Forex Trading Strategies for Range-Bound Markets: Approaches Effective When Prices Move Sideways

Forex trading in range-bound markets can be a challenging endeavor, as traders face periods of sideways price movement where trends are absent. However, with the right strategies and approach, range-bound markets can present profitable opportunities. In this comprehensive guide, we will explore various effective trading approaches for range-bound markets to help traders navigate such conditions successfully.

Table of Contents

1. Understanding Range-Bound Markets

2. Key Characteristics of Range-Bound Markets

3. Identifying Range-Bound Markets

4. Popular Indicators for Range-Bound Markets

5. Developing a Range-Bound Trading Strategy

6. Risk Management in Range-Bound Markets

7. FAQs

8. Footnote

Understanding Range-Bound Markets

Range-bound markets refer to periods where currency pairs or other financial instruments trade within a defined price range, without exhibiting a clear upward or downward trend. During these phases, prices tend to oscillate between established support and resistance levels, providing traders with opportunities to profit from short-term price fluctuations.

Key Characteristics of Range-Bound Markets

Understanding the characteristics of range-bound markets is essential for traders looking to capitalize on such conditions. Here are the key features to consider:

- Sideways Price Movement: Prices move horizontally, with no clear upward or downward trend.

- Support and Resistance Levels: Traders can identify well-defined support and resistance levels within the range.

- Periodic Price Oscillations: Prices fluctuate between support and resistance levels, creating trading opportunities.

- Consolidation Phases: Range-bound markets often follow trends or precede new trends, representing a period of consolidation.

Identifying Range-Bound Markets

To trade effectively in range-bound markets, traders must first identify when a market is exhibiting such behavior. Here are some methods to recognize range-bound conditions:

- Visual Inspection: Observe price charts for periods of horizontal price movement.

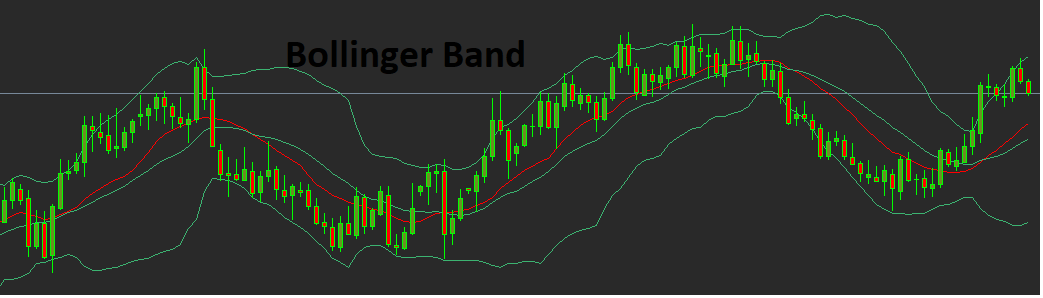

- Bollinger Bands: When the Bollinger Bands contract, it indicates reduced volatility and potential range-bound conditions.

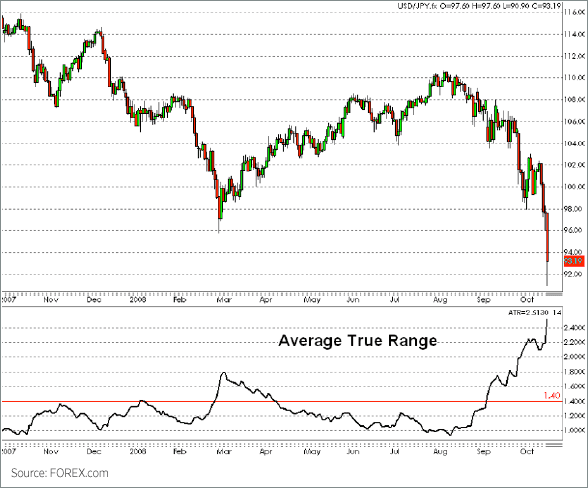

- Average True Range (ATR): Low ATR values suggest reduced market volatility and potential range-bound behavior.

