Forex Trading Strategies for Trading with Market Sentiment: Techniques for Gauging and Following Market Sentiment

Forex trading is a complex endeavor that involves understanding and analyzing a multitude of factors influencing currency movements. One crucial aspect is market sentiment, which reflects the collective emotional state of traders and investors. This article delves into various strategies for effectively gauging and following market sentiment in forex trading. From fundamental analysis to sentiment indicators and risk management techniques, traders can enhance their decision-making process by incorporating these approaches.

Table Content

1. Introduction

2. The Importance of Market Sentiment in Forex Trading

3. Gauging Market Sentiment through Fundamental Analysis

4. Using Sentiment Indicators

5. Leveraging Technical Analysis with Sentiment

6. Sentiment-Driven Trading Strategies

7. Risk Management and Psychology in Sentiment Trading

8. FAQs:

9. Footnote

Introduction:

Market sentiment plays a pivotal role in shaping forex markets. Traders often make decisions based on the prevailing sentiment, which can range from bullish (positive) to bearish (negative) and can influence short-term and long-term trends. Understanding how to gauge and follow market sentiment is essential for successful forex trading. This article explores techniques and strategies to effectively incorporate market sentiment analysis into trading decisions.

The Importance of Market Sentiment in Forex Trading

Market sentiment reflects the psychology of market participants. It is influenced by economic indicators, geopolitical events, news releases, and other factors that impact trader emotions. When market sentiment aligns with fundamentals, trends are more likely to develop and sustain. Ignoring sentiment can lead to missed opportunities and unexpected losses.

Gauging Market Sentiment through Fundamental Analysis

Fundamental analysis involves assessing economic indicators, central bank decisions, and geopolitical events to understand market sentiment. Positive economic data, such as strong GDP growth or low unemployment, can create bullish sentiment for a currency. Conversely, negative data can lead to bearish sentiment. Central bank announcements and political developments also shape sentiment.

Using Sentiment Indicators

Several sentiment indicators help traders gauge market sentiment quantitatively. These include the COT (Commitments of Traders) Report, which provides insights into positioning of institutional traders; the VIX (Volatility Index), indicating market uncertainty; and the Fear and Greed Index, measuring investor emotions. Integrating these indicators with technical and fundamental analysis offers a comprehensive view of market sentiment.

Leveraging Technical Analysis with Sentiment

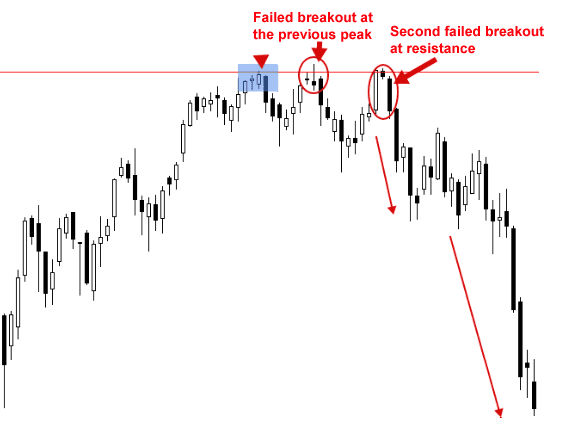

Combining technical analysis with sentiment analysis can yield powerful insights. Patterns such as bullish engulfing or bearish harami can be more meaningful when aligned with prevailing sentiment. Traders can also use sentiment to validate support and resistance levels, helping identify potential entry and exit points.

Sentiment-Driven Trading Strategies

I) Trend Following with Sentiment: Traders can align with the prevailing sentiment by adopting trend-following strategies. In a bullish sentiment, they can focus on buying opportunities, while in bearish sentiment, short-selling can be considered. Moving averages and trendlines can aid in trend identification.

II) Contrarian Approach: Contrarian traders go against prevailing sentiment, assuming the crowd is often wrong. This approach requires careful analysis and is riskier, but it can yield substantial rewards during sentiment reversals.

III) News Trading: Major news releases often trigger significant market movements. Traders can anticipate and capitalize on these movements by assessing sentiment before and after news announcements.

Risk Management and Psychology in Sentiment Trading

Trading with market sentiment requires effective risk management and emotional control. While sentiment analysis enhances decision-making, it's not foolproof. Traders should diversify their portfolios, use proper position sizing, and set stop-loss orders to mitigate losses during unexpected sentiment shifts.

FAQs:

Q1: Can sentiment analysis replace fundamental analysis in forex trading?

A: No, sentiment analysis complements fundamental analysis. While sentiment provides insights into trader emotions, fundamental analysis assesses economic and geopolitical factors that influence sentiment. Both approaches combined offer a comprehensive trading strategy.

Q2: Are sentiment indicators suitable for all types of traders?

A: Yes, sentiment indicators can benefit traders of all styles, from day traders to long-term investors. However, understanding how to interpret and integrate these indicators with other forms of analysis is crucial.

Q3: How often does market sentiment change?

A: Market sentiment can change rapidly due to news releases, geopolitical events, and other factors. Traders should stay updated with current events to accurately gauge shifts in sentiment.

Q4: Is sentiment analysis reliable during times of extreme market volatility?

A: Sentiment analysis can be less reliable during extreme volatility when emotions are heightened. Traders should exercise caution and consider a range of factors before making decisions solely based on sentiment.

Q5: Can sentiment analysis be automated?

A: Yes, sentiment analysis can be automated using algorithms that scan news articles, social media, and other sources to gauge sentiment. However, human judgment is often required to interpret nuances accurately.

Footnote:

Incorporating market sentiment analysis into forex trading strategies can provide traders with a valuable edge. By combining fundamental analysis, sentiment indicators, technical analysis, and risk management techniques, traders can make more informed decisions that align with prevailing market sentiment. However, it's essential to remember that sentiment is just one piece of the puzzle, and a holistic approach to trading is crucial for long-term success.

Discussion