Forex trading strategies for using the 123 pattern: Approaches for trading with the 123 pattern.

The world of forex trading is a complex and dynamic environment, where traders employ various strategies to gain an edge in the market. One such strategy is the utilization of chart patterns, and the 123 pattern stands out as a popular choice among traders. The 123 pattern, also known as the 1-2-3 pattern, is a versatile technical analysis tool that can offer insightful entry and exit points for traders. In this article, we will delve into the intricacies of the 123 pattern and explore different approaches to effectively trade using this pattern.

Table Content

I. Understanding the 123 Pattern

1. Wave 1

2. Wave 2

3. Wave 3

II. Breakout Trading Strategy

III. Retracement Trading Strategy

IV. Confluence Trading Strategy

V. Footnote

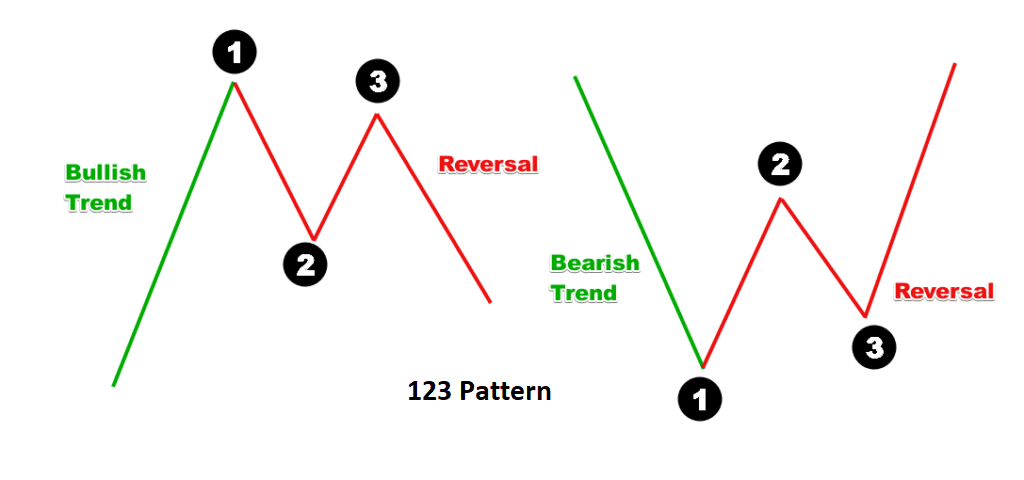

Understanding the 123 Pattern:

The 123 pattern is a reversal pattern that consists of three consecutive price swings. These price swings are labeled as follows:

1. Wave 1: This is the initial move in a given direction, often initiated by a prevailing trend. If the trend is bullish, Wave 1 will be a downward movement. Conversely, if the trend is bearish, Wave 1 will be an upward movement.

2. Wave 2: Following the completion of Wave 1, a correction or counter-trend movement occurs. Wave 2 corrects the price action of Wave 1 but does not typically retrace beyond the starting point of Wave 1.

3. Wave 3: After the correction of Wave 2, the price resumes its original trend in Wave 3. This movement tends to be more significant than Wave 1 and validates the reversal pattern.

The 123 pattern is deemed complete when price action breaks out from the high or low of Wave 2, confirming the new trend direction established by Wave 3. This breakout serves as a crucial signal for traders to enter the market.

