Forex trading strategies for oil: Techniques for trading oil, USO/USD or UKO/USD.

Are you ready to dive into the dynamic world of Forex trading strategies for oil? Whether you're a seasoned trader or a newcomer to the financial landscape, this guide will provide you with the essential techniques needed to navigate the exciting realm of oil trading. Trading oil, specifically with USO/USD or UKO/USD, requires a unique set of skills and insights. In this comprehensive guide, we'll explore proven strategies, expert tips, and real-world examples to help you make informed trading decisions. Let's get started!

Table Content

1. Understanding Oil Trading

2. The Fundamentals of Forex Trading

3. Strategies for Successful Oil Trading

4. Risk Management and Psychology

5. Technical and Fundamental Analysis

6. Real-Life Examples

7. Advanced Techniques for Oil Trading

8. Footnote

9. FAQs (Frequently Asked Questions)

Understanding Oil Trading

Before we delve into the strategies, let's establish a foundational understanding of oil trading. Crude oil, a highly valued global commodity, holds significant influence over economies and financial markets. Its pricing can be affected by geopolitical events, supply-demand dynamics, and economic indicators. As a Forex trader, focusing on oil trading through USO/USD or UKO/USD pairs opens doors to exciting opportunities.

The Fundamentals of Forex Trading

1. Know Your Markets

To succeed in oil trading, it's crucial to keep a close eye on both the forex and oil markets. Understand the correlation between currency pairs and oil prices. Stay updated with relevant news, such as OPEC decisions, geopolitical tensions, and economic reports.

2. Choose Your Oil Pair Wisely

Select the right trading pair—USO/USD or UKO/USD—for your strategy. Each pair has unique characteristics and responds differently to market forces. Research their historical performance and consider factors like spreads and volatility.

Strategies for Successful Oil Trading

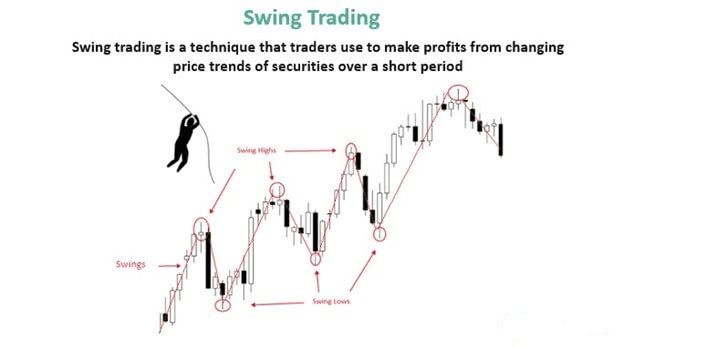

a. Swing Trading: Seizing Short to Medium-Term Trends

Swing trading involves capitalizing on short to medium-term price movements. Identify support and resistance levels, use technical indicators, and combine fundamental analysis to make well-informed trading decisions.

b. Breakout Strategies: Riding Price Surges

Breakout strategies aim to capture price movements when the market breaks through key levels. Monitor consolidation patterns, set entry and exit points, and implement risk management tools.

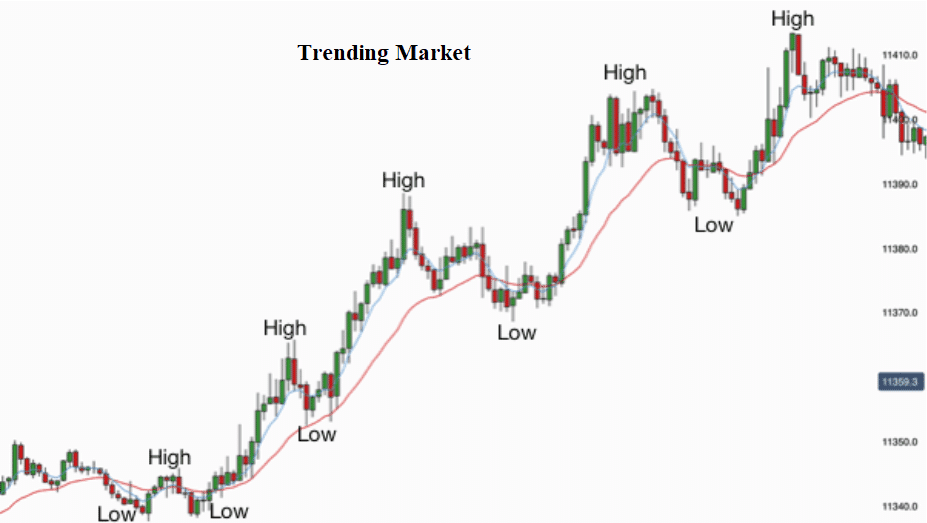

c. Trend Following: Riding the Profitable Wave

Trend-following strategies involve identifying and capitalizing on sustained price trends. Utilize moving averages, trendlines, and momentum indicators to confirm trends before entering positions.

Risk Management and Psychology

i. Effective Risk Management

Mitigate potential losses by setting stop-loss and take-profit orders. Never risk more than a small portion of your trading capital on a single trade. Diversify your portfolio and avoid overleveraging.

ii. Mastering Trading Psychology

Maintaining discipline and emotional control is vital. Keep your emotions in check, avoid impulsive decisions, and stick to your trading plan. Acknowledge that losses are part of trading and learn from them.

Technical and Fundamental Analysis

a. Technical Analysis Tools

Utilize candlestick patterns, support and resistance levels, and oscillators to analyze price charts. Combine multiple indicators to confirm signals and reduce the risk of false positives.

b. Fundamental Analysis Insights

Stay informed about macroeconomic indicators, geopolitical events, and oil-specific news. Understand how these factors impact oil prices and use this knowledge to fine-tune your trading strategies.

