Forex trading strategies for using Bearish Engulfing pattern: Techniques for trading with Bearish Engulfing candlestick patterns.

In the complex world of forex trading, success hinges on the ability to interpret market signals accurately and execute well-informed strategies. Among the various tools available to traders, candlestick patterns stand out as visual representations of market sentiment and potential price movements. One such powerful pattern is the Bearish Engulfing pattern. In this article, we will delve into the intricacies of the Bearish Engulfing pattern, exploring techniques and strategies to effectively incorporate it into your trading arsenal.

Table Content

I. Understanding the Bearish Engulfing Pattern

II. Identifying the Bearish Engulfing Pattern

1. An Uptrend

2. Bullish Candle

3. Bearish Candle

4. Volume Consideration

5. Confirmation

III. Trading Strategies with the Bearish Engulfing Pattern

1. Bearish Reversal Signal

2. Confirmation Indicators

3. Combining with Support and Resistance Levels

4. Timeframe Consideration

5. Risk Management

6. Waiting for Confirmation Candle

IV. Real-World Example: Applying the Bearish Engulfing Pattern

V. Footnote

Understanding the Bearish Engulfing Pattern

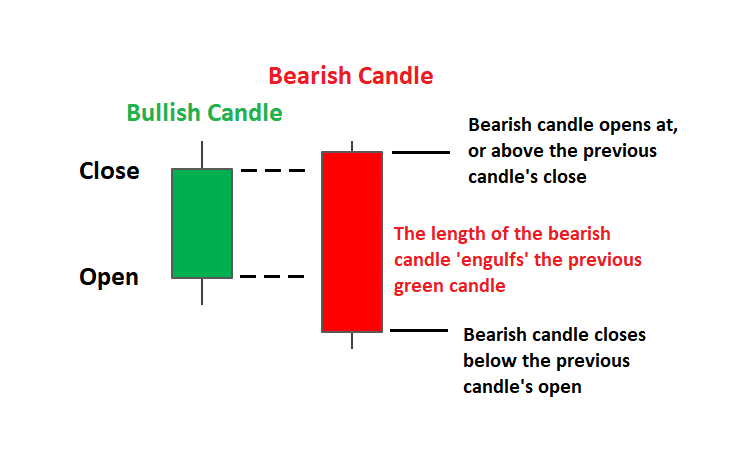

Candlestick charts provide traders with an intuitive way to grasp market dynamics. The Bearish Engulfing pattern is a two-candlestick pattern that signals a potential reversal of an uptrend. It consists of two candles: a bullish (up) candle followed by a larger bearish (down) candle that completely engulfs the previous bullish candle. This pattern suggests a shift in market sentiment from bullish to bearish, indicating a possible downturn in price.

Identifying the Bearish Engulfing Pattern

Recognizing the Bearish Engulfing pattern is fundamental for any trader seeking to capitalize on its potential. To identify the pattern, follow these steps:

1. An Uptrend: The pattern should occur after a sustained uptrend, highlighting a potential trend reversal.

2. Bullish Candle: The first candle is a smaller bullish candle, representing the continuation of the existing uptrend.

3. Bearish Candle: The second candle is a larger bearish candle that completely engulfs the body of the preceding bullish candle.

4. Volume Consideration: Ideally, the bearish candle should have higher trading volume than the preceding bullish candle, emphasizing the shift in market sentiment.

