Forex Trading Strategies for Trading with Oscillators: Approaches for Using Oscillators as Timing Indicators

The world of forex trading is replete with a myriad of tools and techniques aimed at providing traders with an edge in the complex and dynamic market. One such tool that has gained popularity among traders is the oscillator. Oscillators are technical indicators that help traders identify potential market reversals, overbought or oversold conditions, and trends. In this article, we will delve into the realm of forex trading strategies involving oscillators and explore various approaches to effectively use oscillators as timing indicators.

Table Content

1. Understanding Oscillators

2. Using Oscillators as Timing Indicators

I. Overbought and Oversold Conditions

II. Divergence and Convergence

III. Signal Line Crossovers

IV. Range-Bound Market Strategies

3. Frequently Asked Questions (FAQs)

4. Footnote

Understanding Oscillators:

Before we delve into trading strategies, let's establish a foundational understanding of oscillators. Oscillators are indicators that oscillate between two extreme levels, usually 0 and 100. They help traders identify market conditions that might be ripe for a reversal or a continuation of a trend. Common examples of oscillators include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Stochastic Oscillator, and the Commodity Channel Index (CCI), among others.

Using Oscillators as Timing Indicators:

Oscillators are invaluable tools for traders, especially when used as timing indicators. By analyzing their readings and patterns, traders can make informed decisions about entry and exit points, helping them capitalize on potential market movements. Here are a few approaches to consider when using oscillators for timing:

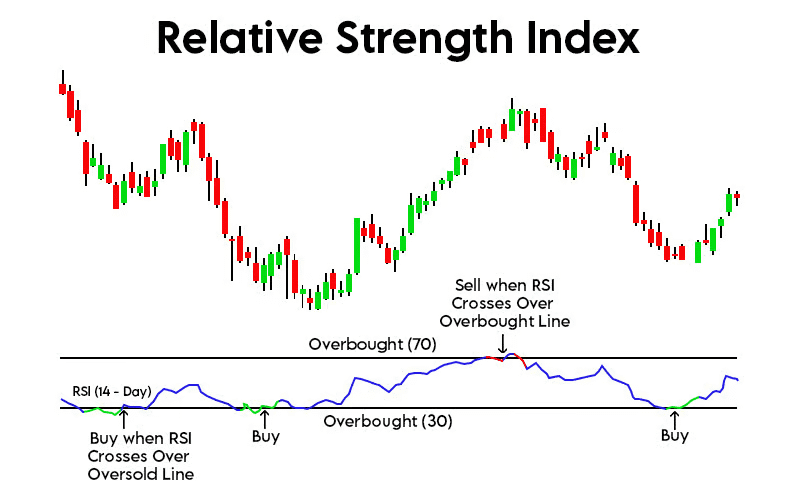

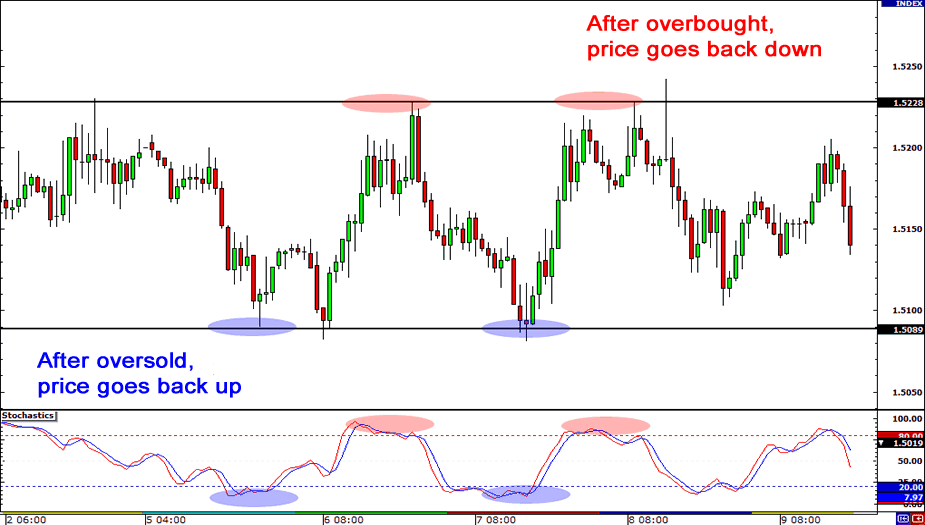

1. Overbought and Oversold Conditions: Oscillators like the RSI and Stochastic Oscillator are often used to identify overbought and oversold conditions in the market. When an oscillator reaches the upper threshold (e.g., 70) it indicates that the asset may be overbought and due for a potential reversal. Conversely, when the oscillator reaches the lower threshold (e.g., 30), it signals that the asset may be oversold and due for a potential upward reversal. Traders can use these levels to time their trades, potentially entering a trade when the oscillator indicates an overbought or oversold condition is present.

