Forex Trading Strategies for Trading Gaps: Approaches for Trading on Price Gaps Between Market Sessions

The forex market, renowned for its 24-hour trading cycle, presents unique opportunities for traders to capitalize on price discrepancies that occur between market sessions. One such phenomenon that traders often exploit is known as a "gap." A gap occurs when the price of a currency pair opens significantly higher or lower than its previous closing price. These gaps can be caused by a variety of factors, including economic news releases, geopolitical events, or changes in market sentiment. In this article, we will explore different forex trading strategies designed to take advantage of these gaps and navigate the challenges they pose.

Table Content

I. Understanding Price Gaps

1. Common Gap

2. Breakaway Gap

3. Exhaustion Gap

II. Trading Strategies for Gap Trading

1. Gap Fading Strategy

2. Breakaway Gap Strategy

3. Gap and Go Strategy

4. Measuring Gap Strategy

5. News-Based Gap Strategy

III. Risk Management and Considerations

1. Volatility

2. Confirmation

3. Position Sizing

4. Stop Loss Orders

IV. FAQs About Trading Gaps in Forex

V. Footnote

Understanding Price Gaps:

Price gaps occur when there is a sudden jump in price between the closing price of one trading session and the opening price of the next session. There are three main types of gaps:

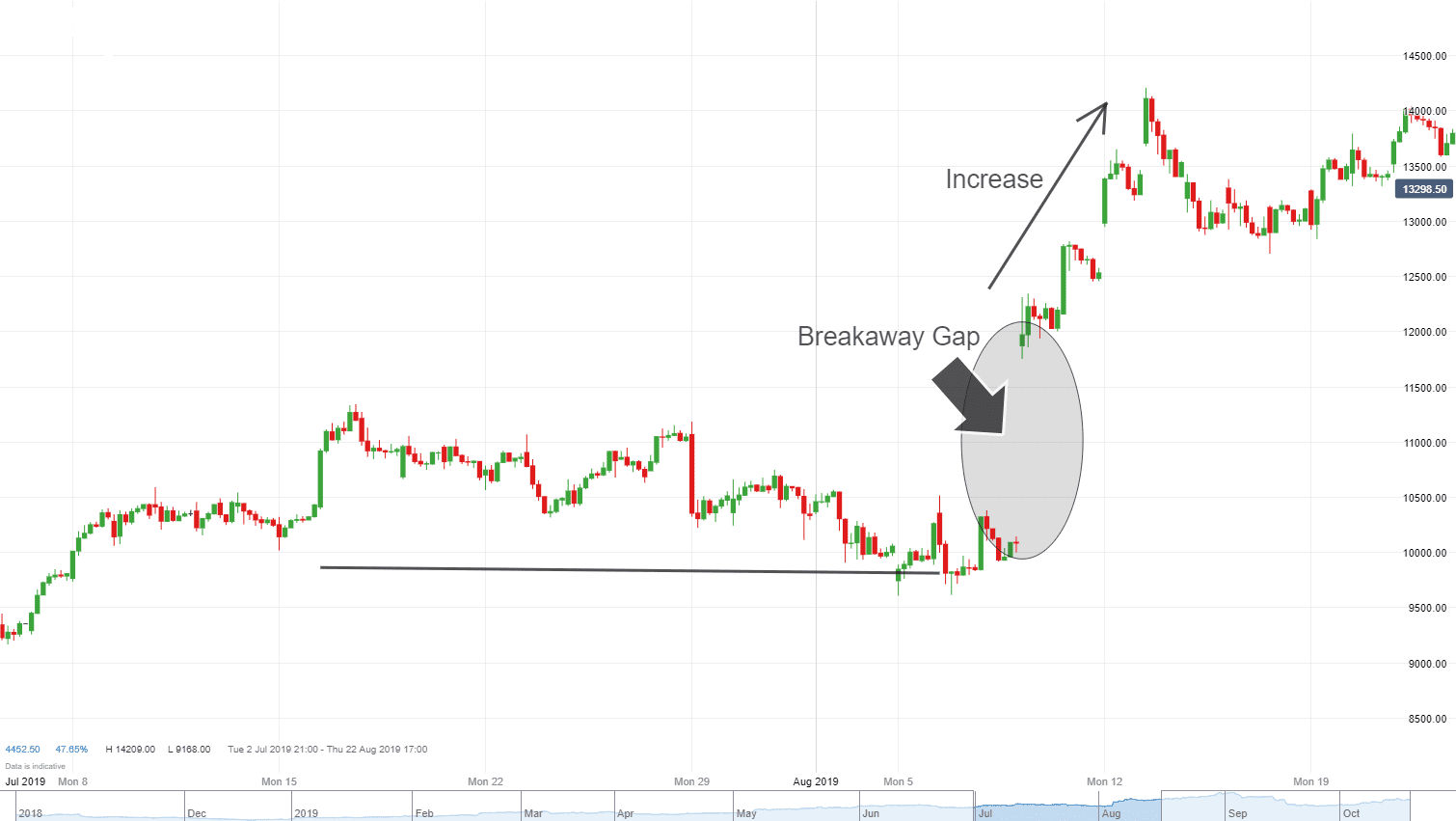

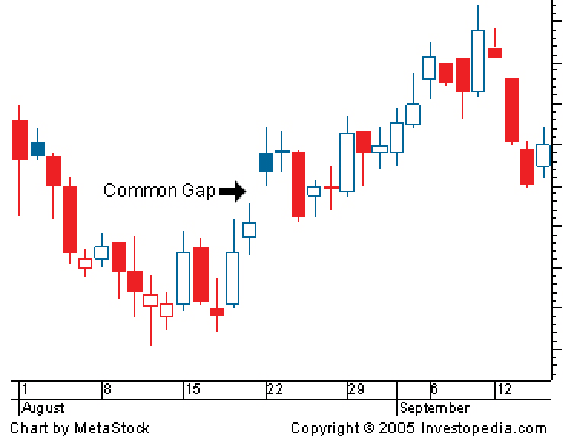

1) Common Gap: This type of gap is not associated with any significant market event and is often filled relatively quickly. It's usually caused by a lack of trading activity during off-market hours.

