Forex Brokers: Making Forex Trading Accessible to All

In the huge and dynamic financial world, forex trading is a major part of it. The market for foreign exchange, sometimes referred to as Forex, is the place where currency can be bought and sold, offering traders and investors the to profit on the fluctuations in exchange rates. However, how does one get into this market and get through the many complexities? This article will help you understand this process by shedding light on Forex brokers. They are platforms or companies that provide Forex trading for individual traders as well as institutions.

Table Content

1. Understanding Forex Trading

2. The Basics of Currency Pairs

3. The Role of Market Participants

4. What Are Forex Brokers?

5. Defining Forex Brokers

6. Types of Forex Brokers

7. The Advantages of Using Forex Brokers

8. How to Choose the Right Forex Broker

9. Getting Started with Forex Trading

10. Trading Strategies for Success

11. Common Pitfalls to Avoid

12. Footnote

13. FAQs

Understanding Forex Trading

Before we get deep into the world of brokers for forex, it is crucial to comprehend the basics of trading in forex. Fundamentally the forex market involves trading one currency for another and anticipating fluctuations in exchange rates, enabling profitable transactions. It is open 24/7 and is spread across various locations around the world.

The Basics of Currency Pairs

The foundation of forex trading is the use of currencies. Every transaction involves two currencies: an initial currency and the quote currency. Understanding the dynamic between these two pairs is vital to your success in the Forex market.

The Role of Market Participants

The forex market is a welcoming place for many players, including traders who are individuals and financial institutions, hedge funds, and central banks. Each player plays its own function, which contributes to the liquidity of the market and its volatility.

What Are Forex Brokers?

After we've laid the basis of forex trading, Let's look at the crucial function of brokers for forex in this wider ecosystem.

Defining Forex Brokers

They are intermediaries who help bridge the gap between forex traders and the market. They offer a way for institutions and individuals to manage trades effectively. By providing the ability to access trading charts, analytical tools, as well as instant quotes, Forex brokers enable their customers to make educated choices.

Types of Forex Brokers

The Forex broker comes in many types, meeting different needs and requirements:

1. Dealing Desk Brokers

Dealing desk brokers, sometimes known as market makers, make their own market for customers. They provide prices for both selling and buying and can also take on the positions of their trading counterparts. Although this type of model provides instant execution, some might be concerned about the possibility of conflicts.

2. No Dealing Desk Brokers

However, brokers that do not have a dealing desk connect directly with liquidity suppliers. This approach ensures transparency and could lead to improved pricing. However, execution time is subject to change during periods of high market fluctuations.

The Advantages of Using Forex Brokers

Forex brokers offer an array of benefits to traders. They are an integral component of trading in forex.

i. Access to Leverage

Leverage lets traders control greater positions for a lesser initially invested amount, which can increase profit opportunities. But, it's important to utilize leverage wisely since it increases possible loss.

ii. Diverse Trading Platforms

Forex brokers provide a variety of user-friendly trading platforms that are suitable for both novice and skilled traders. They are often with sophisticated charting tools as well as technical indicators.

iii. Educational Resources

Numerous forex brokers provide educational materials, like webinars, tutorials, and market analysis. These resources allow traders to improve their abilities as well as their knowledge.

How to Choose the Right Forex Broker

Finding the most suitable broker for your forex trading is crucial to ensure the best trading experience. Be aware of the following elements in deciding on a broker:

i. Regulatory Compliance

The forex brokers that are licensed by the government offer an assurance of protection for your money. Make sure that the broker you choose is licensed and monitored by financial regulators relevant to the area.

ii. Trading Costs

Be aware of commissions, spreads, and fees for overnight trading. These expenses can greatly impact your profits in trading.

iii. Customer Support

Reliable customer service is crucial for a successful market. Check out the support channels of your broker to determine their speed of response.

iv. Trading Instruments

There are a variety of brokers that offer different types of trading instruments. Select a broker that is compatible with your preferences in trading.

v. Account Types

Please take note of the kinds of broker accounts that are available because they might differ in features as well as requirements for deposits.

Getting Started with Forex Trading

After you have a better understanding of the importance of forex brokers and the best way to select the best one, let's follow an easy step-by-step approach to getting to grips with the forex market.

