Forex Trading Strategies for Asian Sessions: Techniques Suitable for Trading During the Asian Market Hours

In the world of Forex trading, mastering different trading sessions is essential to maximize profits and minimize risks. The Asian trading session, spanning from the Tokyo market open to the European session's close, is a unique time for traders to capitalize on specific strategies tailored to this timeframe. In this comprehensive guide, we'll delve into a variety of trading techniques suitable for trading during the Asian market hours, providing you with the expertise you need to navigate this important session successfully.

Table Content

1. Understanding the Asian Trading Session

2. Range Trading: Exploiting Consolidation

3. Carry Trade Strategy

4. Breakout Strategies

5. Trading the Yen Crosses

6. Incorporating Fundamental Analysis

7. Overlapping Sessions: Asian-European Transition

8. Utilizing Technical Indicators

9. Risk Management is Key

10. Psychological Preparedness

11. FAQs

12. Footnote

1. Understanding the Asian Trading Session

The Asian market hours are characterized by lower volatility compared to other sessions. This period covers major financial hubs such as Tokyo, Singapore, and Hong Kong. Traders need to be aware of economic news releases from countries within this region that can influence market movements.

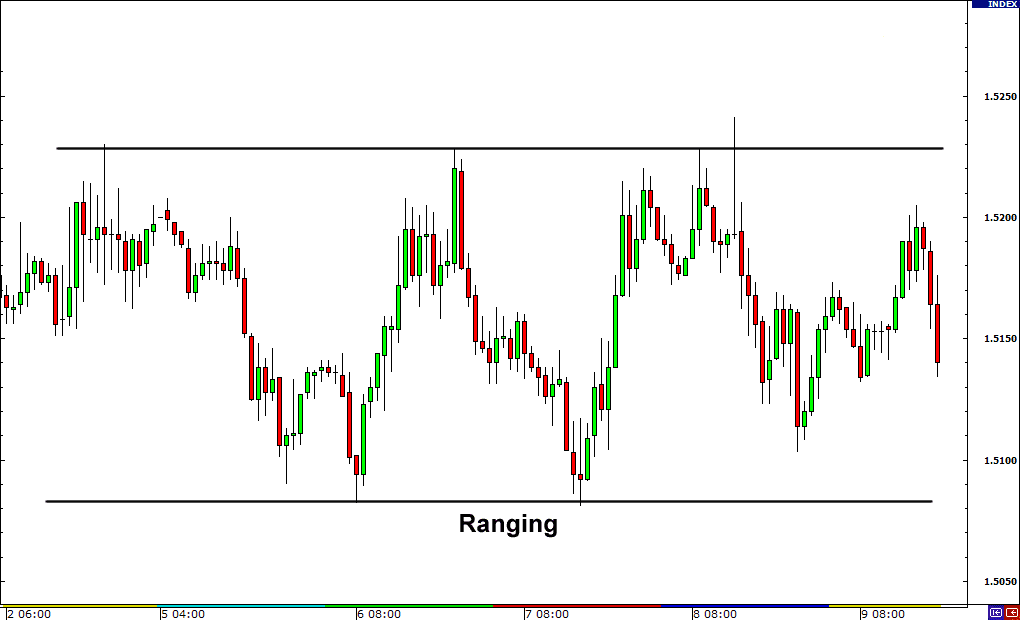

2. Range Trading: Exploiting Consolidation

During the Asian session, currency pairs often exhibit ranging behavior due to reduced market activity. Traders can take advantage of this by employing range trading strategies, buying near support levels and selling near resistance levels.

3. Carry Trade Strategy

The carry trade involves capitalizing on the interest rate differential between two currencies. In the Asian session, traders can earn from the interest rate spread between the Japanese Yen (JPY) and higher-yielding currencies like the Australian Dollar (AUD) or New Zealand Dollar (NZD).

