Forex Trading Strategies for Swing Traders: Approaches for Traders Holding Positions for Several Days to Weeks

Forex trading strategies for swing traders involve a unique approach where traders hold positions for several days to weeks. This strategy falls between day trading and long-term investing, offering opportunities for both short-term gains and minimizing the risks associated with longer investment horizons. In this comprehensive guide, we'll delve into various aspects of swing trading, from understanding the basics to exploring top strategies that can help traders make informed decisions.

Table of Contents

1. Understanding Swing Trading

2. Benefits of Swing Trading

3. Essential Tools for Swing Traders

4. Technical Analysis for Swing Trading

5. Fundamental Analysis for Swing Trading

6. Top Swing Trading Strategies

a) Moving Average Crossover

b) Bollinger Bands Strategy

c) MACD Swing Trading Strategy

d) Fibonacci Retracement Strategy

e) Breakout Strategy

f) Trend Reversal Strategy

7. Risk Management for Swing Traders

8. Setting Stop-Loss and Take-Profit Levels

9. Position Sizing and Leverage

10. Psychological Discipline

11. FAQs

12. Footnote

Understanding Swing Trading

Swing trading is a trading style that focuses on capturing short- to medium-term price movements within the financial markets. Unlike day traders who make multiple trades within a single day, swing traders hold their positions for a few days to several weeks, aiming to benefit from price fluctuations during that time. This approach allows traders to take advantage of both upward and downward trends.

Benefits of Swing Trading

Swing trading offers several advantages for traders looking to navigate the dynamic world of forex:

- Flexibility: Swing trading doesn't demand constant monitoring, making it suitable for individuals with full-time jobs or other commitments.

- Less Stress: Unlike day trading, swing traders aren't required to make quick decisions, reducing emotional stress.

- Trend Profits: Swing traders capitalize on market trends, potentially leading to substantial gains during strong price movements.

- Risk Management: Holding positions for days to weeks allows traders to implement effective risk management strategies.

Essential Tools for Swing Traders

To succeed as a swing trader, you need the right tools at your disposal:

- Reliable Trading Platform: Choose a reputable platform with advanced charting tools and real-time data.

- Technical Indicators: Use indicators like Moving Averages, Bollinger Bands, and MACD to analyze trends and momentum.

- Fundamental Analysis: Stay updated on economic news and events that can impact the forex market.

- Risk Management Tools: Implement stop-loss orders, take-profit orders, and position sizing calculators.

Technical Analysis for Swing Trading

Technical analysis involves studying historical price data to forecast future price movements. Key technical indicators for swing traders include:

