Forex Trading for Beginners: A Step-by-Step Guide

The Ultimate Beginner's Guide to Forex Trading

Introduction

Are you new to forex trading and eager to learn the basics? This step-by-step guide is designed to help beginners like you understand the fundamentals of forex trading, from setting up your trading account to grasping important terminology and basic trading concepts. Whether you're a complete novice or have dabbled in other forms of trading, this article will provide you with the knowledge and resources to get started in the exciting world of forex trading.

Table of Contents

Understanding Forex Trading

- What is Forex Trading?

- Why Trade Forex?

- Major Currency Pairs

- How Does Forex Trading Work?

Getting Started with Forex Trading

- Setting Up a Trading Account

- Choosing a Reliable Broker

- Demo Trading vs. Live Trading

Essential Terminology

- Pips and Lots

- Leverage and Margin

- Stop Loss and Take Profit

- Spread and Commission

Basic Trading Concepts

- Technical Analysis vs. Fundamental Analysis

- Candlestick Patterns

- Support and Resistance Levels

- Trend Lines and Channels

Developing a Trading Strategy

- Identifying Your Trading Goals

- Timeframes and Trading Styles

- Risk Management Techniques

- Backtesting and Demo Trading

Recommended Resources for Learning

- Online Courses and Tutorials

- Forex Trading Books

- Trading Forums and Communities

- Webinars and Seminars

Conclusion

FAQs (Frequently Asked Questions)

Understanding Forex Trading

· What is Forex Trading?

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the global market. It involves speculating on the price movements of currency pairs, such as EUR/USD or GBP/JPY, with the aim of making a profit.

· Why Trade Forex?

Forex trading offers several advantages, making it an attractive market for beginners and experienced traders alike. Some of the key reasons to trade forex include:

- High Liquidity: The forex market is the largest financial market in the world, with trillions of dollars being traded daily. This high liquidity ensures that you can easily enter and exit trades at any time.

- Accessibility: Forex trading can be done online, allowing you to trade from anywhere with an internet connection. The market is open 24 hours a day, five days a week, providing flexibility for traders.

- Profit Potential: Due to the constant fluctuations in currency prices, there are numerous opportunities to profit from both rising and falling markets.

- Leverage: Forex brokers offer leverage, which allows you to control larger positions with a smaller amount of capital. However, it's important to use leverage wisely and understand the associated risks.

· Major Currency Pairs

In forex trading, currencies are traded in pairs. Some of the major currency pairs include:

- EUR/USD (Euro/US Dollar)

- GBP/USD (British Pound/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

These currency pairs represent the most actively traded currencies in the world.

· How Does Forex Trading Work?

Forex trading involves placing trades based on your predictions about the future movements of currency pairs. When you believe a currency will increase in value, you buy it, and when you anticipate a decline, you sell it.

Forex trading platforms provide you with real-time charts and tools to analyze price movements. You can execute trades by selecting the currency pair, specifying the trade size, and choosing whether to buy or sell.

Getting Started with Forex Trading

· Setting Up a Trading Account

The first step in forex trading is to set up a trading account with a reputable broker. Here's a brief overview of the account setup process:

- Research and choose a forex broker that suits your needs. Consider factors such as regulation, trading platforms, customer support, and account types.

- Visit the broker's website and click on the "Open Account" or "Register" button.

- Fill out the registration form, providing your personal information, including your name, email address, and phone number.

- Choose the account type that best fits your trading style, such as a standard account or an ECN account.

- Complete the account verification process by submitting the required documents, such as proof of identity and address.

Once your account is approved, you will receive your login credentials and can proceed to the next steps.

· Choosing a Reliable Broker

Selecting a reliable broker is crucial for a successful trading experience. Consider the following factors when choosing a forex broker:

- Regulation: Ensure that the broker is regulated by a reputable financial authority to protect your funds and ensure fair trading practices.

- Trading Platforms: Evaluate the trading platforms offered by the broker. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their user-friendly interface and comprehensive trading tools.

- Customer Support: Look for brokers that provide responsive customer support, offering assistance when you need it.

- Account Types: Different brokers offer various account types with different features and minimum deposit requirements. Choose an account type that aligns with your trading goals and risk tolerance.

- Fees and Spreads: Consider the fees charged by the broker, including spreads, commissions, and overnight financing rates. Low-cost trading can significantly impact your profitability.

· Demo Trading vs. Live Trading

Before risking real money, it's advisable to practice trading strategies and familiarize yourself with the trading platform through demo trading. Most brokers offer demo accounts where you can trade with virtual funds in real market conditions.

