Forex Trading Platforms: Software Used to Execute Trades and Manage Accounts

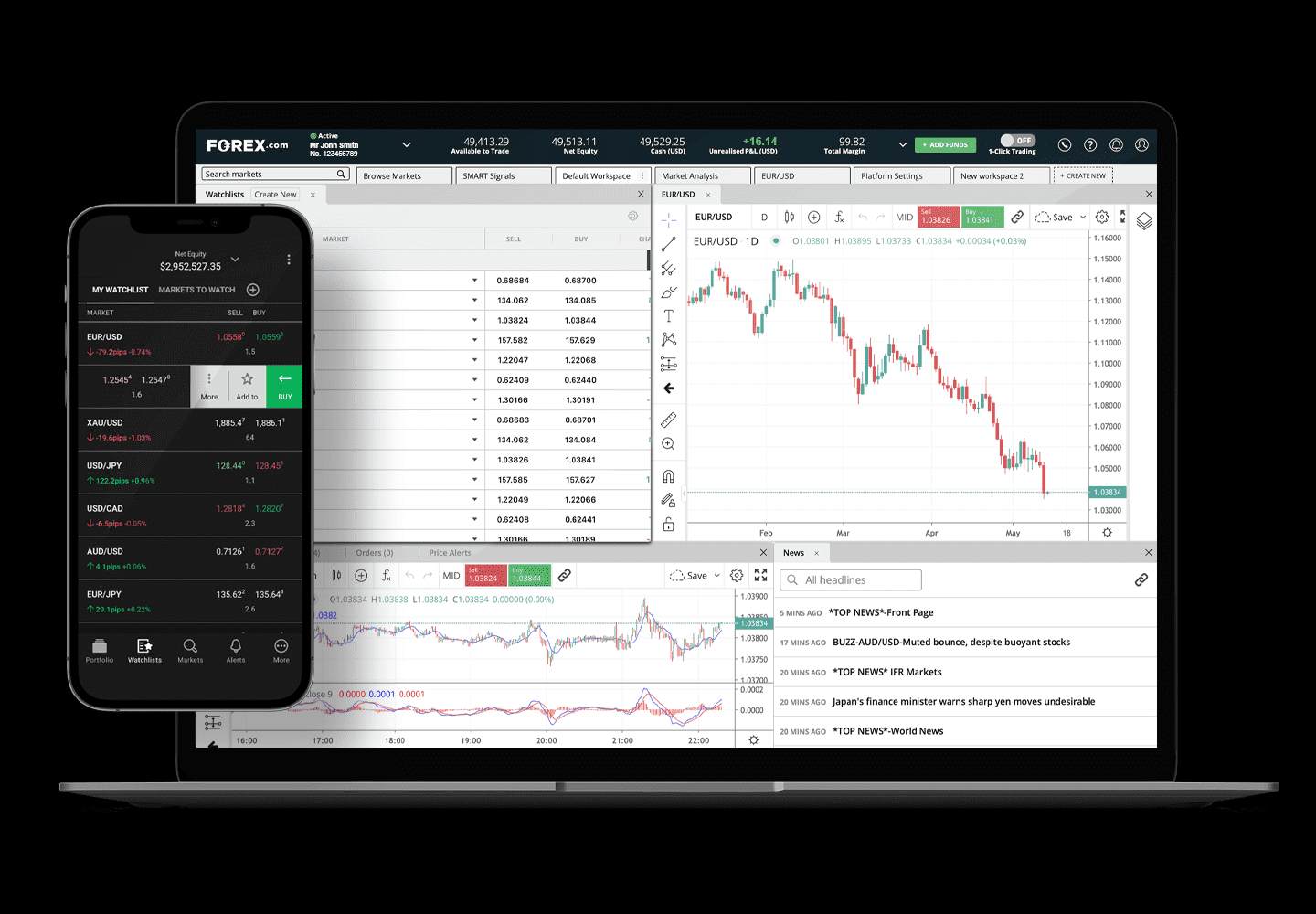

When it comes to the world of Forex trading, having the right platform at your disposal can make all the difference. Forex trading platforms are essential tools that enable traders to execute trades, analyze the market, and manage their accounts effectively. In this comprehensive guide, we will delve into the key aspects of Forex trading platforms, exploring their features, benefits, and the best options available.

Table Content

· Understanding Forex Trading Platforms

· Key Features of Forex Trading Platforms

· Types of Forex Trading Platforms

· Comparing the Best Forex Trading Platforms

· Selecting the Right Forex Trading Platform

· Footnote

· FAQs

Understanding Forex Trading Platforms

What Are Forex Trading Platforms?

