FBS Broker Review 2023: Regulations, Trading Platforms, Instruments, Pros, and Cons

FBS stands as a prominent online brokerage platform specializing in forex and CFD trading. Our comprehensive review for the year 2023 delves into crucial aspects of this broker, including its legitimacy, leverage options, spreads, demo accounts, and minimum deposit requirements. Discover whether an FBS account aligns with your trading goals.

Background and Notable Achievements

Established in 2009 by a group of enthusiastic investors with a keen interest in trading research and technical analysis, the FBS CFD trading platform has evolved into a globally recognized brand. It serves the needs of over 27 million CFD traders worldwide, providing them with transparent and reliable trading applications.

Today, FBS operates as an international brand, extending its services to more than 150 countries. The FBS umbrella encompasses multiple entities, each offering Margin FX and CFD trading opportunities:

- FBS Markets Inc. (licensed by IFSC)

- Tradestone Ltd. (licensed by CySEC)

- Intelligent Financial Markets Pty Ltd. (licensed by ASIC)

- TRADE STONE SA (PTY) LTD. (licensed by FSCA)

Trading Platforms

FBS adopts a non-dealing desk (NDD) system with an electronic communications network (ECN) for swift order execution. Upon registration and login, clients can choose from three distinct trading platforms:

- MetaTrader 4 (MT4): A market-leading platform available for PC download, MT4 offers a rich array of features, including one-click execution, expert advisors (EA) service, an extensive range of technical indicators and charting tools, and support for virtual private server (VPS) usage. FBS also provides MT4 MultiTerminal for clients managing multiple accounts simultaneously.

- MetaTrader 5 (MT5): An enhanced version of MT4, MT5 introduces features like hedging and netting, market depth view, additional technical indicators, and a broader selection of order types and timeframes. Both MT4 and MT5 are accessible through the WebTrader solution, compatible with all major operating systems.

- FBS Trader: Designed for convenience, FBS Trader allows investors to trade various assets, including cryptocurrencies, stocks, gold, and forex, with real-time price alerts and market tracking. The platform facilitates instant deposits, withdrawals, and easy account and order parameter adjustments, making it an excellent choice for beginners.

Available Markets

FBS clients have access to a diverse array of trading opportunities, including:

- Forex: Offering 28 standard currency pairs and 16 exotics.

- Metals: Featuring gold and silver.

- Indices: Providing access to more than 10 cash-based indexes, including NASDAQ.

- Stocks: Limited to global markets and encompassing a wide range of US, UK, and German company shares.

- Energies: Including WTI oil, Brent crude oil, and natural gas.

- Cryptocurrency: A broad range of tokens is accessible through the FBS Trader app, allowing direct trading and multiple pairing options, such as BTC/USD and LTC/USD.

Trading Fees

FBS offers varying spreads based on account type, market, and region. For instance, the EU branch offers an average spread of 0.7 pips for EUR/USD. Additionally, a 0.7% commission is applied to US stock trading. FBS also imposes overnight rollover fees, with certain exceptions like swap-free investing. A fixed-rate option is available for clients from Nigeria, allowing for precise currency exchange rates.

