Forex Trading Strategies for Interest Rate Decisions: Approaches for Trading During Central Bank Interest Rate Announcements

Forex trading is a dynamic and ever-evolving market that requires traders to stay informed and adapt their strategies to various economic indicators and events. One of the most significant events that impact currency values is central bank interest rate decisions. In this article, we delve into the strategies and approaches that traders can employ to navigate the volatile waters of the forex market during central bank interest rate announcements. We'll explore the significance of interest rates, analyze different trading strategies, and provide valuable insights to help traders make informed decisions.

Table of Contents:

- Introduction

- Understanding Interest Rates and Their Impact on Forex

- Preparing for Central Bank Interest Rate Announcements

- Forex Trading Strategies for Interest Rate Decisions

- Case Studies: Real-Life Examples

- Risk Management During Interest Rate Announcements

- Psychological Considerations and Emotional Discipline

- Conclusion

Introduction:

Forex trading is a complex endeavor that involves understanding economic indicators, geopolitical events, and market sentiment. One of the key factors that can significantly influence currency values is central bank interest rate decisions. These decisions not only affect the domestic economy but also have a global impact on financial markets. Successful traders are those who can anticipate and react to these announcements with well-defined strategies.

Understanding Interest Rates and Their Impact on Forex:

Interest rates play a crucial role in shaping a country's economic landscape. Central banks use interest rates to control inflation, encourage borrowing, and stimulate economic growth. When central banks make changes to interest rates, they can influence the value of their currency. Higher interest rates generally attract foreign capital, leading to an appreciation in the currency's value, while lower interest rates can lead to depreciation.

Preparing for Central Bank Interest Rate Announcements:

Before trading during central bank interest rate announcements, it's essential to be thoroughly prepared. This involves tracking economic calendars, conducting fundamental analysis, and implementing risk management strategies to mitigate potential losses.

Forex Trading Strategies for Interest Rate Decisions:

- The Breakout Strategy: This strategy involves placing buy or sell orders just above or below significant technical levels. Traders anticipate that a sharp price movement will occur once the central bank announcement is made.

- The Fade Strategy: Contrarian traders use the fade strategy, where they bet against the initial market reaction to the interest rate decision. This strategy assumes that market participants often overreact to the news and that prices will revert to their original levels.

- The Carry Trade Strategy: This strategy focuses on profiting from interest rate differentials between two currencies. Traders buy the currency with the higher interest rate and sell the currency with the lower interest rate, aiming to profit from the interest rate spread.

- The Fundamental Analysis Strategy: Traders who engage in fundamental analysis study the central bank's statement, press conference, and economic projections to gauge the future direction of the currency. This approach requires a deep understanding of economic fundamentals and policy implications.

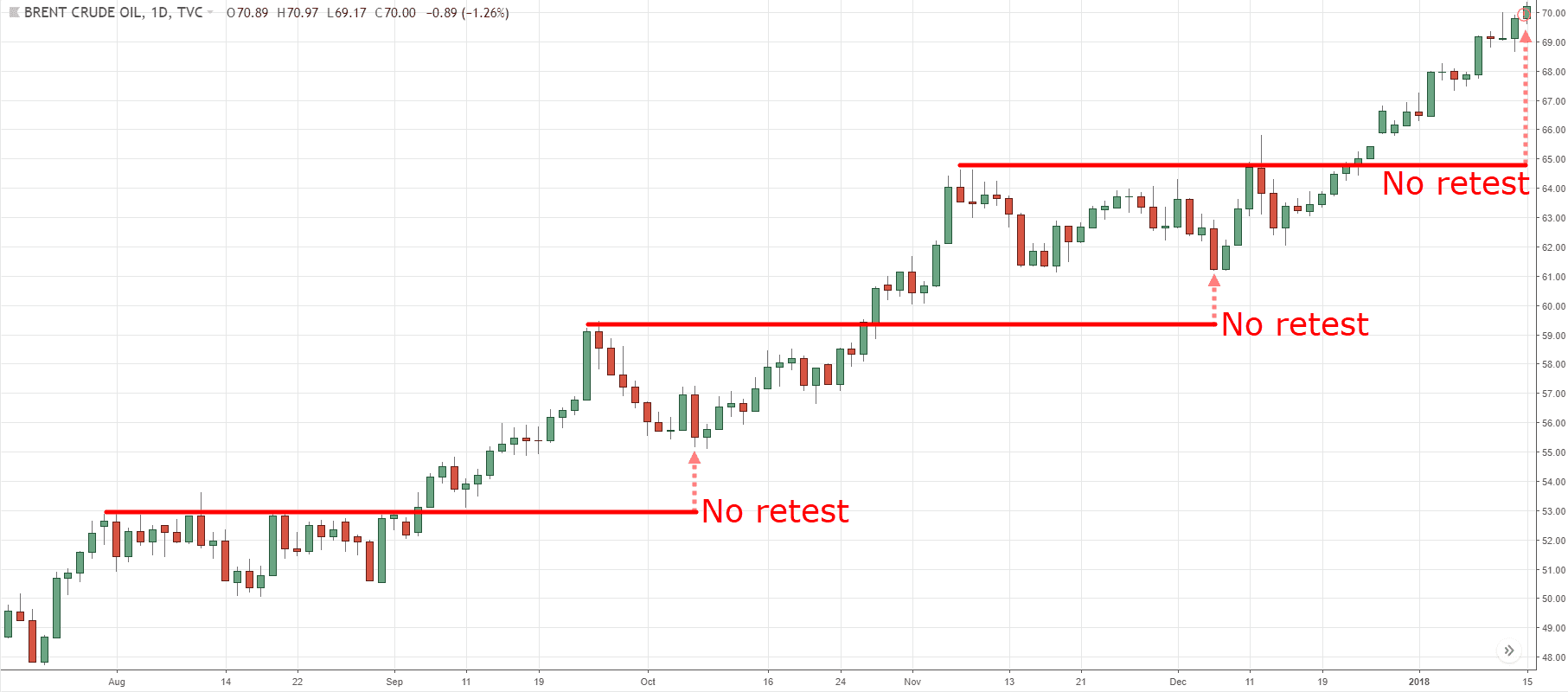

Case Studies: Real-Life Examples:

Examining real-life examples of interest rate decisions and their impact on forex markets can provide valuable insights into how these strategies play out in practice. Case studies help traders understand the dynamics of market reactions and adjust their strategies accordingly.

Risk Management During Interest Rate Announcements:

Trading during central bank interest rate announcements comes with heightened volatility and potential risk. Implementing effective risk management strategies, such as setting stop-loss orders, limiting position sizes, and avoiding overleveraging, is essential to protect capital.

Psychological Considerations and Emotional Discipline:

The forex market's rapid fluctuations during interest rate announcements can evoke strong emotions in traders. Maintaining emotional discipline, adhering to trading plans, and avoiding impulsive decisions are crucial for long-term success.

Footnote:

Forex trading during central bank interest rate announcements requires a blend of technical expertise, fundamental analysis, and emotional control. While it presents opportunities for substantial gains, it also comes with inherent risks. By understanding the impact of interest rates on currency values, adopting well-defined trading strategies, and practicing prudent risk management, traders can navigate this volatile terrain with greater confidence and potentially achieve success in the forex market.

In summary, the world of forex trading is intricate and challenging, but it offers significant opportunities for those who can adapt and make informed decisions during critical events like central bank interest rate announcements. By mastering the strategies discussed in this article and keeping a keen eye on market developments, traders can position themselves for success in the dynamic realm of forex trading.

Discussion