Step 1: Education Is Key

Start by informing yourself about the market for forex. Be familiar with strategies for trading as well as risk management and the analysis of markets.

Step 2: Set Up a Demo Account

The majority of forex brokers provide demo accounts that have virtual money. Make use of this to test trading with no risk of real money.

Step 3: Develop a Trading Plan

Develop a carefully thought-out plan for trading that is compatible with your financial goals as well as your risk-taking capacity. Your trading plan is your plan of action in the constantly changing Forex market.

Step 4: Choose a Reliable Forex Broker

Review the points that were mentioned previously and pick the most reliable forex broker that fulfills your needs.

Step 5: Test Your Strategy

Apply your strategy to trading using the demo account, and analyze its performance. Modify your strategy as necessary for consistently good outcomes.

Step 6: Fund Your Live Account

When you are confident about your trading plan, you can add funds to your live account using the amount you are able to risk losing.

Step 7: Start Trading!

After you have your account live being funded, you're now all set to start the journey of trading forex. Be sure to adhere to your plan of trading and take care to manage risk effectively.

Trading Strategies for Success

The Forex market offers a variety of strategies that can be adapted to various styles of trading and risk preferences. Here are some strategies that have been praised by many:

i. Scalping

The process of scaling involves the making of multiple trading sessions throughout the day in order to make money from tiny fluctuations in price. The strategy demands concentration and a certain amount of discipline.

ii. Day Trading

Day traders trade and close positions on the same day of trading in order to avoid overnight exposure. Analysis of technical aspects plays an essential part when it comes to day trading.