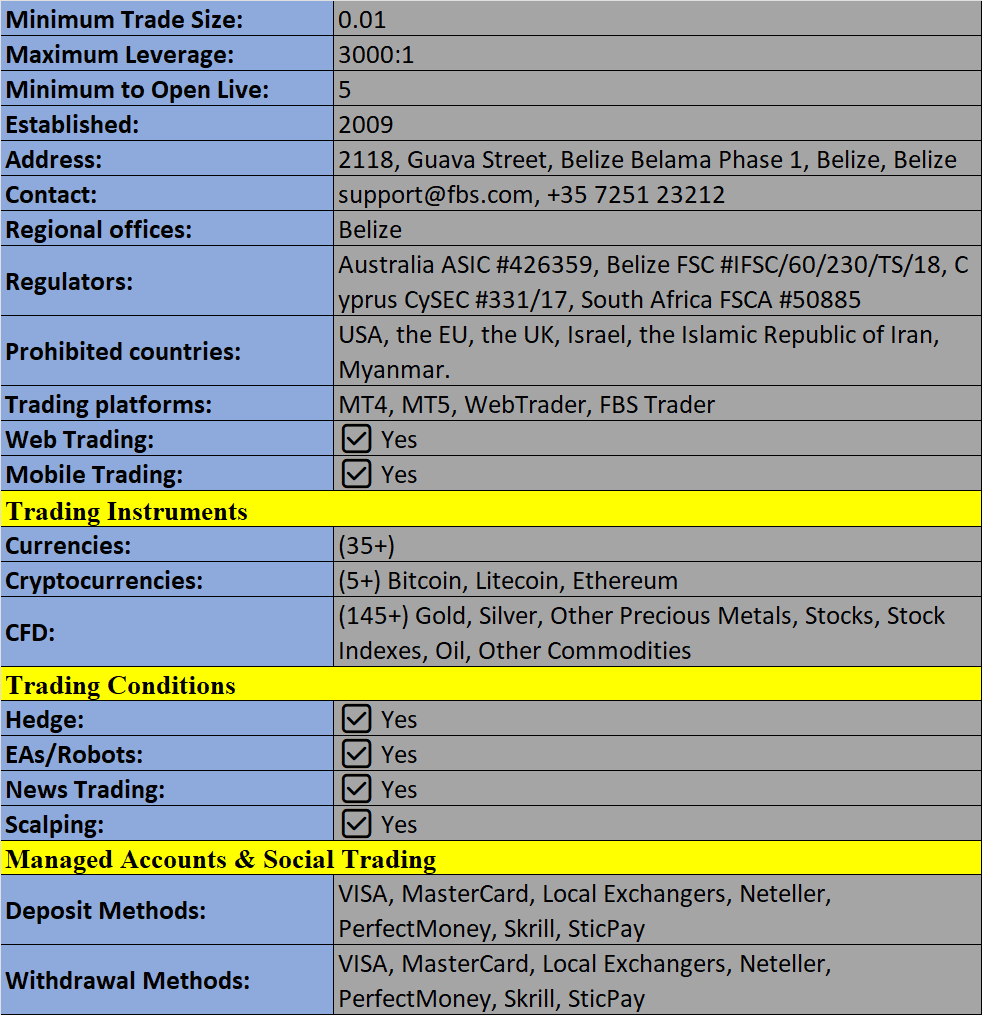

Leverage

Leverage levels depend on the account type and region. In the EU, Standard and Cent account types offer leverage up to 1:30, while Crypto accounts provide 1:2 leverage. Globally, the company extends leverage options up to an impressive 1:3000. FBS enforces a margin call threshold of 40% or lower, following which it reserves the right to close a client's position.

Mobile Apps

Both MetaTrader platforms, MT4 and MT5, are available as mobile apps on the App Store and Google Play. These apps retain the core features of their desktop counterparts, including technical analysis tools and one-click trading.

FBS Trader App is a complimentary, feature-rich trading app that allows users to trade forex and various instruments, access real-time statistics, and manage their accounts with ease.

Deposits & Withdrawals

FBS sets varying minimum deposit requirements depending on the account type and trading region. For instance, the Cent account requires an initial deposit of €10, while the Standard account demands €100. Impressively, Crypto accounts offer a minimal deposit of just $1.

Deposits and withdrawals can be made through multiple methods, including wire transfers, Visa, Maestro, Mastercard, and electronic payment systems like Skrill, Rapid Transfer, and Neteller. Deposits are typically processed instantly, except for wire transfers, which may take up to 48 hours. While FBS does not impose commission fees for these transactions, it's advisable to check with your bank regarding any potential fees. Moreover, clients may be required to submit identification documents for transaction processing.

Demo Account

FBS offers demo versions of Cent and Standard accounts, facilitating practice trading without any deposit obligations. Integration with MT4 and MT5 allows traders to experiment with a variety of instruments. Once comfortable with FBS's services, clients can transition to live accounts.

Trading Bonuses

FBS Global features the 'Level Up' bonus program, wherein clients can receive up to $140 by using the FBS Personal Area App. Additionally, FBS runs a loyalty program offering various perks, including gadgets and cash prizes. Clients can accumulate prize points by participating in the loyalty scheme. Keep in mind that promotions may not be available in certain regions with restrictions, and terms and conditions may dictate expiration dates.

