Forex Trading Strategies for Stable Economic Periods: Techniques for Capitalizing on Steady Market Conditions

In the ever-evolving world of Forex trading, one thing remains certain – market conditions are never static. However, there are periods when the market exhibits a certain level of stability. During these times, traders have unique opportunities to capitalize on their strategies and maximize profits. This article delves into effective Forex trading strategies tailored for stable economic periods.

Table content

1. Understanding Stable Economic Periods

2. Strategies for Capitalizing on Stability

3. Maximizing Profits and Mitigating Risks

4. Footnote

5. Frequently Asked Questions

Understanding Stable Economic Periods

i) Defining Stability in Forex Markets

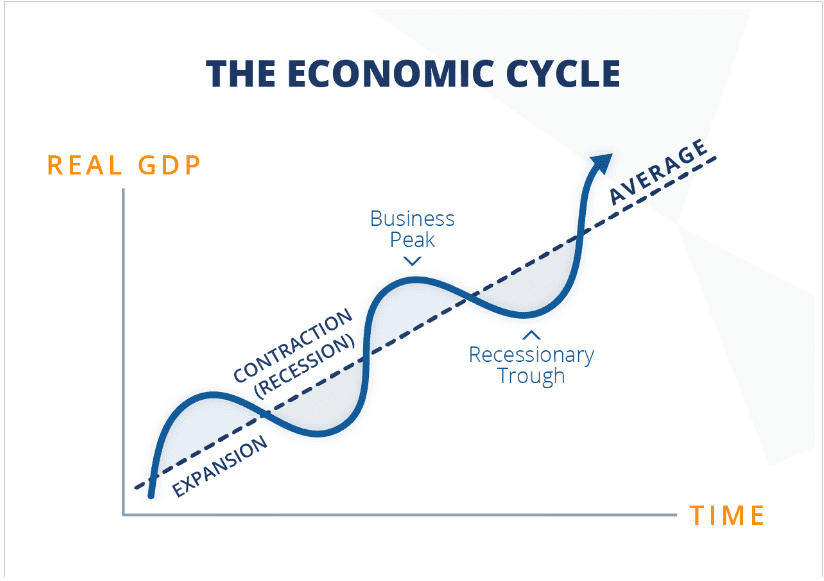

Before diving into strategies, it's essential to understand what a stable economic period entails in Forex trading. Stability is characterized by consistent market conditions, minimal volatility, and less abrupt price fluctuations. These periods are often a result of steady economic growth, low inflation rates, and controlled interest rates.

ii) Recognizing Indicators of Stability

Identifying stable periods is key to implementing appropriate strategies. Some indicators of stability include a steady GDP growth rate, a balanced trade environment, and consistent employment figures. Monitoring these indicators can help traders anticipate periods of relative market calmness.

Strategies for Capitalizing on Stability

i) Trend-Following Strategy

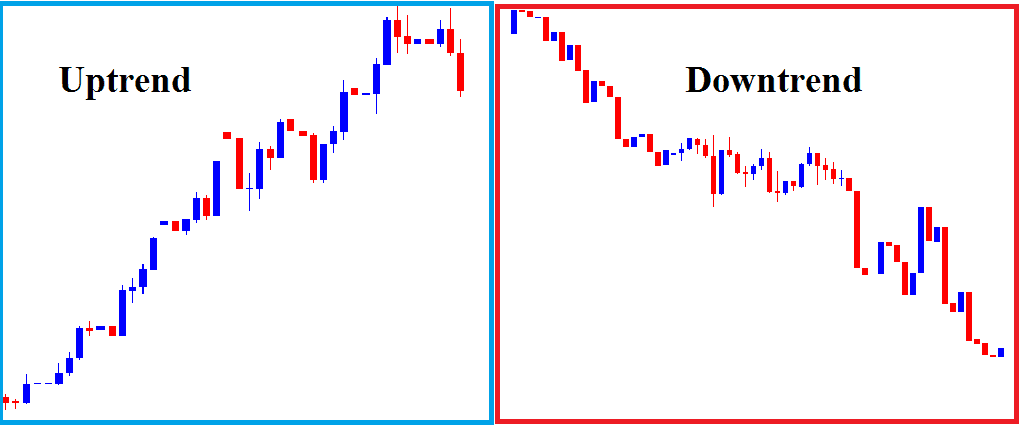

One effective strategy during stable economic periods is trend-following. Traders identify established trends in the market and capitalize on them. This involves tracking long-term charts and technical indicators to make informed trading decisions. By following the trend, traders aim to ride the momentum and profit from sustained price movements.

