Forex Trading Strategies for Trending Markets: Techniques Suitable for Markets with Clear Directions

In the fast-paced world of foreign exchange trading, known as Forex, implementing the right strategies can make a significant difference in your success. One of the key market conditions that traders encounter is trending markets, where prices move consistently in one direction. In this article, we will explore effective Forex trading strategies tailored for trending markets. Whether you are a novice or experienced trader, these techniques will help you capitalize on markets with clear directions and increase your chances of profitable trades.

Table Content

1. Understanding Trending Markets

2. The Power of Moving Averages

3. Riding the Trend with Trendlines

4. Using the Relative Strength Index (RSI)

5. Embracing the Moving Average Convergence Divergence (MACD)

6. The Alligator Indicator

7. Mastering Breakouts

8. The Parabolic SAR (Stop and Reverse)

9. The Importance of Risk Management

10. Emotions and Discipline

11. Footnote

12. Frequently Asked Questions (FAQs)

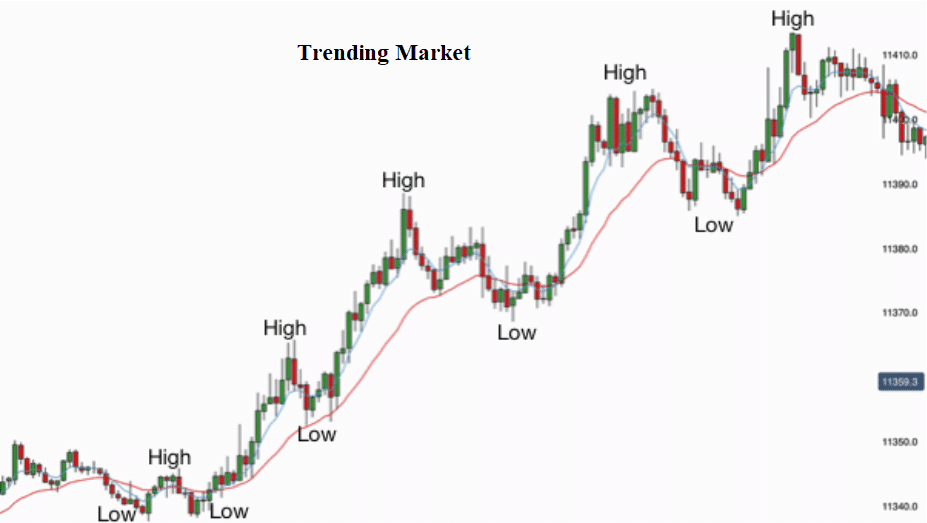

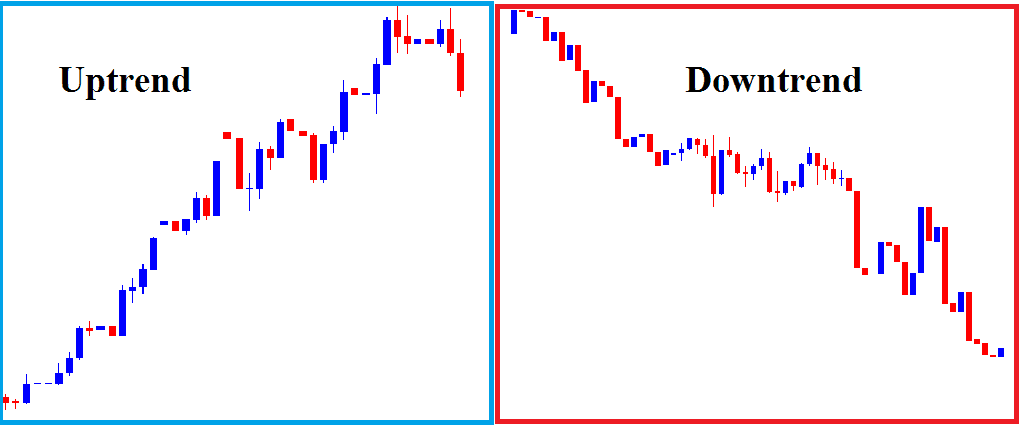

1. Understanding Trending Markets

Before diving into specific strategies, it's essential to understand what constitutes a trending market. A trending market occurs when the price consistently moves in a particular direction, either upward (bullish trend) or downward (bearish trend), with relatively minimal retracements. Identifying the prevailing trend is crucial for the successful application of the strategies discussed here.

