Forex trading strategies for using the ABCD pattern: Techniques for trading with the ABCD pattern.

In the world of forex trading, success hinges on the ability to identify and utilize patterns that provide valuable insights into market trends. One such powerful pattern is the ABCD pattern, a key tool in the arsenal of experienced traders. By understanding and effectively applying the ABCD pattern, traders can enhance their trading strategies and increase the likelihood of making profitable trades. In this article, we will delve into the intricacies of the ABCD pattern and explore techniques for trading with it.

Table Content

I. Demystifying the ABCD Pattern

II. Constructing the ABCD Pattern

1. Leg AB

2. Leg BC

3. Leg CD

III. Trading Techniques with the ABCD Pattern

1. Confirming with Fibonacci Retracements

2. Confluence with Other Indicators

3. Using Oscillators

4. Managing Risk with Stop-Loss Orders

5. Monitoring Time Frames

6. Patience and Discipline

7. Back testing and Practice

IV. Real-World Example

V. Footnote

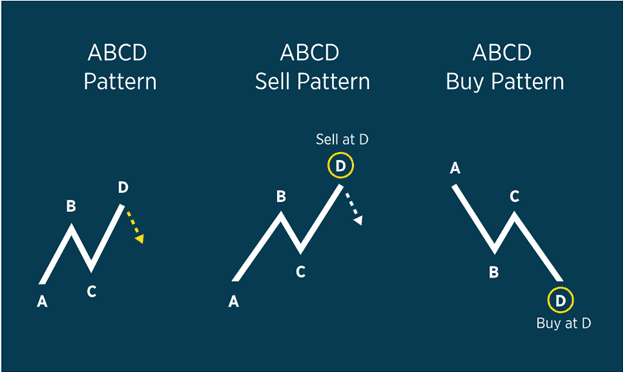

Demystifying the ABCD Pattern

The ABCD pattern is a geometric price pattern that helps traders identify potential trend reversals or continuations in the forex market. It is named after the sequence of four price swings it represents – A to B, B to C, C to D. Each of these price swings is composed of both magnitude and time, allowing traders to anticipate potential price movements. The pattern consists of two legs in the direction of the trend (AB and BC) followed by a corrective or reversal leg (CD).

Constructing the ABCD Pattern

1. Leg AB: This is the initial price move in the direction of the trend. It is called the "AB leg." It establishes the base for the pattern and forms the first significant move.

2. Leg BC: After the AB leg, a retracement occurs, which is the BC leg. This leg usually retraces a portion of the AB leg's movement. It is during this phase that traders start looking for potential reversal or continuation signals.

3. Leg CD: The CD leg is the final leg of the pattern. It is a move in the direction opposite to the trend established by the AB leg. If the CD leg extends beyond the initial price move of the AB leg, it indicates a trend continuation. If it retraces the AB leg by a significant percentage, it suggests a trend reversal.

Trading Techniques with the ABCD Pattern

Mastering the ABCD pattern involves more than just recognizing the shape on a chart; it requires a comprehensive trading strategy. Here are some techniques to consider when trading with the ABCD pattern:

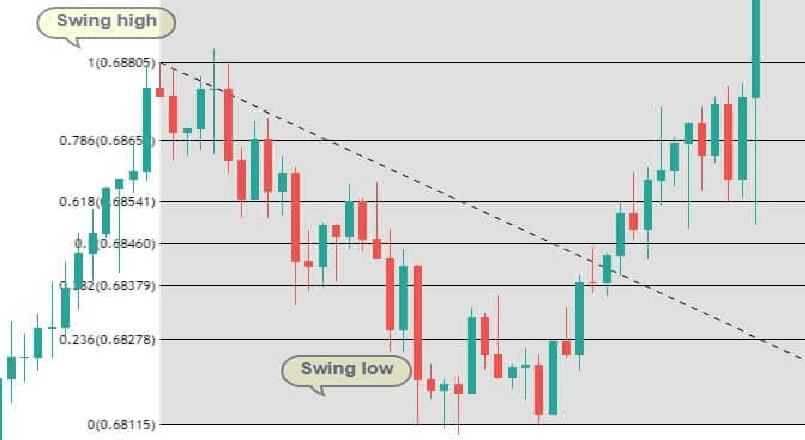

1. Confirming with Fibonacci Retracements: The ABCD pattern often aligns with Fibonacci retracement levels, enhancing its reliability. Traders can use these retracement levels to identify potential reversal or continuation zones. When the ABCD pattern completes near a key Fibonacci level, it adds weight to the potential trade.

2. Confluence with Other Indicators: To increase the accuracy of ABCD pattern trades, traders can look for confluence with other technical indicators. For instance, if the pattern completion coincides with a trendline, support/resistance level, or a moving average, it strengthens the trade signal.

3. Using Oscillators: Oscillators like the Relative Strength Index (RSI) or Stochastic Oscillator can help identify overbought or oversold conditions. When the CD leg aligns with such conditions, it can serve as an additional confirmation of a potential reversal.

4. Managing Risk with Stop-Loss Orders: Effective risk management is essential in forex trading. Placing a stop-loss order below the low (for a long trade) or above the high (for a short trade) of the CD leg can help limit potential losses if the trade goes against you.

5. Monitoring Time Frames: The ABCD pattern can appear on various time frames. Traders should consider the pattern's appearance on higher time frames for a broader perspective on market trends, while using lower time frames for precise entry points.

6. Patience and Discipline: Like any trading strategy, patience and discipline are crucial when trading the ABCD pattern. Wait for all components of the pattern to be in place before executing a trade. Avoid the temptation to enter prematurely, as this could lead to false signals.

7. Back testing and Practice: Before incorporating the ABCD pattern into a live trading strategy, it's wise to conduct thorough back testing. This involves analyzing historical price data to see how the pattern would have performed in different market conditions. Practice on demo accounts can also help refine your skills.

Real-World Example

Let's consider an example of how a trader might apply the ABCD pattern in a real-world scenario:

Suppose a trader identifies a bullish ABCD pattern forming on the EUR/USD currency pair. The AB leg sees a significant upward movement, followed by a retracement in the BC leg. The trader waits for the CD leg to complete the pattern, looking for confirmation from other indicators.

Upon completing the pattern, the CD leg aligns with a key Fibonacci retracement level and is also near a major support level on the daily chart. The RSI indicator shows an oversold condition, reinforcing the potential for a reversal. The trader places a stop-loss order just below the low of the CD leg.

With all criteria met, the trader enters a long position on the EUR/USD pair. As the market unfolds, price action validates the ABCD pattern, and the currency pair starts moving in the anticipated direction. The trader manages the trade by trailing the stop-loss order to secure profits and minimize risk.

Footnote:

The ABCD pattern is a versatile tool that can significantly enhance a trader's forex strategy. However, it requires a combination of technical analysis, patience, and risk management to be effective. Traders should remember that no trading strategy is foolproof, and losses are a part of the trading journey.

By mastering the ABCD pattern and integrating it with other technical indicators and risk management techniques, traders can increase their probability of success. As with any skill, practice makes perfect. Aspiring traders should dedicate time to studying charts, practicing on demo accounts, and continually refining their approach. With dedication and a solid understanding of the ABCD pattern, traders can navigate the forex market with greater confidence and precision.

Discussion