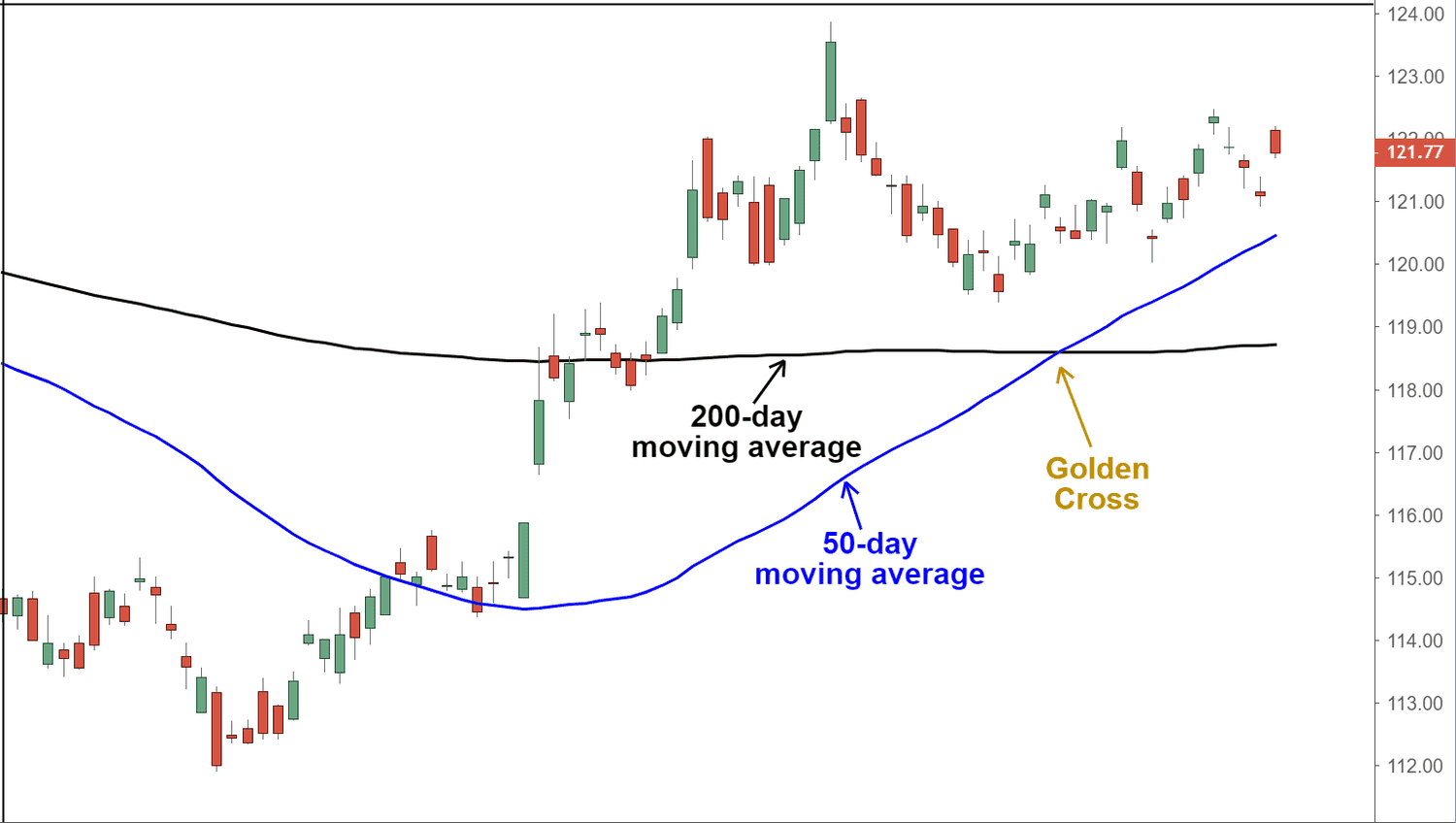

- Moving Averages: Identifies trends by smoothing out price fluctuations over a specified period.

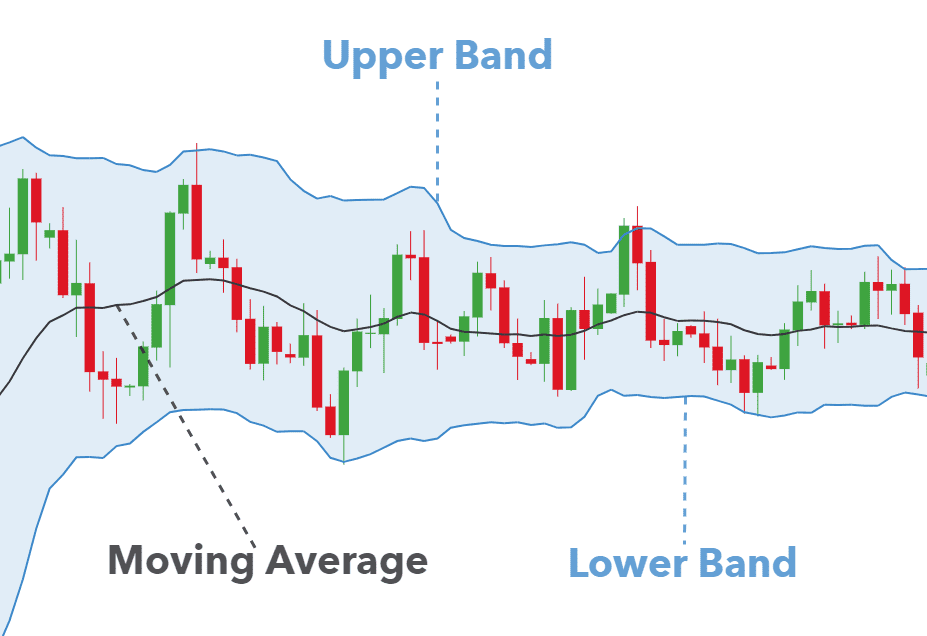

- Bollinger Bands: Measures volatility and identifies potential entry and exit points based on price deviation.