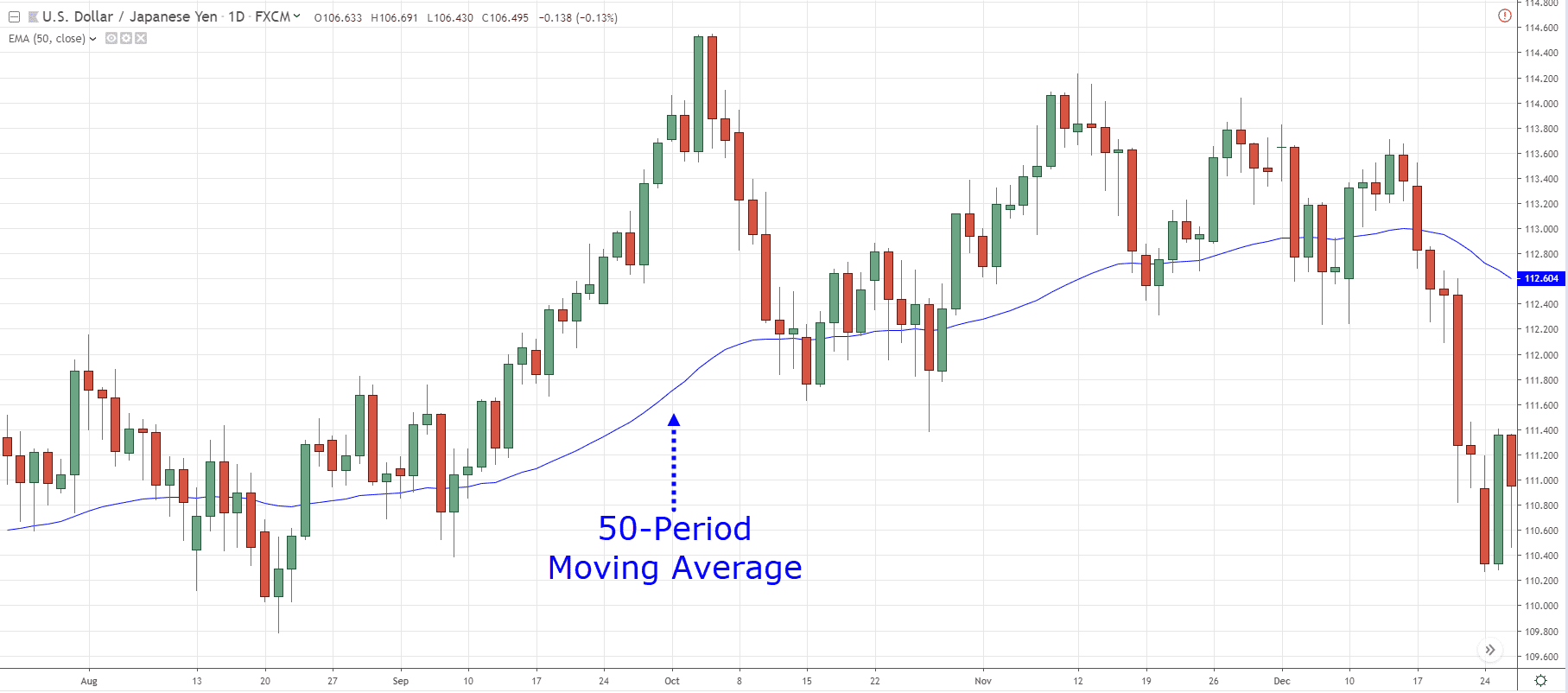

2. The Power of Moving Averages

One effective tool for trading in trending markets is the use of moving averages. Moving averages smooth out price data over a specified period, providing a clear visual representation of the trend. Traders commonly use the 50-day and 200-day moving averages to identify trends. When the shorter moving average crosses above the longer one, it indicates an uptrend, while a cross below signals a downtrend.

3. Riding the Trend with Trendlines

Trendlines are straight lines drawn on a price chart to connect significant price lows or highs. They serve as dynamic support or resistance levels and help traders visualize the trend's direction. Buying near the trendline support in an uptrend and selling near the trendline resistance in a downtrend can be a profitable strategy.

