Forex Day Trading: Opening and Closing Trades within the Same Trading Day

In the fast-paced world of financial markets, forex day trading has emerged as a popular strategy for traders looking to capitalize on short-term price movements. This approach involves opening and closing trades within the same trading day, allowing traders to take advantage of small price fluctuations and potentially generate profits. In this article, we will delve into the ins and outs of forex day trading, covering essential strategies, tips, and best practices.

Table Content

1. Understanding Forex Day Trading

2. Getting Started with Forex Day Trading

3. The Best Strategies for Forex Day Trading

4. Tips for Successful Forex Day Trading

5. Footnote

6. FAQs (Frequently Asked Questions)

Understanding Forex Day Trading

Forex, short for foreign exchange, refers to the global decentralized market where currencies are bought and sold. Day trading, on the other hand, involves executing trades within the same trading day, with the aim of profiting from intraday price movements. Forex day trading combines these two concepts, creating an opportunity for traders to leverage currency price fluctuations for short-term gains.

Getting Started with Forex Day Trading

1. Choosing a Reliable Forex Broker

Before you dive into forex day trading, it's crucial to select a reputable and trustworthy forex broker. Look for brokers with low spreads, quick execution times, and strong customer support.

2. Educate Yourself

Equip yourself with a solid understanding of forex trading fundamentals, technical analysis, and various trading strategies. Knowledge is key to making informed decisions and managing risks effectively.

3. Create a Trading Plan

Develop a well-defined trading plan that outlines your risk tolerance, profit goals, and trading strategies. A trading plan will keep you disciplined and focused during your trading sessions.

The Best Strategies for Forex Day Trading

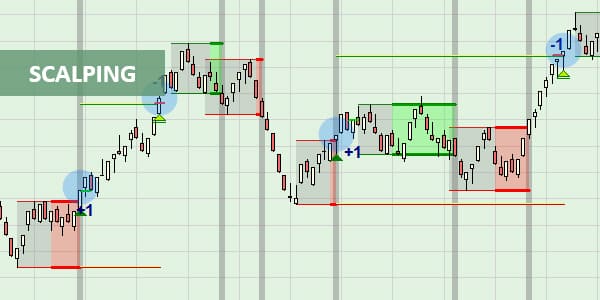

1. Scalping

Scalping involves making multiple trades throughout the day, holding positions for a brief period, usually seconds to minutes. Traders aim to profit from small price movements.

2. Momentum Trading

Momentum trading involves identifying strong trends and riding the wave to maximize profits. Traders focus on currencies with significant price movements and high trading volumes.

