Forex Trading Strategies for Gold: Mastering Techniques for Trading the Precious Metal (XAU/USD)

Gold has been captivating the human imagination for centuries. Its lustrous shine and inherent value have made it an attractive investment option. If you're keen on exploring the realm of Forex trading strategies for gold, also known as XAU/USD, you're in the right place. In this guide, we'll walk through a variety of techniques to help you navigate this precious metal's market effectively.

Table of Contents

- Understanding Gold Trading Basics

- Factors Influencing Gold Prices

- Technical Analysis: A Key Tool for XAU/USD Trading

- Fundamental Analysis: Unveiling Market Trends

- Top Forex Trading Strategies for Gold

- Risk Management: Safeguarding Your Investments

- Psychology of Gold Trading: Mastering Your Mindset

- Combining Strategies for Optimal Results

- Demo Trading: Practice Without Risks

- Live Trading: Real Profits, Real Challenges

- Keeping Up With Global Events: Geopolitical Impacts on Gold

- Diversification: Balancing Your Portfolio

- Long-Term vs. Short-Term Gold Trading

- Golden Nuggets: Expert Tips for Successful XAU/USD Trading

Understanding Gold Trading Basics

Gold, often referred to as "the ultimate store of value," holds a special place in the financial world. Its scarcity and universal acceptance make it a popular choice among traders and investors alike. The XAU/USD currency pair allows you to speculate on the price movements of gold against the US dollar.

Factors Influencing Gold Prices

The price of gold is influenced by a multitude of factors. Geopolitical tensions, economic indicators, and market sentiment can cause significant fluctuations. It's essential to keep an eye on these aspects to make informed trading decisions.

Technical Analysis: A Key Tool for XAU/USD Trading

Technical analysis involves studying historical price charts and patterns to predict future movements. Chart patterns, trend lines, and indicators can provide valuable insights into potential price directions.

Fundamental Analysis: Unveiling Market Trends

Fundamental analysis delves into the economic, social, and political factors affecting gold prices. Understanding supply and demand dynamics, interest rates, and inflation can give you a competitive edge.

Top Forex Trading Strategies for Gold

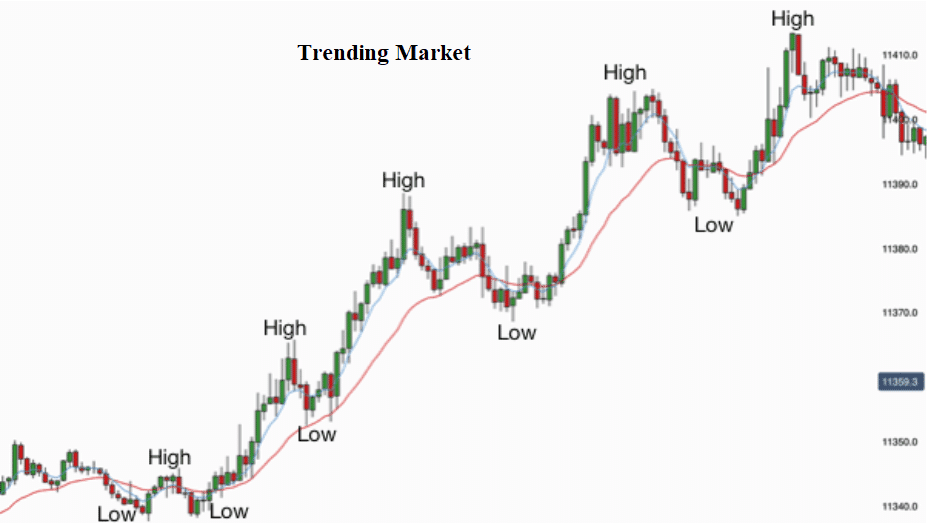

5.1 Trend Following Strategy

This strategy involves identifying and following the prevailing trend. Riding the trend wave can lead to substantial profits.