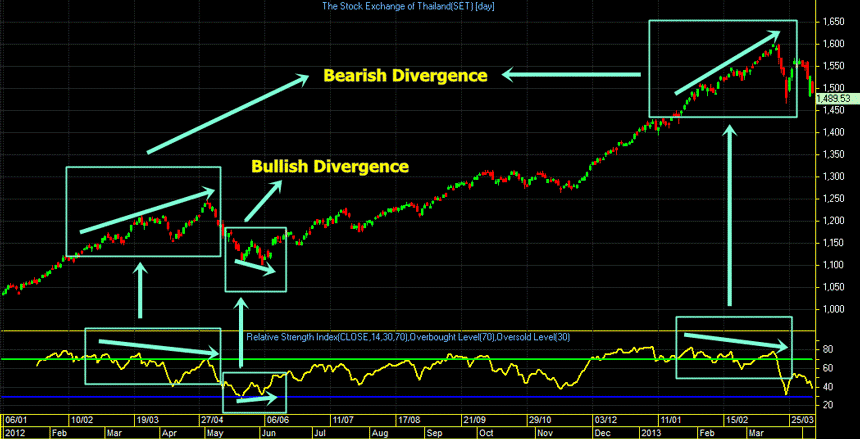

2. Divergence and Convergence: Divergence and convergence patterns can offer valuable insights into potential market reversals. Divergence occurs when the price of an asset moves in the opposite direction of the oscillator. For instance, if the price is making lower lows while the oscillator is making higher lows, it suggests a potential reversal might be on the horizon. Conversely, convergence happens when the price and oscillator move in the same direction. These patterns can serve as early signals of trend continuation.

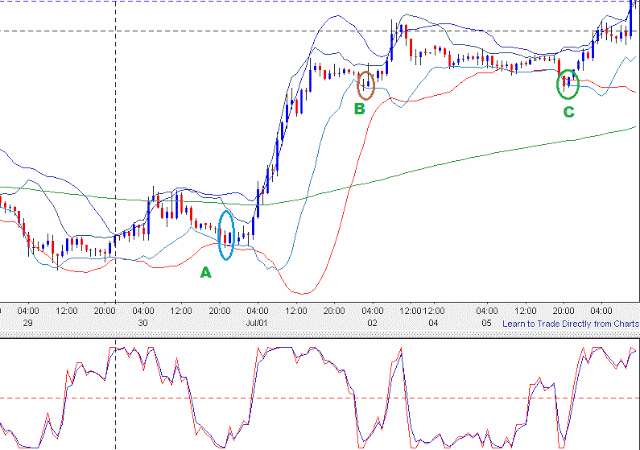

3. Signal Line Crossovers: Many oscillators, like the MACD, consist of a main line and a signal line. Signal line crossovers can provide traders with actionable signals. When the main line crosses above the signal line, it might signal a potential uptrend, while a cross below could indicate a potential downtrend. These crossovers can help traders time their entries and exits in line with the prevailing market direction.

4. Range-Bound Market Strategies: Oscillators are particularly useful in range-bound markets, where prices are stuck between support and resistance levels. In such scenarios, oscillators can help traders identify potential buy and sell points within the range. Traders might consider buying when the oscillator reaches oversold levels and selling when it reaches overbought levels.

Frequently Asked Questions (FAQs):

Q1: Are oscillators suitable for all types of traders?

A: Yes, oscillators can be used by various types of traders, including day traders, swing traders, and even long-term investors. However, their effectiveness might vary depending on the trader's preferred time frame and overall trading strategy.

Q2: Can oscillators provide accurate predictions all the time?

A: No, oscillators, like any other technical indicator, are not infallible. They provide probabilities and potential signals, but market conditions can change unexpectedly. It's important to use oscillators in conjunction with other indicators and analysis tools for a comprehensive view of the market.

Q3: How do I choose the right oscillator for my strategy?

A: The choice of oscillator depends on your trading style and preferences. Some oscillators might work better in certain market conditions. Experiment with different oscillators and observe their performance to determine which ones align with your trading strategy.

Q4: Can oscillators be used as standalone indicators?

A: While some traders use oscillators as standalone indicators, it's generally recommended to combine them with other technical analysis tools, such as trend lines, support and resistance levels, and candlestick patterns, for a more robust trading strategy.

Footnote:

Oscillators are potent tools in a forex trader's arsenal, providing valuable insights into market conditions and potential trade setups. When used as timing indicators, oscillators can help traders make more informed decisions about entry and exit points, enhancing the likelihood of successful trades. However, like all trading tools, oscillators are most effective when used in conjunction with other forms of analysis. By understanding different oscillator-based strategies and their applications, traders can harness the power of these indicators to navigate the complex and ever-changing world of forex trading. Remember, practice, observation, and continuous learning are key to mastering the art of trading with oscillators.

Discussion