Real-Life Examples

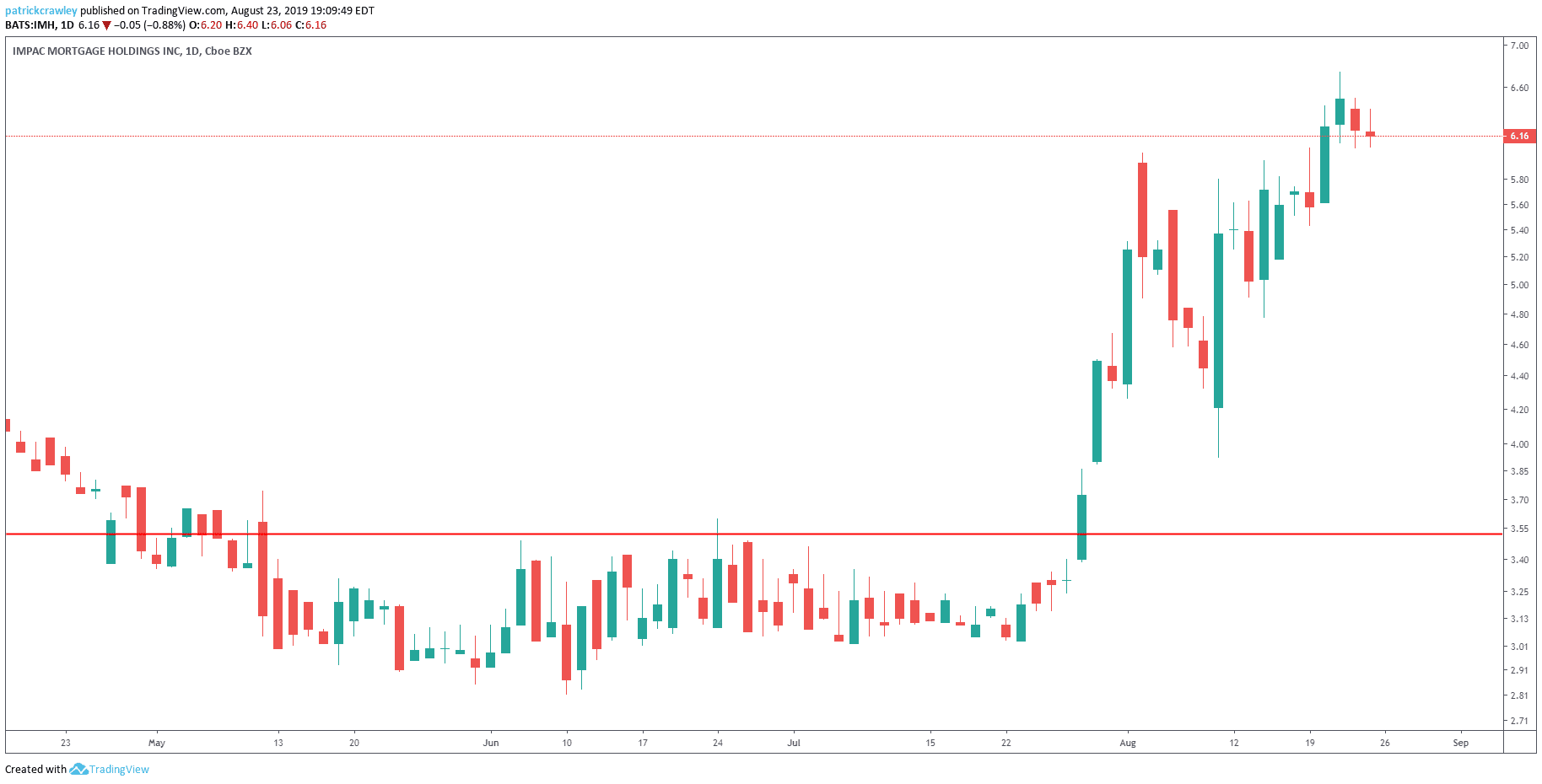

I. Case Study: USO/USD Short-Term Breakout

Explore a real-life scenario where a short-term breakout strategy resulted in profitable oil trading. Analyze the factors that contributed to the breakout and how to identify similar opportunities.

Advanced Techniques for Oil Trading

a. Scalping: Quick Profits, Quick Exits

Scalping involves making rapid trades to profit from small price movements. Monitor short-term charts, leverage tight spreads, and react swiftly to market shifts.

b. Hedging Strategies

Learn how to use hedging techniques to minimize risk exposure. Offset potential losses in one position with gains in another, reducing overall risk in your trading portfolio.

Footnote

Mastering Forex trading strategies for oil requires a blend of technical expertise, fundamental awareness, risk management skills, and emotional resilience. By combining these elements, you'll be better equipped to navigate the ever-changing landscape of oil trading. Remember, success in trading doesn't come overnight. It's a journey of continuous learning and adaptation.

FAQs (Frequently Asked Questions)

Q1: Can I trade oil using any Forex trading platform?

A: Absolutely. Most reputable Forex platforms offer oil trading options, allowing you to trade USO/USD or UKO/USD pairs.

Q2: What's the recommended starting capital for oil trading?

A: Your starting capital should align with your risk tolerance. It's wise to start with an amount you can afford to lose while adhering to proper risk management.

Q3: Are the strategies mentioned suitable for beginners?

A: Yes, we've covered strategies suitable for traders of all levels. However, beginners should focus on mastering a few techniques before branching out.

Q4: How do I stay updated with oil-related news?

A: Follow reputable financial news sources, subscribe to market analysis platforms, and utilize economic calendars to stay informed.

Q5: Is trading psychology truly important?

A: Absolutely. Emotional control and discipline play a significant role in maintaining a successful trading career.

Discussion