Forex Trading Strategies for Beginners Without Indicators: Techniques Based on Price Action and Chart Patterns

Welcome to the world of Forex trading! If you're a beginner eager to dive into the world of currency trading without relying on complex indicators, this article is your essential guide. The key to successful Forex trading lies in understanding price action and chart patterns. In this comprehensive guide, we'll walk you through proven strategies that utilize these techniques. So, grab your notebook, and let's explore the exciting realm of Forex trading strategies for beginners without indicators!

Table Content

1. Understanding Price Action and Its Significance

2. The Power of Candlestick Patterns

3. Identifying Support and Resistance Levels

4. Trendline Analysis: Riding the Market Waves

5. Chart Patterns: Triangles, Flags, and Head and Shoulders

6. Risk Management: Preserving Your Capital

7. Embracing Naked Trading: A No-Indicator Approach

8. Building a Price Action Trading Plan

9. Psychology of Trading: Mastering Your Mindset

10. Keeping Up with Market News

11. FAQs

12. Footnote

Understanding Price Action and Its Significance

Price action refers to the movement of a currency pair's price over time. It involves analyzing patterns, trends, and formations on the price chart to predict future price movements. Price action trading empowers traders to make informed decisions based on raw price data, allowing them to react to market dynamics with precision.

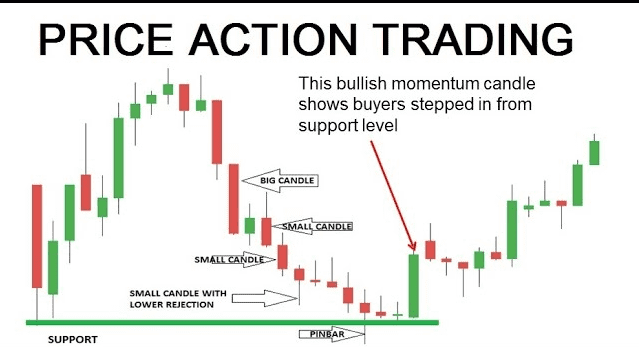

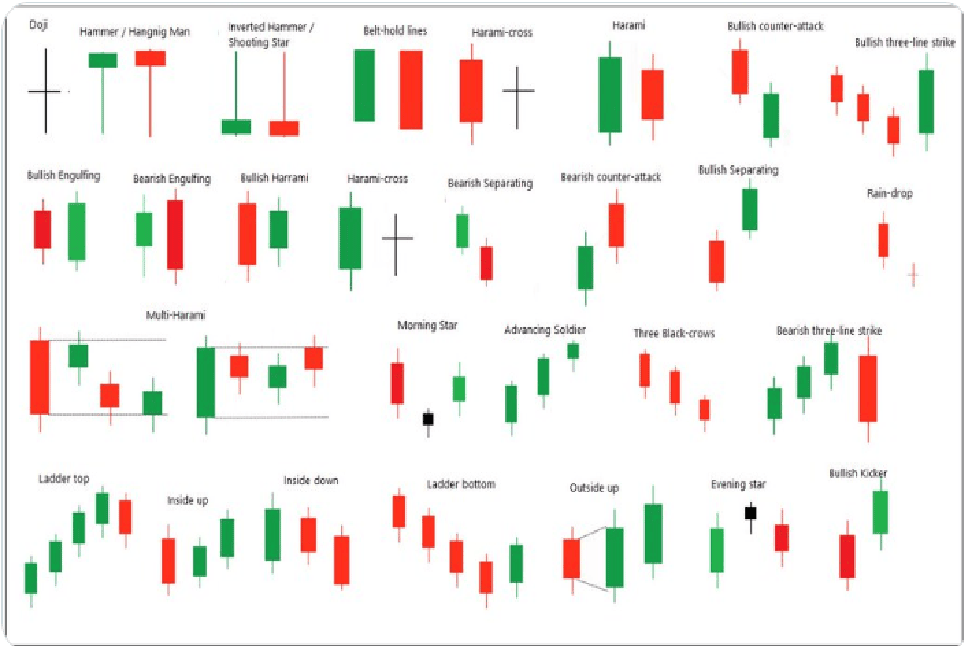

The Power of Candlestick Patterns

Candlestick patterns are a cornerstone of price action analysis. These visual representations of price movements provide insights into market sentiment and potential reversals. From Doji to Hammer to Engulfing patterns, understanding candlestick formations can significantly enhance your trading accuracy.