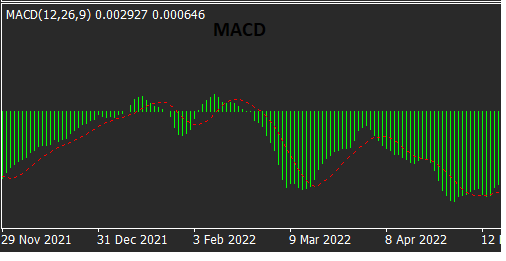

- Moving Average Convergence Divergence (MACD): A lack of MACD crossovers can signal range-bound conditions.

- Historical Price Analysis: Analyze past price data to identify recurring range-bound patterns.

Popular Indicators for Range-Bound Markets

Certain technical indicators can assist traders in confirming range-bound market conditions and making informed trading decisions. Some of the most widely used indicators are:

1. Bollinger Bands

Bollinger Bands consist of three lines: a central moving average and two bands that represent standard deviations from the average. These bands expand and contract with market volatility, helping traders identify potential entry and exit points.

2. Moving Average Convergence Divergence (MACD)

MACD is a trend-following momentum indicator that can also be used to identify range-bound conditions. When the MACD line and signal line move close together, it suggests a lack of trend, indicating a possible range-bound phase.

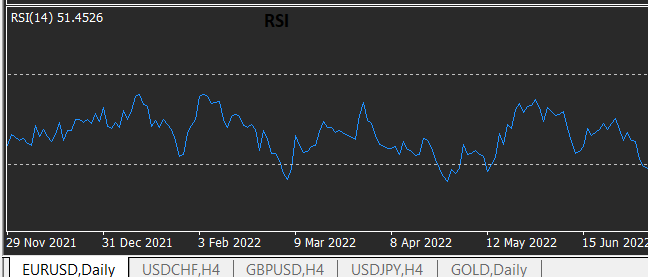

3. Relative Strength Index (RSI)

The RSI measures the speed and change of price movements. In a range-bound market, the RSI will often stay within specific levels, signaling overbought or oversold conditions at the support and resistance levels.

4. Average True Range (ATR)

The ATR measures market volatility and can help traders identify potential range-bound periods. Low ATR values indicate reduced volatility, characteristic of range-bound behavior.

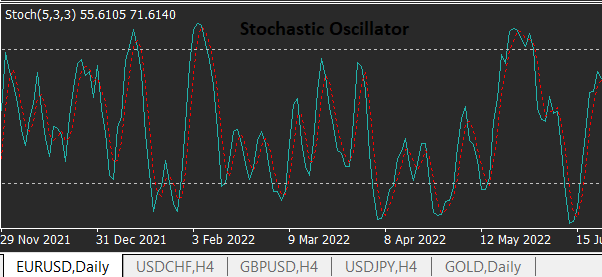

5. Stochastic Oscillator

The stochastic oscillator compares a security's closing price to its price range over a specific period. In a range-bound market, it can show overbought or oversold conditions, indicating potential reversal points.

Developing a Range-Bound Trading Strategy

To capitalize on range-bound markets, traders need well-defined strategies. Here are some effective approaches to consider:

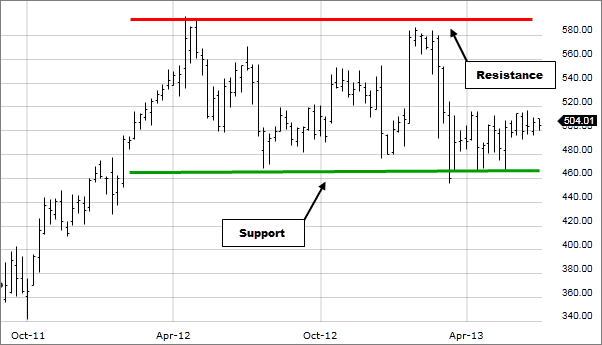

1. Support and Resistance Levels

Identify key support and resistance levels and execute trades when the price approaches these levels. Buy at support and sell at resistance, targeting short-term profits.

