Forex Trading Strategies for News Breakouts: Approaches for Trading on Major News Event Outcomes

The world of forex trading is a dynamic landscape that thrives on information and events. One of the most impactful drivers of price movements in the forex market is major news events. Traders who are well-versed in trading on news breakouts have a unique opportunity to capitalize on significant market shifts that can occur as a result of these events. In this article, we will delve into the strategies for trading on major news event outcomes, exploring various approaches that traders can employ to navigate this high-stakes arena.

Understanding the Impact of News Events

Before delving into trading strategies, it's crucial to understand why news events have such a profound impact on the forex market. News events, especially those that pertain to economic indicators, monetary policy decisions, geopolitical developments, and other macroeconomic factors, have the power to alter market sentiment in an instant.

For instance, the release of non-farm payrolls data in the United States can lead to significant fluctuations in currency pairs involving the US dollar. Similarly, central bank decisions on interest rates can create waves in the forex market, as they reflect a country's economic health and growth prospects.

Approaches to Trading News Breakouts

Trading news breakouts involves taking advantage of sudden and sharp price movements that occur when major news events are announced. Here are several approaches traders can consider when navigating this terrain:

1. Straddle Strategy:

The straddle strategy involves placing both a buy (long) and a sell (short) order simultaneously on the same currency pair just before a major news event. This strategy anticipates a substantial market move and aims to profit regardless of the direction of the breakout. Traders using this strategy should set stop-loss and take-profit levels to manage risk and capture gains.

2. Directional Bias Strategy:

Traders employing this strategy form a directional bias based on their analysis of the news event's potential impact. If they anticipate positive outcomes, they may go long on a currency pair, and if they expect negative outcomes, they may go short. This strategy requires a deep understanding of the news event and its potential implications for the market.

3. Volatility Breakout Strategy:

Volatility breakout strategies involve waiting for a major news event to create a surge in market volatility. Traders set entry orders above and below the current price, anticipating that the increased volatility will trigger one of the orders as the price breaks out of its current range.

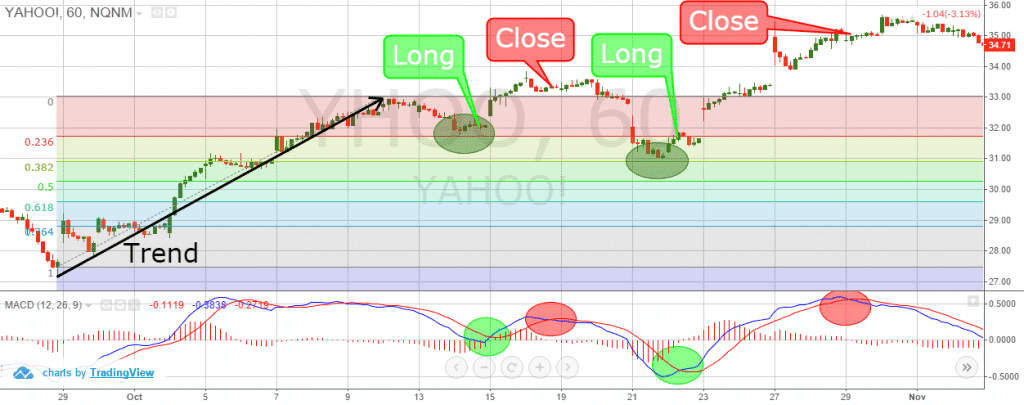

4. Post-Event Confirmation Strategy:

Instead of trying to predict the market's initial reaction, traders employing this strategy wait for the initial market move following a news event and then enter a trade once the direction is confirmed. This approach seeks to avoid the initial volatility and "whipsaw" effect that can occur immediately after a news release.