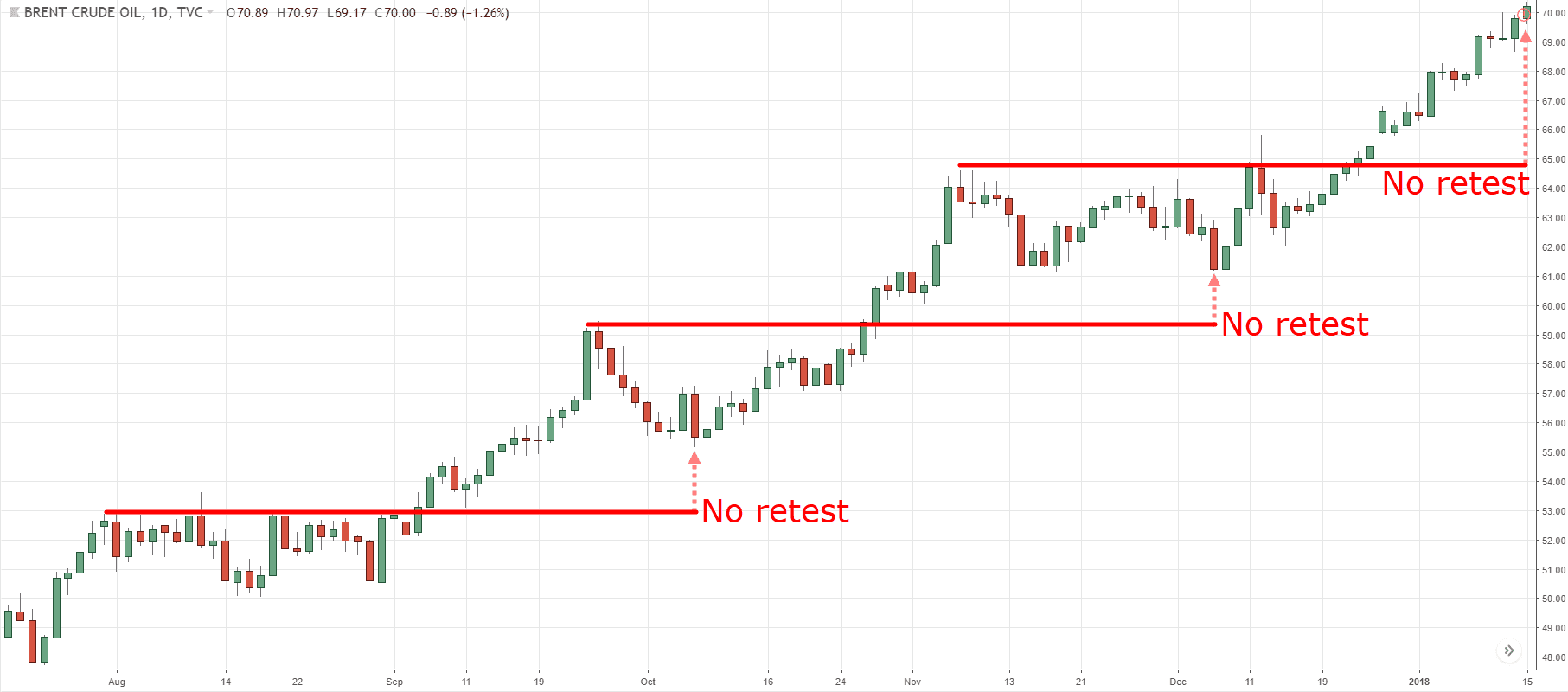

4. Breakout Strategies

While the Asian session is relatively calm, it can set the stage for breakouts in other trading sessions. Identifying key support and resistance levels during this time can help traders position themselves for potential breakouts in subsequent sessions.

5. Trading the Yen Crosses

The Asian session is dominated by the Japanese Yen. Traders can focus on trading Yen crosses, such as EUR/JPY or GBP/JPY, as they tend to exhibit substantial price movements during this time.

6. Incorporating Fundamental Analysis

Despite its lower volatility, the Asian session can still experience significant price swings due to economic data releases from Australia, New Zealand, and Japan. Traders should integrate fundamental analysis to anticipate potential market movements.

7. Overlapping Sessions: Asian-European Transition

Toward the end of the Asian session, there's an overlap with the European trading hours. This overlap can lead to increased volatility, making it an opportune time to execute trading strategies that capitalize on both sessions' characteristics.

8. Utilizing Technical Indicators

Technical indicators like the Moving Average and the Relative Strength Index (RSI) can help traders identify trends and potential entry points during the Asian session.

9. Risk Management is Key

With reduced liquidity during the Asian session, traders should employ effective risk management techniques. Using appropriate stop-loss orders and position sizing is crucial to protect capital.

10. Psychological Preparedness

Trading during the Asian session requires patience and discipline due to its slower pace. Traders need to be psychologically prepared to avoid impulsive decisions and stick to their strategies.

FAQs

Q: Can I trade any currency pair during the Asian session?

A: Absolutely, but it's recommended to focus on currency pairs involving the Japanese Yen (JPY) or other major currencies within the Asian region for better trading opportunities.

Q: Is the Asian session suitable for day trading?

A: Yes, the Asian session provides ample opportunities for day trading, especially for traders who prefer a calmer trading environment.

Q: How do I stay updated on Asian session news releases?

A: You can use financial news websites, economic calendars, and Forex forums to stay informed about upcoming economic data releases from Asian countries.

Q: Is leverage advisable during the Asian session?

A: Leverage can amplify gains and losses, so exercise caution. It's advisable to use lower leverage due to reduced market volatility during this session.

Q: Can I use automated trading systems during the Asian session?

A: Yes, automated trading systems can be effective during the Asian session, provided they are designed to adapt to lower volatility conditions.

Q: What timeframes are most suitable for Asian session trading?

A: Shorter timeframes like 1-hour and 4-hour charts are often preferred during the Asian session for quicker trades.

Footnote

Mastering Forex trading during the Asian session requires a blend of technical expertise, fundamental analysis, and disciplined execution. By understanding the unique characteristics of this trading timeframe and employing the strategies discussed above, traders can navigate the Asian market hours with confidence. Remember, success in Forex trading comes from a combination of skill, adaptability, and continuous learning.

Discussion