Market Context

7. Practice and Adaptation

III. Footnote

Understanding the Bearish Flag Pattern

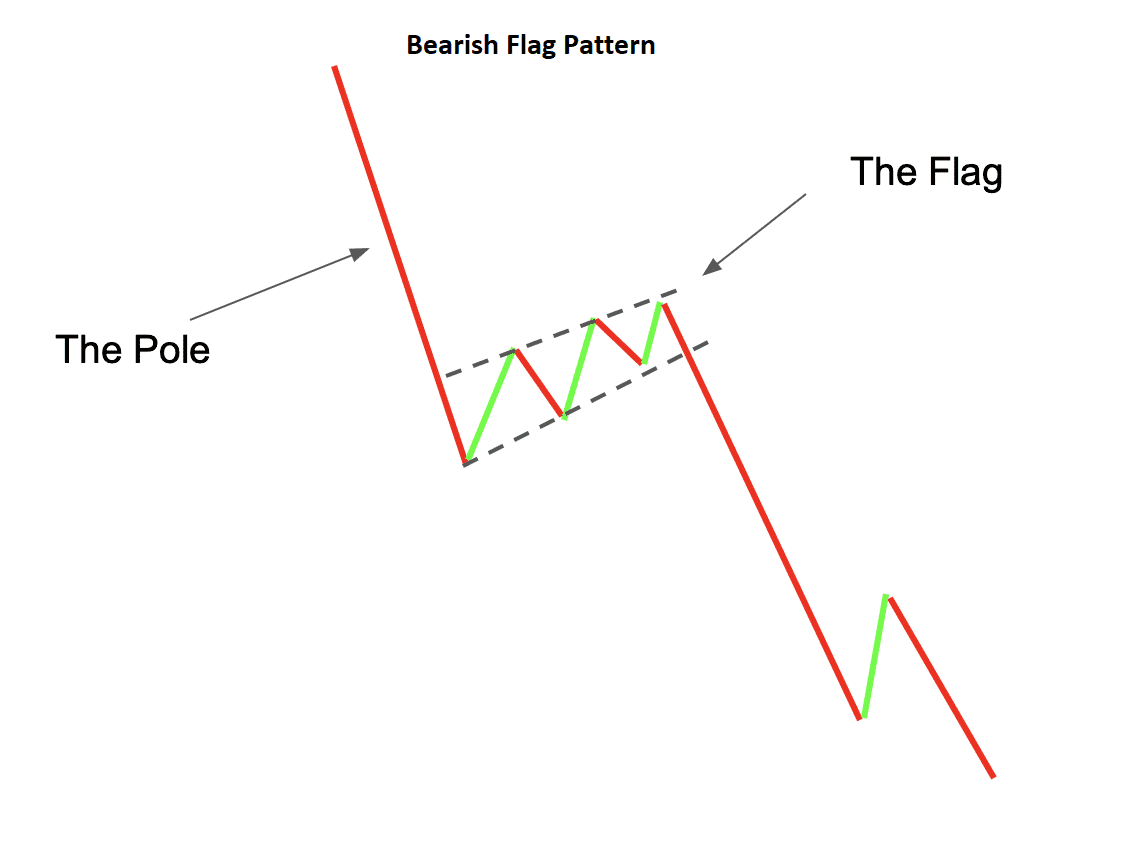

Before diving into trading strategies, it's essential to grasp the fundamentals of the Bearish Flag pattern. The Bearish Flag is a short-term continuation pattern that typically occurs after a significant downward price movement, known as the flagpole. The pattern derives its name from its appearance: a rectangular shape that resembles a flag, with the flagpole representing the initial sharp decline and the flag acting as a consolidation period.

The flag portion of the pattern is characterized by a series of parallel trendlines that slope against the prevailing trend, forming a channel. The price within this channel tends to move sideways, which signifies a temporary pause in the market as traders catch their breath and evaluate their next moves. This consolidation is often accompanied by lower trading volumes.

Once the flag formation concludes, the price is expected to continue its downward trajectory, mirroring the initial flagpole's decline. The key aspect here is that the pattern suggests a potential resumption of the previous downtrend, making it an attractive opportunity for bearish traders.

Trading Strategies with the Bearish Flag Pattern

Trading the Bearish Flag pattern requires a systematic approach and careful consideration of entry and exit points. Here are some effective strategies that traders can employ when encountering the Bearish Flag pattern:

1. Confirmation is Key

Before initiating any trade based on the Bearish Flag pattern, it's crucial to wait for confirmation. Traders often look for a decisive breakout below the lower trendline of the flag channel. This breakout is seen as validation that the consolidation phase is concluding, and the price is poised to continue its downward movement. Waiting for confirmation helps reduce false signals and enhances the probability of successful trades.

2. Entry Point and Stop Loss Placement

For optimal entry points, traders commonly wait for the price to break below the lower trendline and retest it as a new resistance level. This retest can serve as an entry opportunity, as traders can place a short position with a stop loss slightly above the upper trendline of the flag. This placement minimizes risk in case the price unexpectedly reverses.

3. Measuring Flagpole Length for Price Targets

One intriguing aspect of the Bearish Flag pattern is its potential to provide price targets. Traders often measure the length of the flagpole (the initial sharp decline) and project it downward from the point of the breakout. This projected distance gives an approximate target for the price's downward movement, aiding in setting realistic profit targets.

4. Using Technical Indicators

Integrating technical indicators can enhance the effectiveness of trading strategies. Traders often combine the Bearish Flag pattern with indicators like the Relative Strength Index (RSI) or Moving Averages. These indicators can offer additional confirmation of potential price movements, adding an extra layer of analysis to trading decisions.

5. Risk Management and Position Sizing

Like any trading strategy, risk management is paramount. Traders should avoid allocating an excessively large portion of their capital to a single trade. Position sizing should be in line with the trader's overall risk tolerance and account size. Implementing a risk-reward ratio of at least 1:2 can help ensure that profitable trades outweigh losing ones, even if not every trade is a success.

6. Consider Market Context

While the Bearish Flag pattern itself is a powerful signal, considering the broader market context is equally important. Traders should take into account any upcoming economic events, geopolitical factors, or other developments that could impact the market. This contextual analysis can help avoid unexpected surprises that might invalidate the pattern's potential outcomes.

7. Practice and Adaptation

As with any trading strategy, practice makes perfect. Traders are encouraged to backtest their strategies using historical data and refine their approach over time. Additionally, market conditions can change, so remaining adaptable and willing to adjust strategies based on evolving trends is crucial for long-term success.

Footnote

The Bearish Flag pattern is a versatile tool in a trader's arsenal, offering valuable insights into potential price movements. By understanding the pattern's dynamics and employing well-defined trading strategies, forex traders can effectively capitalize on its signals. Remember that, like all trading strategies, the Bearish Flag pattern is not foolproof and requires careful analysis, risk management, and continuous learning. With a disciplined approach and a commitment to refining your skills, you can navigate the forex market with greater confidence and potentially achieve consistent profitability.

Discussion