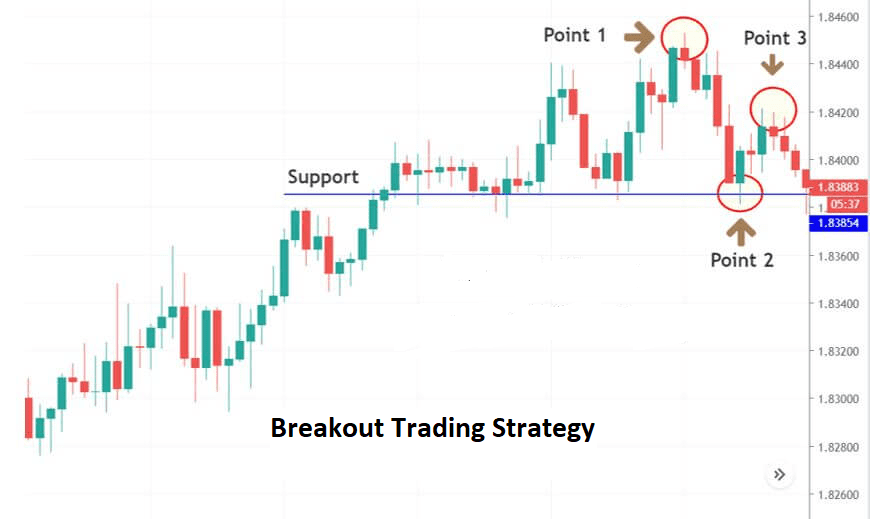

Breakout Trading Strategy:

One of the fundamental approaches to trading the 123 pattern is the breakout strategy. Traders using this approach wait for the price to break out from the high or low of Wave 2. This breakout is seen as a confirmation of the pattern's validity and a potential indication of the beginning of a new trend. Once the breakout occurs, traders can enter the market in the direction of Wave 3, aiming to capitalize on the continuation of the new trend.

To implement the breakout strategy with the 123 pattern:

1. Identify the Pattern: Locate the 123 pattern on your forex chart. Ensure that Waves 2 and 3 adhere to the defined criteria of the pattern.

2. Set Entry and Stop-Loss Levels: When the breakout occurs, place an entry order slightly above the high (for a bullish breakout) or below the low (for a bearish breakout) of Wave 2. Additionally, set a stop-loss order to manage risk in case the breakout fails.

3. Determine Take-Profit Targets: Calculate potential take-profit levels based on the projected extension of Wave 3. Traders often use Fibonacci retracement and extension levels, previous support and resistance zones, or other technical tools to identify suitable take-profit targets.

Retracement Trading Strategy:

The retracement strategy is another effective way to trade the 123 pattern. In this approach, traders anticipate a retracement or pullback after the completion of Wave 3. The goal is to enter the market during the retracement and ride the subsequent continuation of the trend initiated by Wave 3.

To implement the retracement strategy with the 123 pattern:

1. Identify the Pattern: As with the breakout strategy, start by identifying a valid 123 pattern on the chart.

2. Wait for Retracement: Instead of entering immediately after the breakout, wait for the price to retrace a certain percentage of the distance covered by Wave 3. Common retracement levels used by traders include 38.2%, 50%, and 61.8% Fibonacci retracement levels.

3. Enter and Set Stop-Loss: Once the price retraces to the desired level, enter the market in the direction of Wave 3. Place a stop-loss order below the low of the retracement.

4. Identify Take-Profit Levels: Similar to the breakout strategy, identify potential take-profit levels based on technical analysis tools. Traders often use the extension of Wave 3 or support/resistance levels as their take-profit targets.

Confluence Trading Strategy:

The confluence strategy involves combining the 123 pattern with other technical indicators or chart patterns to increase the probability of successful trades. This approach aims to enhance the quality of trade signals by confirming the pattern's potential reversal or continuation.

To implement the confluence strategy with the 123 pattern:

1. Identify the Pattern: Begin by identifying a valid 123 pattern on the chart.

2. Confirm with Other Indicators: Look for additional technical indicators or chart patterns that align with the direction suggested by the 123 pattern. For instance, you might seek confirmation from oscillators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD).

3. Evaluate Support and Resistance: Check if the breakout or retracement levels align with significant support or resistance zones on the chart. Such alignment can reinforce the potential success of the trade.

4. Implement Risk Management: As with any trading strategy, incorporate proper risk management techniques. Set appropriate stop-loss levels and position sizes based on your risk tolerance and the confluence of signals.

Footnote:

The 123 pattern is a versatile tool that can empower forex traders with valuable insights into market reversals and continuations. The breakout, retracement, and confluence strategies provide traders with different approaches to harness the power of this pattern. However, it's essential to remember that no strategy guarantees success in the forex market. Traders should combine the 123 pattern with comprehensive market analysis, risk management, and discipline to make informed trading decisions. As with any trading strategy, practice, learning, and adaptation to changing market conditions are key to mastering the art of trading with the 123 pattern.

Discussion