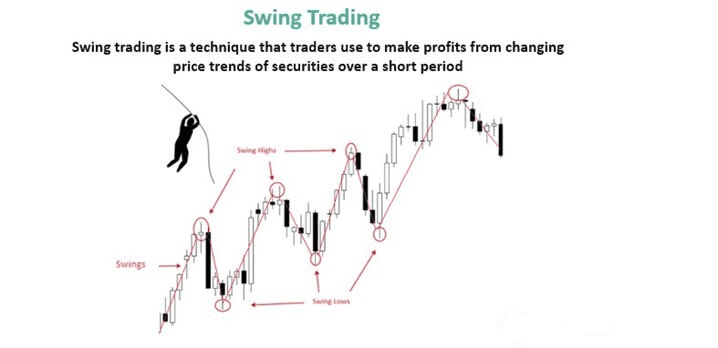

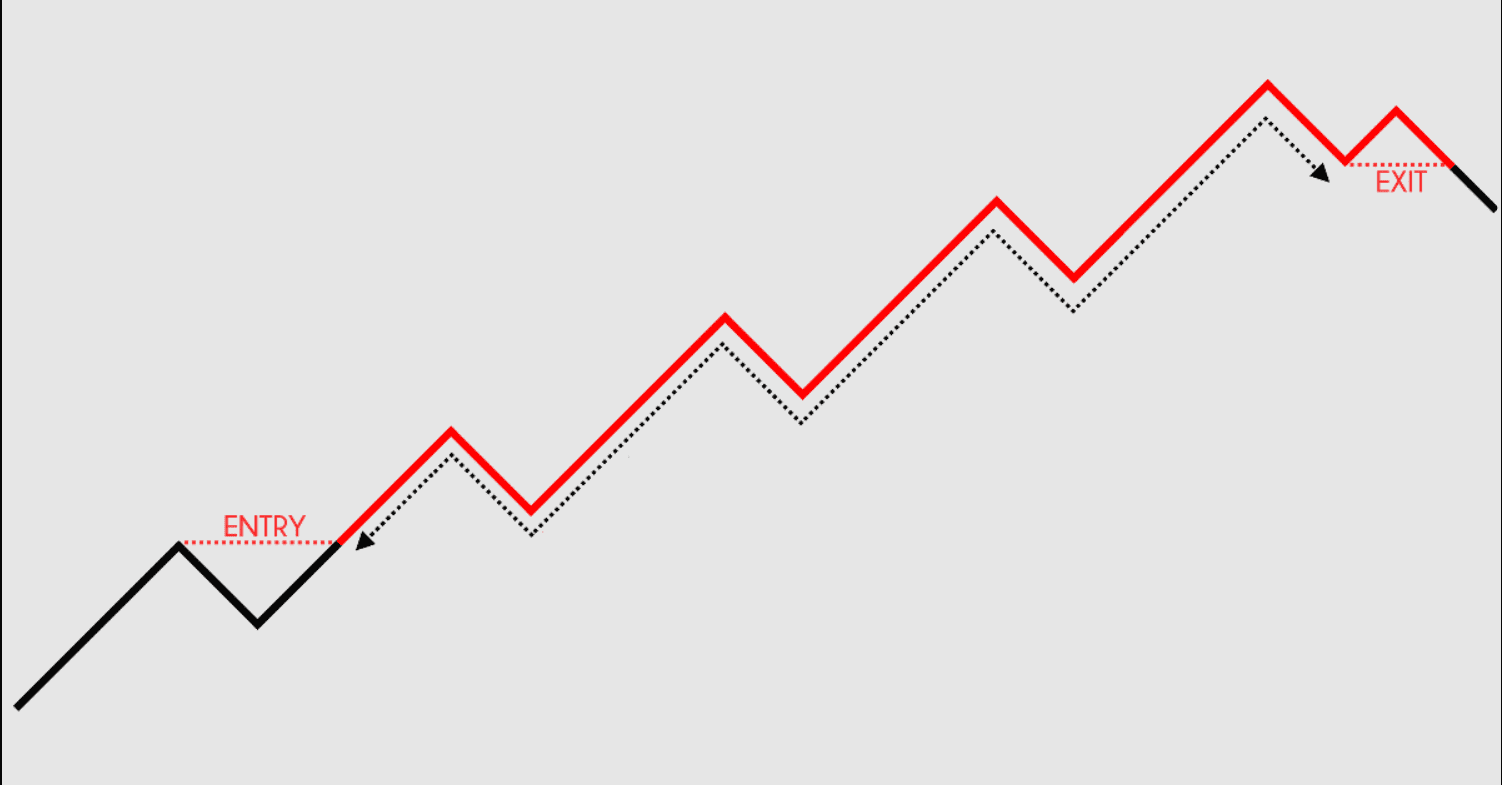

iii. Swing Trading

Swing traders maintain their position for many days and profit from short and medium-term price changes. Analytical analysis can be a great complement to the swing trade.

iv. Position Trading

The traders who trade in positions take a longer-term perspective, holding positions for a period of weeks or months. The strategy involves studying macroeconomic and economic indicators.

Common Pitfalls to Avoid

Like any other financial venture, Forex trading comes with its own challenges. Pay attention to these commonly fallacious risks to ensure the safety of your trading capital

i. Overtrading

In excess, trading may cause emotional decision-making and even losses. Be consistent with your strategy and stay clear of impulsive decisions.

ii. Ignoring Risk Management

The ability to manage risk effectively is crucial to protect capital. Beware of taking too much risk for a single trade, and utilize stop-loss options.

iii. Chasing Losses

Losing a trade is common; however, chasing loss can result in a larger loss. Be disciplined and learn from the mistakes you make.

Footnote

The role of brokers in the forex market is crucial. Function in providing access to the market for forex that allows individuals as well as institutions to take part in the currency market. If one is aware of the fundamentals of foreign exchange trading and choosing the right broker, one is able to embark on a profitable and profitable adventure. Make sure you continue to educate yourself to improve your techniques and take care to manage risk effectively.

FAQs

1. Is there a minimum amount necessary to open a Forex trading account?

The minimum amount of deposit needed differs among brokers. Some offer accounts that require just $50, and others require a greater starting investment.

2. Are there ways to trade currency without the use of a forex broker?

Forex brokers are not important intermediaries between traders and the foreign exchange market. They offer the platform and instruments for trading.

3. What is the maximum leverage I should utilize in my forex trading?

The right leverage is contingent upon your tolerance to risk and the trading strategy. In general, traders who are conservative use lesser leverage. On the other hand, reckless traders could choose greater leverage.

4. Are there any risks in the trading of forex?

Forex trading is a risky business. Inherent risk because of its volatility. It is essential to use the right strategies to manage risk and protect your money.

5. Can I trade forex on a mobile device?

There are many brokers that provide mobile-friendly trading applications which allow traders to get access to markets and trade from anywhere.

Discussion