Forex order flow: The process of buying and selling orders that move the market.

Forex trading, also known as foreign exchange trading, is a global decentralized market for trading national currencies against one another. One of the key factors that influence price movements in the Forex market is the order flow. Understanding the Forex order flow is crucial for traders seeking to gain an edge in the highly competitive Forex market. In this article, we will explore the concept of Forex order flow, its significance, and how it impacts the market dynamics.

Table Content

1. The Basics of Forex Order Flow

2. The Relationship Between Order Flow and Liquidity

3. The Mechanism Behind Forex Order Flow

4. Analyzing Forex Order Flow

5. Strategies for Trading with Forex Order Flow

6. Advantages of Trading with Forex Order Flow

7. Challenges of Trading with Forex Order Flow

8. FAQs

9. Footnote

The Basics of Forex Order Flow

· What is Forex Order Flow?

Forex order flow refers to the process of buying and selling orders that directly impact the supply and demand of a currency pair. It represents the flow of orders from traders around the world, including banks, financial institutions, hedge funds, and retail traders.

· The Significance of Forex Order Flow

Forex order flow plays a pivotal role in determining price movements and market trends. Understanding the order flow can help traders anticipate potential price reversals, identify liquidity levels, and gauge market sentiment.

The Relationship Between Order Flow and Liquidity

Liquidity refers to the ease with which an asset can be bought or sold without causing a significant price change. Order flow affects liquidity levels in the Forex market, with high liquidity ensuring smoother trading and lower spreads.

The Mechanism Behind Forex Order Flow

· How Order Flow is Generated

Order flow is generated by traders placing market orders, limit orders, stop orders, and other order types. Market orders execute immediately at the current market price, while limit orders execute when the price reaches a specified level.

· The Role of Market Makers

Market makers are entities, often financial institutions, that provide liquidity to the market by offering to buy or sell assets. They help maintain a continuous flow of orders, ensuring smoother market operations.

· Order Books and Depth of Market

Order books display all the current buy and sell orders in the market. The depth of the market shows the number of orders at different price levels, revealing where the market has significant demand or supply.

Analyzing Forex Order Flow

· Tools and Techniques for Analyzing Order Flow

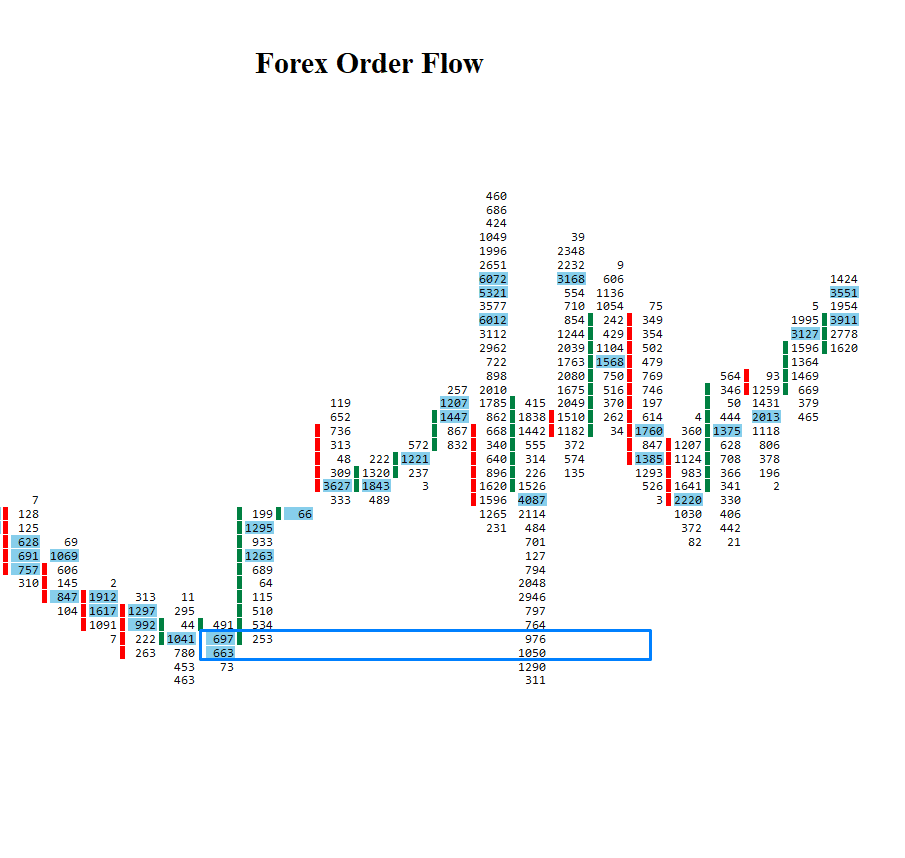

Traders utilize various tools and techniques to analyze Forex order flow, including order flow indicators, footprint charts, and volume profile analysis. These tools provide valuable insights into market sentiment and potential price movements.

· Reading Market Sentiment through Order Flow

By analyzing order flow, traders can gauge market sentiment. High buying pressure indicates a bullish sentiment, while strong selling pressure suggests a bearish sentiment.

· Identifying Key Support and Resistance Levels

Order flow analysis helps identify critical support and resistance levels. These levels act as barriers where the market is likely to reverse or stall.

Strategies for Trading with Forex Order Flow

· Order Flow Trading Strategies

Order flow trading strategies involve leveraging order flow analysis to make informed trading decisions. Some common strategies include order block trading, volume trading, and liquidity zone trading.

· Managing Risk with Forex Order Flow

Proper risk management is essential when trading with Forex order flow. Traders should implement stop-loss orders, position sizing, and risk-reward ratios to protect their capital.

Advantages of Trading with Forex Order Flow

· Increased Trading Precision

Trading with Forex order flow provides traders with a more precise understanding of market dynamics, enhancing their trading accuracy.

· Real-time Market Insights

Order flow analysis offers real-time market insights, allowing traders to adapt quickly to changing market conditions.

Challenges of Trading with Forex Order Flow

· Complexity of Analysis

Forex order flow analysis requires proficiency in using specialized tools and interpreting complex data, making it challenging for inexperienced traders.

· Market Noise and False Signals

In some instances, order flow analysis may generate false signals due to market noise, requiring traders to exercise caution.

FAQs

Q: What is the best time frame for Forex order flow analysis?

A: There is no fixed time frame for order flow analysis. Traders may use various time frames based on their trading objectives and strategies.

Q: Can Forex order flow analysis be used in conjunction with technical analysis?

A: Yes, order flow analysis can complement technical analysis and provide additional insights for traders.

Q: Is Forex order flow analysis suitable for day traders?

A: Yes, order flow analysis can be highly beneficial for day traders seeking to capitalize on intraday price movements.

Q: How can I improve my order flow analysis skills?

A: Improving order flow analysis skills requires practice, studying market patterns, and seeking guidance from experienced traders.

Q: Does order flow analysis work for all currency pairs?

A: Yes, order flow analysis can be applied to all currency pairs traded in the Forex market.

Q: Can order flow analysis predict major market events?

A: While order flow analysis can provide valuable insights, it cannot guarantee the prediction of major market events.

Footnote

In Summary, forex order flow is a dynamic and vital aspect of the foreign exchange market. Traders who master the art of analyzing order flow gain a significant advantage in making informed trading decisions. By understanding the nuances of Forex order flow, traders can navigate the complexities of the market with confidence and precision. Incorporating order flow analysis into their strategies, traders can enhance their potential for success in the competitive world of Forex trading.

Discussion