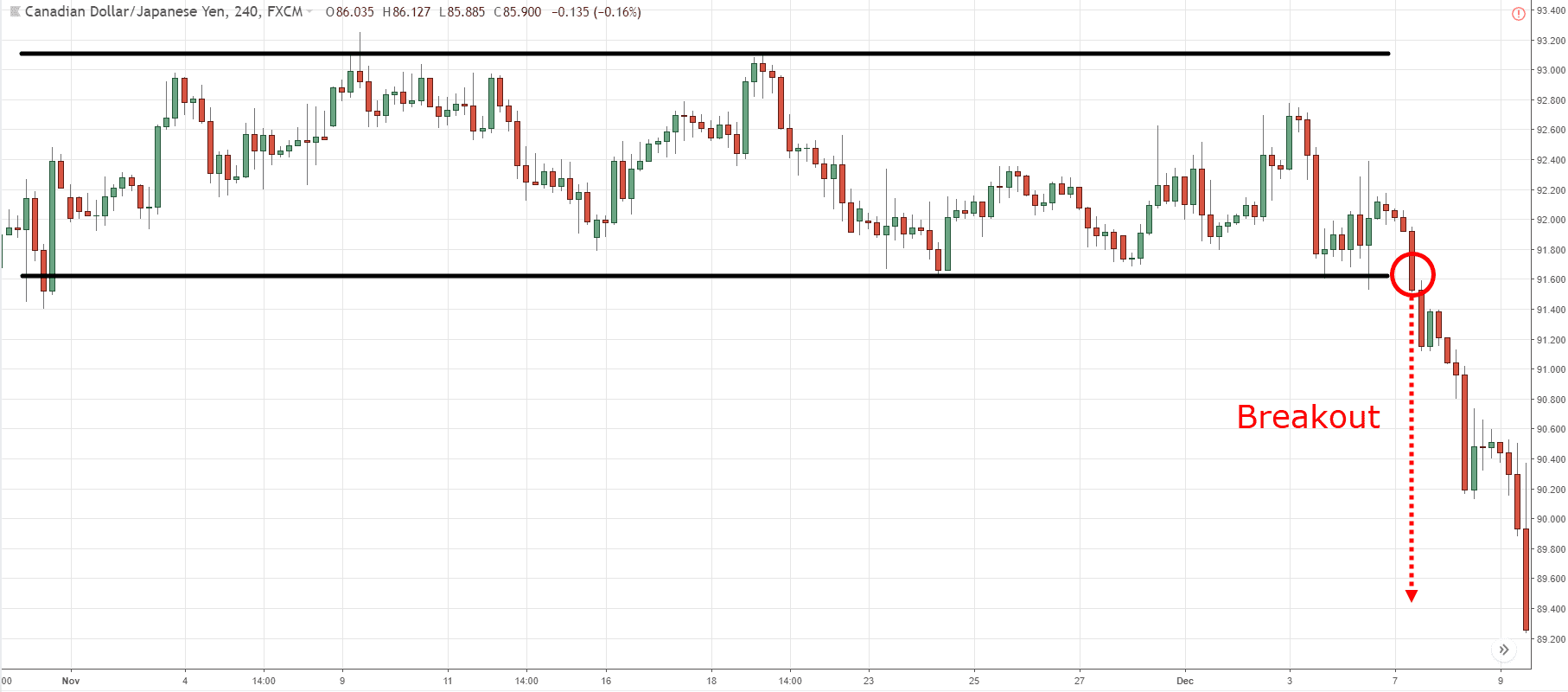

5.2 Breakout Strategy

Breakouts occur when the price breaches a significant support or resistance level. Jumping on these breakouts can result in lucrative trades.