Demo trading allows you to gain experience without the risk of financial loss. Use this opportunity to test different trading strategies, analyze charts, and understand how various indicators work.

Once you feel confident in your trading skills, you can transition to live trading by depositing real funds into your trading account.

Essential Terminology

Understanding key terminology is essential for navigating the forex market effectively. Let's explore some important terms you should know:

· Pips and Lots: A pip is the smallest unit of measurement in forex trading, representing the price change of a currency pair. Most currency pairs are quoted to four or five decimal places, with a pip typically equal to 0.0001 or 0.00001.

A lot refers to the trade size in forex. Standard lots are typically 100,000 units of the base currency, while mini lots are 10,000 units, and micro lots are 1,000 units. The lot size determines the value of a pip.

· Leverage and Margin: Leverage allows traders to control larger positions with a smaller amount of capital. It is expressed as a ratio, such as 1:50 or 1:100. For example, with a leverage of 1:100, you can control a position worth $100,000 with a margin requirement of $1,000.

Margin refers to the amount of money required to open and maintain a position. It is a percentage of the total trade size and acts as collateral for the leverage provided by the broker. It's important to understand the risks associated with leverage and use it wisely.

· Stop Loss and Take Profit: A stop loss is an order placed to limit potential losses on a trade. It specifies a price level at which the trade will be automatically closed to prevent further losses.

A take profit order, on the other hand, is used to lock in profits by automatically closing the trade when the price reaches a predetermined level.

· Spread and Commission: The spread is the difference between the buy and sell prices of a currency pair. It represents the cost of the trade and is typically measured in pips. Brokers can offer fixed or variable spreads.

Some brokers charge a commission in addition to the spread. Commission-based accounts may have lower spreads but higher trading costs in the form of commissions.

Basic Trading Concepts

· Technical Analysis vs. Fundamental Analysis

Forex traders use two primary methods to analyze the market: technical analysis and fundamental analysis.

Technical analysis involves studying historical price data and using various indicators and chart patterns to predict future price movements. Traders look for trends, support and resistance levels, and other patterns that can provide insight into potential trade opportunities.

Fundamental analysis focuses on analyzing economic, political, and social factors that can influence currency prices. Traders examine economic indicators, such as GDP growth, inflation rates, and interest rates, to make trading decisions.

Both approaches have their merits, and many traders use a combination of technical and fundamental analysis to make informed trading decisions.

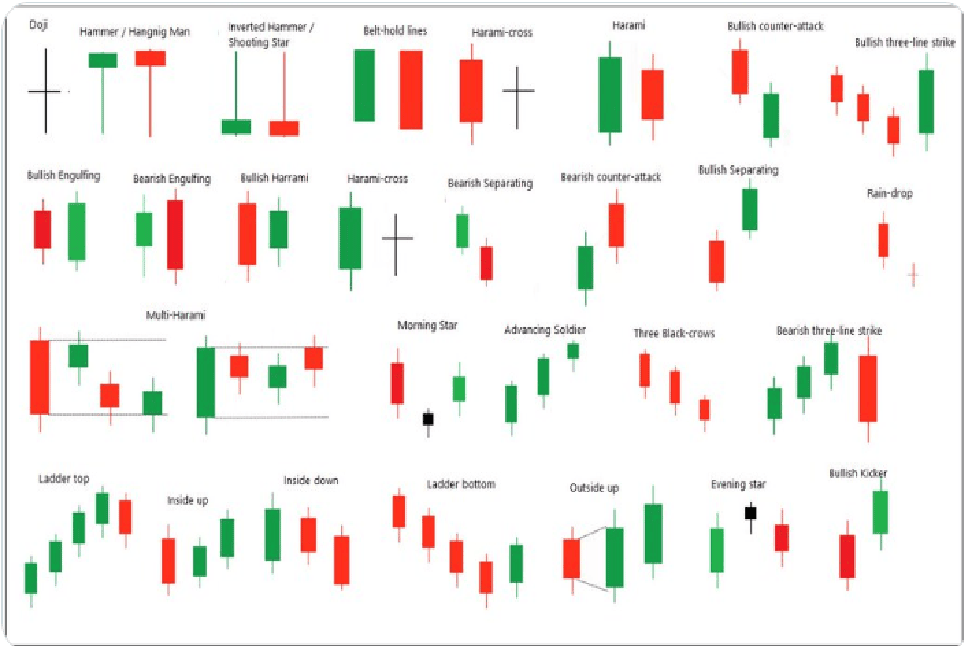

· Candlestick Patterns

Candlestick patterns are graphical representations of price movements within a specific timeframe. They can provide valuable information about market sentiment and potential trend reversals.