ii) Range Trading Strategy

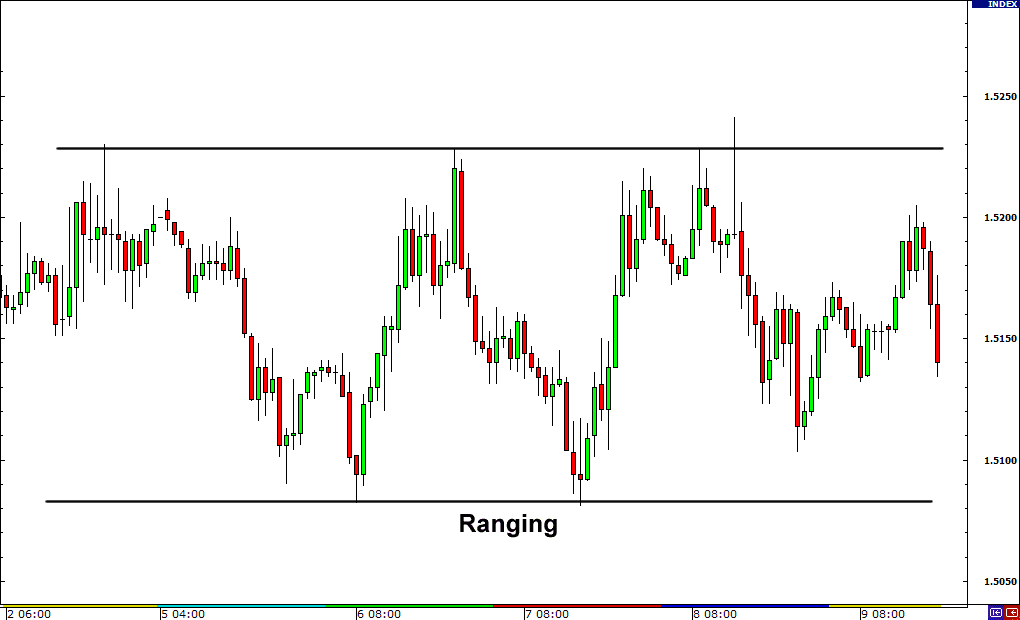

Range trading is another approach suited for stable market conditions. Traders identify price ranges or support and resistance levels where the currency pair is likely to trade within. They buy near support and sell near resistance, profiting from predictable price oscillations.

iii) Carry Trade Strategy

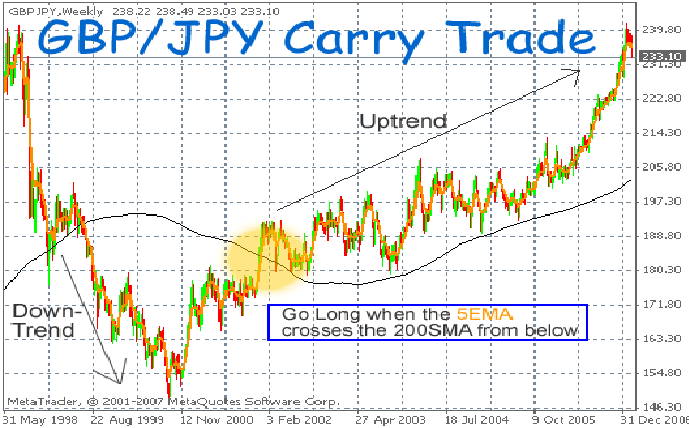

The carry trade strategy involves capitalizing on interest rate differentials between two currencies. During stable periods, central banks often maintain steady interest rates. Traders can leverage this by buying a currency with a higher interest rate while simultaneously selling a currency with a lower interest rate.