5. Confirmation: Confirmation of the pattern's significance can be sought by observing subsequent price movements.

Trading Strategies with the Bearish Engulfing Pattern

While identifying the Bearish Engulfing pattern is crucial, devising effective trading strategies around it requires a deeper understanding of market dynamics and risk management. Here are several techniques to consider:

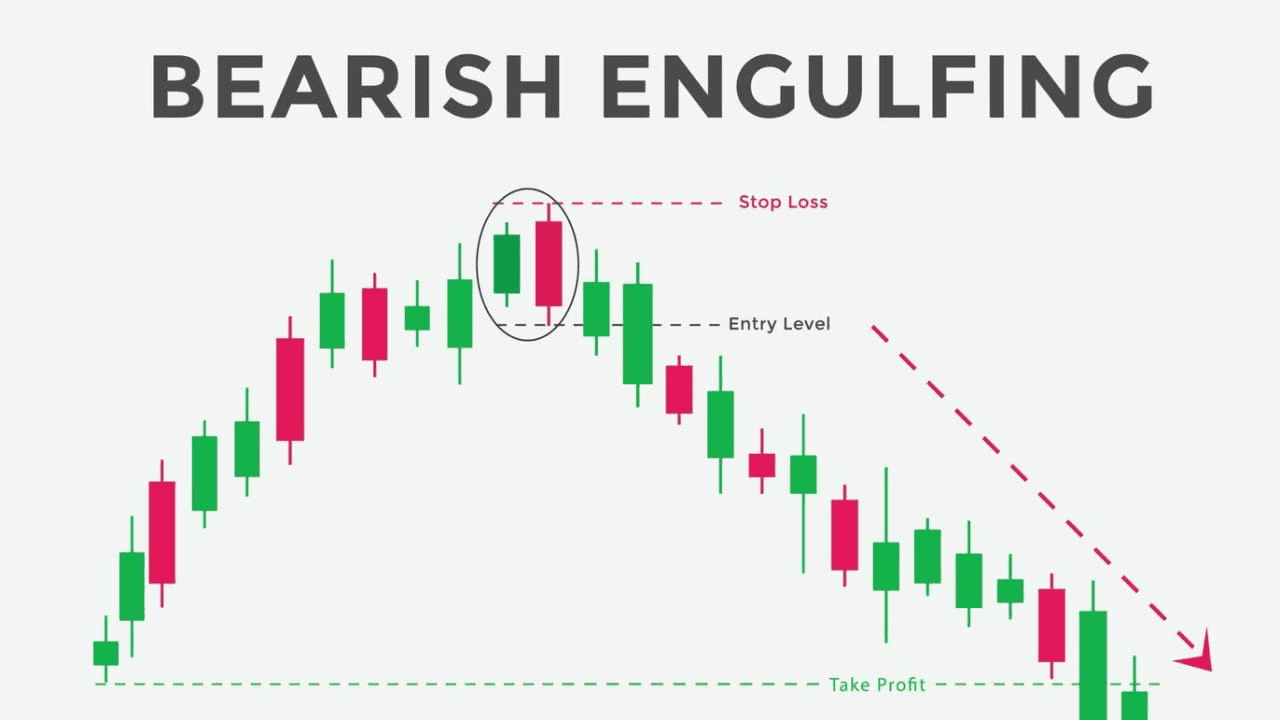

1. Bearish Reversal Signal

The most straightforward strategy involves using the Bearish Engulfing pattern as a bearish reversal signal. When this pattern emerges after a prolonged uptrend, it suggests that the bulls are losing their grip on the market, potentially leading to a downtrend. Traders can initiate short positions or tighten stop-loss orders to protect against potential losses.

2. Confirmation Indicators

To enhance the reliability of the Bearish Engulfing pattern, traders often incorporate confirmation indicators. These could include other technical indicators like the Relative Strength Index (RSI) or Moving Averages to provide additional evidence of a potential trend reversal. When multiple indicators align with the pattern, it strengthens the trading signal.