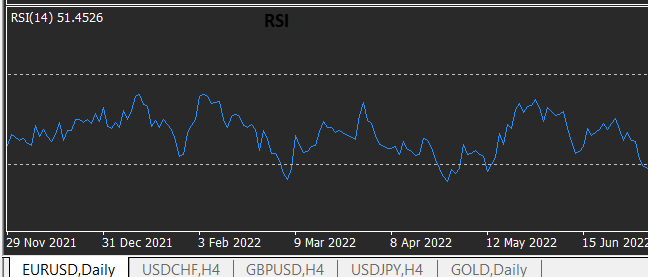

4. Using the Relative Strength Index (RSI)

The Relative Strength Index is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and indicates overbought conditions above 70 and oversold conditions below 30. In trending markets, the RSI can help traders identify potential reversal points and entry opportunities.

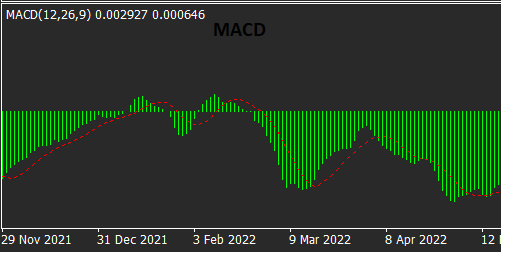

5. Embracing the Moving Average Convergence Divergence (MACD)

The MACD is another popular indicator that provides insights into the relationship between two moving averages. It consists of the MACD line and the signal line. Crossovers between these lines can signal trend changes. Traders can use the MACD to confirm trend strength and potential trend reversals.

