Forex Trading Strategies for Currency Correlation: Techniques for Considering Currency Correlations in Trading Decisions

Currency correlation plays a crucial role in the world of forex trading. Understanding and leveraging currency correlations can significantly enhance a trader's decision-making process, leading to more informed and strategic trading moves. This article explores various forex trading strategies that revolve around currency correlation analysis, offering insights into how traders can effectively consider these correlations to make informed trading decisions.

Table of Contents:

- Introduction

- Understanding Currency Correlation

- Why Currency Correlations Matter in Forex Trading

- Forex Trading Strategies Based on Currency Correlations

- Implementing Currency Correlation Strategies: Best Practices

- FAQs about Currency Correlation in Forex Trading

- Footnote

Introduction:

Forex trading is a dynamic and complex market, where traders make decisions based on a multitude of factors. One such factor that often remains underutilized is currency correlation. Currency correlation refers to the statistical measure of how two currency pairs move in relation to each other. By understanding and applying currency correlation analysis, traders can gain valuable insights into potential market movements, refine their trading strategies, and optimize risk management.

Understanding Currency Correlation:

Currency correlation is measured on a scale of -1 to 1, indicating a negative, no correlation, or positive correlation respectively. A positive correlation means that two currency pairs tend to move in the same direction, while a negative correlation indicates they move in opposite directions. No correlation suggests that there is little to no relationship between the currency pairs' movements.

Why Currency Correlations Matter in Forex Trading:

Currency correlations matter because they can reveal underlying market dynamics that might not be apparent when looking at individual currency pairs in isolation. Traders can utilize these correlations to identify potential opportunities for diversification, risk management, and improved trade timing.

Forex Trading Strategies Based on Currency Correlations:

Strategy 1: Diversification and Risk Management: Diversification involves trading multiple correlated currency pairs simultaneously to spread risk. By doing so, traders can mitigate the impact of a single unfavorable market movement. This strategy works best when combining currency pairs with varying degrees of correlation to reduce dependency on a single trend.

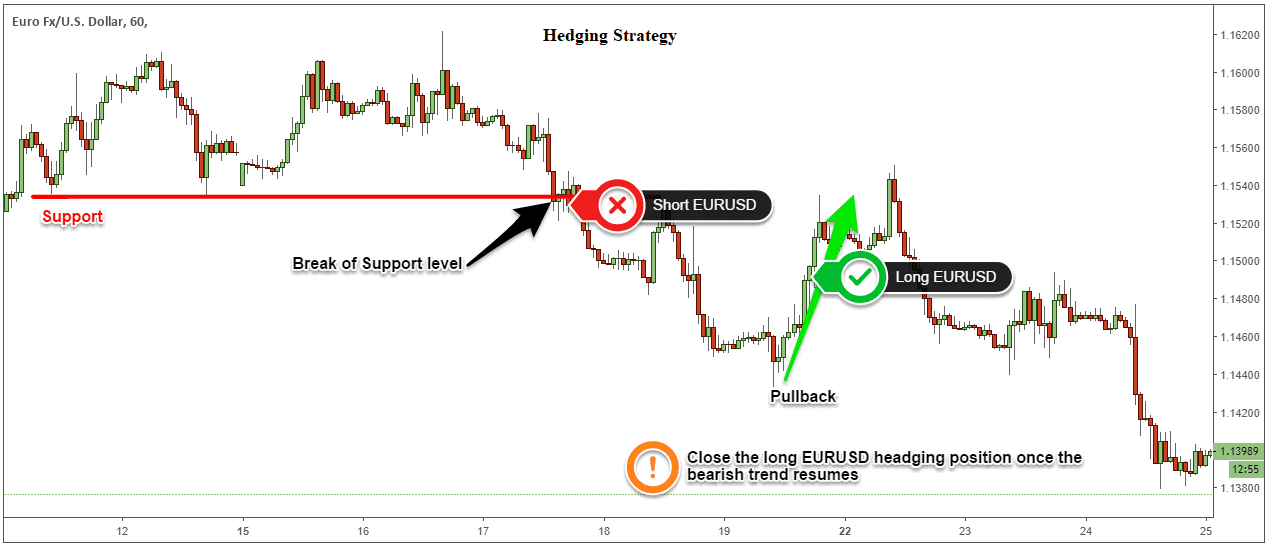

Strategy 2: Hedging: Hedging is a risk management technique where a trader opens positions in two correlated currency pairs, one long and one short. If one position incurs losses, the gains from the other position can offset these losses. However, hedging can be complex and requires careful execution.

Strategy 3: Pair Selection: Currency correlation analysis can help traders select pairs that complement each other's movements. For instance, pairing a highly positively correlated pair with a negatively correlated pair might provide a balanced exposure to market movements.

Strategy 4: Trend Confirmation: Currency correlations can act as a confirmation tool for identifying trends. When two positively correlated pairs are both showing bullish signals, it can lend additional confidence to a trader's decision to enter a long trade.

Implementing Currency Correlation Strategies: Best Practices:

- Stay updated on economic and geopolitical events that can influence currency correlations.

- Utilize correlation coefficients to measure the strength and direction of correlations.

- Avoid over-reliance on correlations, as market conditions can change.

- Combine currency correlation analysis with other technical and fundamental analysis tools.

FAQs about Currency Correlation in Forex Trading:

Q 1: What is currency correlation?

A: Currency correlation measures how two currency pairs move relative to each other. It helps traders understand the relationship between different pairs and their potential impact on trading decisions.

Q 2: How is currency correlation calculated?

A: Currency correlation is calculated using statistical methods to determine the degree of similarity in the price movements of two currency pairs over a specific time period.

Q 3: Can currency correlations change over time?

A: Yes, currency correlations are not fixed and can change due to shifts in economic fundamentals, geopolitical events, or market sentiment.

Q 4: Are there any limitations to relying on currency correlations?

A: While currency correlations provide valuable insights, they are not foolproof indicators. Unexpected market movements or events can lead to temporary breakdowns in correlations.

Q 5: How can beginners effectively incorporate currency correlation into their trading strategies?

A: Beginners can start by studying basic correlation concepts and gradually integrating them into their analysis. It's essential to practice with small positions and gain experience before relying heavily on correlations.

Footnote:

Currency correlation is a powerful tool that can enhance forex trading strategies by offering insights into market dynamics and potential opportunities. Traders who understand and implement currency correlation strategies effectively can make more informed decisions, better manage risks, and potentially achieve greater success in the dynamic world of forex trading.

Discussion