Forex Copy Trading Services: Enhancing Your Investment Strategy with Smart Trading Platforms

Investing in the foreign exchange (forex) market has long been a popular choice for those seeking lucrative opportunities. However, for many potential investors, navigating the complex world of forex trading can be overwhelming and intimidating. This is where forex copy trading services come to the rescue, offering a simplified and efficient approach to trading in the forex market.

Forex copy trading services have gained significant popularity in recent years, and for good reason. By enabling investors to follow and copy the trades of experienced and successful traders, these platforms provide an excellent opportunity for newcomers and seasoned investors alike to enhance their investment strategy.

In this comprehensive guide, we will explore the concept of forex copy trading, its advantages, how to choose the right platform, and valuable tips for successful copy trading. Whether you're a beginner looking to dip your toes into the forex market or an experienced trader seeking to optimize your portfolio, this article will serve as a valuable resource to empower your investment journey.

Table of Contents

1. Understanding Forex Copy Trading Services

2. Advantages of Forex Copy Trading

3. Choosing the Right Forex Copy Trading Platform

4. Getting Started with Forex Copy Trading

5. Tips for Successful Forex Copy Trading

6. Common Misconceptions about Forex Copy Trading

7. Footnote

8. FAQs

Understanding Forex Copy Trading Services

A. What is Forex Copy Trading?

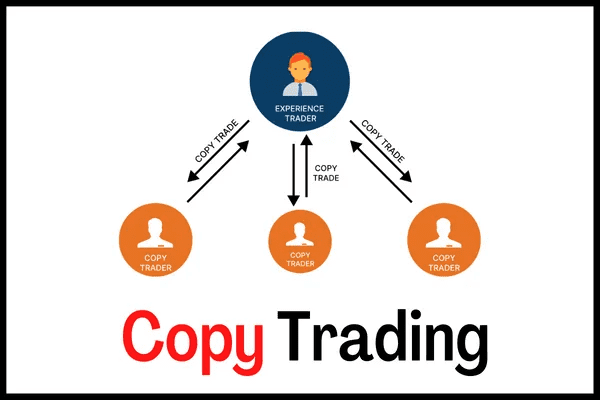

Forex copy trading is a form of social trading that allows investors to automatically copy the trading strategies and positions of skilled and experienced traders. It operates on a platform that facilitates the replication of trades from one trading account (the expert or master trader) to other accounts (the followers or copiers). Essentially, copy trading allows individuals to benefit from the expertise of successful traders without having to actively participate in the trading process themselves.

B. How Does Forex Copy Trading Work?

The operation of forex copy trading platforms is relatively straightforward. When a user signs up for a copy trading service, they gain access to a pool of experienced traders who share their trading data on the platform. The user can browse through the profiles of these traders, analyzing their historical performance, risk levels, and preferred trading instruments.

Once the user identifies a trader they wish to copy, they can allocate a certain portion of their investment capital to mirror the selected trader's trades. From that point on, any trade executed by the expert trader will be automatically replicated in the follower's account, proportionally to the allocated funds.

It's important to note that while the trades are automatically copied, users have the flexibility to intervene and adjust their portfolios as they see fit. They can stop copying a trader, adjust the allocation, or even diversify their investments by copying multiple traders simultaneously.

Advantages of Forex Copy Trading

Forex copy trading offers numerous benefits to investors, making it an attractive option for those looking to optimize their investment strategy. Here are some of the key advantages:

· Access to Expertise

One of the most significant advantages of forex copy trading is the opportunity to access the expertise of seasoned traders. Novice investors can learn from experienced professionals, observing their strategies and decision-making processes. This access to insights from successful traders can be invaluable in improving one's own trading skills and knowledge.

· Diversification of Investments

Diversification is a fundamental principle of sound investing, and copy trading allows investors to achieve diversification easily. By copying multiple traders with different trading styles and focusing on various currency pairs, investors can spread their risk and reduce the impact of any single trader's performance on their overall portfolio.

· Learning Opportunity

Forex copy trading is not just about following blindly; it's also a learning experience. Investors can analyze the trades made by the expert traders and gain insights into the reasoning behind their decisions. This learning opportunity can help investors develop a deeper understanding of the forex market and make more informed choices in the future.

· Time-Saving and Convenience

For individuals with limited time or expertise in forex trading, copy trading offers a convenient solution. Instead of dedicating hours to market research and trading, investors can rely on the expertise of others to make profitable trades on their behalf.

· Risk Management

Copy trading platforms often provide risk management tools that allow investors to set specific parameters for copying trades. By controlling the amount of capital allocated to each trader and defining stop-loss and take-profit levels, investors can manage their risk effectively.

Choosing the Right Forex Copy Trading Platform

Selecting the right forex copy trading platform is crucial to ensure a successful and rewarding experience. Here are some key factors to consider when choosing a platform:

· Reputation and Security

Ensure that the copy trading platform has a solid reputation and a track record of providing reliable services. Look for user reviews and testimonials to gauge the platform's reliability. Additionally, verify that the platform uses robust security measures to protect users' personal and financial information.

