Forex Trading Strategies for Major Stock Indices: Approaches for Trading Index CFDs like S&P 500 and Dow Jones

Welcome to an insightful guide on Forex trading strategies for major stock indices, focusing on approaches for trading index CFDs such as S&P 500 and Dow Jones. If you're an aspiring trader looking to navigate the world of indices, this article is tailored to equip you with comprehensive strategies and insights that can enhance your trading prowess.

Trading index CFDs, particularly on major stock indices like S&P 500 and Dow Jones, demands a deep understanding of market dynamics, trends, and risk management.

Let's delve into various strategies that can help you make informed trading decisions:

1. Long-Term Trend Following Strategy

Utilize this strategy to identify and capitalize on long-term trends in major stock indices. Monitor moving averages, such as the 200-day moving average, to identify the overall trend direction. This strategy involves holding positions for extended periods, aligning with the predominant trend direction.

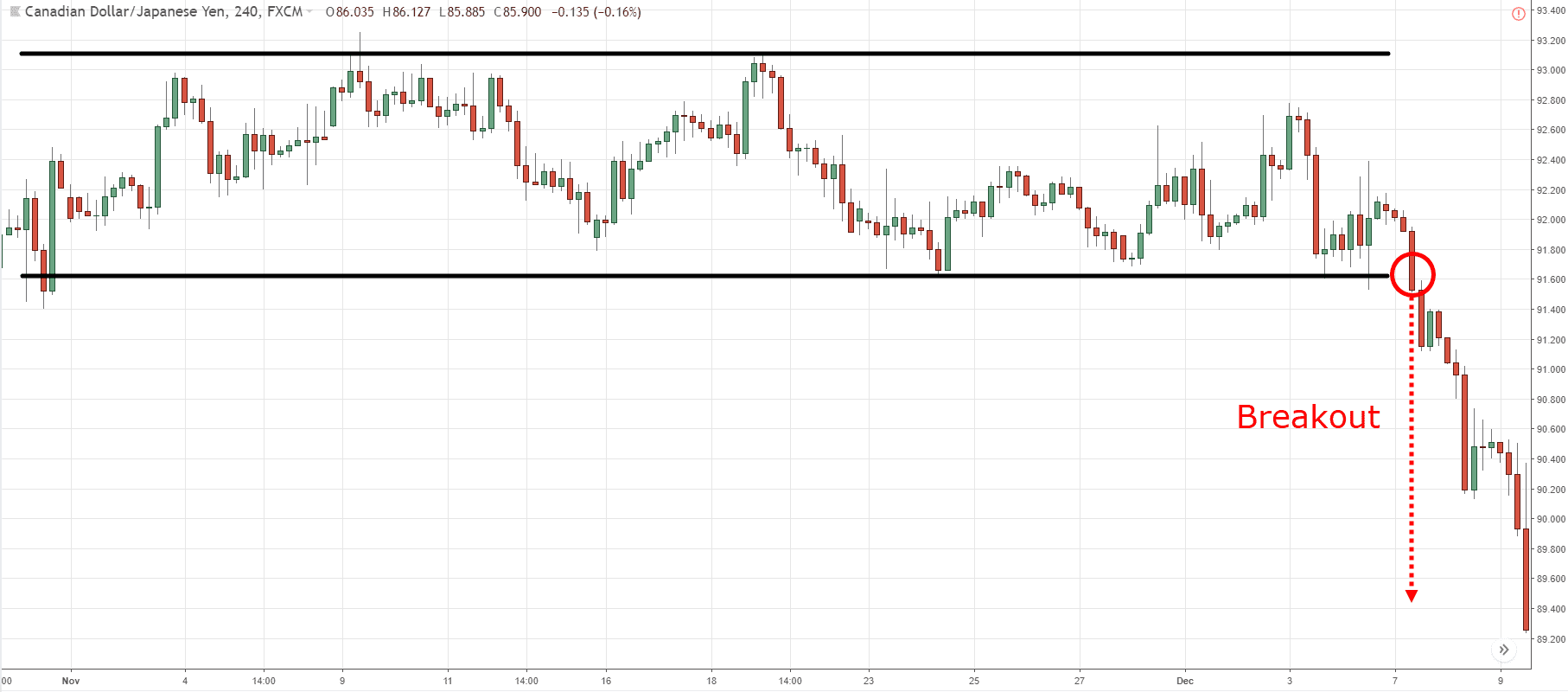

2. Breakout Trading Strategy

With this strategy, you aim to catch price movements after a period of consolidation. Look for chart patterns like triangles or rectangles, which indicate potential breakouts. When the price breaks above resistance or below support levels, it could signal a strong move in the respective direction.