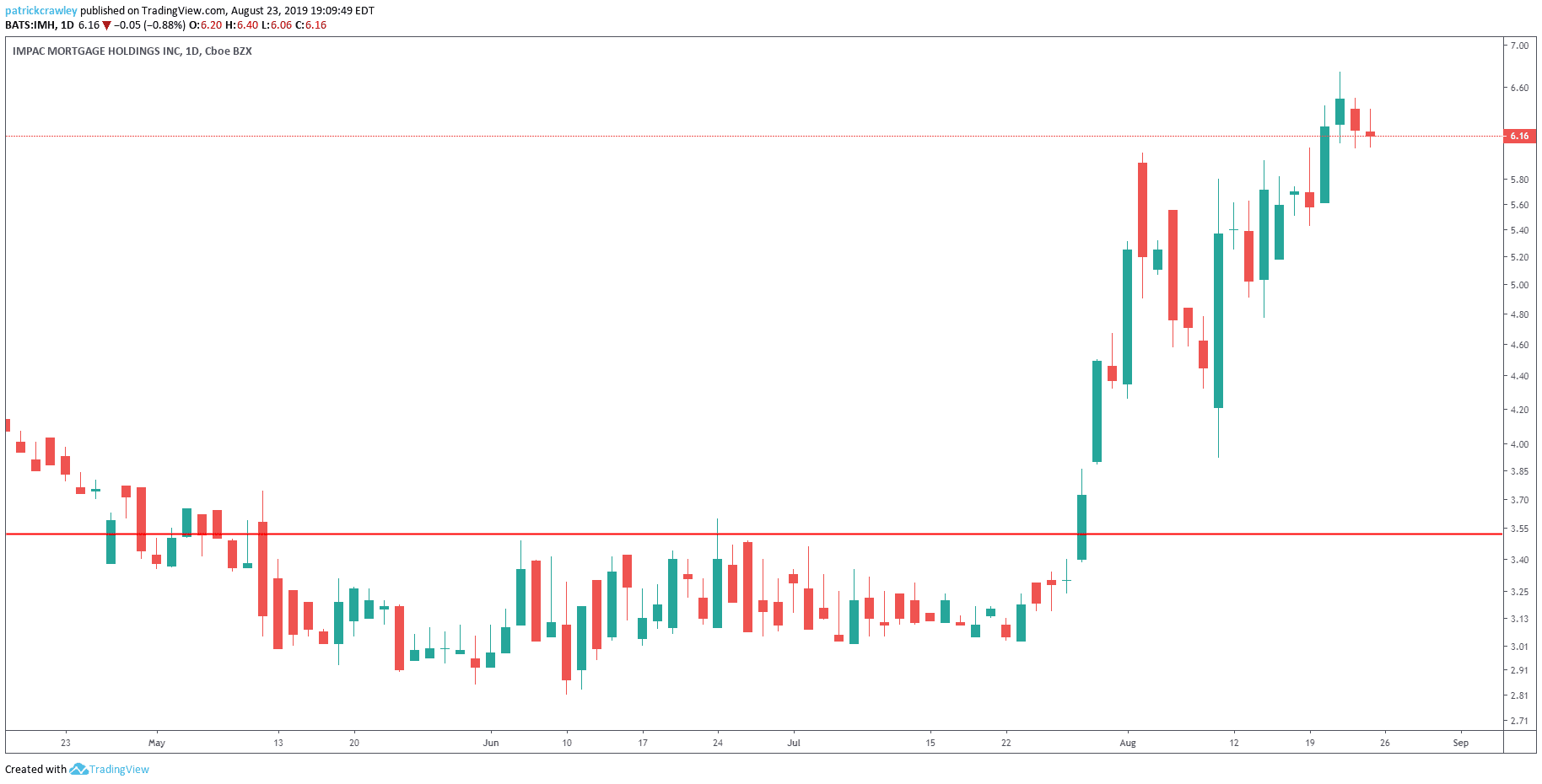

3. Breakout Trading

Breakout trading entails entering a trade when the price breaks through a significant support or resistance level. Traders anticipate substantial price movements after the breakout.

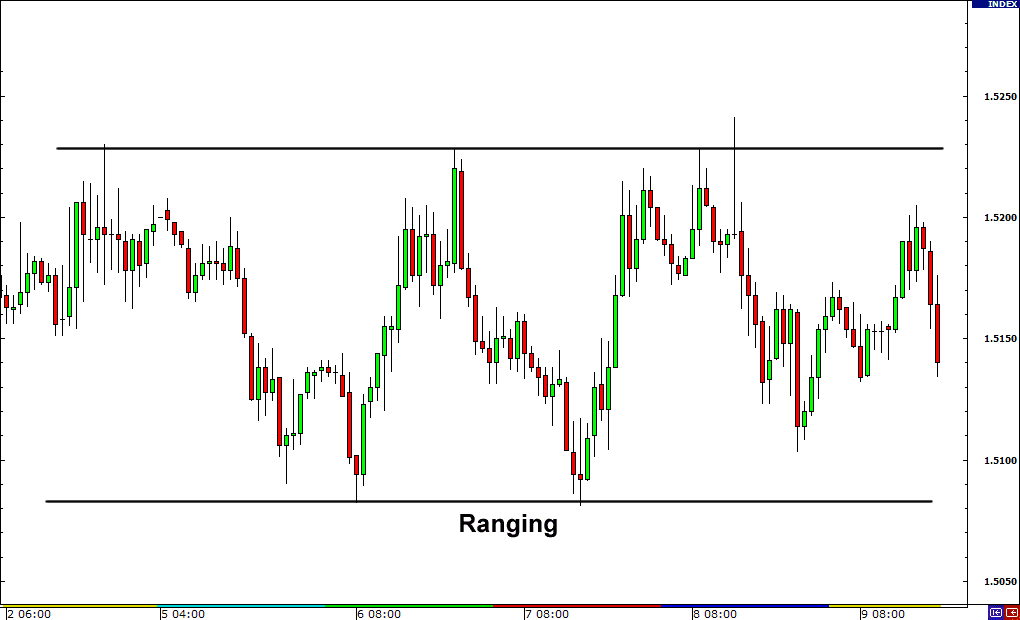

4. Range Trading

Range trading occurs when traders identify a price range where the currency pair's price tends to oscillate. Traders buy at the bottom of the range and sell at the top.

Tips for Successful Forex Day Trading

1. Manage Your Risk

Set strict stop-loss and take-profit levels to limit potential losses and protect your capital.

2. Stick to Liquid Currency Pairs

Trade in liquid currency pairs with high trading volumes to ensure efficient execution and tight spreads.

3. Practice with a Demo Account

Before risking real money, practice your day trading strategies using a demo account to gain experience.

4. Control Your Emotions

Emotional discipline is vital in day trading. Avoid making impulsive decisions driven by fear or greed.

Footnote

In Summary, forex day trading offers an exciting opportunity for traders to profit from short-term currency price movements. However, it comes with its share of risks. Successful day trading requires a blend of knowledge, discipline, and the ability to adapt to market conditions. By following the strategies and tips outlined in this article, you can enhance your chances of success in the dynamic world of forex day trading.

FAQs (Frequently Asked Questions)

Q1: Can anyone start forex day trading?

A: Yes, anyone can start forex day trading, but it requires dedication, knowledge, and risk management skills.

Q2: How much capital do I need to begin forex day trading?

A: The amount of capital needed varies, but it's advisable to start with an amount you can afford to lose and gradually increase as you gain experience.

Q3: Are there risks in forex day trading?

A: Yes, forex day trading involves risks due to the volatile nature of the forex market. Proper risk management is crucial.

Q4: What is the best time of day to trade forex?

A: The best time to trade depends on the currency pairs you choose and your trading strategy. Some traders prefer highly active market hours.

Q5: Can I use leverage in forex day trading?

A: Yes, leverage is commonly used in forex day trading, but it amplifies both potential profits and losses.

Discussion