Forex Pips: The Smallest Unit by Which a Currency Pair's Value Can Change

As we delve into the captivating world of forex trading, it becomes essential to understand the fundamental concept of "Forex Pips." In this article, we will explore what forex pips are, their significance in currency pair valuation, and the dynamics that influence their movements. Whether you're an aspiring forex trader or someone seeking to deepen their knowledge of the financial markets, this article will provide a comprehensive understanding of forex pips and their role in the exciting realm of currency trading.

Table Content

1. Understanding Forex Pips

2. The Significance of Forex Pips in Currency Trading

3. Factors Influencing Forex Pip Movements

4. Analyzing Forex Pips with Charts and Tables

5. Tips for Mastering Forex Pips

6. Footnote

7. FAQs (Frequently Asked Questions)

Understanding Forex Pips

Forex pips, often referred to as "percentage in point" or "price interest point," represent the smallest unit by which a currency pair's value can change. They serve as the foundation for measuring price movements in the forex market, where currencies are traded in pairs. Each currency pair has its unique pip value, and these fluctuations play a critical role in determining profits and losses in forex trading.

To comprehend forex pips better, let's consider an example. Suppose the EUR/USD currency pair has a pip value of 0.0001. If the pair moves from 1.2000 to 1.2001, it has increased by one pip. Conversely, if it moves from 1.2000 to 1.1999, it has decreased by one pip. These seemingly small increments or decrements can significantly impact trading outcomes.

The Significance of Forex Pips in Currency Trading

Forex pips hold immense importance in currency trading, as they directly influence profit and loss calculations. Traders aim to capitalize on even the slightest pip movements to maximize their gains. The concept of leverage amplifies the significance of pips. With leverage, traders can control larger positions in the market with a smaller amount of capital. While this presents an opportunity for substantial profits, it also exposes traders to higher risks.

Factors Influencing Forex Pip Movements

Several factors contribute to the fluctuations in forex pips. Understanding these dynamics is crucial for making informed trading decisions:

1. Economic Indicators

Economic indicators, such as GDP growth, employment rates, and inflation, play a significant role in influencing currency values. Positive economic data often strengthens a country's currency, leading to an increase in pips, while negative data can have the opposite effect.

2. Interest Rates

Central banks' decisions on interest rates directly impact currency values. Higher interest rates attract foreign investors, increasing demand for the currency and potentially raising its value in pips.

3. Geopolitical Events

Political stability and geopolitical events can create uncertainty in the forex market, causing fluctuations in pips. Major political developments can lead to rapid changes in currency values.

4. Market Sentiment

Trader sentiment and market speculation also influence forex pips. Positive sentiment towards a currency can boost its value, while negative sentiment can lead to depreciation.