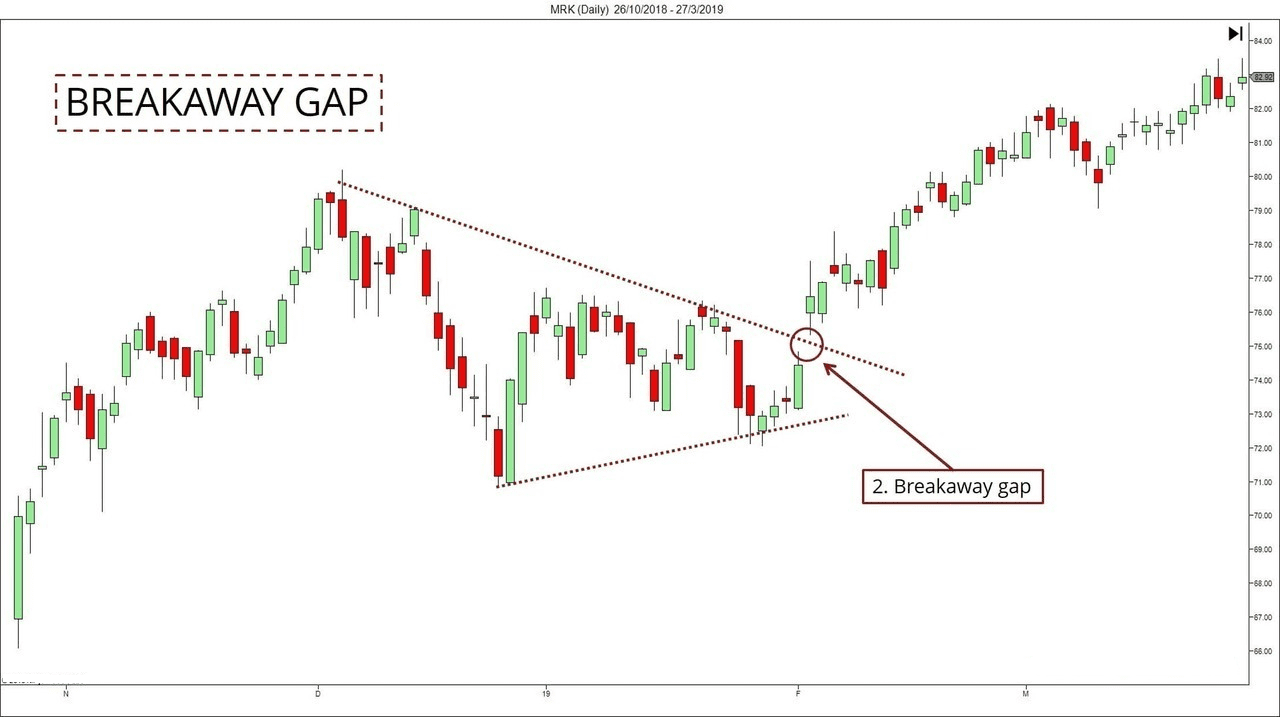

2) Breakaway Gap: Breakaway gaps occur at the beginning of new trends. They are caused by a surge of buying or selling pressure, often due to a major news event or economic release.