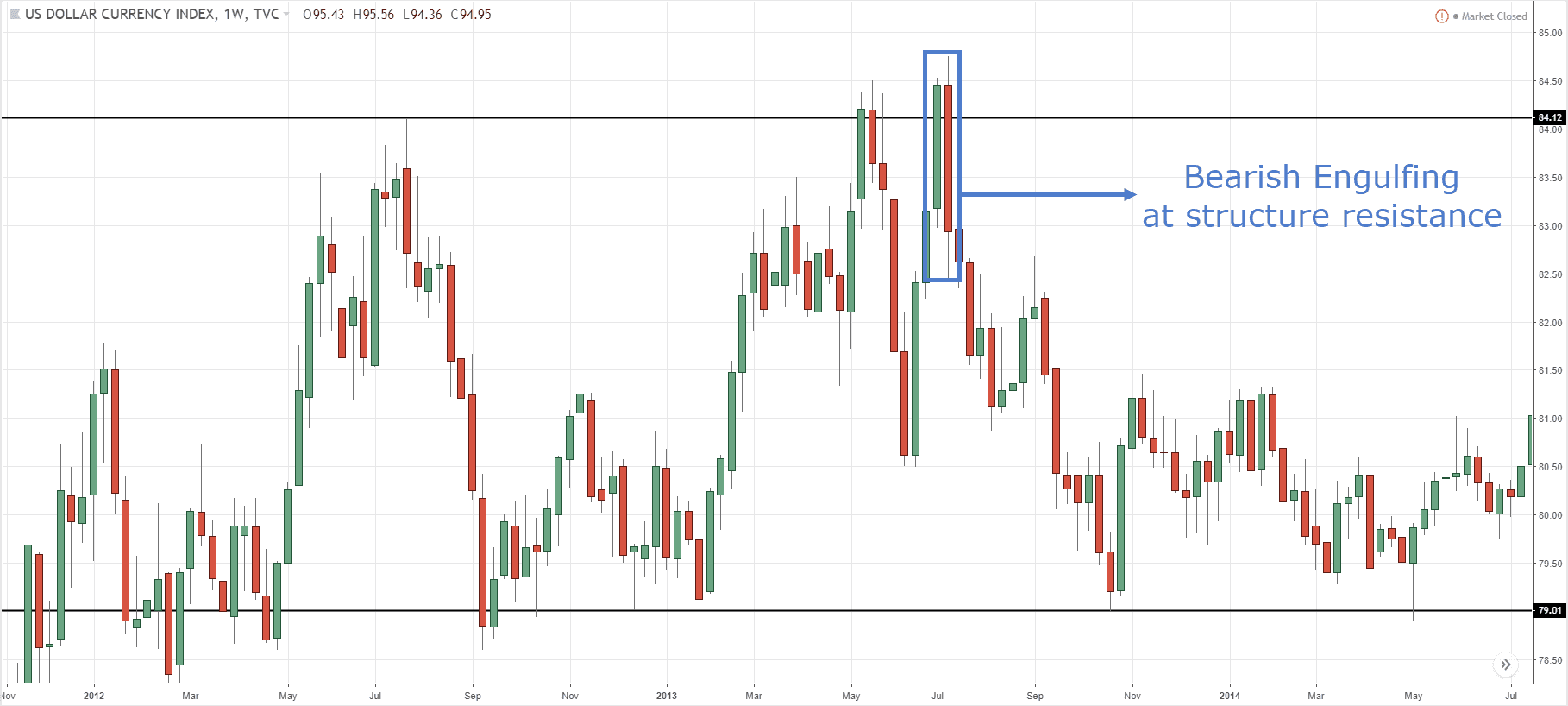

3. Combining with Support and Resistance Levels

Integrating the Bearish Engulfing pattern with support and resistance levels can yield valuable insights. If the pattern forms near a significant resistance level, it could amplify the bearish signal, indicating a potential price reversal. Conversely, if the pattern emerges around a support level, cautiousness is warranted, as it might lead to a temporary pause in the downtrend or a potential reversal.

4. Timeframe Consideration

Different timeframes can yield varying results when trading the Bearish Engulfing pattern. Shorter timeframes might offer more frequent but less reliable signals due to increased market noise. Longer timeframes, on the other hand, could provide stronger signals with higher profit potential. Traders should align their choice of timeframe with their overall trading strategy and risk tolerance.