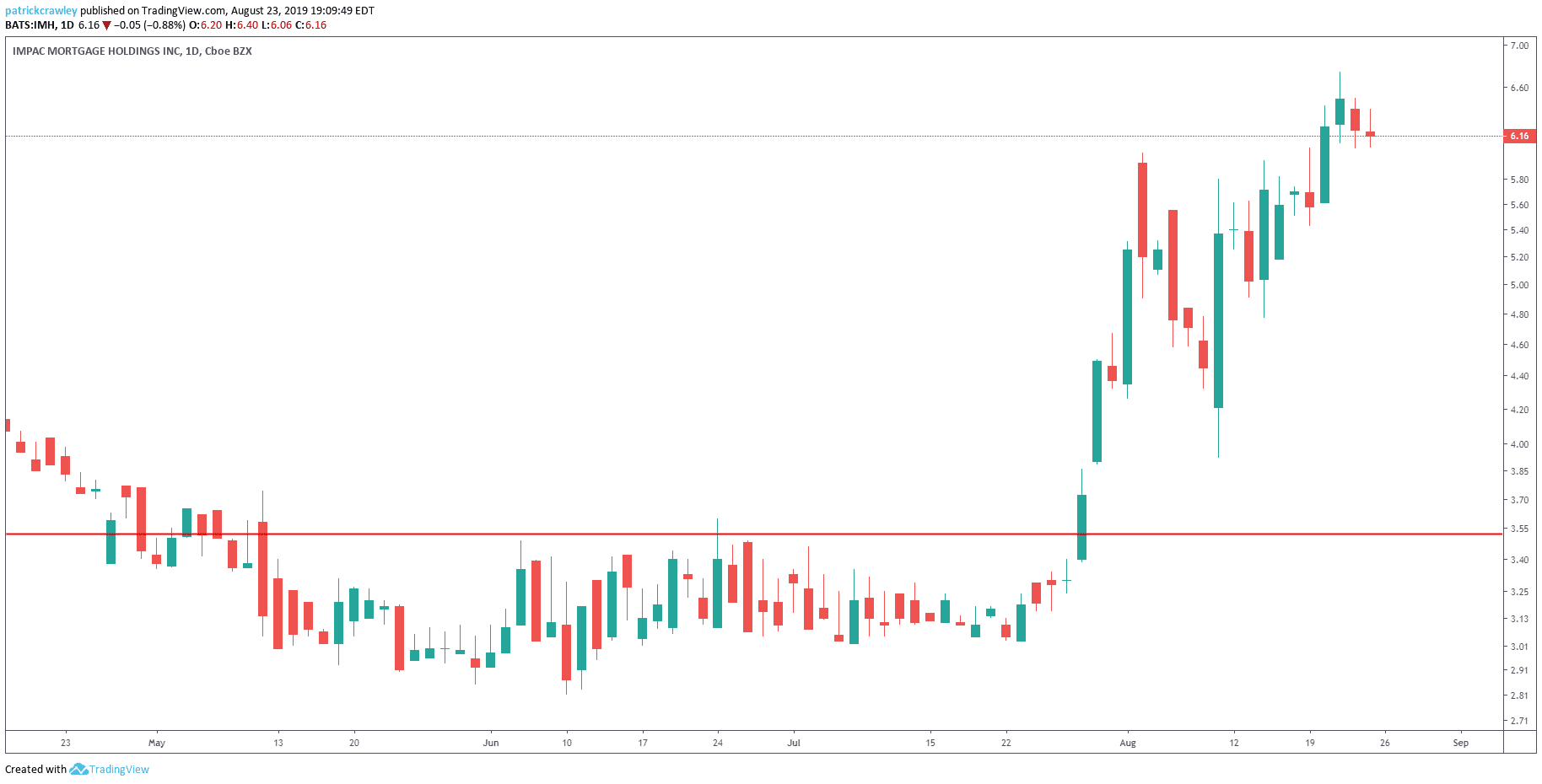

2. Breakout Trading Strategy

Monitor price movements near support or resistance levels and enter positions when a confirmed breakout occurs. Place stop-loss orders to manage risk.