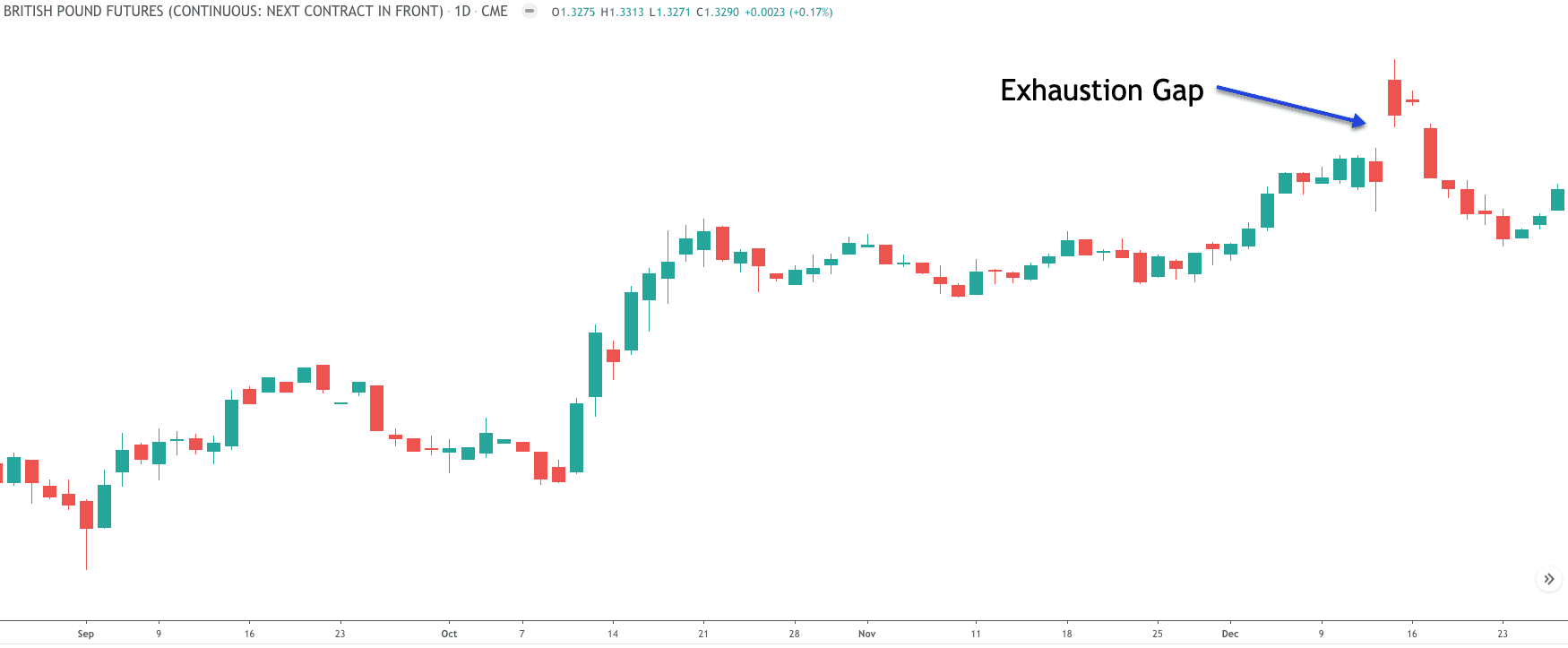

3) Exhaustion Gap: Exhaustion gaps occur near the end of a trend. They signify a final push in the direction of the trend before a reversal occurs.

