Forex trading strategies for trading with the Ichimoku cloud: Approaches for using the Ichimoku indicator.

The world of forex trading is constantly evolving, with traders seeking new and innovative strategies to gain an edge in the highly competitive market. One such strategy that has gained popularity over the years is trading with the Ichimoku Cloud, a versatile and comprehensive technical indicator that offers valuable insights into market trends and potential entry and exit points. In this article, we will delve into the intricacies of the Ichimoku Cloud and explore various approaches to effectively integrate it into forex trading strategies.

Table Content

1. Understanding the Ichimoku Cloud

2. Approach 1: Trend Identification and Confirmation

3. Approach 2: Cloud Breakout Strategy

4. Approach 3: Kumo Twists and Reversals

5. Approach 4: Support and Resistance Levels

6. Approach 5: Chikou Span Confirmation

7. Footnote

Understanding the Ichimoku Cloud

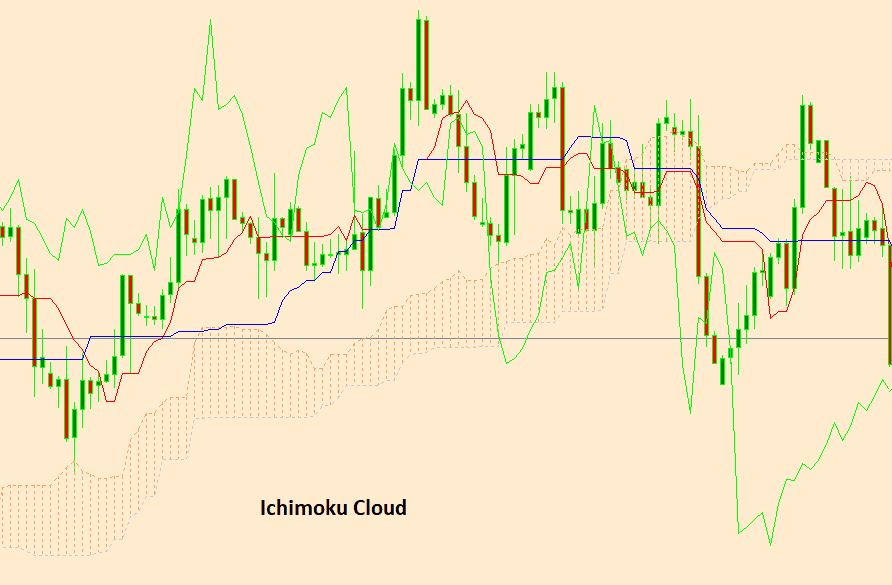

Developed by Japanese journalist Goichi Hosoda in the late 1960s, the Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a dynamic indicator that provides a holistic view of price action, support and resistance levels, and potential market trends. The indicator consists of five key components:

1) Tenkan-sen (Conversion Line): This is a short-term moving average calculated by adding the highest high and lowest low over the past 9 periods and then dividing by 2. It reflects short-term momentum and trend direction.

2) Kijun-sen (Base Line): Similar to the Tenkan-sen, this is a longer-term moving average calculated over the past 26 periods. It helps identify medium-term trends.

3) Senkou Span A (Leading Span A): This component forms the first boundary of the "cloud." It is calculated by averaging the Tenkan-sen and Kijun-sen and then plotted 26 periods ahead. It provides insights into future support and resistance levels.

4) Senkou Span B (Leading Span B): This is calculated in a similar manner to Senkou Span A, but over a longer 52-period period. It forms the second boundary of the cloud and offers further indications of potential support and resistance levels.

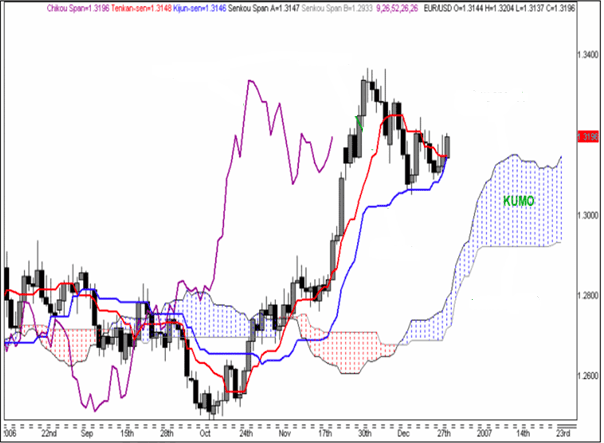

5) Kumo (Cloud): The cloud is formed by the area between Senkou Span A and Senkou Span B. It is often colored differently, with the color changing based on the relative position of Senkou Spans A and B. The cloud's width indicates market volatility, while its slope suggests potential trend direction.

Approach 1: Trend Identification and Confirmation

One of the fundamental uses of the Ichimoku Cloud is to identify and confirm trends in the forex market. This approach involves analyzing the positioning of the various components to determine the prevailing trend and its strength.

When the price is above the cloud, it suggests a bullish trend, and traders can look for buying opportunities. Conversely, when the price is below the cloud, a bearish trend is indicated, prompting traders to consider selling positions.