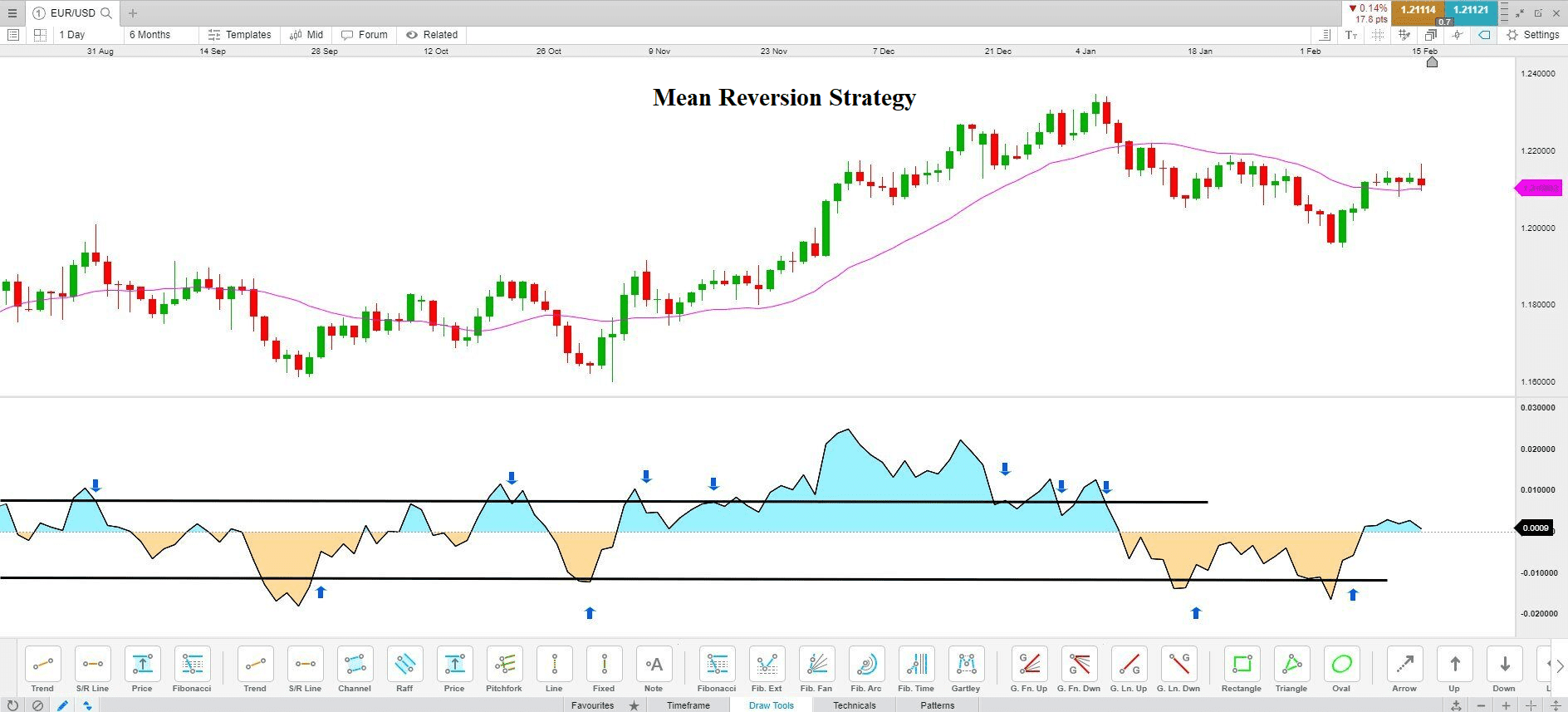

3. Mean Reversion Strategy

This strategy involves trading based on the belief that prices will revert to their mean or average value. Buy when prices are below the mean and sell when they are above it.