Trading Strategies for Gap Trading:

Trading gaps can be profitable, but they also carry risks. Gaps can be deceptive, leading to rapid price reversals that can catch traders off guard. Here are some gap trading strategies to consider:

1) Gap Fading Strategy: This strategy involves assuming that the gap will be filled and the price will return to its pre-gap level. Traders who employ this strategy would short the currency pair that has gapped up or buy the pair that has gapped down. However, this strategy can be risky, especially during strong trending markets, as gaps may not always be filled immediately.

2) Breakaway Gap Strategy: Breakaway gaps often signal the beginning of a new trend. Traders can use this strategy to ride the trend in the direction of the gap. For instance, if there's a gap up, traders might consider opening a long position, expecting the price to continue rising. However, thorough analysis and confirmation of the trend's strength are crucial before entering such trades.

3) Gap and Go Strategy: The gap and go strategy involves trading in the direction of the gap but waiting for a confirmation before entering a trade. Traders wait for the price to move a certain percentage or pip amount beyond the gap before entering. This approach aims to avoid false breakouts that can occur immediately after the gap.

4)Measuring Gap Strategy: This strategy involves measuring the size of the gap and using it to set profit targets or stop-loss levels. For instance, if the gap is large, traders might expect a significant price move and set wider profit targets. Conversely, smaller gaps might lead to smaller profit expectations.

5) News-Based Gap Strategy: Some traders focus on trading gaps that are caused by significant news releases or events. They analyze the news, assess its potential impact on the market, and take positions accordingly. This strategy requires staying informed about upcoming news releases and reacting quickly to market developments.

Risk Management and Considerations:

While gap trading strategies offer potential rewards, they also come with risks that need to be managed effectively:

- Volatility: Gaps can lead to increased volatility, and prices can move rapidly in both directions. Traders should be prepared for sudden market movements and adjust their position sizes accordingly.

- Confirmation: It's important to wait for confirmation before entering a trade. Gaps can be deceptive, and false breakouts are not uncommon immediately after a gap.

- Position Sizing: Given the potential for volatility, proper position sizing is essential. Traders should avoid overleveraging, as gaps can lead to substantial losses if trades move against them.

- Stop Loss Orders: Placing stop-loss orders is crucial to limit potential losses. Gaps can lead to significant price movements that may not be in line with a trader's expectations.

FAQs About Trading Gaps in Forex

Q1: Are all price gaps worth trading?

A: Not all gaps are worth trading. Common gaps are often small and tend to get filled quickly, making them less attractive for trading. Breakaway and exhaustion gaps provide more significant trading opportunities due to their potential for trend continuation or reversal, respectively.

Q2: What timeframes are best for trading gaps?

A: Gaps can appear on various timeframes, but larger gaps are usually more visible on higher timeframes like daily or weekly charts. However, traders should adapt their strategies based on the timeframe they choose and consider the associated risks.

Q3: How should I manage risk when trading gaps?

A: Risk management is crucial when trading gaps due to their potential for high volatility. Set appropriate stop-loss orders and position sizes to limit potential losses. Avoid risking a significant portion of your trading capital on a single trade.

Q4: Can gaps result in significant losses?

A: Yes, gaps can lead to significant losses if not managed properly. Sudden market movements during gaps can result in slippage, where a trade is executed at a different price than expected. This can lead to losses that exceed the initially intended risk.

Footnote:

Trading gaps in the forex market offers both opportunities and challenges. The potential for quick profits makes gaps appealing, but their inherent volatility requires traders to have a solid understanding of the market and effective strategies in place. Whether employing the gap fading, gap filling, continuation gap, or breakaway gap strategy, traders must conduct thorough analysis and use proper risk management techniques to succeed in trading these price gaps. As with any trading approach, continuous learning and practice are essential for mastering the art of trading gaps in the forex market.

Discussion