Forex Trading Strategies for Trading During Economic Expansions: Techniques for Capitalizing on Economic Growth Periods

The world of forex trading is a dynamic and ever-changing landscape, influenced by a myriad of factors, including economic conditions. One such crucial factor is economic expansion, a period marked by increased economic activity, rising consumer spending, and positive market sentiment. As economies flourish, forex traders can employ specific strategies to maximize their profits during these growth phases. In this article, we will delve into various forex trading strategies tailored to capitalize on economic expansions.

Table Content

I. Understanding Economic Expansions and Their Impact on Forex Trading

1. Trend Following Strategies

2. Breakout Strategies

3. Carry Trade Strategies

4. Fundamental Analysis Strategies

5. Risk Management and Diversification

6. Stay Updated with Economic Data Releases

7. Flexibility and Adaptability

II. Footnote

Understanding Economic Expansions and Their Impact on Forex Trading:

Economic expansions, often referred to as boom periods or growth phases, are characterized by robust economic indicators such as increased GDP growth, low unemployment rates, rising consumer confidence, and higher industrial production. During these periods, currencies of countries experiencing economic growth tend to strengthen due to increased foreign investments, higher exports, and overall positive sentiment in the market.

For forex traders, economic expansions present both opportunities and challenges. On one hand, the heightened volatility and increased market activity can lead to substantial profits. On the other hand, this volatility can also expose traders to higher risks if not managed properly. To make the most of these periods, traders must employ carefully crafted strategies that align with the unique characteristics of economic expansions.

1. Trend Following Strategies:

Trend following strategies are particularly effective during economic expansions when currencies often display clear and sustained trends. Traders can use technical indicators such as moving averages, Bollinger Bands, and MACD to identify and confirm trends. The goal is to buy when an uptrend is established and sell when a downtrend is confirmed. These strategies are suited for traders who prefer a systematic approach and seek to ride the momentum of the market.