3. Mean Reversion Strategy

This strategy capitalizes on the idea that prices tend to revert to their historical averages. Identify overbought or oversold conditions using indicators like RSI (Relative Strength Index). When the index deviates significantly from its average, there's a potential trading opportunity as it might return to its mean value.

4. News-Based Trading Strategy

Stay updated with economic releases and major news events that can impact stock indices. Positive or negative news can cause rapid price movements. Prepare for volatility by placing stop-loss orders and consider trading during high-impact news releases.

5. Diversification Strategy

Reduce risk by diversifying your portfolio across different sectors represented in the index. This approach can help mitigate losses from a decline in a specific sector. ETFs (Exchange-Traded Funds) can be a useful tool for diversification.

6. Technical Analysis Strategy

Employ technical indicators like Moving Averages, MACD (Moving Average Convergence Divergence), and Fibonacci retracements to analyze historical price data. Combine multiple indicators for a holistic view of market trends.

7. Fundamental Analysis Strategy

Conduct thorough research on the underlying components of the index. Analyze economic indicators, earnings reports, and geopolitical factors that could impact the index's performance.

8. Risk Management Strategy

Implement strict risk management practices to protect your capital. Use tools like stop-loss and take-profit orders to minimize potential losses and secure profits.

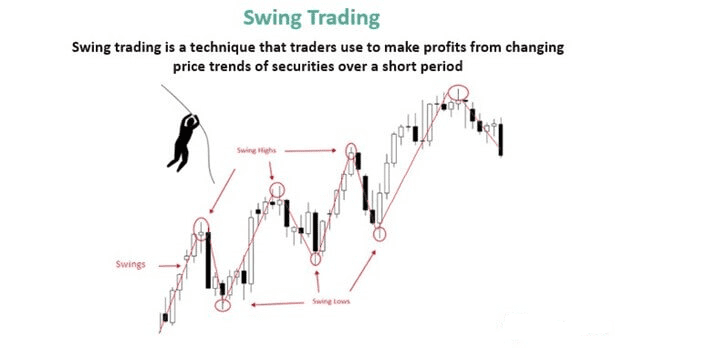

9. Swing Trading Strategy

This strategy involves capitalizing on short- to medium-term price swings within the overall trend. Identify points of entry and exit using technical analysis and set specific targets for each trade.

10. Options Trading Strategy

Explore options contracts to benefit from both rising and falling markets. Strategies like straddles and strangles can help you profit from volatility.

11. Contrarian Trading Strategy

Contrarian traders go against prevailing market sentiment. This strategy involves identifying points of extreme optimism or pessimism and taking positions opposite to the consensus.

12. Index Fund Investing Strategy

Consider investing in index funds for a long-term approach. Index funds aim to replicate the performance of a specific index, providing diversification and a hands-off investment approach.

13. Seasonal Trading Strategy

Analyze historical seasonal patterns in index performance. Some indices tend to perform consistently well or poorly during certain months of the year.

14. Pair Trading Strategy

Pair trading involves simultaneously trading two correlated stocks or indices. This strategy aims to profit from the relative performance between the two, regardless of the overall market direction.

15. Pyramiding Strategy

Gradually increase your position size as a trade moves in your favor. Pyramiding allows you to maximize profits during strong trends while managing risk.

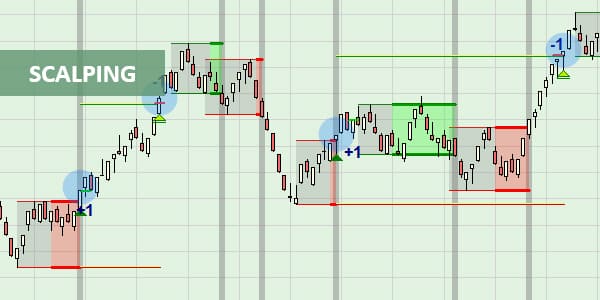

16. Scalping Strategy

Scalpers aim to profit from small price movements within a short time frame. This strategy requires quick decision-making and execution.