· Available Trading Instruments

Different copy trading platforms may offer varying selections of currency pairs and other financial instruments. Choose a platform that provides access to the markets and trading instruments that align with your investment goals and strategies.

· Fee Structure

Consider the fee structure of the copy trading platform. Some platforms charge a flat fee or a percentage of the profits made by copiers, while others may offer commission-based compensation for expert traders. Evaluate the fees and choose a platform that aligns with your budget and investment objectives.

· Risk Management Tools

Examine the risk management tools provided by the platform. The ability to set stop-loss and take-profit levels and adjust the allocation of funds among different traders is essential for managing risk effectively.

· User-Friendly Interface

A user-friendly and intuitive interface is essential for seamless navigation and efficient use of the copy trading platform. Choose a platform that is easy to use, even for beginners, to ensure a smooth user experience.

Getting Started with Forex Copy Trading

Once you've chosen the right copy trading platform, follow these steps to get started with your copy trading journey:

· Account Creation

Create an account on the chosen copy trading platform by providing the required personal information and agreeing to the terms and conditions.

· Selecting the Traders to Copy

Browse through the list of available expert traders on the platform. Analyze their trading history, risk levels, and performance metrics. Choose one or multiple traders whose strategies align with your investment goals.

· Setting Risk and Portfolio Allocation

Decide on the amount of capital you wish to allocate to each trader you're copying. Set risk parameters, including stop-loss and take-profit levels, to control the risk associated with copying specific traders.

· Monitoring and Adjusting Your Portfolio

Keep a close eye on the performance of the traders you're copying. Regularly review their trades and assess their impact on your overall portfolio. Make adjustments as necessary, such as diversifying your investments or stopping copying underperforming traders.

Tips for Successful Forex Copy Trading

While forex copy trading offers great potential, it's essential to approach it with a strategic mindset. Here are some tips to maximize your chances of success:

· Conduct Thorough Research

Before selecting traders to copy, conduct thorough research into their trading strategies and historical performance. Look for consistency in their results and align their trading styles with your risk tolerance and investment objectives.

· Diversify Your Portfolio

Copying multiple traders with diverse trading strategies can help reduce risk and enhance the potential for returns. Diversification spreads risk and ensures that a single trader's performance does not significantly impact your overall investment.

· Manage Risk Effectively

While copy trading can be relatively low-risk compared to individual trading, it's essential to manage risk prudently. Set appropriate stop-loss levels and avoid allocating a significant portion of your capital to a single trader.

· Regularly Review and Adjust

The forex market is dynamic, and traders' performance can change over time. Regularly review the performance of the traders you're copying and be prepared to make adjustments to your portfolio as needed.

Common Misconceptions about Forex Copy Trading

Despite its many advantages, forex copy trading is sometimes subject to misconceptions. Let's address some common myths:

· It's a Get-Rich-Quick Scheme

Forex copy trading is not a guarantee of overnight wealth. While it can be profitable, success requires research, strategic decision-making, and patience.

· Lack of Control

While copy trading involves replicating expert traders' trades, investors still retain control over their portfolios. They can adjust allocations, stop copying traders, or even intervene manually if they choose to do so.

· All Traders Are Equally Skilled

Not all traders on copy trading platforms have the same level of expertise. Conduct due diligence to identify traders with a proven track record of success.

Footnote

Forex copy trading services have revolutionized the way individuals participate in the forex market. By allowing investors to copy the trades of experienced traders, these platforms provide an accessible and efficient approach to forex trading. Whether you're a novice looking to learn from the best or a seasoned investor seeking to diversify your portfolio, forex copy trading offers numerous advantages and learning opportunities.

Remember to choose a reputable copy trading platform, conduct thorough research before copying traders, and employ effective risk management strategies. While forex copy trading can simplify the investment process, success ultimately depends on the commitment to learning, strategic decision-making, and disciplined execution.

FAQs

Q: What is forex copy trading?

A: Forex copy trading enables investors to automatically replicate the trades of experienced traders, known as experts, in their own trading accounts.

Q: Can I intervene in the copied trades?

A: Yes, as a copier, you can still intervene in the copied trades. You can adjust allocations, stop copying a trader, or manually close trades.

Q: Is forex copy trading a guaranteed way to make profits?

A: No, forex copy trading is not a guaranteed profit-making method. Success depends on several factors, including thorough research, risk management, and aligning with skilled traders.

Q: How many traders can I copy simultaneously?

A: The number of traders you can copy depends on the copy trading platform's rules and your risk tolerance. You can choose to copy multiple traders if the platform allows it.

Q: Are there risks associated with forex copy trading?

A: While forex copy trading reduces the need for in-depth market knowledge, it still involves risks. It's crucial to employ risk management strategies and diversify your portfolio to mitigate potential losses.

Discussion