5. Risk Management

As with any trading strategy, risk management is paramount. The Bearish Engulfing pattern may indicate a potential reversal, but markets are inherently unpredictable. Traders should implement appropriate position sizing, set stop-loss orders, and consider the risk-to-reward ratio before entering a trade. Managing risk can mitigate potential losses if the pattern's signal doesn't materialize as expected.

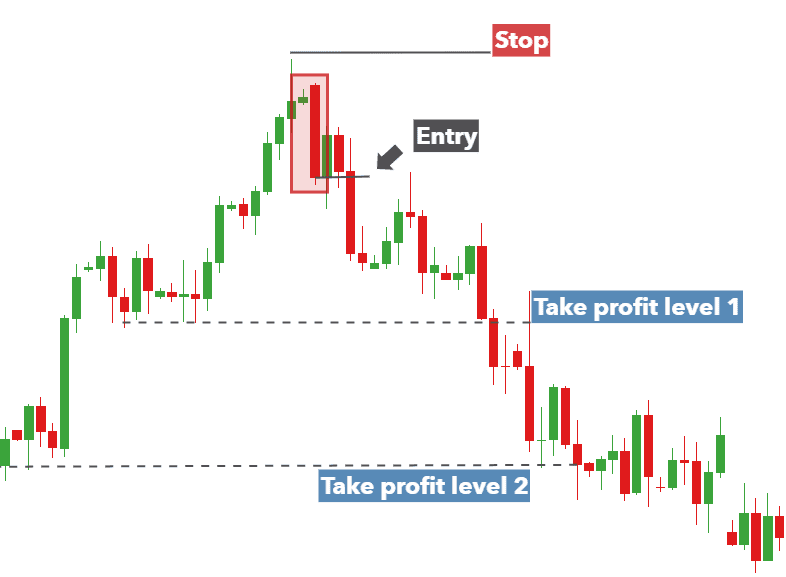

6. Waiting for Confirmation Candle

Some traders opt to wait for a confirmation candle after the Bearish Engulfing pattern forms. This involves waiting for the subsequent candle to close below the low of the engulfing bearish candle before entering a trade. This approach adds an extra layer of confirmation, reducing the likelihood of false signals.

Real-World Example: Applying the Bearish Engulfing Pattern

Let's illustrate the application of the Bearish Engulfing pattern with a hypothetical scenario:

Suppose you're monitoring the EUR/USD currency pair, and after a sustained uptrend, you identify a Bearish Engulfing pattern forming on the daily chart. The first candle is a modest bullish candle, followed by a substantially larger bearish candle that completely engulfs the previous candle's body. Additionally, the bearish candle has notably higher trading volume.

To further validate the signal, you consult the Relative Strength Index (RSI), which indicates overbought conditions. This aligns with the potential for a reversal.

Furthermore, the pattern's formation coincides with a significant resistance level on the chart, adding weight to the bearish sentiment.

Implementing a risk management strategy, you decide to enter a short position after the confirmation candle closes below the low of the engulfing bearish candle. You set a stop-loss order above the recent high and aim for a take-profit level near the nearest support level.

Footnote

In summary, mastering the art of forex trading involves a delicate balance of technical analysis, market understanding, and disciplined execution. The Bearish Engulfing pattern, with its potential to signal trend reversals, can be a valuable addition to a trader's toolkit. However, it's essential to approach this pattern with caution and employ complementary strategies for confirmation and risk management.

As with any trading technique, practice and continuous learning are key. Traders should refine their skills through simulated trading or demo accounts before applying strategies in live markets. Additionally, staying updated on market news and developments can provide valuable context for interpreting candlestick patterns effectively. Remember that while the Bearish Engulfing pattern offers insights into potential market movements, no strategy guarantees success in the complex and ever-changing world of forex trading.

Discussion