Forex Trading Strategies for Carry Traders: Approaches for Those Using the Carry Trade Strategy

In the world of Forex trading, the carry trade strategy has emerged as a popular approach among traders seeking to capitalize on interest rate differentials between currencies. This article delves into the various approaches and techniques that carry traders can employ to maximize their gains while minimizing risks. If you're aiming to refine your Forex trading strategies for carry trading, read on to gain valuable insights and practical tips.

Table Content

1. Understanding Carry Trading

2. Identifying Strong Currency Pairs

3. Risk Management is Key

4. Staying Abreast of Economic Indicators

5. Leveraging Technical Analysis

6. Diversification Across Assets

7. Monitoring Interest Rate Trends

8. Adapting to Changing Market Conditions

9. Utilizing Carry and Economic Calendars

10. Psychology and Discipline

11. Long-Term vs. Short-Term Carry Trading

12. Monitoring Global Economic Trends

13. Hedging Strategies

14. Frequently Asked Questions (FAQs)

15. Footnote

Understanding Carry Trading

Carry trading involves borrowing funds in a currency with a low-interest rate and investing those funds in a currency with a higher interest rate. The goal is to profit from the interest rate differential between the two currencies while also potentially benefiting from any favorable currency price movements.

Identifying Strong Currency Pairs

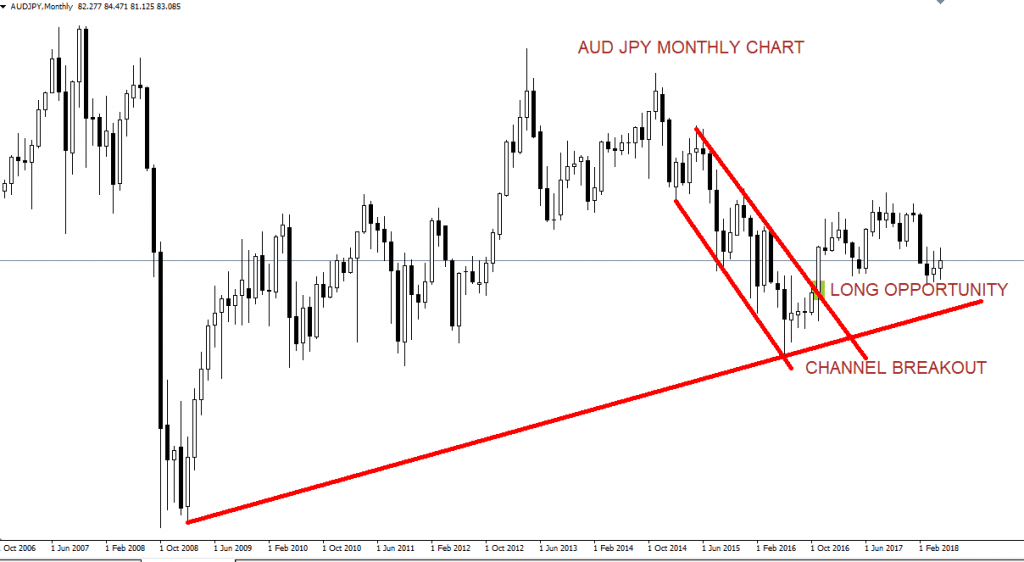

When employing the carry trade strategy, it's essential to choose currency pairs with a substantial interest rate differential. Popular choices often include pairs like AUD/JPY, NZD/JPY, and GBP/JPY. Conduct thorough research to identify currency pairs that align with your trading goals and risk appetite.

Risk Management is Key

Like any trading strategy, carry trading comes with its fair share of risks. Market volatility and unexpected currency fluctuations can impact your trades. Implementing robust risk management techniques, such as setting stop-loss orders and position sizing, is crucial to protect your capital and minimize potential losses.

Staying Abreast of Economic Indicators

Carry traders must remain vigilant about economic indicators and central bank policies. Factors such as interest rate decisions, inflation reports, and GDP growth can significantly influence currency movements. Stay informed about these economic events to make informed trading decisions.

Leveraging Technical Analysis

Integrating technical analysis into your carry trading strategy can provide valuable insights. Tools such as moving averages, trendlines, and oscillators can help you identify potential entry and exit points. Combining technical analysis with your fundamental research can enhance the accuracy of your trading decisions.

Diversification Across Assets

Diversifying your portfolio is a fundamental principle in trading. Applying this concept to carry trading involves spreading your investments across different currency pairs and potentially other asset classes. Diversification helps mitigate the impact of adverse market movements on your overall trading portfolio.

Monitoring Interest Rate Trends

Interest rates play a pivotal role in carry trading. Monitor interest rate trends of the currencies you're trading to anticipate potential shifts in the market sentiment. Positive interest rate differentials can attract carry traders and lead to increased demand for a particular currency.

Adapting to Changing Market Conditions

The Forex market is dynamic and subject to rapid changes. Successful carry traders are those who can adapt their strategies to evolving market conditions. This might involve adjusting your trading frequency, altering position sizes, or even temporarily stepping back during highly uncertain periods.

Utilizing Carry and Economic Calendars

Carry traders can benefit from using carry and economic calendars. These tools provide insights into upcoming events that could impact interest rates and currency values. By staying ahead of these events, you can make more informed decisions and adjust your positions accordingly.

Psychology and Discipline

Maintaining the right psychological mindset and discipline is crucial for any trader, especially carry traders. Emotions can cloud judgment and lead to impulsive decisions. Develop a trading plan, stick to it, and avoid overtrading or chasing losses.

Long-Term vs. Short-Term Carry Trading

Carry trading strategies can vary in duration. Long-term carry traders aim to hold positions for extended periods to capture interest rate differentials and potential currency appreciation. On the other hand, short-term carry traders focus on shorter holding periods, capitalizing on smaller price movements and interest differentials.

Monitoring Global Economic Trends

Global economic trends can impact currency markets and carry trading strategies. Factors like geopolitical events, trade agreements, and commodity prices can influence currency values. Stay informed about these trends to make well-informed trading decisions.

Hedging Strategies

Carry traders can also consider implementing hedging strategies to mitigate potential losses. Hedging involves taking positions that offset the risk of existing trades. While it adds complexity to your strategy, hedging can be valuable in volatile markets.

Frequently Asked Questions (FAQs)

Q: Can beginners effectively use the carry trade strategy?

A: Absolutely. Beginners can start with the carry trade strategy, but it's crucial to invest time in learning about fundamental and technical analysis and risk management.

Q: What is the main risk associated with carry trading?

A: The main risk is currency volatility. Sudden and unexpected currency price movements can lead to losses, especially if positions are not adequately managed.

Q: Do I need a large capital to start carry trading?

A: While having a substantial capital can offer more flexibility, it's possible to start with a smaller capital. Just ensure you're managing your positions carefully.

Q: How frequently should I monitor my carry trades?

A: Regular monitoring is important, but avoid the trap of over-monitoring, as it can lead to impulsive decisions. Set specific times for analysis and adjustments.

Q: Can I use automated trading systems for carry trading?

A: Yes, automated systems can be used, but ensure they're well-tested and aligned with your strategy. Human oversight is still essential.

Q: What's the potential return on investment for carry trading?

A: Returns can vary widely based on market conditions and trading decisions. Some carry traders aim for a few percentage points, while others seek higher returns.

Footnote

Navigating the world of Forex trading using the carry trade strategy requires a combination of expertise, strategy, and disciplined execution. By understanding the nuances of carry trading and employing effective strategies, you can enhance your chances of success in the dynamic currency markets. Remember to stay informed, manage risks, and adapt your approach as market conditions evolve.

Discussion