Forex trading strategies for using moving average crossovers: Techniques for identifying trend shifts with moving averages.

In the world of forex trading, the ability to accurately predict and capitalize on market trends is paramount. While the forex market can be volatile and unpredictable, traders often turn to various technical indicators to make informed decisions. Among these indicators, moving averages stand out as a fundamental tool for identifying trend shifts and making well-timed trades. In this article, we will delve into the world of moving averages and explore effective forex trading strategies using moving average crossovers.

Table Content

I. Understanding Moving Averages

II. The Power of Moving Average Crossovers

III. Identifying Trend Shifts with Moving Average Crossovers

1. Golden Cross and Death Cross

2. EMA Crossover Strategy

3. Dual Moving Average Crossover

IV. Implementing Moving Average Crossovers: Tips and Considerations

1) Confirm with Other Indicators

2) Timeframes Matter

3) Consider Market Conditions

4) Risk Management

5) Back-testing and Optimization

V. Footnote

Understanding Moving Averages

A moving average (MA) is a widely used technical indicator that smooths out price data over a specified period to create a trend-following line on a price chart. By doing so, it helps traders identify the general direction of the market trend, filtering out the day-to-day noise that can obscure meaningful patterns.

There are various types of moving averages, with the most common being the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA calculates the average price over a predetermined number of periods, treating each period's data equally. On the other hand, the EMA places more weight on recent price data, making it more responsive to recent market developments.

The Power of Moving Average Crossovers

Moving averages become especially powerful when used in conjunction with each other through a technique known as moving average crossovers. A crossover occurs when two different moving averages, typically one short-term and one long-term, intersect on a price chart. This event can signal potential changes in market direction, making it an important tool for forex traders.

The two most common moving averages used in crossovers are the 50-period and 200-period moving averages. The 50-period MA represents the short-term trend, capturing price movements over a relatively recent time frame. Conversely, the 200-period MA represents the long-term trend, smoothing out price data over a more extended period.