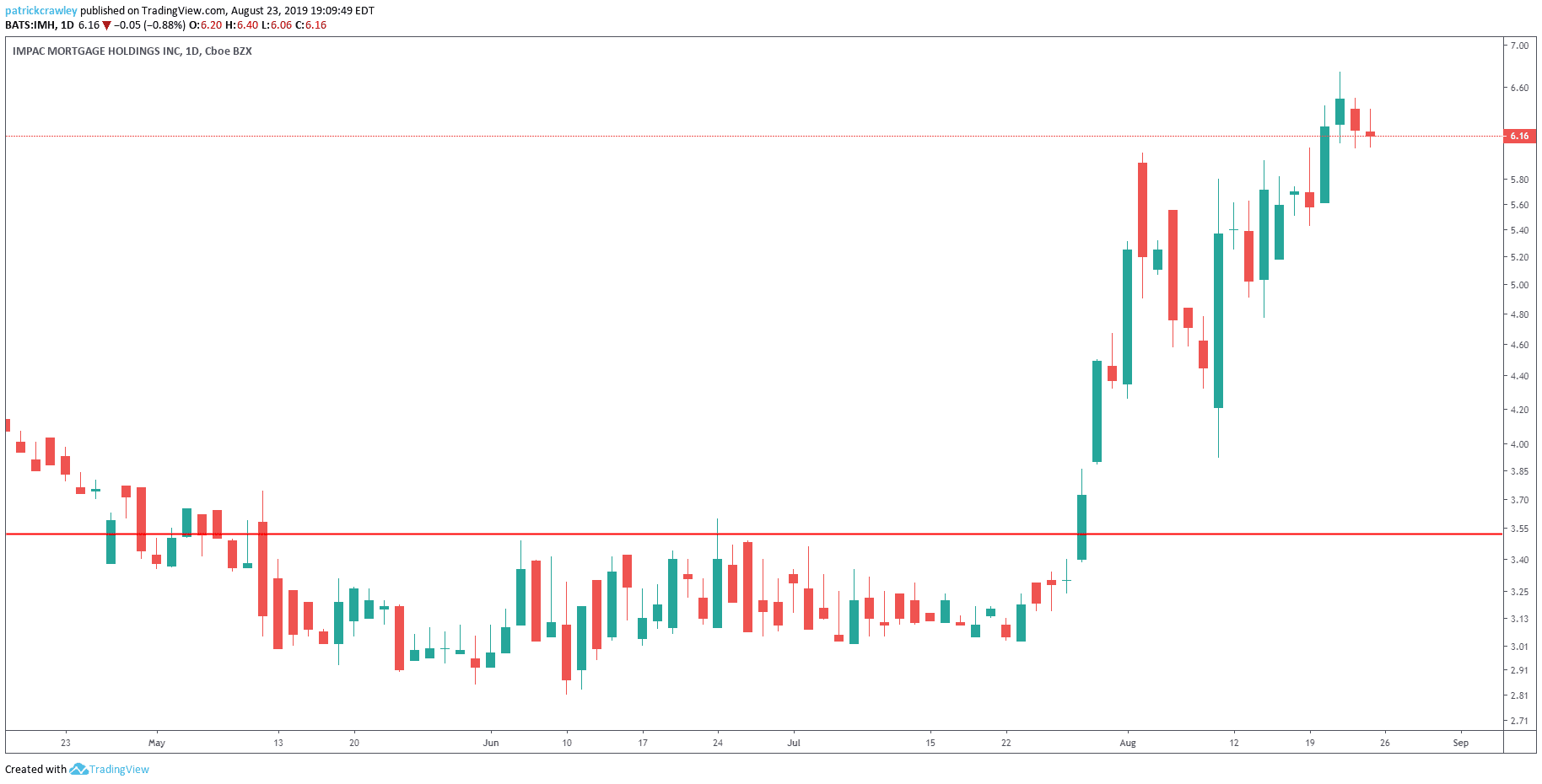

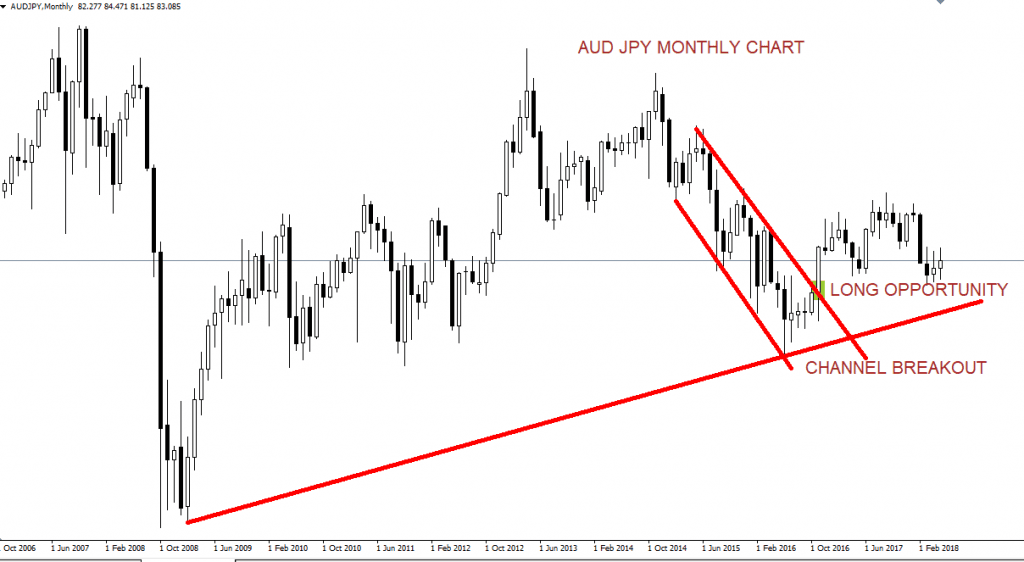

2. Breakout Strategies:

During economic expansions, markets are known to experience breakout movements as new highs and lows are established. Breakout strategies involve identifying key support and resistance levels and waiting for a currency pair to break through these levels. Once a breakout occurs, traders can enter positions in the direction of the breakout, anticipating further price movement in that direction.

3. Carry Trade Strategies:

Carry trade strategies involve exploiting the interest rate differentials between currencies. During economic expansions, central banks of countries experiencing growth often raise interest rates to curb inflation. This results in a higher yield on that currency, making it attractive to traders. By borrowing a low-yielding currency and investing in a high-yielding currency, traders can earn the interest rate differential as profit in addition to potential capital gains.

4. Fundamental Analysis Strategies:

Economic expansions are closely tied to strong economic fundamentals. Fundamental analysis involves evaluating economic indicators such as GDP growth, employment rates, inflation, and trade balances to gauge the overall health of an economy. Traders can take advantage of positive economic data by going long on currencies of countries with strong fundamentals and shorting currencies of countries with weaker fundamentals.

5. Risk Management and Diversification:

While the potential for profits during economic expansions is enticing, traders must not overlook the importance of risk management and diversification. The increased volatility can lead to sudden market reversals, causing substantial losses. To mitigate these risks, traders should implement proper risk management techniques, including setting stop-loss orders, position sizing based on account balance, and not putting all their capital into a single trade.

6. Stay Updated with Economic Data Releases:

Economic expansions are characterized by a flurry of economic data releases, including GDP reports, employment data, inflation figures, and consumer confidence indices. These releases can significantly impact currency movements. Traders must stay well-informed about the economic calendar and the expected impact of each data release. Tools like economic calendars and news feeds can help traders make informed decisions.

7. Flexibility and Adaptability:

The forex market is known for its unpredictability. Even during economic expansions, unexpected events can trigger rapid market shifts. Successful traders are those who can adapt quickly to changing market conditions. Being flexible in your approach, using both technical and fundamental analysis, and being willing to adjust your strategies based on new information are key traits of a successful trader during economic expansions.

Footnote:

Forex trading during economic expansions offers a realm of opportunities for traders to profit from the increased market activity and volatility. However, it is essential to approach this period with a well-defined trading strategy and a solid understanding of the underlying economic factors. Whether you choose to follow trends, trade breakouts, employ carry trade strategies, or base your decisions on fundamental analysis, the key lies in discipline, risk management, and continuous learning.

As with any trading endeavor, there are risks involved, and no strategy is foolproof. It's crucial to remember that successful trading is a long-term endeavor that requires dedication, patience, and a willingness to adapt. By combining these qualities with the right strategies tailored to economic expansions, traders can position themselves to capitalize on the opportunities presented by periods of economic growth.

Discussion