Common candlestick patterns include doji, hammer, engulfing, and shooting star patterns. Each pattern has its own interpretation and can indicate bullish or bearish market conditions.

Above image of candlestick pattern

Traders use candlestick patterns in conjunction with other technical indicators to identify entry and exit points for trades.

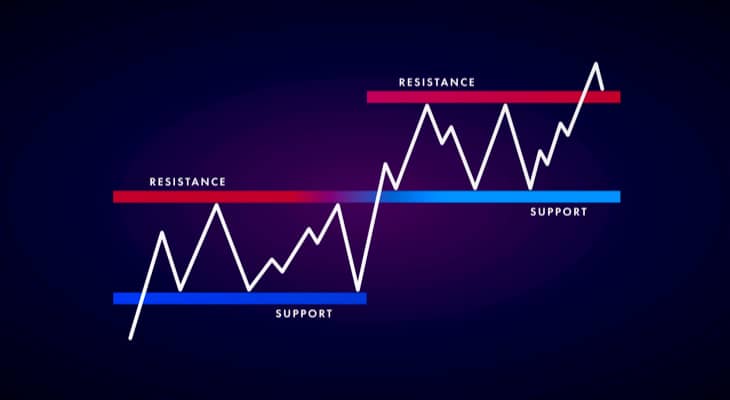

· Support and Resistance Levels

Support and resistance levels are key areas on a price chart where the buying and selling pressure is significant. Support acts as a floor that prevents the price from falling further, while resistance acts as a ceiling that prevents the price from rising further.

Above image of Support and Resistance level

Traders use support and resistance levels to identify potential entry and exit points. When the price approaches a support level, it may bounce back, presenting a buying opportunity. Conversely, when the price nears a resistance level, it may reverse and provide a selling opportunity.

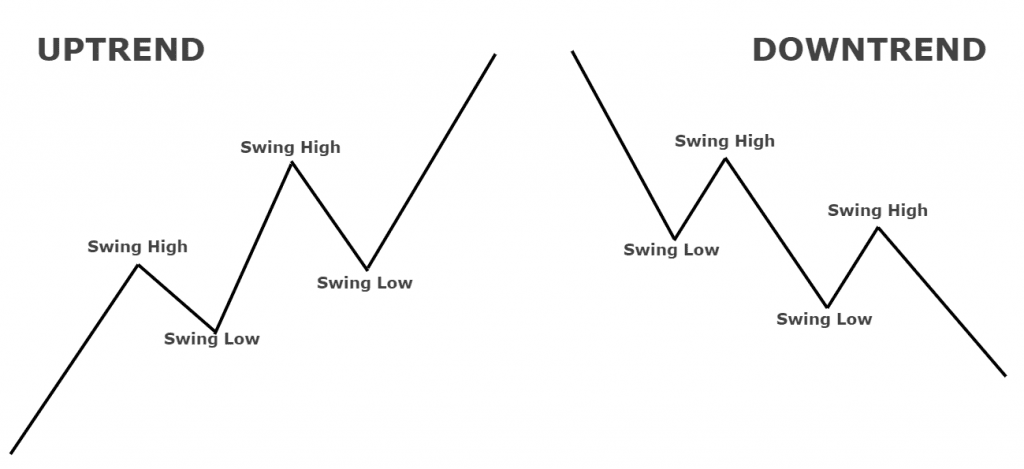

· Trend Lines and Channels

Trend lines and channels are tools used to identify and visualize the direction and strength of a trend.

A trend line is drawn by connecting the higher lows in an uptrend or the lower highs in a downtrend. It helps traders identify the overall direction of the market and potential areas of support or resistance.

Above image of trend lines and channels

A channel is formed when two parallel trend lines enclose the price action. Traders can use channels to identify potential buying or selling opportunities when the price reaches the upper or lower boundary of the channel.

Developing a Trading Strategy: -

· Identifying Your Trading Goals: Before diving into forex trading, it's important to define your trading goals. Ask yourself what you want to achieve through trading and set realistic expectations.

Are you looking to generate a secondary income or trade full-time? Do you prefer short-term or long-term trading? Clarifying your goals will help you choose a suitable trading strategy and stay focused on your objectives.

· Timeframes and Trading Styles: Forex traders can choose from various timeframes, ranging from short-term intraday trading to long-term position trading. Each timeframe requires a different approach and trading strategy.

- Scalping: Traders aim to profit from small price movements, typically holding trades for a few minutes to an hour.