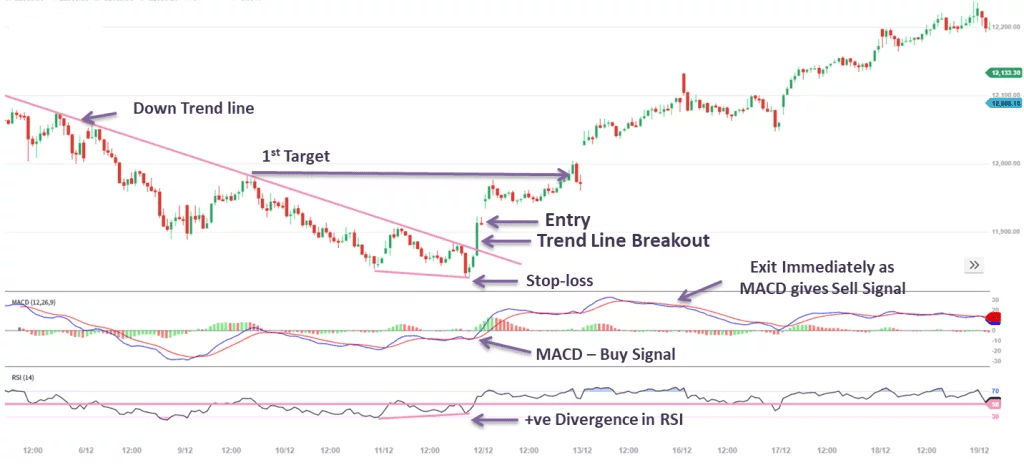

- MACD (Moving Average Convergence Divergence): Gauges momentum and trend strength.

Fundamental Analysis for Swing Trading

While swing trading primarily relies on technical analysis, fundamental factors also play a role. Consider these factors:

- Economic Indicators: Keep an eye on economic indicators like GDP, unemployment rates, and interest rates.

- Central Bank Decisions: Monetary policy decisions can significantly impact currency values.

- Political Events: Geopolitical events and elections can lead to market volatility.

Top Swing Trading Strategies

a) Moving Average Crossover

The Moving Average Crossover technique doesn't just rely on guesswork; it's a tried-and-true method that takes advantage of market trends and patterns. By analyzing the intersection of short-term and long-term moving averages, this technique provides a clear signal for optimal entry and exit points. Don't let uncertainty dominate your trading journey. Embrace the Moving Average Crossover technique today and pave your way to more strategic and successful trading decisions. Your financial future awaits – seize it now.

B) Bollinger Bands Strategy

Bollinger Bands consist of a central moving average and two outer bands that indicate price volatility. Breakouts from these bands can signal potential trade opportunities. The Bollinger Bands strategy offers a remarkable solution to this dilemma. By incorporating volatility and price movements, this strategy serves as a dynamic guide for your trading decisions. Imagine having a clear visual representation of overbought and oversold conditions, enabling you to time your trades with precision. The Bollinger Bands strategy isn't just another technique; it's a proven method used by experienced traders to enhance their profitability. Step into a world of calculated risk and informed choices. Whether you're a seasoned trader or just starting, the Bollinger Bands strategy empowers you to navigate the market with confidence. Don't let uncertainty hold you back – embrace the Bollinger Bands strategy and take charge of your trading destiny today.

c) MACD Swing Trading Strategy

MACD combines moving averages to identify changes in momentum. Traders look for MACD line crossovers and histogram reversals for entry points. This strategy isn't just a tool; it's a game-changer that can give your trading an edge. By analyzing the convergence and divergence of moving averages, the MACD indicator provides valuable insights into potential trend shifts. Imagine being able to spot favorable entry and exit points with confidence, all while riding the waves of market trends. The MACD Swing Trading strategy empowers you to make calculated moves that can lead to substantial profits. Whether you're a seasoned trader or just starting out, this strategy equips you with a powerful tool to navigate the complexities of the market. Don't let indecision and missed opportunities define your trading journey. Embrace the MACD Swing Trading strategy today and pave your way to a more prosperous trading future.

d) Fibonacci Retracement Strategy

Fibonacci retracement levels help identify potential support and resistance levels based on the Fibonacci sequence. Traders use these levels to find entry and exit points. The Fibonacci Retracement strategy offers a scientific approach to trading that can elevate your success. Imagine having a tool that helps you identify potential support and resistance levels with unparalleled accuracy. By applying the mathematical ratios derived from the Fibonacci sequence, this strategy provides a clear roadmap of where the market might reverse or continue its trend. The Fibonacci Retracement strategy isn't just a theory; it's a battle-tested technique that has stood the test of time. Whether you're a novice or an experienced trader, this strategy can be your compass in the complex world of trading. Don't let uncertainty dictate your moves. Embrace the Fibonacci Retracement strategy today and take charge of your trading destiny. Your path to more informed and profitable trades starts here.