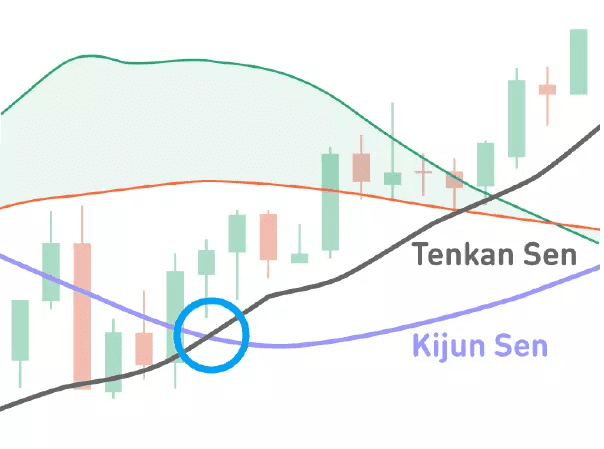

The Tenkan-sen and Kijun-sen crossovers can provide additional confirmation of trend changes. A bullish crossover occurs when the Tenkan-sen crosses above the Kijun-sen, indicating a potential shift to an upward trend. Conversely, a bearish crossover, where the Tenkan-sen crosses below the Kijun-sen, signals a potential downward trend.

Approach 2: Cloud Breakout Strategy

Another popular strategy involves trading breakouts from the Ichimoku Cloud. In this approach, traders wait for the price to break out of the cloud, which often indicates a potential trend reversal or the continuation of an existing trend.

When the price breaks above the cloud, it signals a potential bullish breakout, indicating a possible upward trend. Traders can look for buying opportunities in such cases. On the other hand, a price breakout below the cloud suggests a bearish breakout, indicating a potential downward trend. Traders can consider short positions in this scenario.

It's important to note that the width of the cloud also plays a role in this strategy. A wider cloud indicates higher volatility, which can lead to more significant price movements following a breakout.

Approach 3: Kumo Twists and Reversals

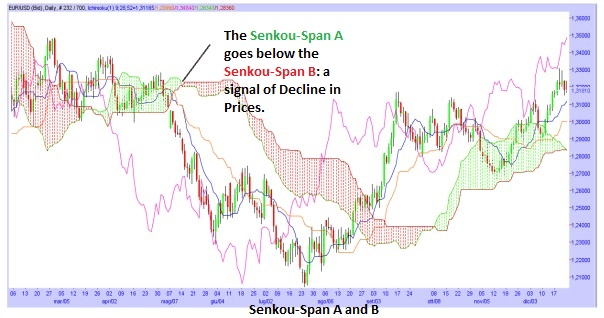

Kumo twists, also known as "Kumo twists" or "Kumo twists," are situations where Senkou Span A crosses above or below Senkou Span B. These twists can provide valuable insights into potential trend reversals or shifts in market sentiment.

When Senkou Span A crosses above Senkou Span B, it suggests a bullish reversal, indicating a possible shift from a bearish to a bullish trend. Conversely, when Senkou Span A crosses below Senkou Span B, a bearish reversal is indicated, potentially signaling a shift from a bullish to a bearish trend.

Traders can use these twists in conjunction with other technical indicators or chart patterns to make more informed trading decisions. It's essential to confirm these signals with other factors to reduce the likelihood of false signals.

Approach 4: Support and Resistance Levels

The Ichimoku Cloud can also be used to identify key support and resistance levels, aiding traders in determining potential entry and exit points.

The Senkou Span components of the cloud, along with the Kijun-sen and Tenkan-sen lines, can serve as dynamic support and resistance levels. When the price approaches these levels, traders can assess how the price reacts—whether it bounces off these levels or breaks through them. This information can guide traders in making decisions about placing stop-loss orders, taking profits, or entering new positions.

Approach 5: Chikou Span Confirmation

The Chikou Span, or lagging line, is another component of the Ichimoku Cloud that can be utilized for confirmation purposes. The Chikou Span represents the current closing price plotted 26 periods back on the chart. Traders can use the Chikou Span to confirm the signals generated by other components of the Ichimoku Cloud.

For instance, if the Chikou Span crosses above the price, it can provide additional confirmation of a bullish trend. Similarly, if the Chikou Span crosses below the price, it can offer confirmation of a bearish trend.

Footnote

The Ichimoku Cloud is a versatile and comprehensive technical indicator that offers various approaches to forex trading. From identifying trends and support/resistance levels to trading breakouts and reversals, the Ichimoku Cloud provides a wealth of information to help traders make more informed decisions.

However, like any trading strategy, using the Ichimoku Cloud requires practice, patience, and thorough analysis. Traders should avoid solely relying on this indicator and consider integrating it with other technical and fundamental analysis tools for a well-rounded trading approach. Additionally, risk management strategies, including setting stop-loss and take-profit levels, are crucial to protect capital and navigate the inherent uncertainties of the forex market.

As with any trading strategy, it's recommended that traders thoroughly backtest and practice their chosen Ichimoku Cloud-based approach on demo accounts before implementing it with real funds. By gaining a deep understanding of the indicator and refining their strategies over time, traders can harness the power of the Ichimoku Cloud to potentially improve their forex trading outcomes.

Discussion