Forex Trading Strategies for Trading on Fibonacci Retracement Levels: Approaches for Using Fibonacci Levels in Trading Decisions

The world of foreign exchange (forex) trading is characterized by its complexity and dynamism, with traders employing a wide range of tools and strategies to maximize their potential for profit. One such tool that has gained considerable popularity among traders is the Fibonacci retracement levels. These levels are derived from the Fibonacci sequence, a mathematical pattern that holds significant importance in various natural phenomena, and they are utilized to identify potential support and resistance levels within price trends. In this article, we will delve into the world of forex trading strategies centered around Fibonacci retracement levels, exploring different approaches to effectively integrate these levels into trading decisions.

Table Content

I. Understanding Fibonacci Retracement Levels

II. Approaches to Incorporating Fibonacci Levels in Trading Strategies

1. Fibonacci Retracement as a Support/Resistance Tool

2. Combining Fibonacci with Other Indicators

3. Fibonacci Extensions for Target Identification

4. Fibonacci Confluence Zones

5. Applying Fibonacci to Different Timeframes

III. Risk Management and Limitations

IV. Footnote

Understanding Fibonacci Retracement Levels:

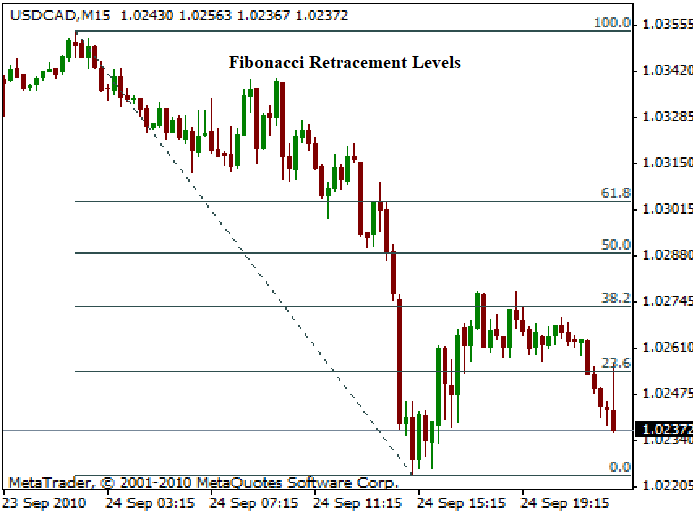

Before diving into the trading strategies, it's crucial to grasp the concept of Fibonacci retracement levels. These levels are a set of horizontal lines drawn on a price chart to indicate potential areas of support and resistance during a price trend. The key Fibonacci retracement levels include 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels are derived from the Fibonacci sequence, where each number is the sum of the two preceding ones (1, 1, 2, 3, 5, 8, 13, 21, and so on).

The core idea behind using these levels is that during a price trend, markets often experience temporary pullbacks or retracements before continuing in the direction of the prevailing trend. Traders utilize Fibonacci retracement levels to identify potential areas where these retracements might find support and reverse their course.

Approaches to Incorporating Fibonacci Levels in Trading Strategies:

1. Fibonacci Retracement as a Support/Resistance Tool:

One of the simplest ways to employ Fibonacci retracement levels is by treating them as potential support and resistance levels. When a currency pair is in an uptrend, traders look for potential buying opportunities when the price retraces to a Fibonacci level, such as the 38.2% or 50% level. Conversely, in a downtrend, traders seek potential selling opportunities as the price retraces to the same levels. These retracement levels often align with psychological price points, where traders anticipate a higher probability of trend continuation or reversal.

