Forex Signals: Recommendations or Alerts That Help Traders Make Informed Decisions

Welcome to the exciting world of Forex signals, where trading decisions get a boost through expert recommendations and timely alerts. In this comprehensive article, we will delve into the concept of Forex signals, exploring their significance, how they work, and the immense value they bring to traders. Whether you're a seasoned investor or a newcomer to the Forex market, understanding and utilizing these signals can make a significant difference in your trading success.

Table Content

1. What Are Forex Signals?

2. The Significance of Forex Signals

3. How Do Forex Signals Work?

4. Types of Forex Signals

5. How to Utilize Forex Signals Effectively

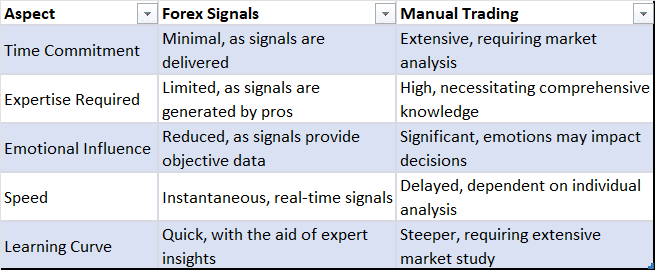

6. Comparison Table: Forex Signals vs. Manual Trading

7. Infographic: The Power of Forex Signals

8. Footnote

9. FAQs

What Are Forex Signals?

Forex signals are crucial tools in the currency trading market that provide valuable insights to traders. They serve as alerts or recommendations generated by experienced analysts and automated systems, guiding traders on potential entry and exit points, stop-loss levels, and profit targets for specific currency pairs. These signals come with detailed rationales, empowering traders with the knowledge to make informed decisions based on expert analysis.

The Significance of Forex Signals

Forex signals offer numerous advantages that can enhance your trading experience:

1. Minimize Risk and Maximize Opportunities

By receiving timely signals, traders can minimize risks associated with blind trading decisions. These signals identify potentially profitable opportunities while suggesting stop-loss levels to safeguard against adverse market movements.

2. Expert Analysis at Your Fingertips

Access to expert analysis and insights allows traders to understand the market better. This knowledge empowers them to navigate the complexities of Forex trading with confidence and clarity.

3. Time-Saving and Convenient

Utilizing Forex signals saves traders the time and effort required for in-depth market analysis. This convenience is especially beneficial for those with busy schedules or limited trading experience.

4. Learn from the Experts

By observing and analyzing signals provided by seasoned traders, beginners can learn valuable trading strategies and principles, accelerating their growth as traders.

How Do Forex Signals Work?

Forex signals can be generated through various methods:

1. Manual Analysis

Experienced traders and analysts perform in-depth market research and analysis to identify potential trading opportunities. They then send out signals with detailed insights into their recommendations.

2. Automated Systems

Sophisticated algorithms and trading bots continuously scan the market for patterns and indicators. When predefined conditions are met, these systems generate and dispatch Forex signals in real-time.

3. Copy Trading

Copy trading platforms allow traders to automatically replicate the trades of successful and seasoned investors. When these experts execute trades, the same actions are mirrored in the accounts of their followers.

Types of Forex Signals

Forex signals can come in different forms:

1. Buy/Sell Signals

The most common type of signal indicates whether traders should enter a long (buy) or short (sell) position on a specific currency pair.

2. Stop-Loss and Take-Profit Signals

These signals advise traders on the appropriate levels to set their stop-loss and take-profit orders, aiming to protect profits and limit potential losses.

3. News-Based Signals

News events can significantly impact the Forex market. Signals that highlight major news releases help traders adapt their strategies accordingly.

How to Utilize Forex Signals Effectively

To maximize the benefits of Forex signals, consider the following tips:

1. Choose a Reliable Signal Provider

Research and select a reputable signal provider with a track record of accurate signals and transparent performance data.

2. Understand the Rationales

Don't blindly follow signals; take the time to comprehend the reasoning behind each recommendation. This will help you make more informed decisions.

3. Use Signals as a Tool, Not a Crutch

While Forex signals offer valuable insights, they should complement your trading strategy rather than dictate it entirely.

4. Risk Management

Even with reliable signals, trading involves risk. Implement proper risk management strategies to protect your capital.

Comparison Table: Forex Signals vs. Manual Trading

Infographic: The Power of Forex Signals

Footnote

Forex signals act as guiding stars in the vast universe of currency trading. By providing timely recommendations and expert insights, these signals empower traders to make well-informed decisions, unlocking new dimensions of success. Remember, they are not a magic wand but a valuable tool to enhance your trading strategies. Embrace the power of Forex signals, and watch your trading journey soar to new heights.

FAQs

- Are Forex signals suitable for beginners?

Absolutely! Forex signals can be immensely beneficial for beginners, as they offer valuable guidance from experienced traders.

- How do I choose the right signal provider?

When selecting a signal provider, look for transparency in performance, a proven track record, and positive user reviews.

- Can I rely solely on Forex signals for trading?

While signals are valuable, they should be used alongside your trading strategy and risk management practices.

- Are there free Forex signal services available?

Yes, some signal providers offer free services, but be cautious and verify their reliability before relying on them.

- What's the typical success rate of Forex signals?

The success rate varies among signal providers, but the best ones often boast success rates of around 70% or higher.

Discussion