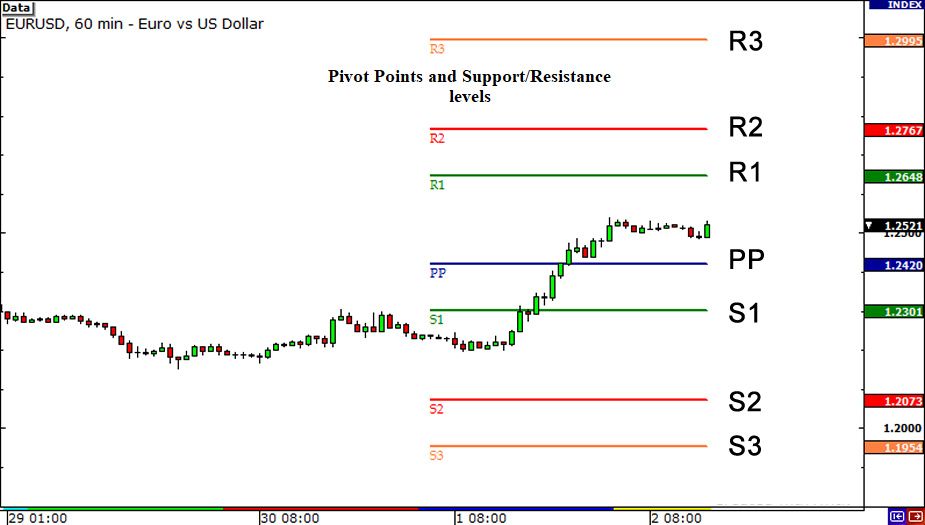

4. Pivot Points Strategy

Pivot points are calculated based on the previous day's price action. They provide potential entry and exit points for range-bound trades.