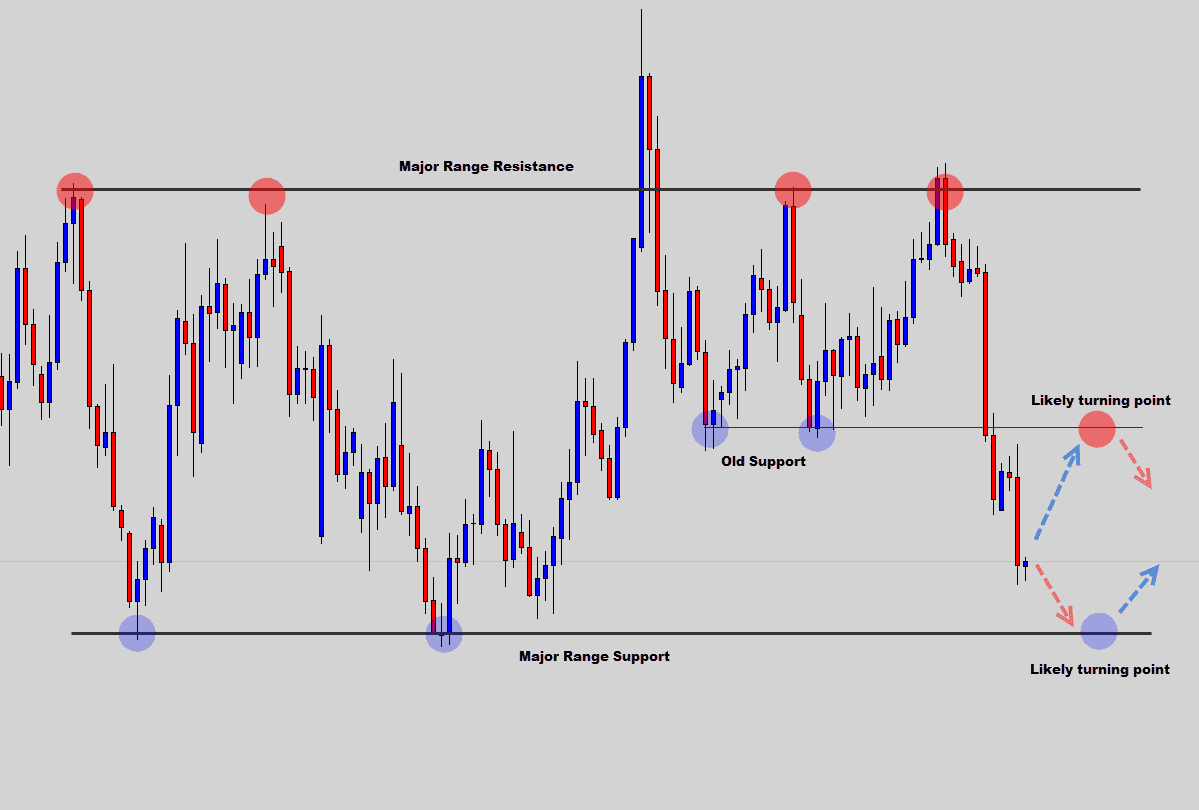

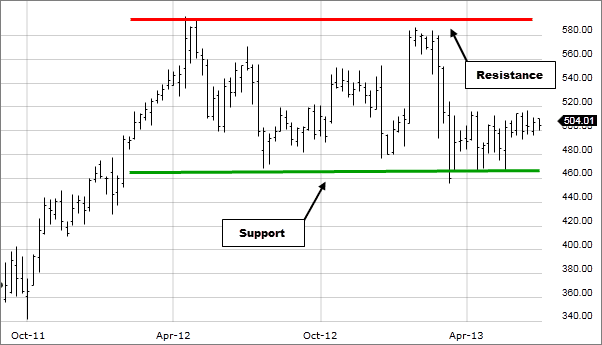

Identifying Support and Resistance Levels

Support and resistance levels are crucial price zones where trends might reverse or continue. By identifying these levels, traders can anticipate potential entry and exit points, making informed decisions without relying on indicators.