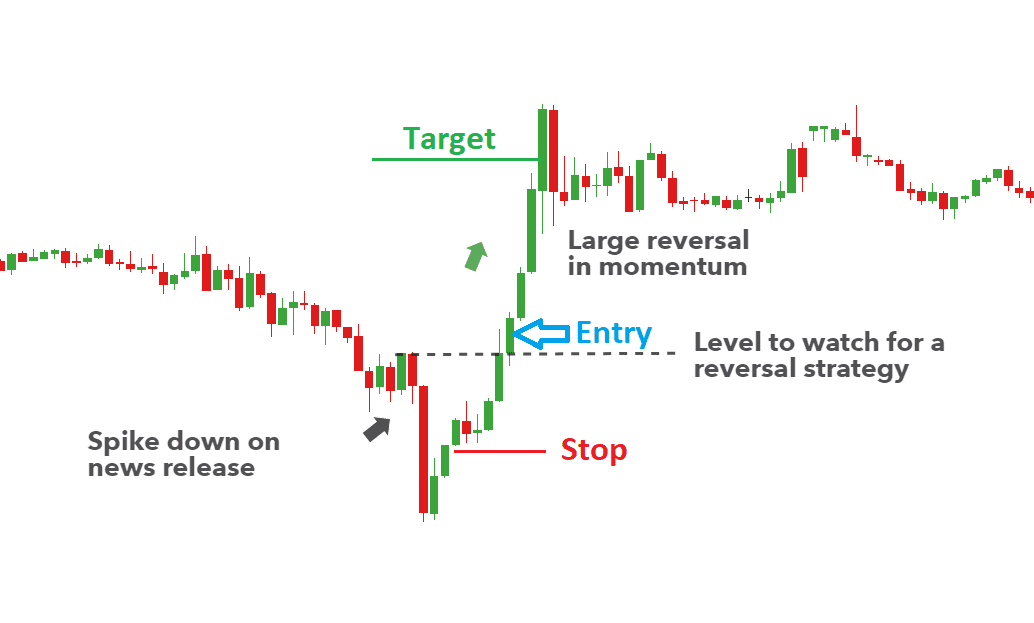

5. Retracement Strategy:

The retracement strategy involves waiting for the initial knee-jerk reaction to a news event to subside and then entering a trade in the opposite direction of the initial move. This strategy relies on the belief that the market's initial reaction is often an overreaction and that prices will eventually revert to more reasonable levels.

Key Considerations and Risk Management

While trading news breakouts can be lucrative, it's important to recognize that it comes with inherent risks due to the market's inherent volatility during these events. Here are some key considerations and risk management strategies to keep in mind:

1. Stay Informed:

Traders need to be well-informed about upcoming news events, their expected impact, and the consensus market forecasts. Economic calendars and news platforms can help traders stay updated on the latest developments.

2. Use Stop-Loss and Take-Profit Orders:

Setting appropriate stop-loss and take-profit orders is crucial to manage risk. Since news events can lead to rapid price swings, having these orders in place helps limit potential losses and secure gains.

3. Manage Position Sizes:

Given the heightened volatility during news events, it's wise to reduce position sizes to prevent overexposure. Smaller positions can help mitigate potential losses in case of adverse market moves.

4. Practice on Demo Accounts:

Before implementing news breakout strategies in live trading, it's advisable to practice on demo accounts. This allows traders to familiarize themselves with the strategy, refine their approach, and understand how the strategy behaves in different market conditions.

5. Diversification:

Traders should diversify their portfolio by using a combination of trading strategies. Relying solely on news breakout strategies can expose traders to undue risks.

6. Avoid Emotional Trading:

News events can trigger intense emotions, especially during high volatility. It's important to stick to the trading plan and avoid making impulsive decisions based on emotional reactions.

Case Study: The Brexit Referendum

A notable example of how news events can impact the forex market is the Brexit referendum in June 2016. The decision of whether the United Kingdom would remain in the European Union or leave had profound implications for the British pound (GBP) and euro (EUR) currency pairs.

As the referendum results were announced, the GBP/USD and EUR/GBP pairs experienced extreme volatility. Traders who anticipated the outcome and had appropriate strategies in place were able to capitalize on the significant price movements. However, those who failed to manage their risk effectively or were caught off guard faced substantial losses.

Footnote

Trading on news breakouts is a high-stakes endeavor that demands a comprehensive understanding of the market, the news events, and the associated risks. The strategies discussed in this article provide traders with various approaches to navigate the complex terrain of trading during major news events. From the straddle strategy that hedges bets on both sides of the market to the post-event confirmation strategy that waits for market direction to be established, each approach has its own merits and challenges.

To succeed in trading news breakouts, traders must remain disciplined, well-informed, and adaptable. This involves staying abreast of upcoming news events, employing effective risk management techniques, and maintaining a clear-headed approach in the face of market volatility. While news events can create significant opportunities, they also come with heightened risks, making it imperative for traders to approach this strategy with caution and diligence.

Discussion