Forex currency pairs: Combinations of two different currencies traded in the forex market.

The forex market is an intricate financial ecosystem where currencies from different countries come together, creating unique combinations known as Forex currency pairs. These pairs hold immense importance as they are the foundation of all forex trading. In this comprehensive guide, we will delve into the world of Forex currency pairs, their significance, trading strategies, and more.

The Basics of Forex Currency Pairs

Forex currency pairs represent the relative value of one currency against another. Each pair consists of two currencies, with the first currency being the "base currency" and the second one referred to as the "quote currency." For instance, in the EUR/USD pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency.

Major Currency Pairs

The major currency pairs are the most heavily traded pairs in the forex market. They include EUR/USD, GBP/USD, USD/JPY, USD/CHF, and more. These pairs have high liquidity and are often influenced by global economic and political events.

Minor Currency Pairs

Also known as "cross currency pairs," minor currency pairs do not involve the US dollar as the base or quote currency. Examples include EUR/GBP, GBP/JPY, and AUD/CAD. These pairs are less liquid but still offer trading opportunities.

Exotic Currency Pairs

Exotic currency pairs involve a major currency paired with the currency of a developing or small economy. Examples include USD/TRY, EUR/TRY, and USD/ZAR. These pairs have low liquidity and higher spreads, making them riskier to trade.

The Significance of Forex Currency Pairs

Understanding the significance of forex currency pairs is crucial for successful trading. Here are some key factors to consider:

Volatility and Risk

Volatility varies among currency pairs, affecting the level of risk associated with each trade. Major pairs are generally less volatile, making them suitable for beginners, while exotic pairs can experience significant price swings, appealing to more experienced traders.

Correlation

Currency pairs can be positively or negatively correlated. Positive correlation means two pairs move in the same direction, while negative correlation indicates they move in opposite directions. Understanding correlations helps traders diversify their portfolios and manage risk.

Pips and Pipettes

Pips and pipettes are units used to measure price movement in forex trading. Most currency pairs are quoted to four decimal places, with the smallest price movement being one pip. Some pairs, especially yen-based ones, are quoted to two decimal places, and their smallest movement is called a pipette.

Economic Indicators

Economic indicators and news events significantly impact currency pairs. Traders need to stay informed about economic data releases, central bank decisions, and geopolitical events to make informed trading decisions.

Forex Currency Pair Trading Strategies

To navigate the forex market successfully, traders employ various strategies to capitalize on currency pair movements. Let's explore some popular strategies:

1. Trend Trading

Trend traders identify and follow the prevailing market trends. They aim to enter positions in the direction of the trend, either buying during an uptrend or selling during a downtrend.