Licensing & Regulation

FBS is a reputable broker with regulatory oversight from esteemed authorities:

- The EU branch operates under the regulation of the Cyprus Securities and Exchange Commission (CySEC).

- The global branch falls under the jurisdiction of the International Financial Services Commission of Belize (IFSC).

- Additional regulatory oversight is provided by the Australian Securities & Investments Commission (ASIC) and the Financial Sector Conduct Authority (FSCA) in South Africa.

For clients in the EU, FBS offers negative balance protection, ensuring retail clients are safeguarded against excessive losses. It's worth noting that FBS does not accept traders from the USA, Japan, Myanmar, Malaysia, Israel, Iran, and Canada due to regulatory restrictions. However, clients from most other countries, including India and Nigeria, are welcome.

Additional Features

FBS's website boasts a comprehensive analysis section that includes educational resources such as courses, a glossary, a guidebook, trading ideas (not a signals service), forex-related news, market updates, and Forex TV, featuring informational videos, weekly insights, and trading plans. The broker also provides an economic calendar accessible through its mobile app, along with forex calculators and extensive educational materials, including live webinars and tutorials.

Although the copy trading app was disabled in 2022, MT4 and MT5 continue to support copy trading alongside expert advisors, serving as a signals service.

Trading Accounts

New clients can select from various live account types, with options varying by region:

- EU offers Crypto, Standard, and Cent accounts.

- The global branch extends its offerings to include Micro, Zero Spread, and ECN accounts.

Order volumes remain consistent across all account types, ranging from 0.01 to 500 lots. Notably, the ECN account imposes no trading limits and executes orders via ECN, distinguishing it from other accounts that utilize STP execution. Generally, higher-tier accounts are associated with more competitive trading conditions.

FBS also caters to aspiring digital currency investors with a dedicated crypto trading account. This account allows clients to trade leading tokens and offers leverage up to 1:5 (limited to 1:2 for EU and UK).

When opening an account, clients are typically required to submit identity verification documents, including proof of name, address, and country of registration.

Trading Hours

The FBS website is accessible 24/7, but trading hours for specific assets depend on the market and timezone. Forex and cryptocurrency markets, however, operate 24 hours a day on weekdays. Additionally, FBS offers a virtual private server (VPS) service, allowing clients to keep their trading platform running on a virtual machine around the clock.

Customer Support

FBS provides customer support services in English and multiple languages, catering to the diverse needs of its clientele. Contact options vary by region:

EU Support:

- Email: info@fbs.eu

- Contact Number: +357 25313540

- Live Chat: Accessible via the logo in the bottom right corner

- Address: Vasileos Georgiou A 89, Office 101, Potamos Germasogeias 4048, Limassol, Cyprus

Global Support: The global website offers a range of contact options, including live chat, callback, and WhatsApp.

Trader Safety

FBS places a strong emphasis on safeguarding client information and privacy. Transactional data is protected using transport layer security (TLS). Moreover, FBS's MetaTrader platforms offer dual-factor authentication during the login process to enhance security.

Pros and Cons

Pros:

- Diverse range of account types, including crypto, cent, and ECN accounts, with competitive spreads as low as 0.7 pips.

- Trusted broker with top-tier licenses, numerous awards, and negative balance protection for EU clients.

- No commissions on deposits or withdrawals, coupled with low minimum deposit requirements, making it accessible for beginners.

- Utilizes NDD technologies for swift order execution within 0.4 seconds, minimizing requotes.

- Comprehensive learning resources, featuring tailored courses, webinars, and trading ideas.

- Accessible trading through MT4 and MT5 platforms, alongside a proprietary app with 24/7 support.

Cons:

- Limited account types available for UK and EU clients.

- Average spreads on some assets.

- Absence of copy trading functionality.

FBS offers a user-friendly platform suitable for both novice and experienced traders, with various account options and comprehensive support. However, it's important to carefully consider your specific trading preferences and requirements before choosing FBS as your broker.

FBS Broker Review

Disclaimer: - We at forexoverflow do not endorse neither refer anyone to trading broker websites. The information is for educational purpose and source of information is from the broker website.

Discussion