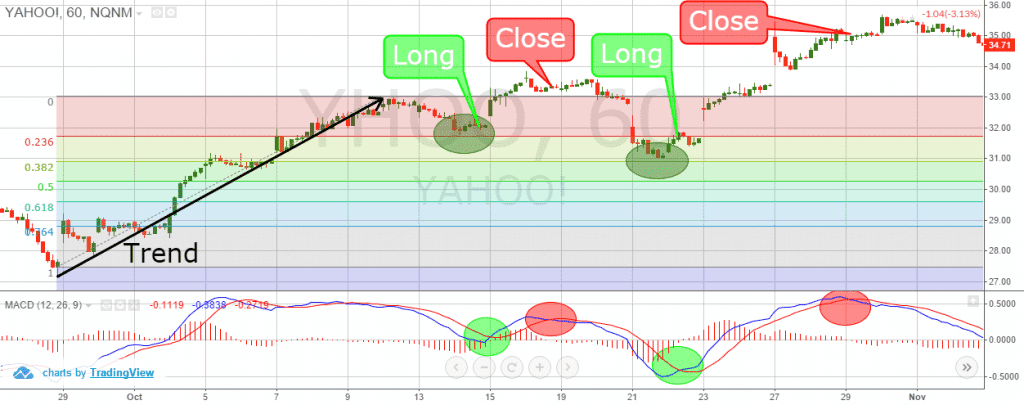

2. Combining Fibonacci with Other Indicators:

Effective trading strategies often involve the combination of multiple indicators to confirm potential entry and exit points. Traders often combine Fibonacci retracement levels with other technical indicators, such as moving averages or oscillators, to strengthen their decision-making process. For instance, a trader might wait for a price retracement to a Fibonacci level while the relative strength index (RSI) indicates an oversold condition, enhancing the likelihood of a reversal.

Sources from TradingView.

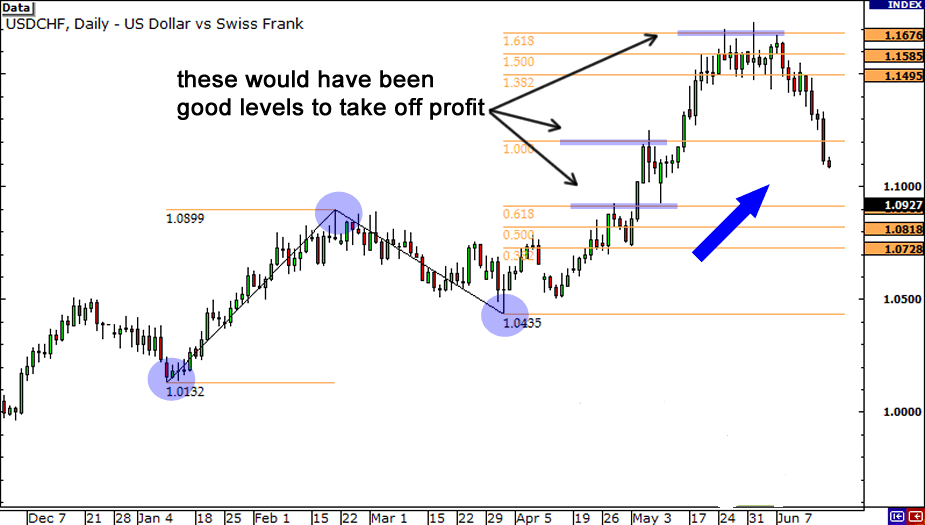

3. Fibonacci Extensions for Target Identification:

While retracement levels help identify potential reversal or continuation points, Fibonacci extensions are used to determine potential price targets. Extensions are drawn beyond the initial price movement and can aid traders in identifying where a trend might exhaust itself. The most commonly used extension levels are 161.8%, 261.8%, and 423.6%. Traders might exit their positions or take profits when the price approaches these extension levels, as they can indicate potential points of trend reversal.

4. Fibonacci Confluence Zones:

Confluence zones are areas where multiple technical factors coincide, increasing their significance. Traders often identify these zones by combining Fibonacci retracement levels with other forms of technical analysis, such as trendlines, chart patterns, or moving averages. When multiple indicators converge around a specific price level, it can serve as a strong signal for potential trading opportunities.