Identifying Trend Shifts with Moving Average Crossovers

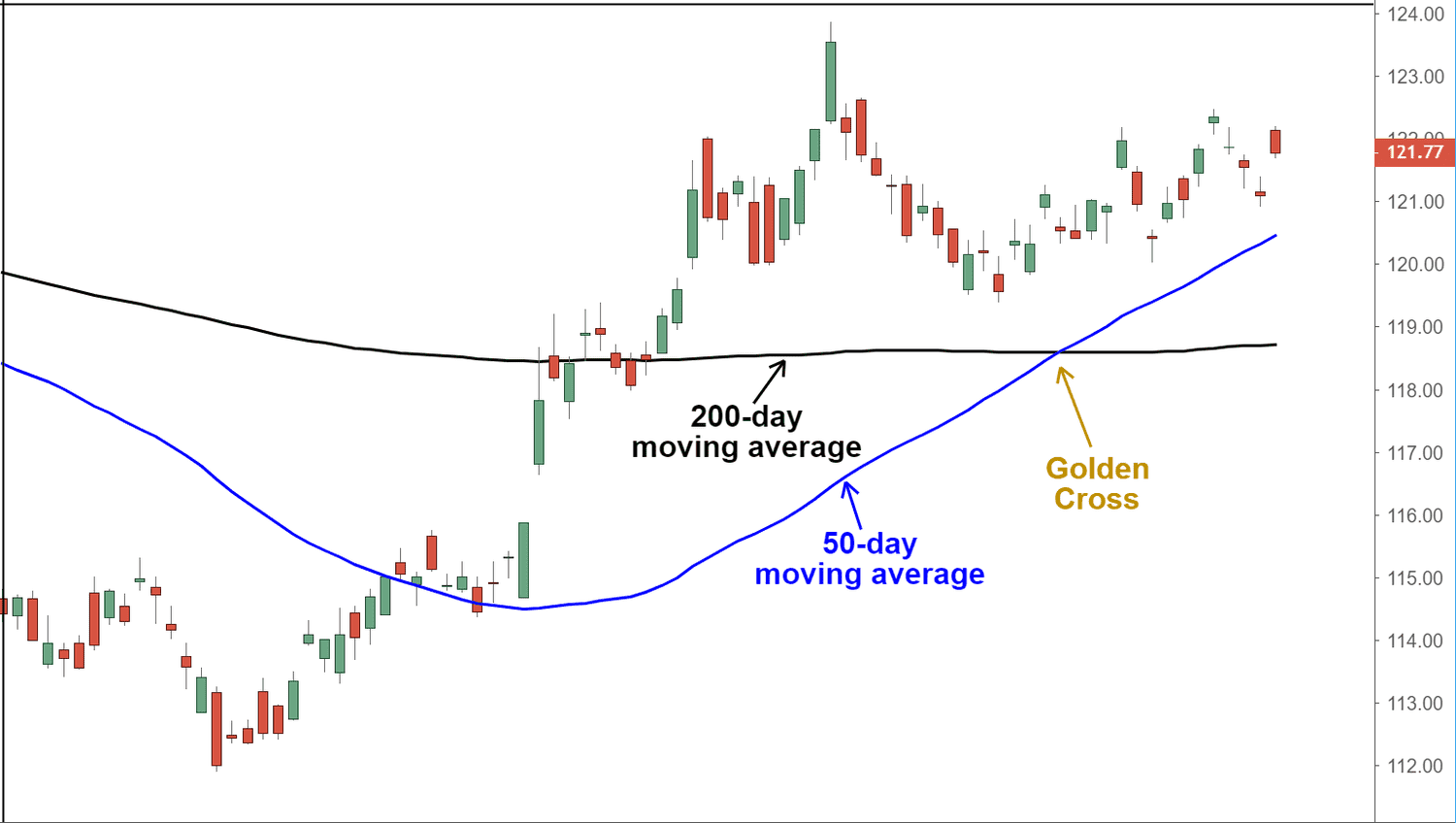

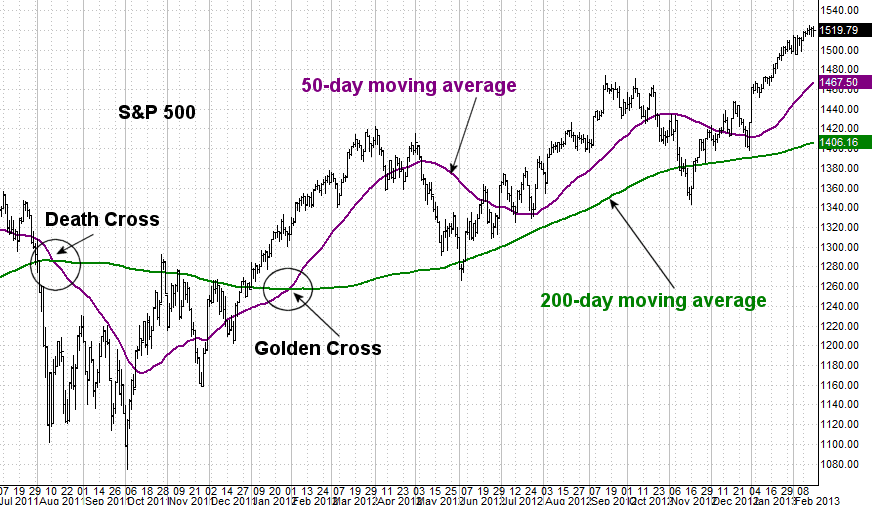

1. Golden Cross and Death Cross

The Golden Cross and Death Cross are two of the most well-known moving average crossover strategies. The Golden Cross occurs when the short-term moving average (e.g., 50-period MA) crosses above the long-term moving average (e.g., 200-period MA). This crossover suggests a potential shift from a downtrend to an uptrend, indicating a bullish signal. Conversely, the Death Cross happens when the short-term moving average crosses below the long-term moving average, indicating a possible shift from an uptrend to a downtrend, giving a bearish signal.

Traders often wait for confirmation of these crossovers through increased trading volume and additional technical indicators before making trading decisions.