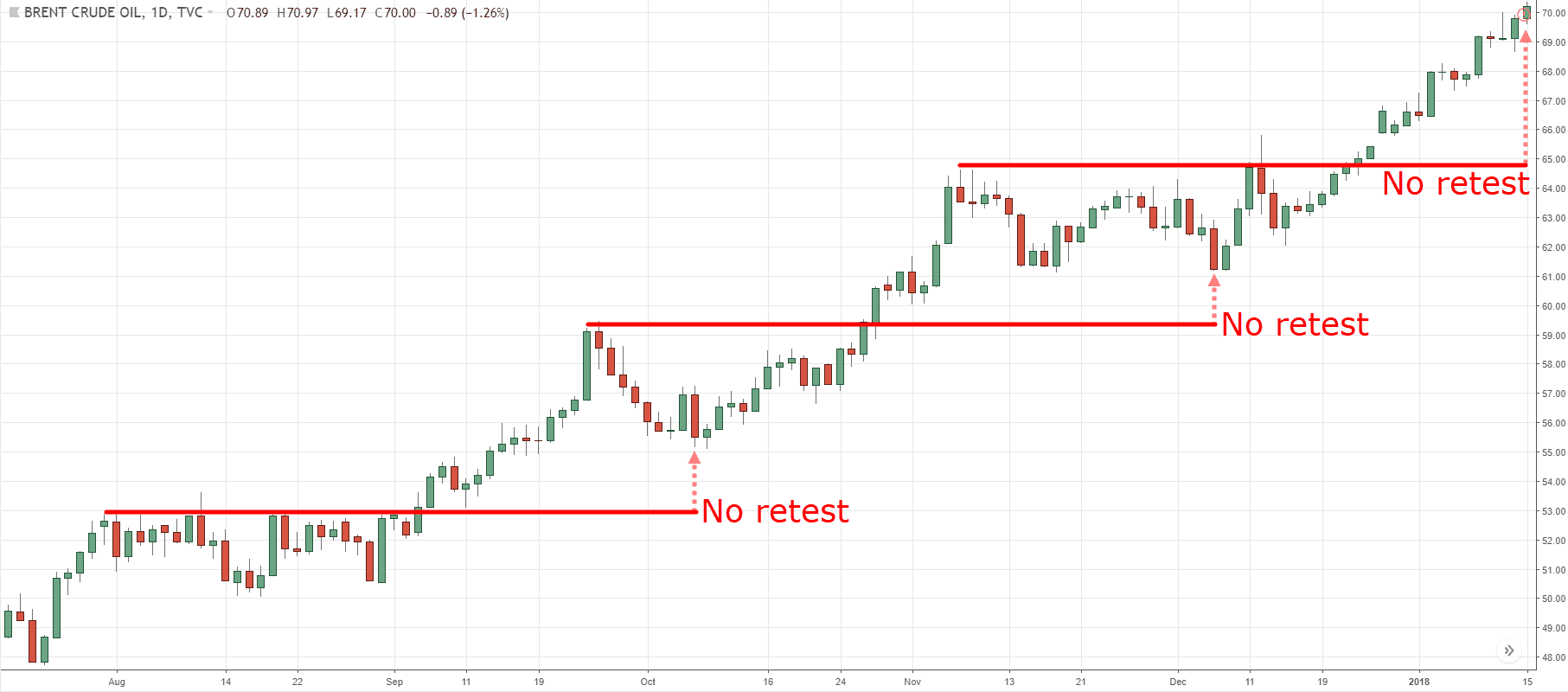

e) Breakout Strategy

Breakout traders look for price levels where significant breakout movements are likely to occur. This strategy involves entering trades when prices breach these levels. The Breakout Strategy isn't just another trading approach; it's a dynamic technique that allows you to take advantage of market volatility. Whether you're a seasoned trader or just starting out, this strategy empowers you to make informed decisions with confidence. Don't let hesitation and missed chances define your trading journey. Embrace the Breakout Strategy today and pave your way to more strategic and profitable trades. Your success story begins now.