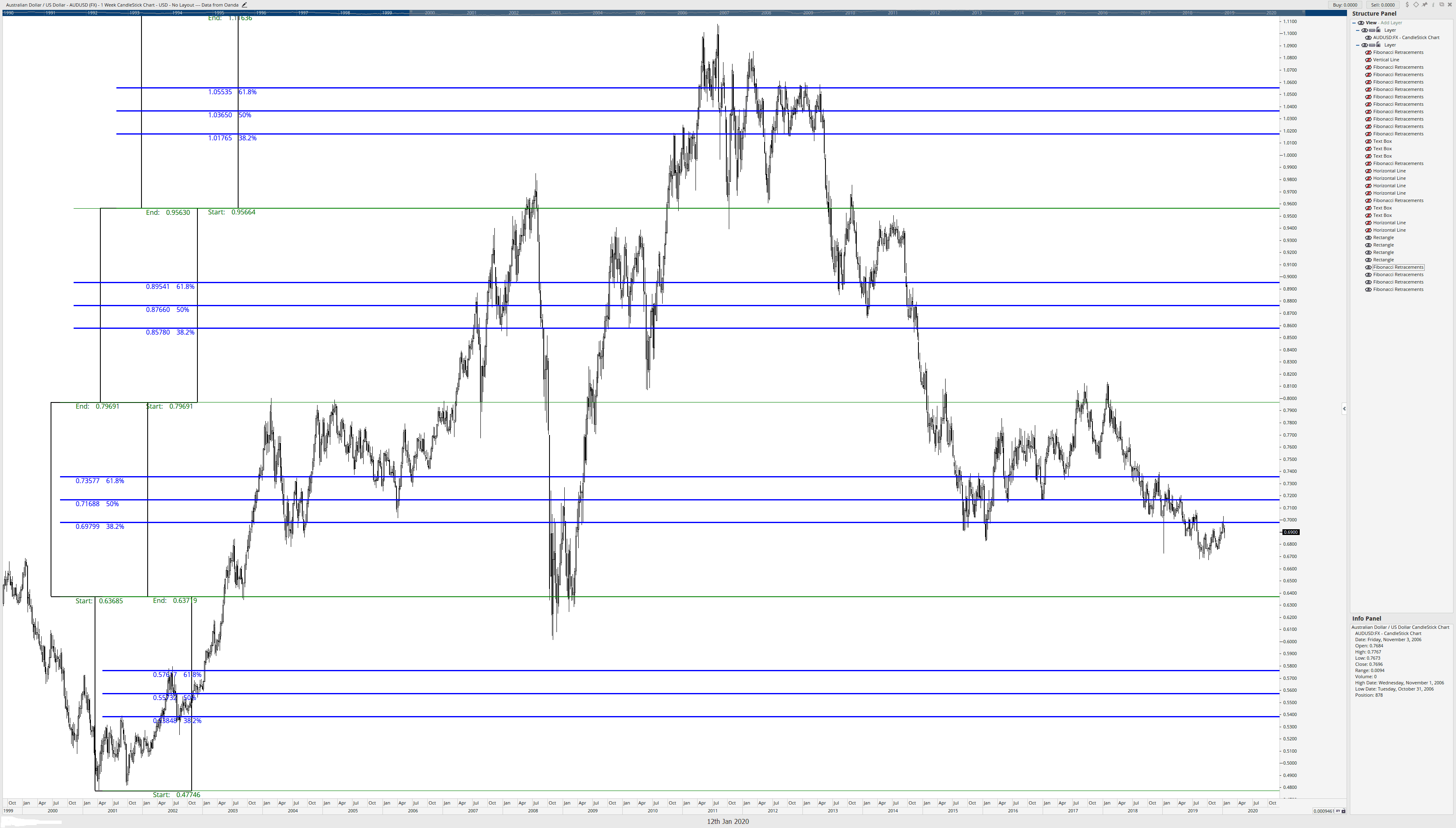

5. Applying Fibonacci to Different Timeframes:

Fibonacci retracement levels can be applied across various timeframes, from short-term intraday trading to long-term position trading. Different timeframes might reveal different retracement levels that align with the price action. Short-term traders might focus on smaller retracement levels (e.g., 23.6% and 38.2%) for quicker trades, while long-term traders might rely on higher retracement levels (e.g., 61.8% and 78.6%) for more significant trend reversals.

Risk Management and Limitations:

While Fibonacci retracement levels offer valuable insights into potential price movements, it's essential to acknowledge their limitations and integrate risk management practices into trading strategies. Not all price movements will adhere to these levels, as markets are influenced by various fundamental and geopolitical factors. Traders should use Fibonacci levels in conjunction with other forms of analysis to avoid making trading decisions solely based on these levels.

Moreover, risk management is crucial to mitigate potential losses. Traders should always set stop-loss orders to protect their capital, especially since price movements can be volatile, and unexpected market events can lead to sharp reversals.

Footnote:

Fibonacci retracement levels have earned their place as a popular tool in the arsenal of forex traders due to their ability to identify potential support and resistance levels within price trends. By understanding the core principles of Fibonacci retracement and employing various strategies, traders can enhance their decision-making process and increase their chances of making successful trades. However, it's important to remember that no single tool guarantees consistent profits, and traders should always practice risk management and employ a holistic approach to analysis. As the forex market continues to evolve, traders who master the art of utilizing Fibonacci levels effectively will have an edge in navigating the intricate world of currency trading.

Discussion