Forex trading platforms are software applications that connect traders to the foreign exchange market. These platforms serve as the intermediary between traders and the market, allowing them to buy and sell currency pairs, access market data, and implement trading strategies.

The Importance of Forex Trading Platforms

Forex trading platforms play a pivotal role in the success of traders. They offer a wide range of features, such as real-time market data, technical analysis tools, and automated trading capabilities. These functionalities empower traders to make informed decisions and execute trades promptly, even in a volatile market.

Key Features of Forex Trading Platforms

A reliable Forex trading platform should possess a comprehensive set of features that cater to the needs of both novice and experienced traders. Here are some essential features to look for:

1. Intuitive User Interface

A user-friendly interface is crucial for seamless navigation and efficient trading. Look for platforms with well-organized menus, customizable layouts, and clear charting tools.

2. Advanced Charting and Analysis

In-depth technical analysis is essential for understanding market trends and making informed trading decisions. Look for platforms that offer a wide range of technical indicators, drawing tools, and charting options.

3. Order Execution Speed

In the fast-paced world of Forex trading, order execution speed is critical. Opt for platforms with low latency and high-speed execution to capitalize on market opportunities instantly.

4. Risk Management Tools

Risk management is fundamental to successful trading. Choose platforms that offer features like stop-loss orders and take-profit orders to protect your capital.

Types of Forex Trading Platforms

Forex trading platforms can be categorized into different types based on their accessibility and features. Let's explore the most common types:

1. Web-Based Platforms

Web-based platforms are accessible through web browsers without the need for any downloads. They offer convenience and flexibility, allowing traders to access their accounts from any device with an internet connection.

2. Desktop Platforms

Desktop platforms are software applications that require installation on a trader's computer. They often provide advanced charting and analysis tools, making them a preferred choice for experienced traders.

3. Mobile Platforms

Mobile platforms are designed for trading on the go. They come in the form of mobile apps, enabling traders to monitor the market and execute trades from their smartphones and tablets.

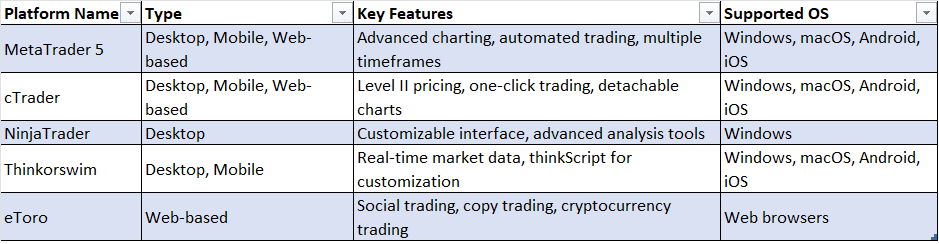

Comparing the Best Forex Trading Platforms

To help you make an informed decision, here is a comparison table of some of the top Forex trading platforms available today:

Selecting the Right Forex Trading Platform

When choosing a Forex trading platform, consider the following factors:

1. Your Trading Experience

Novice traders may prefer user-friendly platforms with educational resources, while experienced traders might require advanced analysis tools and customization options.

2. Platform Security

Ensure that the platform you choose offers robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

3. Supported Currency Pairs

Different platforms offer varying ranges of tradable currency pairs. Pick a platform that aligns with your trading preferences and the markets you wish to explore.

Footnote

Forex trading platforms are the backbone of successful trading ventures. With the right platform at your disposal, you can access the Forex market with confidence, implement trading strategies, and manage your accounts effectively. Remember to choose a platform that suits your trading style, and always stay updated with the latest market trends to make informed decisions.

FAQs

Q: Can I trade Forex without using a trading platform?

A: While it's technically possible, trading without a platform would be impractical, as platforms provide essential tools and connectivity to the market.

Q: Are web-based platforms less secure than desktop platforms?

A: No, web-based platforms use advanced security measures to protect user data, just like desktop platforms.

Q: Can I use multiple trading platforms simultaneously?

A: Yes, many traders use multiple platforms to diversify their trading experience and access different markets.

Q: Are mobile platforms suitable for professional traders?

A: Yes, mobile platforms are designed to offer the same functionalities as desktop platforms and are suitable for both beginners and professionals.

Q: How do I ensure a smooth trading experience on my chosen platform?

A: Regularly update the platform, maintain a stable internet connection, and familiarize yourself with its features for a smoother trading experience.

Discussion