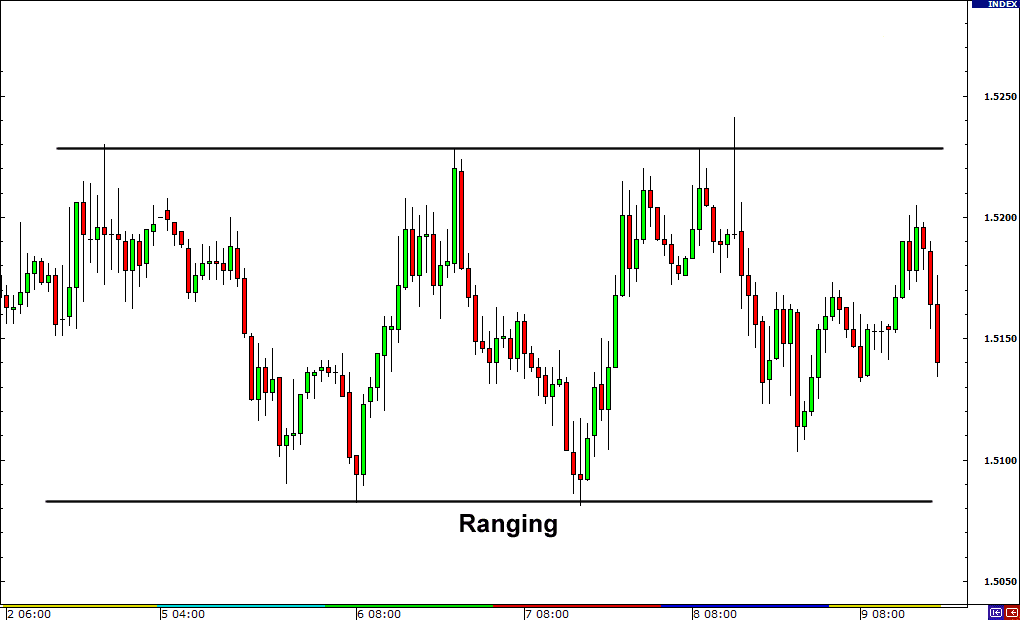

5.3 Range-Bound Strategy

In a range-bound market, gold's price moves within a defined range. Buying near support and selling near resistance can be profitable in such scenarios.

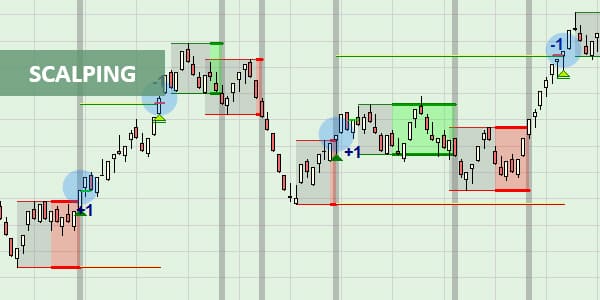

5.4 Scalping Strategy

Scalping involves making quick trades to capture small price movements. It requires swift decision-making and a keen eye on market fluctuations.

5.5 Carry Trade Strategy

This strategy capitalizes on the interest rate differential between two currencies. Holding a higher-yielding currency while shorting a lower-yielding one can generate profits.

Risk Management: Safeguarding Your Investments

Successful traders prioritize risk management. Set stop-loss and take-profit levels to prevent significant losses and secure your gains.

Psychology of Gold Trading: Mastering Your Mindset

Trading psychology plays a vital role. Emotions can cloud judgment. Maintain discipline, manage greed, and handle losses gracefully.

Combining Strategies for Optimal Results

There's no one-size-fits-all approach. Combining multiple strategies based on market conditions can enhance your success rate.

Demo Trading: Practice Without Risks

Before diving into live trading, practice on demo accounts. This helps you understand strategies and gain confidence without risking real money.

Live Trading: Real Profits, Real Challenges

Transitioning to live trading introduces real emotions. Start with a small investment and gradually increase your stake as you gain experience.

Keeping Up With Global Events: Geopolitical Impacts on Gold

Geopolitical events can send shockwaves through the gold market. Stay informed about global news to anticipate potential price movements.

Diversification: Balancing Your Portfolio

Don't put all your eggs in one basket. Diversify your investment portfolio to manage risk effectively.

Long-Term vs. Short-Term Gold Trading

Decide whether you're a long-term investor or a short-term trader. Your strategy will depend on your goals, risk tolerance, and time commitment.

Golden Nuggets: Expert Tips for Successful XAU/USD Trading

- Stay updated on economic calendars.

- Keep emotions in check.

- Practice patience and discipline.

- Adapt to changing market conditions.

- Continuously educate yourself.

Footnote

Navigating the world of Forex trading for gold requires a blend of knowledge, strategy, and a touch of intuition. By mastering various techniques and staying attuned to market trends, you can increase your odds of successful XAU/USD trading. Remember, it's a journey that requires continuous learning and adaptation.

FAQs (Frequently Asked Questions)

Q1: Is gold trading profitable for beginners?

A: Absolutely! With proper education, practice, and the right strategies, beginners can profit from gold trading.

Q2: How much capital do I need to start trading gold?

A: The capital needed depends on your risk tolerance and chosen trading strategy. Start small and scale up gradually.

Q3: Can I trade gold during major economic events?

A: Yes, but it's crucial to be cautious. Economic events can lead to high volatility, which can be both an opportunity and a risk.

Q4: Are technical indicators alone sufficient for successful gold trading?

A: While technical indicators are valuable, a holistic approach that considers both technical and fundamental analysis tends to yield better results.

Q5: What's the best way to stay updated on gold market news?

A: Follow reputable financial news platforms, subscribe to economic calendars, and engage in online trading communities.

Discussion