Forex Market Maker: Providing Liquidity and Facilitating Currency Trading

The foreign exchange (forex) market is the largest and most liquid financial market in the world, with trillions of dollars traded daily. At the heart of this vast market are forex market makers – crucial players responsible for ensuring smooth and efficient currency trading. In this article, we will explore the role of forex market makers, their functions, and their significance in the forex ecosystem.

Table Content

1. What is a Forex Market Maker?

2. How Do Forex Market Makers Operate?

3. Key Functions of Forex Market Makers

4. Advantages of Forex Market Makers

5. Disadvantages of Forex Market Makers

6. Footnote

What is a Forex Market Maker?

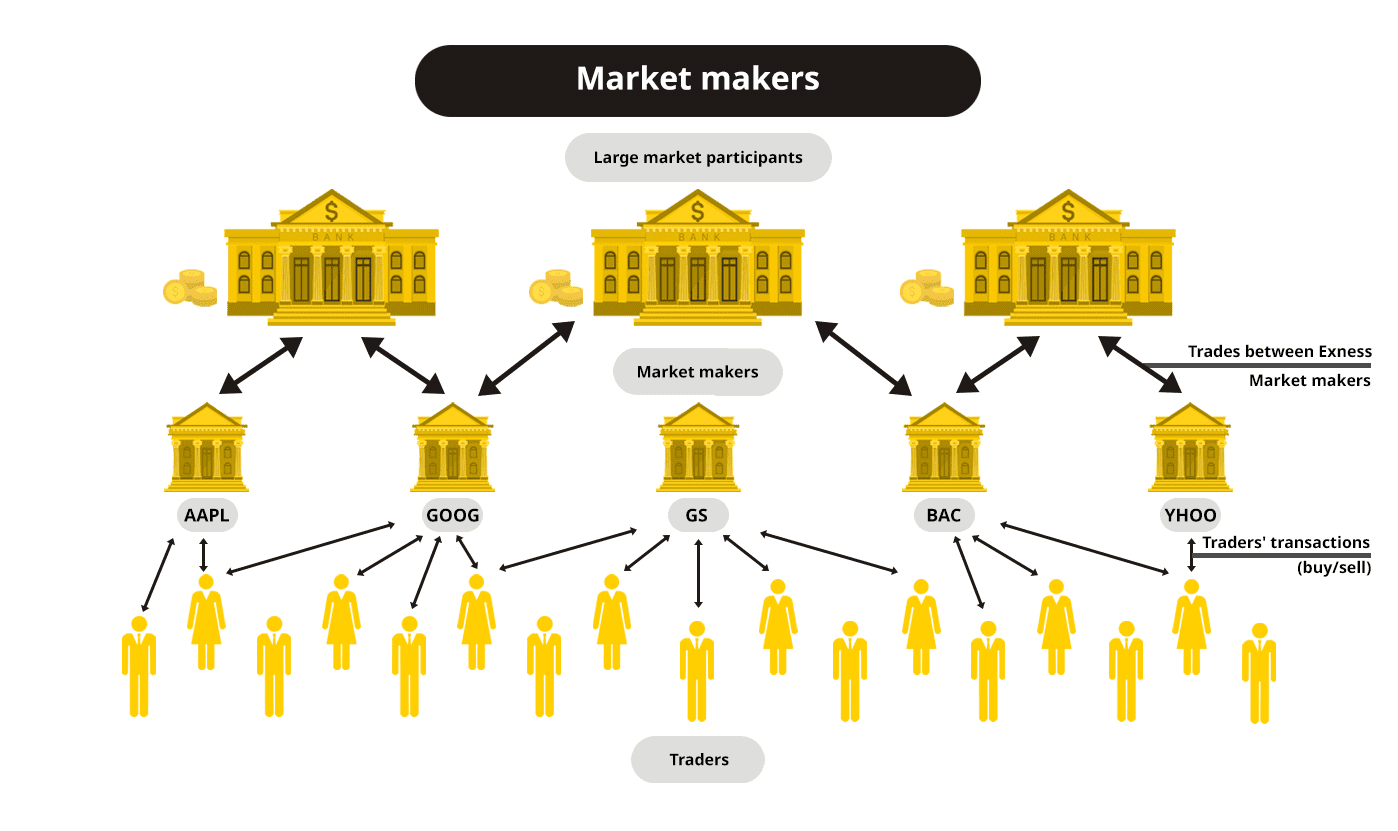

A forex market maker refers to a broker or financial institution that acts as an intermediary between buyers and sellers in the forex market. Their primary responsibility is to provide liquidity by creating a market for various currency pairs. Market makers facilitate trading by offering competitive bid and ask prices at which traders can buy or sell currencies. They play a vital role in ensuring that there are always willing buyers and sellers for any given currency pair, thus enhancing market efficiency and stability.

How Do Forex Market Makers Operate?

Forex market makers operate by maintaining an inventory of currencies. When a trader places an order to buy or sell a currency pair, the market maker uses its inventory to fulfill the trade. In doing so, the market maker assumes the risk of holding the position until it finds a counterparty for the trade. This risk is managed by the market maker through various hedging strategies and risk management techniques.

Key Functions of Forex Market Makers

- Providing Liquidity: One of the primary functions of market makers is to provide liquidity to the forex market. By offering competitive bid and ask prices, they ensure that traders can easily execute their orders without significant price slippage.

- Setting Bid and Ask Prices: Market makers determine the bid and ask prices for currency pairs based on various factors such as market conditions, supply and demand dynamics, and the overall economic environment.

- Executing Orders: When traders place market orders, market makers execute them immediately at the best available price from their inventory. They also fulfill limit orders when the specified price conditions are met.

- Absorbing Price Volatility: Market makers help stabilize the forex market by absorbing sudden price fluctuations. They use their vast resources to prevent extreme price spikes and maintain a more orderly market.

- Facilitating Large Trades: For institutional traders and those dealing with substantial trade volumes, market makers can handle large orders without significantly impacting market prices.

- Profit Generation: Market makers earn profits from the spread, which is the difference between the bid and ask prices. They aim to buy at a lower price and sell at a slightly higher price, earning a profit from each trade.

Advantages of Forex Market Makers

- Increased Market Liquidity: Market makers ensure there are always buyers and sellers in the market, even during times of low trading activity.

- Fast Order Execution: Market makers allow for quick and seamless order execution, especially in liquid currency pairs.

- Fixed Spreads: Some market makers offer fixed spreads, providing traders with price certainty, particularly during high market volatility.

- Anonymity: Market makers provide anonymity to traders, which can be beneficial for those who wish to keep their trading strategies private.

Disadvantages of Forex Market Makers

- Conflict of Interest: As market makers take the opposite side of their clients' trades, there may be a perceived conflict of interest, raising concerns about fair pricing.

- Limited Price Transparency: Market makers do not display the depth of the market, making it difficult for traders to see the true supply and demand levels.

Footnote

In Summary, forex market makers play a critical role in the forex market by providing liquidity, maintaining stable prices, and facilitating currency trading. Their ability to ensure smooth transactions and competitive bid-ask prices makes them an integral part of the forex ecosystem. However, traders should consider the advantages and disadvantages of dealing with market makers and choose their brokers wisely based on their trading needs and preferences. By understanding the role of market makers, traders can navigate the forex market with greater confidence and efficiency.

Discussion