Analyzing Forex Pips with Charts and Tables

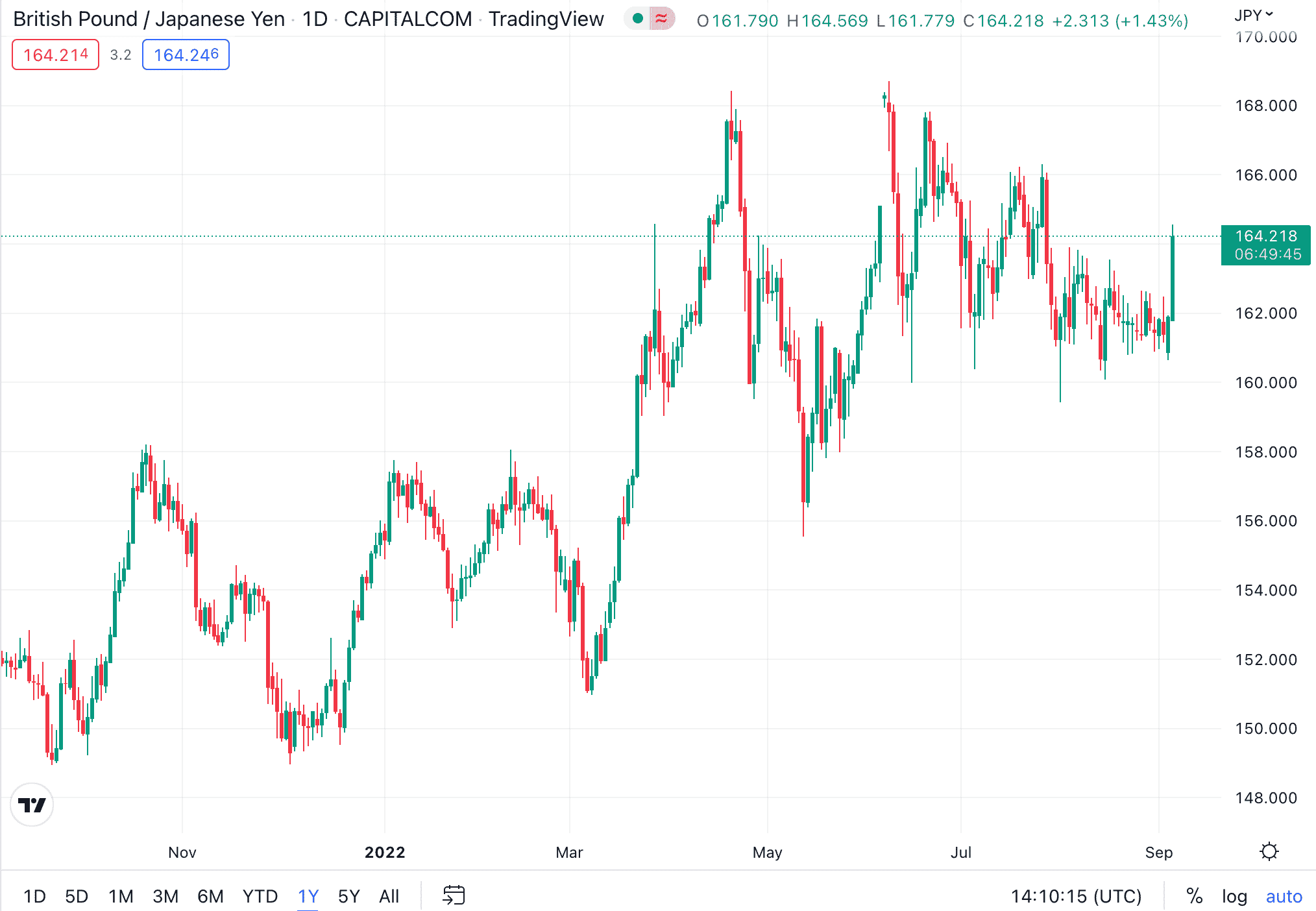

To visually understand the impact of forex pips, let's examine a chart showcasing the historical price movements of a currency pair:

Sources from TradingView

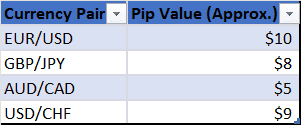

Additionally, here's a comparison table illustrating pip values for some popular currency pairs:

The table above exemplifies the varying pip values among different currency pairs, further emphasizing the importance of understanding pip movements for effective trading.

Tips for Mastering Forex Pips

- Stay Informed: Keep yourself updated with relevant news and economic indicators to anticipate potential pip movements.

- Risk Management: Use stop-loss orders to limit losses in case of unexpected pip fluctuations.

- Demo Trading: Practice with demo accounts to gain experience without risking real money.

- Diversify: Avoid overexposure to a single currency pair; diversify your trades to spread risk.

Footnote

In Summary, forex pips are the bedrock of currency trading, governing how currency pair values evolve in the dynamic forex market. As traders aim to harness the potential of pip movements, understanding the impact of economic indicators, interest rates, geopolitical events, and market sentiment becomes paramount. By using charts, tables, and comparisons, traders can analyze pip movements effectively and make informed decisions to optimize their trading outcomes.

FAQs (Frequently Asked Questions)

1. What is the significance of forex pips in currency trading?

Forex pips are crucial in currency trading as they determine the smallest unit by which a currency pair's value can change, directly influencing profit and loss calculations for traders.

2. How do economic indicators impact forex pips?

Economic indicators, such as GDP growth and inflation, influence currency values, leading to fluctuations in forex pips. Positive indicators can strengthen a currency, while negative indicators may lead to depreciation.

3. What role does market sentiment play in pip movements?

Market sentiment and trader speculation can significantly impact forex pips. Positive sentiment towards a currency can increase its value, while negative sentiment can cause depreciation.

4. How can I effectively analyze forex pips?

You can analyze forex pips using charts, tables, and historical data. Keeping track of economic events and staying informed is also crucial for effective analysis.

5. What are some risk management strategies for forex trading?

Using stop-loss orders, diversifying trades, and practicing with demo accounts are effective risk management strategies in forex trading.

Discussion