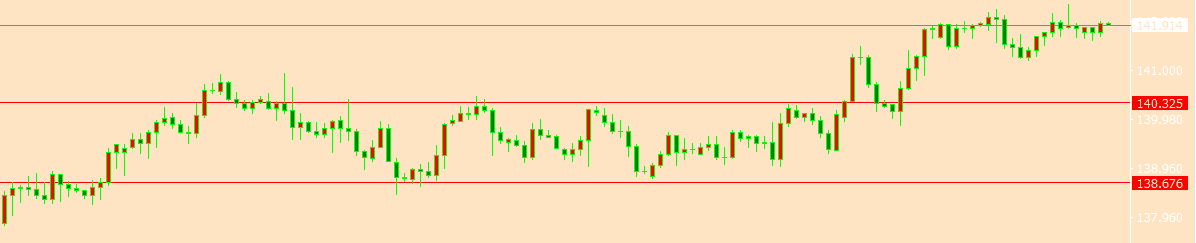

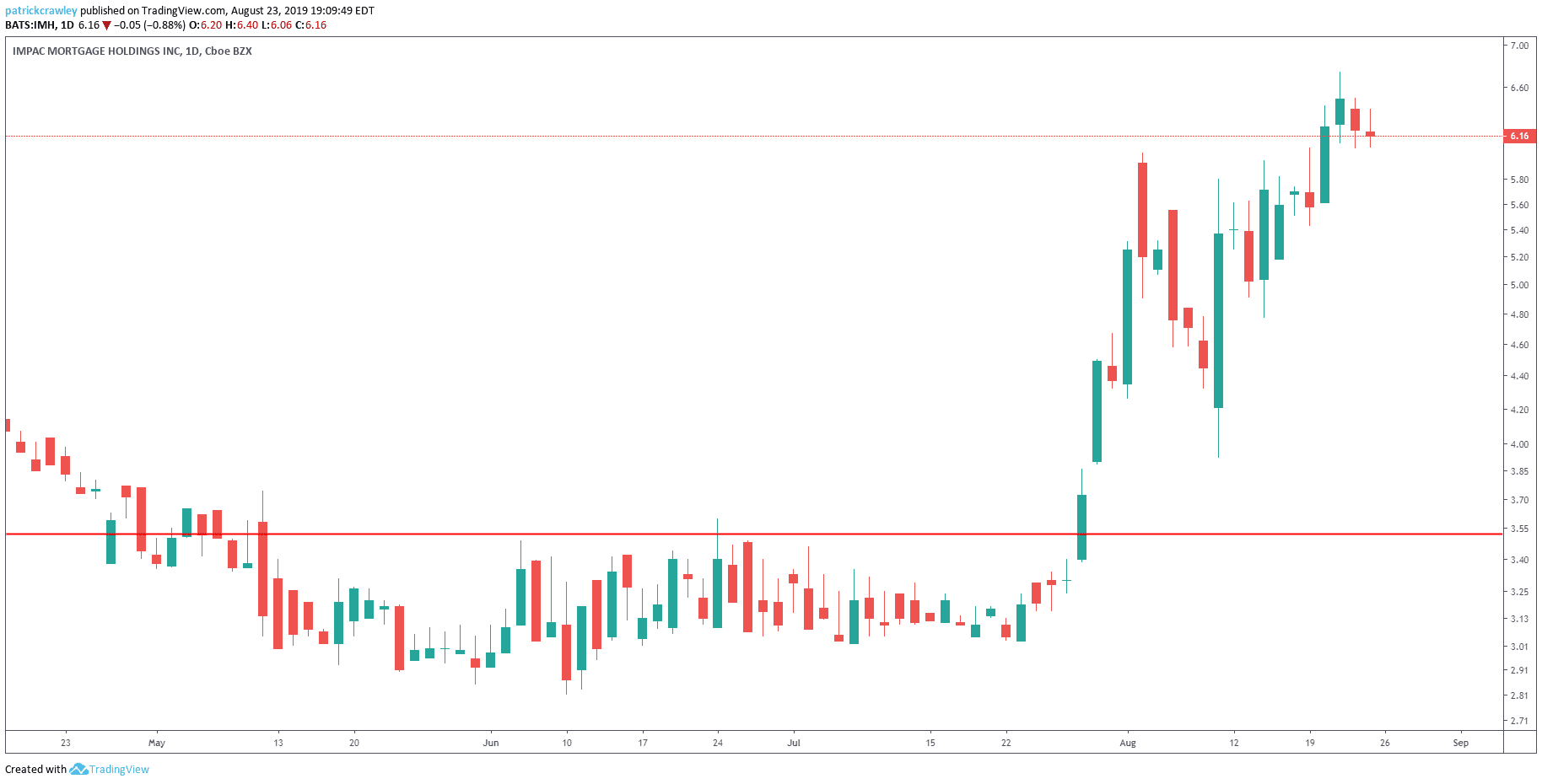

2. Range Trading

Range traders focus on currency pairs that have established support and resistance levels. They buy near support and sell near resistance, profiting from price oscillations within the range.

3. Breakout Trading

Breakout traders anticipate significant price movements and enter positions when prices break through key support or resistance levels. This strategy aims to capitalize on strong trends.

4. Carry Trade

Carry trade involves borrowing funds in a currency with a low-interest rate and investing in a currency with a higher interest rate. Traders profit from the interest rate differential between the two currencies.

5. News Trading

News traders react to economic data releases and news events. They analyze the impact of such events on currency pairs and execute trades based on the resulting volatility.

Risks and Tips for Forex Currency Pair Trading

Trading forex currency pairs can be highly rewarding, but it also involves certain risks. Here are some tips to navigate the challenges successfully:

- Risk Management

Implementing proper risk management strategies is vital. This includes setting stop-loss and take-profit orders to limit potential losses and secure profits.

- Stay Informed

Keep abreast of the latest market news, economic indicators, and geopolitical events that can impact currency pairs.

- Use Leverage Wisely

Leverage can amplify profits, but it also magnifies losses. Use leverage cautiously and according to your risk tolerance.

- Practice with Demo Accounts

Before trading with real money, practice using demo accounts to gain experience and confidence.

Footnote

Forex currency pairs play a pivotal role in the dynamic world of forex trading. Understanding the intricacies of each pair, employing effective trading strategies, and managing risks are essential for success. Stay informed, remain disciplined, and continuously improve your trading skills to thrive in this fast-paced market.

FAQs After The Conclusion

- What are the best times to trade forex currency pairs?

- The best times to trade forex pairs are during overlap periods when multiple major markets are open simultaneously, like the London and New York sessions.

- How can I predict currency pair movements accurately?

- While predicting forex movements with certainty is challenging, you can use technical analysis, fundamental analysis, and a combination of both to make informed predictions.

- What is the significance of the US dollar in forex trading?

- The US dollar is the world's primary reserve currency and acts as the benchmark for many other currencies, making it essential in forex trading.

- Are exotic currency pairs suitable for beginners?

- Exotic pairs are generally riskier due to lower liquidity and higher spreads, making them more suitable for experienced traders.

- Can I trade forex currency pairs with a small budget?

- Yes, many brokers offer the option to trade with small account sizes, allowing traders with limited budgets to participate in forex trading.

Discussion