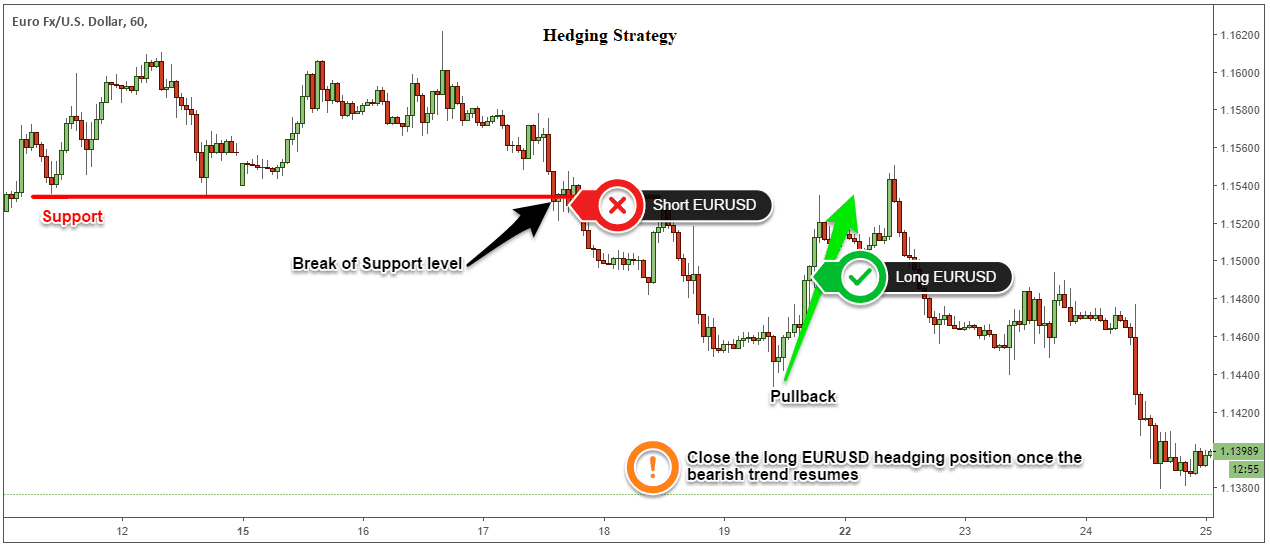

iv) Hedging

Hedging is a risk management technique where traders open positions to offset potential losses. During stable periods, hedging can be utilized to protect existing trades from sudden market fluctuations. This involves opening positions in opposite directions to mitigate risk.

Maximizing Profits and Mitigating Risks

i) Diversification

While stable periods offer opportunities, diversification remains crucial. Spread your investments across various currency pairs and asset classes. This mitigates the risk associated with a sudden change in market sentiment.

ii) Staying Informed

Stable periods don't imply complete predictability. It's essential to stay informed about global economic events that could disrupt stability. Keep an eye on economic calendars and news releases to adjust your strategies accordingly.

Footnote

In the world of Forex trading, stable economic periods provide a unique environment for traders to apply specialized strategies. The trend-following, range trading, carry trade, and hedging strategies discussed in this article offer valuable insights into capitalizing on steady market conditions. By understanding these strategies and staying informed, traders can make the most of stable periods while minimizing risks.

Frequently Asked Questions

Q1: Can I use these strategies during volatile market periods?

A1: While these strategies are tailored for stable periods, some elements can be adapted to volatile markets. However, caution and adjustments are needed.

Q2: How do I identify the beginning of a stable economic period?

A2: Monitoring economic indicators such as GDP growth, employment data, and interest rate trends can help identify the start of a stable period.

Q3: Is there a strategy that works best for all stable periods?

A3: No single strategy guarantees success. Traders should adapt strategies based on current market conditions and their risk tolerance.

Q4: What role does risk management play in stable periods?

A4: Risk management remains crucial in all market conditions. Implementing strategies like diversification and hedging can help manage potential risks.

Q5: Can beginners effectively implement these strategies?

A5: Yes, beginners can apply these strategies, but they should start with a solid understanding of each strategy and practice in a demo environment before using real funds.

Discussion