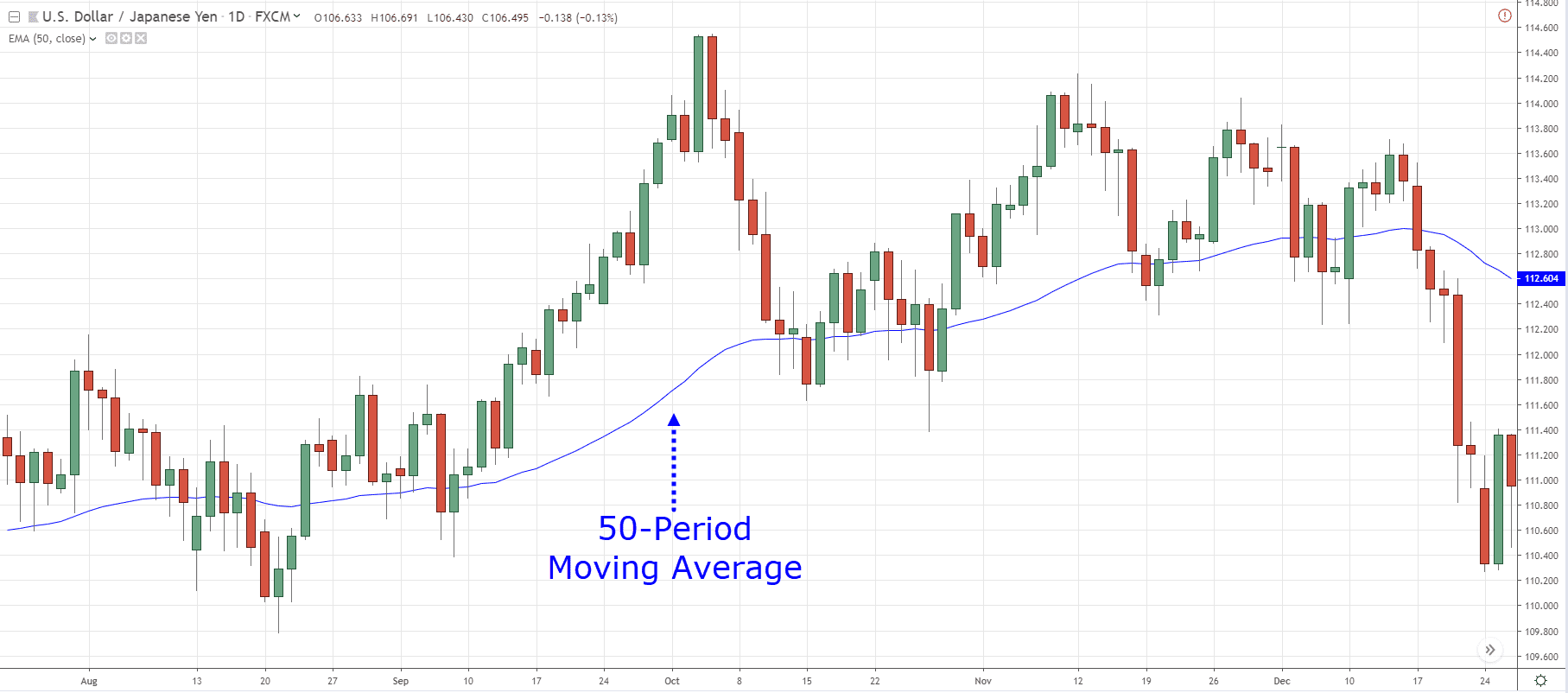

5. Moving Average Strategy

Use moving averages to identify potential entry and exit points. Crossovers between shorter and longer-term moving averages can signal trading opportunities.

6. Scalping Strategy

Scalpers aim to profit from small price movements in a range-bound market by executing numerous quick trades. Tight stop-loss orders are essential for risk management.

Risk Management in Range-Bound Markets

Range-bound trading still involves risk, and traders must adopt proper risk management strategies to protect their capital. Here are some important risk management practices:

1. Proper Position Sizing

Calculate the appropriate position size for each trade based on your risk tolerance and the distance to the stop-loss level.

2. Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses in case the market moves against your position.

3. Diversification

Avoid over-concentrating your capital in a single trade or currency pair. Diversification helps spread risk.

4. Monitoring Market Volatility

Stay informed about changes in market volatility, as it can impact your trading decisions and risk exposure.

5. Keeping Emotions in Check

Emotional trading can lead to impulsive decisions and increased risk. Stay disciplined and stick to your trading plan.

6. Using Trailing Stops

Trailing stops can lock in profits as the market moves in your favor, allowing you to maximize gains while protecting against potential reversals.

FAQs

Q1: What is a range-bound market?

A1: A range-bound market is a condition where prices trade within a defined price range without a clear trend.

Q2: How can I identify range-bound conditions?

A2: Traders can identify range-bound conditions through visual inspection of price charts or by using technical indicators like Bollinger Bands, MACD, RSI, and ATR.

Q3: What are some popular indicators for range-bound markets?

A3: Some popular indicators for range-bound markets are Bollinger Bands, MACD, RSI, ATR, and the Stochastic Oscillator.

Q4: How can I develop a range-bound trading strategy?

A4: Developing a range-bound trading strategy involves using approaches like support and resistance levels, breakout trading, mean reversion, pivot points, moving averages, and scalping.

Q5: How important is risk management in range-bound trading?

A5: Risk management is crucial in range-bound trading to protect capital and minimize losses.

Footnote

Trading in range-bound markets can be a profitable venture with the right strategies and risk management techniques. By understanding the characteristics of range-bound markets, identifying effective indicators, and employing well-defined trading approaches, traders can navigate sideways price movements successfully. Remember to stay disciplined, adapt to changing market conditions, and continuously improve your trading skills to excel in range-bound market environments.

Discussion