Forex Correlation: The Relationship Between Different Currency Pairs' Price Movements

In the dynamic world of Forex trading, understanding the correlation between different currency pairs' price movements is a key skill that can significantly impact your trading strategies. The concept of Forex correlation, also known as currency correlation, refers to the relationship between the price movements of two or more currency pairs. It helps traders identify patterns and trends in the market, allowing them to make better-informed decisions and manage risk more effectively.

Throughout this comprehensive article, we will delve into the depths of Forex correlation, exploring its significance, its various types, and the methods to calculate it. Additionally, we will provide you with essential insights, expert advice, and practical examples to help you grasp this complex yet rewarding concept fully.

Table Content

1. Forex Correlation: Understanding the Basics

2. What is Forex Correlation?

3. Significance of Forex Correlation

4. Types of Forex Correlation

5. Calculating Forex Correlation

6. Leveraging Forex Correlation in Trading

7. Factors Influencing Forex Correlation

8. Challenges and Limitations of Forex Correlation

9. FAQs about Forex Correlation

10. Footnote

Forex Correlation: Understanding the Basics

In this section, we will cover the fundamental aspects of Forex correlation, setting the foundation for a deeper understanding.

What is Forex Correlation?

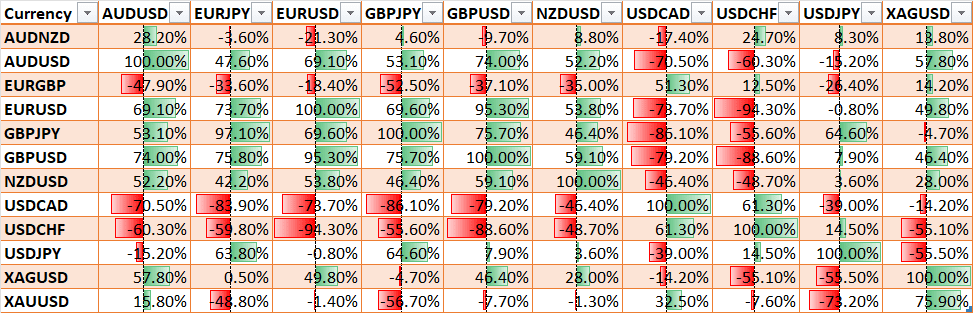

Forex correlation is a statistical measure that quantifies the relationship between the price movements of two or more currency pairs. It ranges from -1 to +1, where -1 represents a perfect negative correlation (inverse movement), +1 signifies a perfect positive correlation (similar movement), and 0 denotes no correlation (random movement).

Significance of Forex Correlation

Understanding Forex correlation is crucial as it allows traders to identify the relationships between different currency pairs, enabling them to anticipate market movements and optimize their trading strategies.

Types of Forex Correlation

In this section, we will explore the various types of Forex correlation and how they impact currency pairs' price movements.

1. Positive Correlation

Positive correlation refers to a situation where two currency pairs move in the same direction. When one pair appreciates, the other also tends to appreciate, and vice versa. A classic example of positive correlation is the EUR/USD and GBP/USD pairs.

2. Negative Correlation

Negative correlation, on the other hand, refers to a scenario where two currency pairs move in opposite directions. When one pair gains value, the other tends to lose value, and vice versa. A common example of negative correlation is the USD/JPY and USD/CHF pairs.

3. Neutral Correlation

Neutral correlation, also known as zero correlation, implies that there is no discernible relationship between the price movements of two currency pairs. Traders often encounter neutral correlation in less commonly traded pairs.

Calculating Forex Correlation

In this section, we will explore the methods and tools used to calculate Forex correlation and how to interpret the results.

1. Using Excel or Spreadsheet Software

One of the simplest ways to calculate Forex correlation is by using Excel or any other spreadsheet software. By inputting historical price data of two currency pairs, traders can utilize various functions to determine the correlation coefficient.

2. Online Correlation Calculator

For traders who prefer a quicker and more straightforward approach, various online correlation calculators are available. These tools allow users to input currency pair symbols and obtain the correlation coefficient instantly.

Leveraging Forex Correlation in Trading

In this section, we will delve into practical applications of Forex correlation in developing effective trading strategies.

1. Portfolio Diversification

Forex correlation plays a pivotal role in portfolio diversification. By selecting currency pairs with low or negative correlation, traders can reduce the overall risk exposure of their portfolios.

2. Hedging Strategies

Traders can use Forex correlation to implement hedging strategies, which involve opening positions in positively correlated currency pairs to offset potential losses.

3. Identifying Trends

Forex correlation assists in identifying trends across multiple currency pairs. Traders can capitalize on these trends to make well-timed and profitable trades.

4. Risk Management

By understanding Forex correlation, traders can manage risk more effectively. They can avoid overexposure to highly correlated pairs, reducing the likelihood of significant losses during adverse market conditions.

Factors Influencing Forex Correlation

In this section, we will explore the various factors that influence Forex correlation and how they can shift over time.

1. Economic Indicators

Economic indicators, such as interest rates, inflation, and GDP, can significantly impact currency pairs' price movements, leading to changes in correlation patterns.

2. Geopolitical Events

Major geopolitical events, such as elections, conflicts, or trade agreements, can create volatility in the Forex market and alter currency pairs' correlation.

3. Market Sentiment

Investor sentiment can influence currency movements and, consequently, Forex correlation. Positive or negative market sentiment may cause shifts in correlation between certain pairs.

Challenges and Limitations of Forex Correlation

In this section, we will discuss the challenges and limitations associated with Forex correlation analysis.

1. Dynamic Nature

Forex correlation is not static and can change over time due to various factors, making it challenging to rely solely on historical data.

2. Black Swan Events

Unforeseen black swan events, such as financial crises or natural disasters, can disrupt correlation patterns and lead to unexpected market movements.

3. False Signals

Traders must exercise caution while interpreting Forex correlation, as false signals or temporary correlations may mislead their trading decisions.

FAQs about Forex Correlation

Here are some frequently asked questions about Forex correlation, along with concise answers:

Q: Is Forex correlation a reliable indicator for trading decisions?

A: While Forex correlation provides valuable insights, it should be used in conjunction with other technical and fundamental analysis tools for well-rounded trading decisions.

Q: Can I apply Forex correlation to all currency pairs?

A: Yes, Forex correlation can be applied to all currency pairs. However, the significance and strength of correlation may vary between different pairs.

Q: Does high correlation always mean a profit opportunity?

A: Not necessarily. High correlation may present profit opportunities, but it also carries higher risk. Traders must consider risk management strategies.

Q: How frequently should I recalculate Forex correlation?

A: The frequency of recalculation depends on your trading style and the timeframes you use. Some traders recalculate daily, while others do it weekly or monthly.

Q: Can Forex correlation predict future price movements accurately?

A: Forex correlation provides a historical relationship between currency pairs but cannot predict future movements with absolute certainty.

Q: Does central bank intervention affect Forex correlation?

A: Yes, central bank interventions can influence Forex correlation by affecting the demand and supply of currencies in the market.

Footnote

Understanding Forex correlation is a powerful tool that can significantly enhance your trading expertise. By recognizing the relationship between different currency pairs' price movements, traders can optimize their strategies, manage risk, and make more informed decisions.

As you delve deeper into the world of Forex correlation, remember that it is essential to complement this knowledge with technical analysis, fundamental analysis, and risk management techniques. Continuously monitor changing correlation patterns and adapt your trading approach accordingly.

Explore, experiment, and learn from experience. Embrace the dynamic nature of the Forex market, and let your understanding of Forex correlation be the guiding light on your trading journey.

Discussion