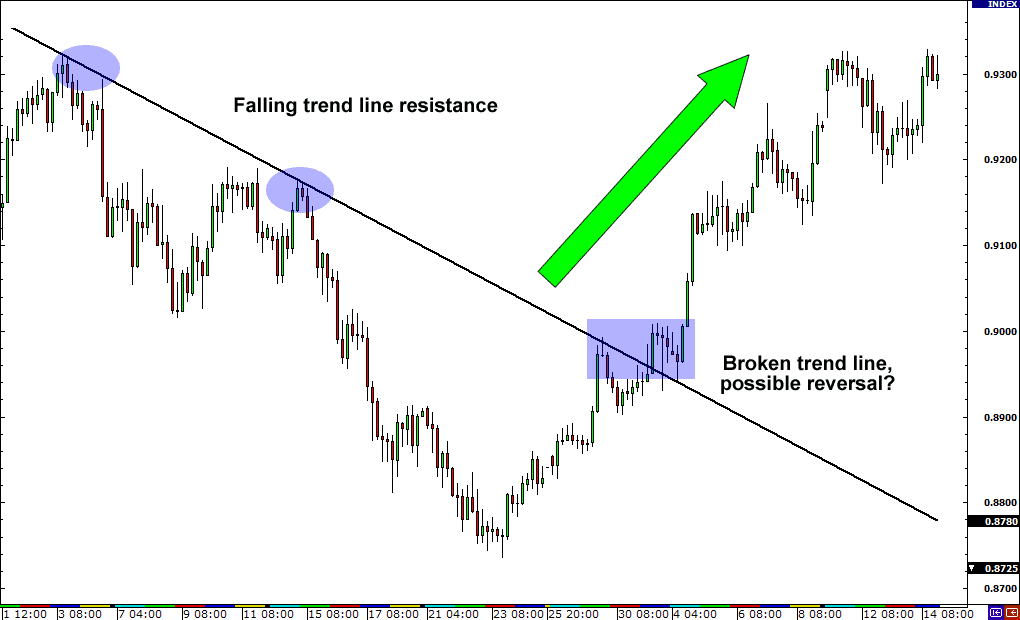

f) Trend Reversal Strategy

Traders using this strategy identify potential trend reversals by analyzing chart patterns, candlestick formations, and technical indicators. The Trend Reversal Strategy is your secret weapon to identifying those crucial moments when trends change course. Imagine having a reliable method to spot the transition from a bull market to a bear market, or vice versa. This strategy provides you with the insights you need to make timely and profitable decisions. The Trend Reversal Strategy isn't just another trading tactic; it's a game-changing approach that empowers you to navigate market dynamics with finesse. Whether you're a seasoned trader or a newcomer, this strategy equips you with the tools to stay ahead of market reversals. Don't let missed opportunities haunt you. Embrace the Trend Reversal Strategy today to embark on a journey of smarter and more strategic trading. Your path to profitable trend shifts starts now.

Risk Management for Swing Traders

Effective risk management is crucial for swing traders to preserve capital and manage potential losses:

- Setting Stop-Loss and Take-Profit Levels: Define price points at which you'll exit a trade to limit losses or secure profits.

- Position Sizing and Leverage: Determine how much of your capital to allocate to each trade and use leverage wisely.

- Psychological Discipline: Maintain emotional control to avoid making impulsive decisions based on fear or greed.

FAQs

Q: What is the difference between swing trading and day trading?

A: Swing trading involves holding positions for several days to weeks, while day trading involves making multiple trades within a single day.

Q: Can beginners succeed in swing trading?

A: Yes, beginners can succeed in swing trading with proper education, practice, and a disciplined approach to risk management.

Q: Do swing traders use fundamental analysis?

A: While swing trading leans heavily on technical analysis, considering fundamental factors can enhance trading decisions.

Q: How do I choose the right trading strategy?

A: Choose a strategy that aligns with your trading goals, risk tolerance, and the time you can dedicate to trading activities.

Q: What is the role of psychology in swing trading?

A: Psychology plays a significant role in managing emotions, maintaining discipline, and making rational trading decisions.

Q: Can I swing trade with a full-time job?

A: Yes, swing trading is suitable for individuals with full-time jobs, as it doesn't require constant monitoring.

Q: What is the recommended capital allocation per trade?

A: It's generally advisable to risk only a small portion of your capital on each trade, usually around 1-3%.

Q: How do I identify potential trend reversals?

A: Look for chart patterns like double tops, double bottoms, and candlestick reversal patterns in conjunction with technical indicators.

Q: Is technical analysis more important than fundamental analysis in swing trading?

A: While both are essential, technical analysis tends to be more crucial in swing trading due to the shorter timeframes involved.

Q: What markets can I apply swing trading strategies to?

A: Swing trading strategies can be applied to various markets, including forex, stocks, commodities, and cryptocurrencies.

Footnote

Forex trading strategies for swing traders provide a balanced approach to trading, catering to both short-term profit opportunities and reduced stress compared to day trading. By leveraging technical and fundamental analysis, implementing proven strategies, and managing risks effectively, swing traders can enhance their chances of success in the dynamic world of forex trading.

Discussion