2. EMA Crossover Strategy

The Exponential Moving Average (EMA) crossover strategy focuses on the dynamic interplay of short-term and long-term EMAs. This approach uses two EMAs, typically a 12-period EMA (short-term) and a 26-period EMA (long-term). When the short-term EMA crosses above the long-term EMA, it generates a bullish signal, suggesting an upward trend shift. Conversely, when the short-term EMA crosses below the long-term EMA, a bearish signal is generated, indicating a potential downward trend shift.

The EMA crossover strategy is popular due to its responsiveness to recent price movements, allowing traders to capture trends as they begin to develop.

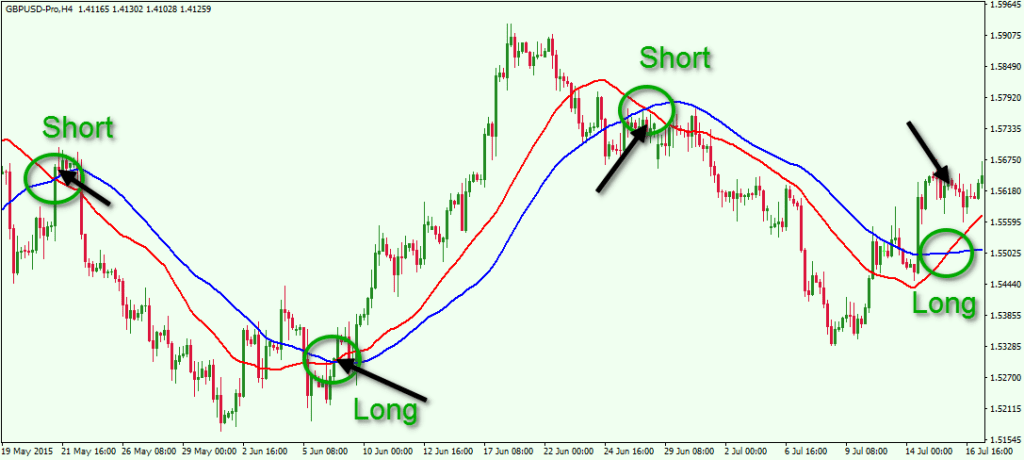

3. Dual Moving Average Crossover

The dual moving average crossover strategy involves using two different moving averages and the crossovers between them to identify trend shifts. For example, a trader might use a combination of the 10-period SMA and the 50-period SMA. When the shorter-term SMA crosses above the longer-term SMA, it signals a potential upward trend shift, and when it crosses below, it indicates a potential downward trend shift.

The dual moving average crossover strategy provides a balance between responsiveness to recent price movements and filtering out short-term noise, making it suitable for traders looking for a comprehensive trend identification approach.

Implementing Moving Average Crossovers: Tips and Considerations

While moving average crossovers can be powerful tools for identifying trend shifts, it's essential to approach their implementation with careful consideration:

1) Confirm with Other Indicators: Moving average crossovers are most effective when supported by other technical indicators such as volume analysis, momentum indicators (e.g., RSI, MACD), and candlestick patterns. This confirmation helps reduce false signals.

2) Timeframes Matter: Different timeframes yield different results. Shorter timeframes (e.g., 10-period and 20-period MAs) provide more frequent signals but may be susceptible to noise. Longer timeframes (e.g., 50-period and 200-period MAs) offer more reliable signals but may result in delayed entries and exits.

3) Consider Market Conditions: Moving average crossovers work best in trending markets. During periods of consolidation or sideways movement, crossovers can generate false signals. It's crucial to factor in the overall market context.

4) Risk Management: No strategy is foolproof. Implement proper risk management techniques, such as setting stop-loss orders and position sizing, to protect your capital from potential losses.

5) Back-testing and Optimization: Before using any moving average crossover strategy in live trading, conduct thorough back-testing on historical data to evaluate its performance. Adjust the strategy parameters as needed to optimize results.

Footnote

Moving average crossovers are versatile and effective tools for forex traders seeking to identify trend shifts and make informed trading decisions. These strategies provide a systematic way to filter out market noise and focus on significant price movements. By using the power of moving average crossovers in conjunction with other technical indicators and maintaining prudent risk management practices, traders can enhance their chances of success in the dynamic world of forex trading. Remember, no strategy guarantees success, but a well-informed approach significantly improves the odds of making profitable trades.

Discussion