- Day Trading: Traders open and close positions within a single trading day, avoiding overnight exposure.

- Swing Trading: Traders aim to capture larger price movements over a few days to a few weeks.

- Position Trading: Traders hold positions for weeks, months, or even years, based on long-term trends and fundamental analysis.

- Select a timeframe and trading style that aligns with your personality, time availability, and risk tolerance.

· Risk Management Techniques: Risk management is crucial in forex trading to protect your capital and minimize potential losses. Here are some essential risk management techniques:

- Set a Risk-Reward Ratio: Determine the potential reward for every dollar risked on a trade. A commonly used ratio is 1:2 or higher, meaning you aim to make twice the amount you're risking.

- Use Stop Loss Orders: Always use stop loss orders to limit potential losses. Place your stop loss at a logical level that allows the trade enough room to breathe but protects you from significant drawdowns.

- Avoid Overtrading: Resist the temptation to trade excessively. Stick to your trading plan and avoid impulsive decisions based on emotions or market noise.

- Diversify Your Trades: Avoid concentrating all your trades in a single currency pair or market. Diversify your trades to spread the risk and reduce the impact of potential losses.

- Use Proper Position Sizing: Determine the appropriate trade size based on your account balance and risk tolerance. Avoid risking a significant portion of your capital on a single trade.

· Back-testing and Demo Trading: Back-testing involves testing your trading strategy against historical price data to assess its performance. Use specialized software or trading platforms that offer back-testing capabilities to evaluate the profitability and reliability of your strategy.

Additionally, continue practicing your trading strategy through demo trading. Experiment with different strategies, indicators, and timeframes to gain confidence and improve your skills.

Recommended Resources for Learning

· Online Courses and Tutorials: Online courses and tutorials provide structured learning materials for beginners to advanced traders. Some popular platforms and websites that offer forex trading courses include:

- Babypips.com: Provides comprehensive free educational content and an interactive online course.

- Udemy: Offers a wide range of forex trading courses taught by experienced instructors.

- Investopedia: Provides articles, tutorials, and quizzes to help beginners understand forex trading concepts.

· Forex Trading Books: Books are a valuable source of knowledge for forex traders. Here are some recommended books for beginners:

- "Japanese Candlestick Charting Techniques" by Steve Nison

- "Trading in the Zone" by Mark Douglas

- "A Beginner's Guide to Forex Trading" by Matthew Driver

- "Forex For Beginners" by Anna Coulling

· Trading Forums and Communities: Engaging with trading forums and communities allows you to learn from experienced traders, share ideas, and seek advice. Some popular forex trading communities include:

- Forex Factory: Offers a forum, economic calendar, and market analysis.

- BabyPips Forum: Provides a community for traders to discuss trading strategies and seek guidance.

- Reddit's r/Forex: A subreddit dedicated to forex trading discussions and insights.

· Webinars and Seminars: Webinars and seminars provide an opportunity to learn from industry experts and gain valuable insights. Many brokers and educational platforms offer free webinars and seminars on various forex trading topics. Keep an eye out for upcoming events and participate to enhance your knowledge.

Conclusion

Forex trading can be an exciting and potentially profitable venture for beginners. By understanding the fundamentals, setting up a trading account, learning key terminology, and mastering basic trading concepts, you'll be well on your way to becoming a successful forex trader.

Remember to develop a trading strategy, practice proper risk management, and continuously educate yourself through recommended resources. Stay disciplined, patient, and open to learning from both successes and failures.

FAQs (Frequently Asked Questions)

Q- Is forex trading suitable for beginners?

A. Yes, forex trading is suitable for beginners. However, it's essential to invest time in learning the fundamentals, practicing with demo accounts, and developing a sound trading strategy.

Q- How much money do I need to start forex trading?

A. The amount of money needed to start forex trading varies depending on the broker and account type. Some brokers allow you to open accounts with as little as $100 or even less.

Q- Can I trade forex on my smartphone?

A. Yes, many brokers offer mobile trading apps that allow you to trade forex on your smartphone or tablet. These apps provide access to real-time charts, trade execution, and account management.

Q- How much time do I need to dedicate to forex trading?

A. The time commitment for forex trading depends on your trading style and strategy. Scalping and day trading require more time and active monitoring, while swing trading and position trading can be done with fewer hours per day.

Q- What is the best way to analyze the forex market?

A. There is no single best way to analyze the forex market. It's recommended to use a combination of technical analysis, fundamental analysis, and market sentiment to make informed trading decisions.

Discussion