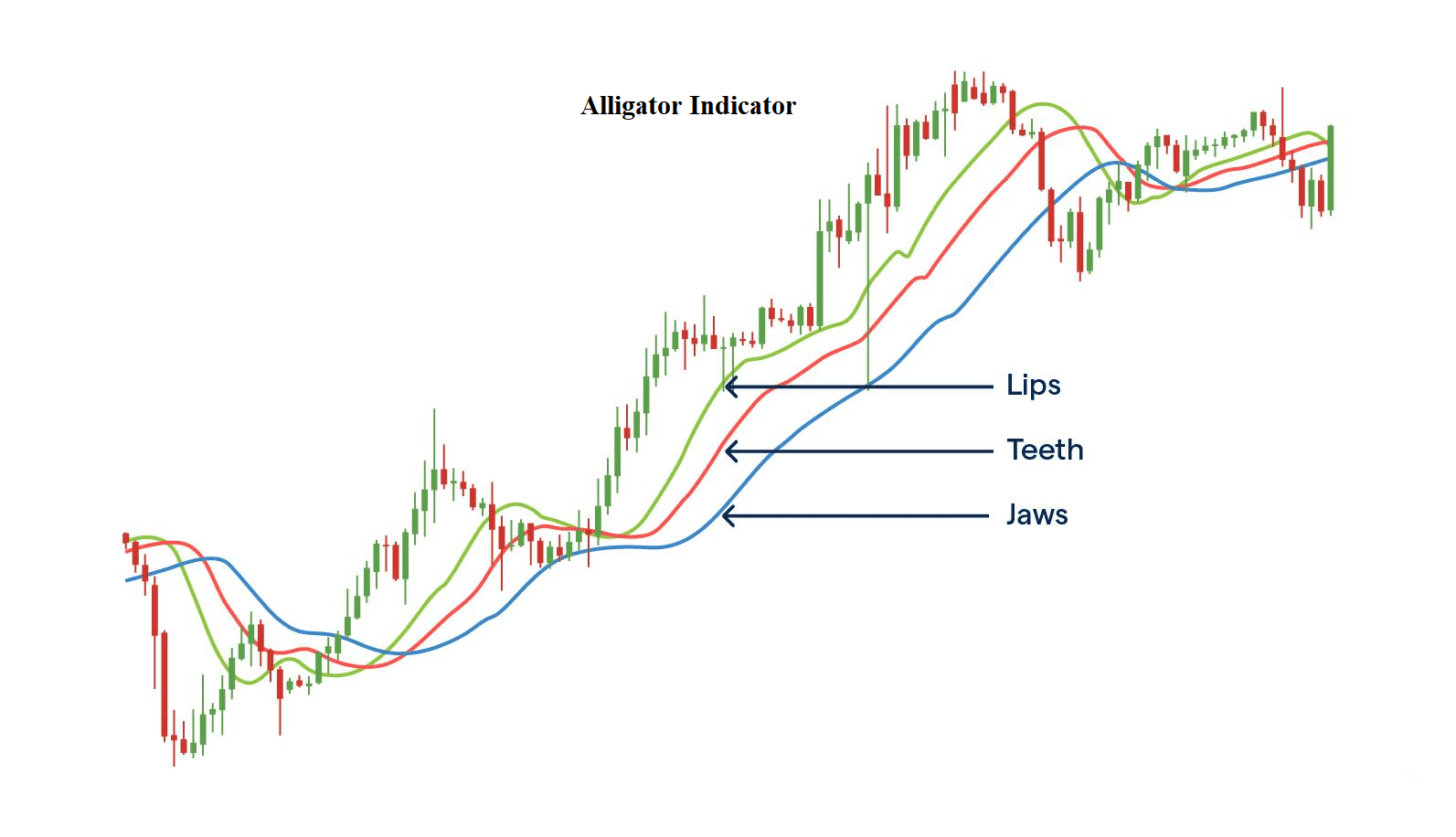

6. The Alligator Indicator

Developed by Bill Williams, the Alligator indicator helps traders identify trends and their direction. It comprises three smoothed moving averages with specific periods. When the lines are entwined, it indicates a sleeping market, but when they diverge, it signals a trending market.