17. High-Frequency Trading Strategy

Utilize advanced algorithms and technology to execute numerous trades within seconds. This strategy requires specialized knowledge and equipment.

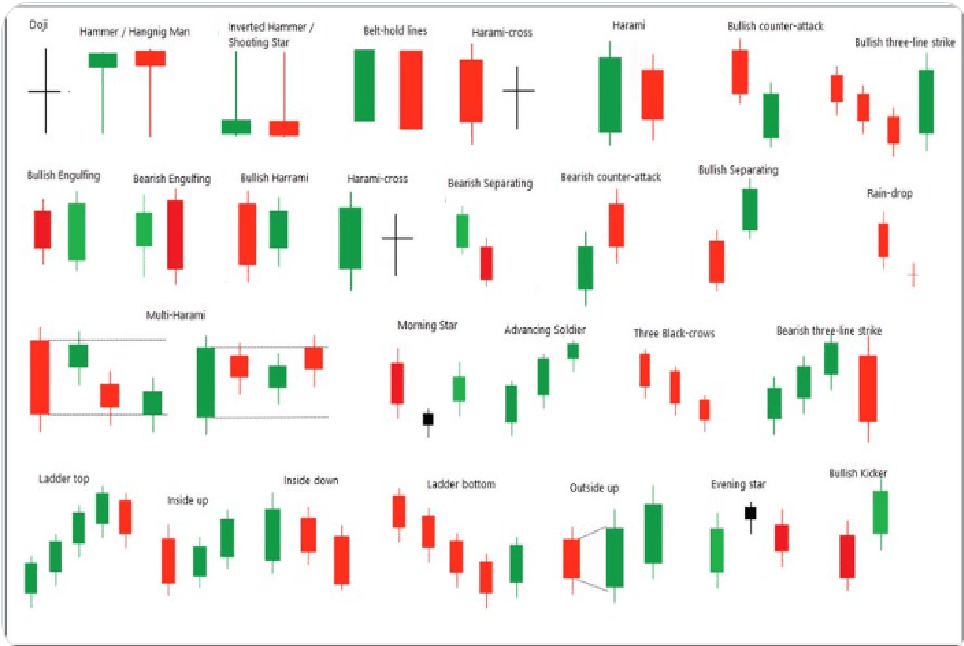

18. Candlestick Patterns Strategy

Master the art of reading candlestick patterns to predict potential price movements. Patterns like doji, engulfing, and hammer can signal reversals or continuations.

19. Momentum Trading Strategy

Trade based on the momentum of the index's price movements. Momentum traders believe that trends are likely to continue in the same direction.

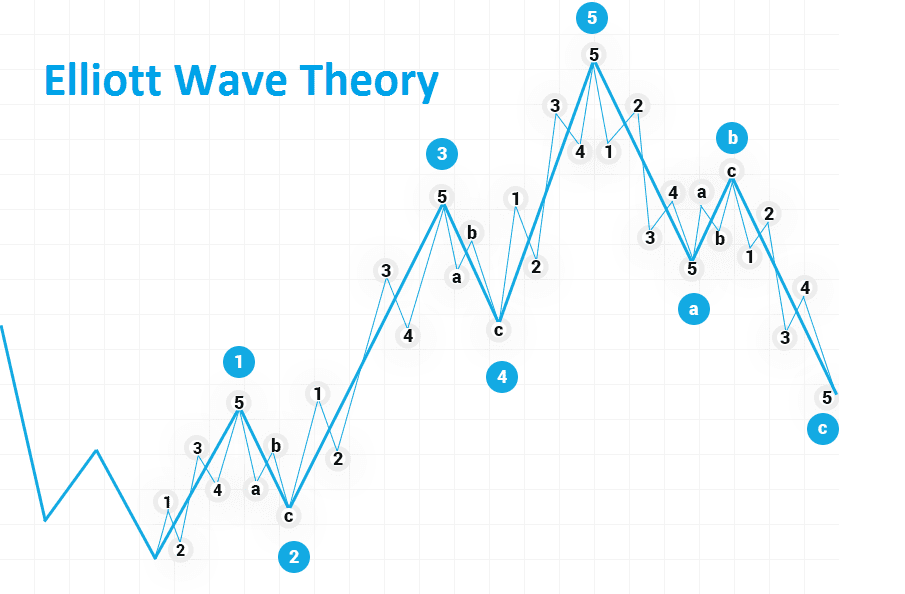

20. Elliott Wave Theory Strategy

Explore the Elliott Wave Theory to analyze price patterns and predict market trends. This theory suggests that markets move in repeating wave patterns.

