Forex risk/reward ratio: Assessing potential profits against potential losses before executing a trade.

In the world of forex trading, understanding and managing risk is crucial to success. One of the essential tools for traders is the risk/reward ratio, which allows them to assess potential profits against potential losses before executing a trade. In this article, we will delve into the significance of the forex risk/reward ratio and how it can enhance your trading strategy.

Table Content

1. What is Forex Risk/Reward Ratio?

2. Why is the Risk/Reward Ratio Important?

3. How to Calculate the Risk/Reward Ratio?

4. The Importance of a Favorable Risk/Reward Ratio

5. Enhancing Trading Psychology

6. Finding the Right Risk/Reward Ratio

7. Utilizing the Risk/Reward Ratio in Your Trading Strategy

8. Footnote

What is Forex Risk/Reward Ratio?

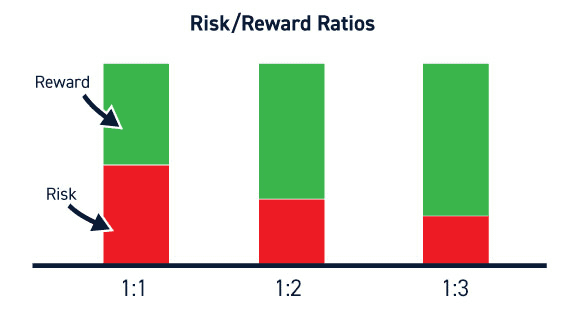

The forex risk/reward ratio is a simple yet powerful concept that measures the potential profit a trader can make on a trade compared to the potential loss they might incur. It is typically expressed as a ratio, such as 1:2, 1:3, or any other combination. For example, a risk/reward ratio of 1:2 means that for every dollar you risk on a trade, you expect to make two dollars in profit.

Why is the Risk/Reward Ratio Important?

Understanding the risk/reward ratio is vital because it allows traders to make informed decisions. By calculating the potential reward against the risk beforehand, traders can evaluate whether a trade is worth pursuing or not. Trades with higher risk/reward ratios offer more significant profit potential relative to the risk taken, making them more attractive to traders seeking lucrative opportunities.

How to Calculate the Risk/Reward Ratio?

Calculating the risk/reward ratio is relatively straightforward. Follow these steps:

- Determine your entry point for the trade.

- Set your stop-loss order, which represents the maximum amount you are willing to lose on the trade.

- Set your take-profit order, which represents the desired profit level.

Once you have these figures, you can calculate the risk/reward ratio using the following formula:

Risk/Reward Ratio = (Take Profit - Entry Point) / (Entry Point - Stop Loss)

The Importance of a Favorable Risk/Reward Ratio

A favorable risk/reward ratio is crucial for long-term success in forex trading. Even if you have a winning percentage of less than 50%, a positive risk/reward ratio can still make you profitable. For instance, let's say you have a risk/reward ratio of 1:2, and out of ten trades, you only win four. In this scenario, you would still be profitable since your winning trades would make up for the losses and leave you with an overall gain.

Enhancing Trading Psychology

Aside from its quantitative benefits, the risk/reward ratio can also have a significant impact on a trader's psychology. When traders know that the potential reward outweighs the potential risk, they tend to have more confidence in their trades and are less likely to make impulsive decisions based on fear or greed. This can lead to a more disciplined and consistent trading approach, which is essential for long-term success in the forex market.

Finding the Right Risk/Reward Ratio

The ideal risk/reward ratio varies from trader to trader and largely depends on their individual trading style and risk tolerance. Some traders might prefer a higher risk/reward ratio, such as 1:3 or 1:4, aiming for more substantial profits even if it means fewer winning trades. On the other hand, conservative traders might opt for a lower risk/reward ratio, such as 1:1.5, to prioritize capital preservation.

Utilizing the Risk/Reward Ratio in Your Trading Strategy

Incorporating the risk/reward ratio into your trading strategy involves more than just calculating the numbers. Here are some essential tips for effectively utilizing the risk/reward ratio:

1. Set Realistic Profit Targets

While it's tempting to aim for the highest possible profits, setting realistic profit targets based on the market conditions and your analysis is crucial. Unrealistic profit expectations can lead to disappointment and impulsive decision-making.

2. Implement a Stop-Loss Strategy

A well-defined stop-loss strategy is fundamental in managing risk. It ensures that losses are limited and prevents emotions from taking over when a trade moves against you.

3. Consider Market Volatility

Market volatility can significantly impact the risk/reward ratio. Assess the market conditions and adjust your risk/reward ratio accordingly to adapt to the changing environment.

Footnote

In Summary, the forex risk/reward ratio is a vital tool for traders to evaluate potential profits against potential losses before executing a trade. By understanding this concept and incorporating it into your trading strategy, you can make more informed decisions, enhance your trading psychology, and increase your chances of long-term success in the forex market. Remember, a favorable risk/reward ratio, combined with proper risk management, can be the key to becoming a successful forex trader.

Discussion