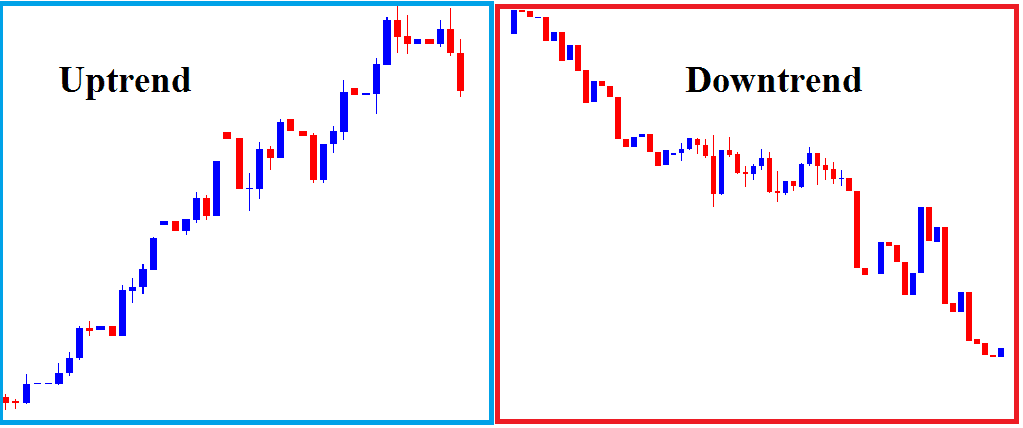

Trendline Analysis: Riding the Market Waves

Trendlines are excellent tools for recognizing market trends. An uptrend is formed by connecting higher swing lows, while a downtrend is established by linking lower swing highs. Riding these trends can offer high-profit opportunities without needing indicators.

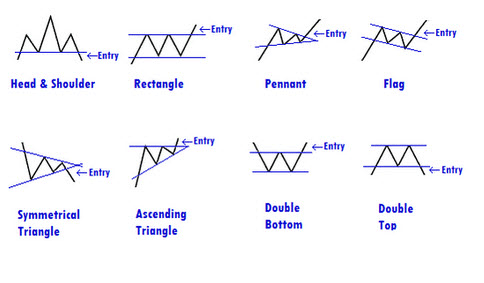

Chart Patterns: Triangles, Flags, and Head and Shoulders

Chart patterns are visual representations of price action that predict future price movements. Triangles, flags, head and shoulders, and other formations offer valuable insights into potential market direction. Learning to recognize and interpret these patterns can be a game-changer for your trading success.

Risk Management: Preserving Your Capital

Effective risk management is the bedrock of successful trading. Without proper risk assessment and control, even the best strategies can fail. Set stop-loss and take-profit levels based on price action analysis to protect your capital.

Embracing Naked Trading: A No-Indicator Approach

Naked trading involves analyzing the markets without indicators, solely relying on price action and chart patterns. This approach encourages traders to understand market dynamics intuitively, enhancing their decision-making skills.

Building a Price Action Trading Plan

Crafting a trading plan is essential for any trader's success. Your plan should outline your trading goals, strategies, risk management techniques, and contingency plans. A well-structured plan will keep you disciplined and focused, improving your overall trading performance.

Psychology of Trading: Mastering Your Mindset

Trading is as much about psychology as it is about strategies. Emotions like fear and greed can cloud judgment and lead to poor decisions. Develop a strong trading mindset by practicing discipline, patience, and emotional control.

Keeping Up with Market News

While our focus is on price action and chart patterns, staying informed about economic news and geopolitical events is vital. These factors can influence market sentiment and impact your trading positions.

FAQs

Q: What is the biggest advantage of trading without indicators?

A: Trading without indicators allows traders to focus on raw price data, enhancing their ability to understand market dynamics and make informed decisions.

Q: How do I identify a trend using price action?

A: Trends can be identified by drawing trendlines connecting swing highs (downtrend) or swing lows (uptrend) on the price chart.

Q: Is price action suitable for all trading styles?

A: Yes, price action can be applied to various trading styles, including day trading, swing trading, and position trading.

Q: Can beginners effectively use these strategies?

A: Absolutely! These strategies are designed to cater to beginners and help them build a strong foundation in Forex trading.

Q: What's the role of risk management in these strategies?

A: Risk management techniques, such as setting stop-loss and take-profit levels, are crucial for preserving your capital and minimizing losses.

Q: How do I develop the discipline needed for successful trading?

A: Developing discipline requires consistent practice, patience, and self-awareness. Stick to your trading plan and avoid emotional decision-making.

Footnote

Congratulations, you've taken a significant step towards mastering Forex trading without indicators! By embracing price action analysis and chart patterns, you're equipped with the skills to navigate the dynamic world of currency trading. Remember, practice makes perfect, so keep refining your strategies and honing your skills. With discipline, determination, and a solid understanding of price action, you're well on your way to becoming a successful Forex trader.

Discussion