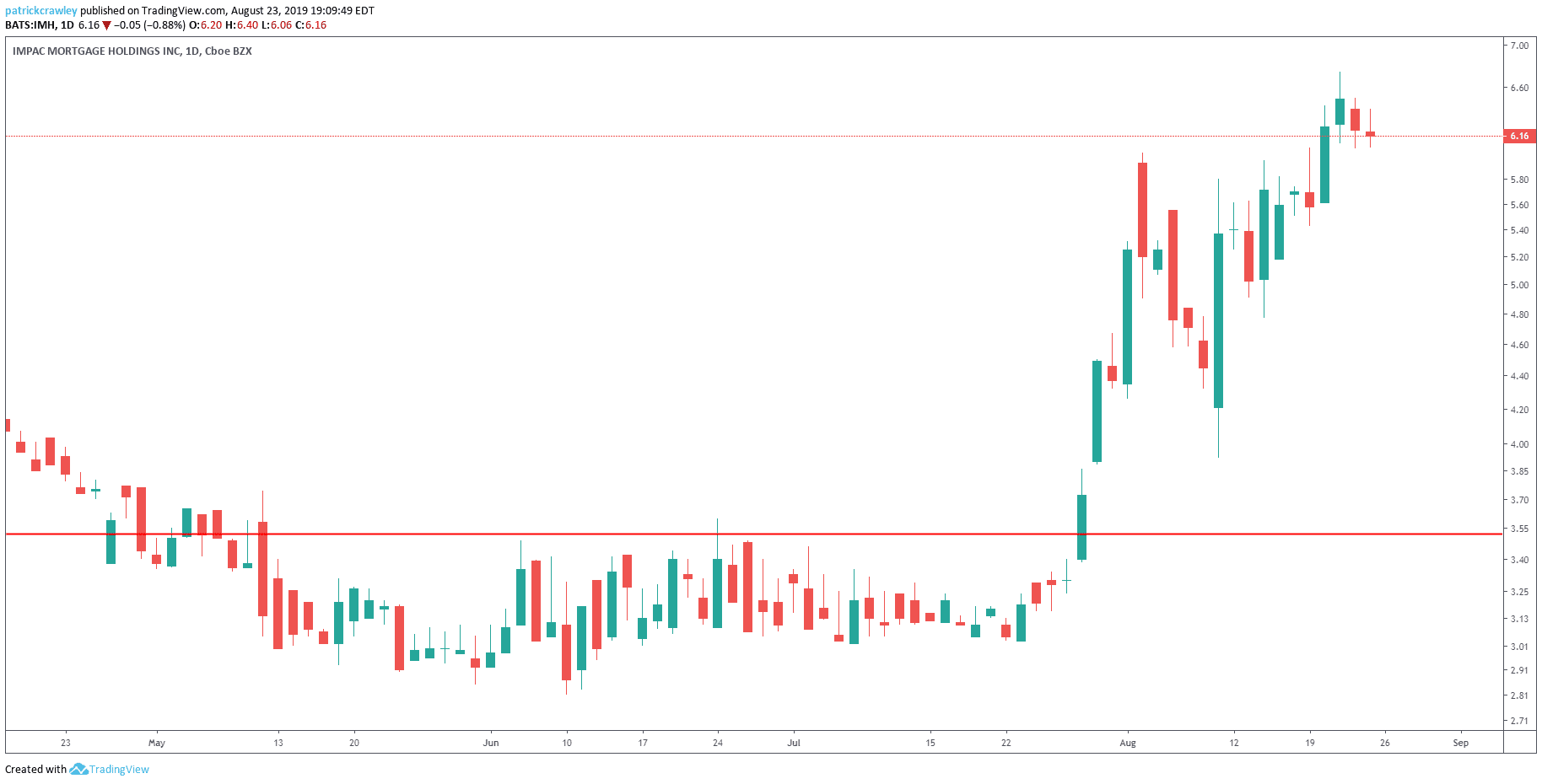

7. Mastering Breakouts

Breakouts occur when the price moves beyond a defined level of support or resistance. In trending markets, breakouts can lead to substantial profits. Traders can use various breakout strategies, such as trading the retest of a breakout level or waiting for a confirmed breakout before entering a trade.

Sources from TradingView

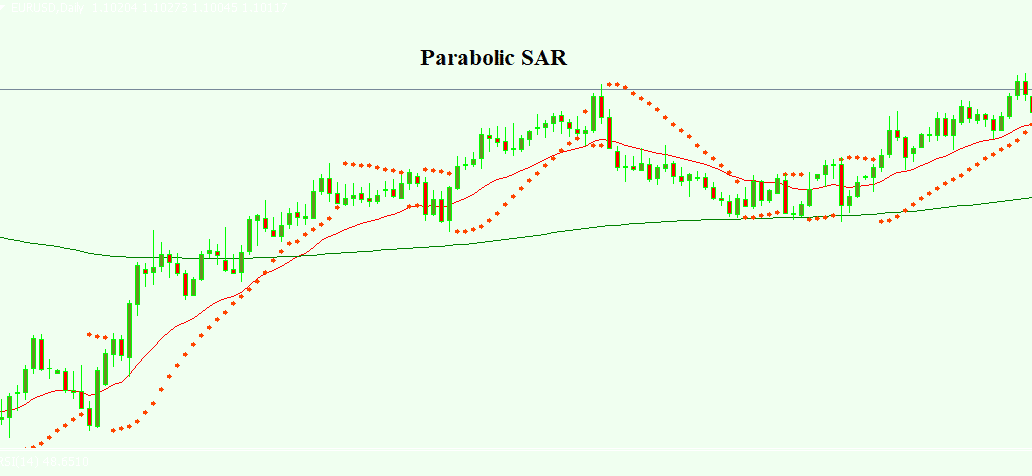

8. The Parabolic SAR (Stop and Reverse)

The Parabolic SAR is a versatile indicator that provides potential entry and exit points. It appears as dots above or below the price chart, indicating the direction of the trend. When the dots switch sides, it signals a potential trend reversal.

9. The Importance of Risk Management

While these strategies can enhance your trading in trending markets, it's crucial to employ proper risk management techniques. Set appropriate stop-loss orders to limit potential losses and never risk more than a small percentage of your trading capital on a single trade.

10. Emotions and Discipline

Trading in trending markets can be exciting and challenging. Emotions can cloud judgment and lead to impulsive decisions. Maintain discipline, stick to your strategy, and avoid chasing quick profits. Consistency and patience are essential traits for successful trading.

11. Footnote

Forex trading in trending markets can be highly profitable when armed with the right strategies and tools. Understanding the prevailing trend, using indicators like moving averages, RSI, and MACD, and practicing sound risk management are crucial steps to succeed in this endeavor. Remember, discipline and emotional control play a pivotal role in your long-term success as a Forex trader.

12. Frequently Asked Questions (FAQs)

Q: Are these strategies suitable for all market conditions?

A: While these strategies are effective in trending markets, they may not perform as well in choppy or sideways markets.

Q: Can I rely solely on technical indicators for trading in trending markets?

A: While technical indicators are valuable, it's essential to consider other factors like fundamental analysis and market sentiment.

Q: How can I identify a strong trending market from a weak one?

A: A strong trending market exhibits a clear and steady price movement, while a weak one may have frequent retracements and indecisive price action.

Q: What is the recommended risk percentage per trade?

A: It's generally advised to risk no more than 1-2% of your trading capital on any single trade.

Q: Can I use these strategies in other financial markets besides Forex?

A: Yes, many of these strategies are applicable to other markets like stocks and commodities as well.

Discussion