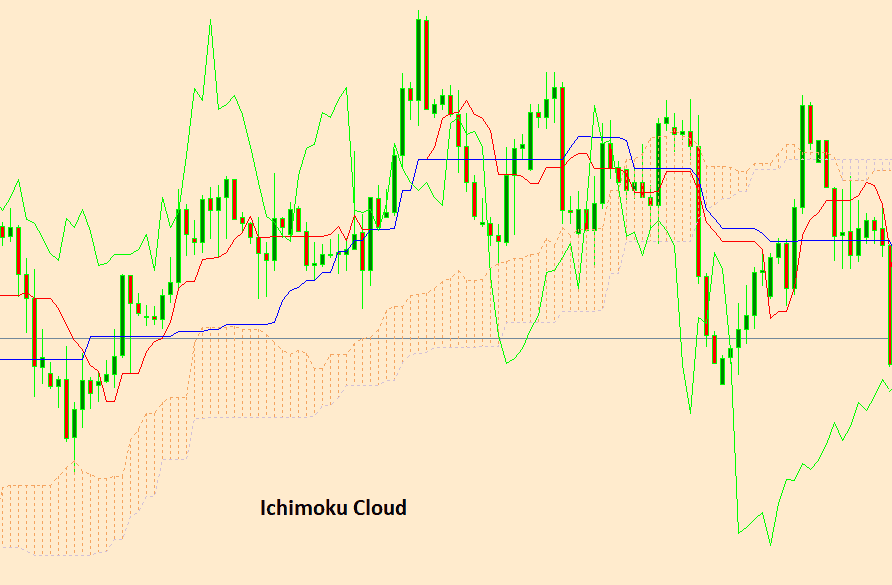

21. Ichimoku Cloud Strategy

Utilize the Ichimoku Cloud indicator to gauge trends, support and resistance levels, and potential entry and exit points.

22. Trading Psychology Strategy

Develop emotional resilience and discipline in trading. Emotional intelligence is crucial to manage losses and avoid impulsive decisions.

23. Algorithmic Trading Strategy

Create or use pre-programmed algorithms to automate trading decisions. Algorithmic trading can execute trades at a faster pace than manual trading.

24. Risk-Reward Ratio Strategy

Maintain a favorable risk-reward ratio for each trade. This strategy ensures that potential profits outweigh potential losses.

25. Trend Confirmation Strategy

Confirm trends using multiple indicators and technical analysis tools. When different indicators align, it strengthens your trading signal.

Incorporating these strategies into your trading approach can significantly enhance your success when trading index CFDs like S&P 500 and Dow Jones. Remember that no strategy guarantees success, and it's essential to adapt your approach based on market conditions and your risk tolerance.

FAQs

Q: What are CFDs?

A: CFDs (Contracts for Difference) are derivative instruments that allow traders to speculate on price movements without owning the underlying asset.

Q: How do I choose the right strategy?

A: The right strategy depends on your trading goals, risk tolerance, and market analysis. Experiment with different strategies to find what suits you.

Q: Can I trade indices with a small account?

A: Yes, many brokers offer mini contracts or micro contracts that allow traders with smaller accounts to participate in index trading.

Q: Is leverage advisable for index CFDs?

A: Leverage can amplify both gains and losses. Use it cautiously and consider your risk management strategy.

Q: Are these strategies suitable for beginners?

A: Some strategies are more complex and may be better suited for experienced traders. Beginners should start with simpler strategies and gradually advance.

Q: Where can I access reliable market news?

A: Reputable financial news websites like Bloomberg, CNBC, and Reuters offer reliable market news and analysis.

Footnote

In summary, trading index CFDs on major stock indices like S&P 500 and Dow Jones requires a blend of knowledge, skill, and adaptability. By incorporating a diverse range of strategies and staying informed about market trends, you can navigate the complex world of trading indices successfully.

Discussion