Evaluating Currency Strength: Teach Traders How to Assess the Strength of a Currency Relative to Other Currencies Using Economic Data and Indicators

Introduction

In the dynamic world of forex trading, understanding the strength of a currency relative to others is a key aspect that can make or break a trader's success. Evaluating currency strength involves analyzing economic data and using various indicators to gain insights into the market trends. This comprehensive guide will walk you through the essential techniques and strategies for assessing currency strength effectively.

Why Currency Strength Matters?

Before we dive into the nitty-gritty of evaluating currency strength, it's crucial to understand why it matters. The strength of a currency directly impacts international trade, foreign investment, and the overall economic stability of a country. As a trader, knowing which currencies are strong and which ones are weak allows you to make informed decisions and seize profitable opportunities.

Economic Data and Its Significance

· Unraveling Economic Indicators

Economic indicators provide valuable information about a country's economic health. These indicators encompass various aspects such as GDP growth, employment rates, inflation, interest rates, and trade balances. Each indicator affects the currency's strength differently. For example, a higher GDP growth rate often leads to currency appreciation, while rising inflation can have the opposite effect.

· Tracking Interest Rates

Central banks play a pivotal role in determining interest rates, which greatly impact a currency's value. Higher interest rates attract foreign investors seeking better returns, leading to a stronger currency. Conversely, lower interest rates might deter foreign investment, resulting in a weaker currency.

· Analyzing Trade Balances

A country's trade balance, which represents the difference between exports and imports, can significantly influence its currency. A trade surplus indicates strong demand for the country's goods and services, boosting the currency. On the other hand, a trade deficit suggests excessive imports, potentially weakening the currency.

Understanding Currency Indices

· The Power of Currency Indices

Currency indices offer a comprehensive view of a currency's performance against a basket of other currencies. They provide a broader perspective, enabling traders to gauge the overall strength or weakness of a currency. Popular currency indices include the US Dollar Index (DXY), Euro Currency Index (EURX), and more.

· Calculating Currency Indices

Currency indices are typically weighted averages of exchange rates against a group of other currencies. The weighting varies based on trade volumes and economic significance. By calculating these indices, traders can identify trends and make informed decisions.

Key Indicators for Currency Strength Evaluation

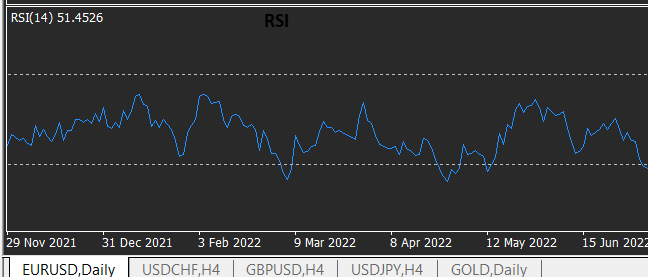

· Relative Strength Index (RSI)

RSI is a momentum oscillator that compares the magnitude of recent gains to recent losses. It helps traders identify overbought or oversold conditions in a currency pair, indicating potential reversals in the market.

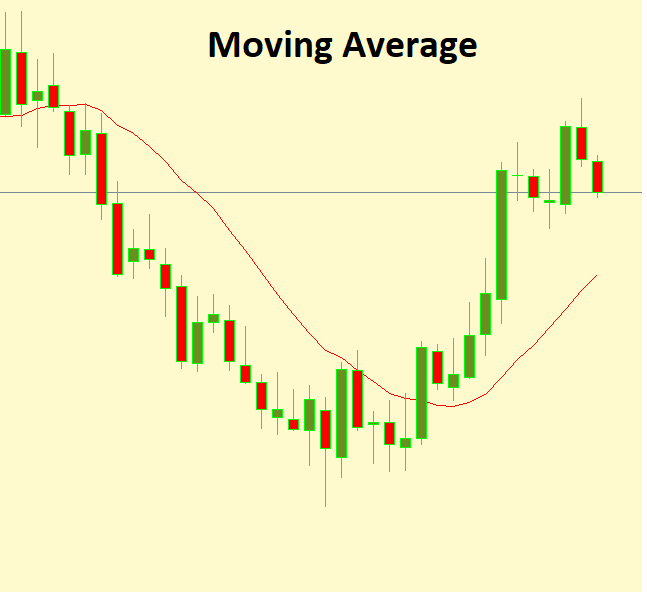

· Moving Averages

Moving averages smooth out price data to identify trends over a specific period. Traders use them to spot changes in currency strength and predict potential entry and exit points.

· Bollinger Bands

Bollinger Bands consist of three lines: a simple moving average and two standard deviation lines. They help traders assess volatility and potential price reversals.

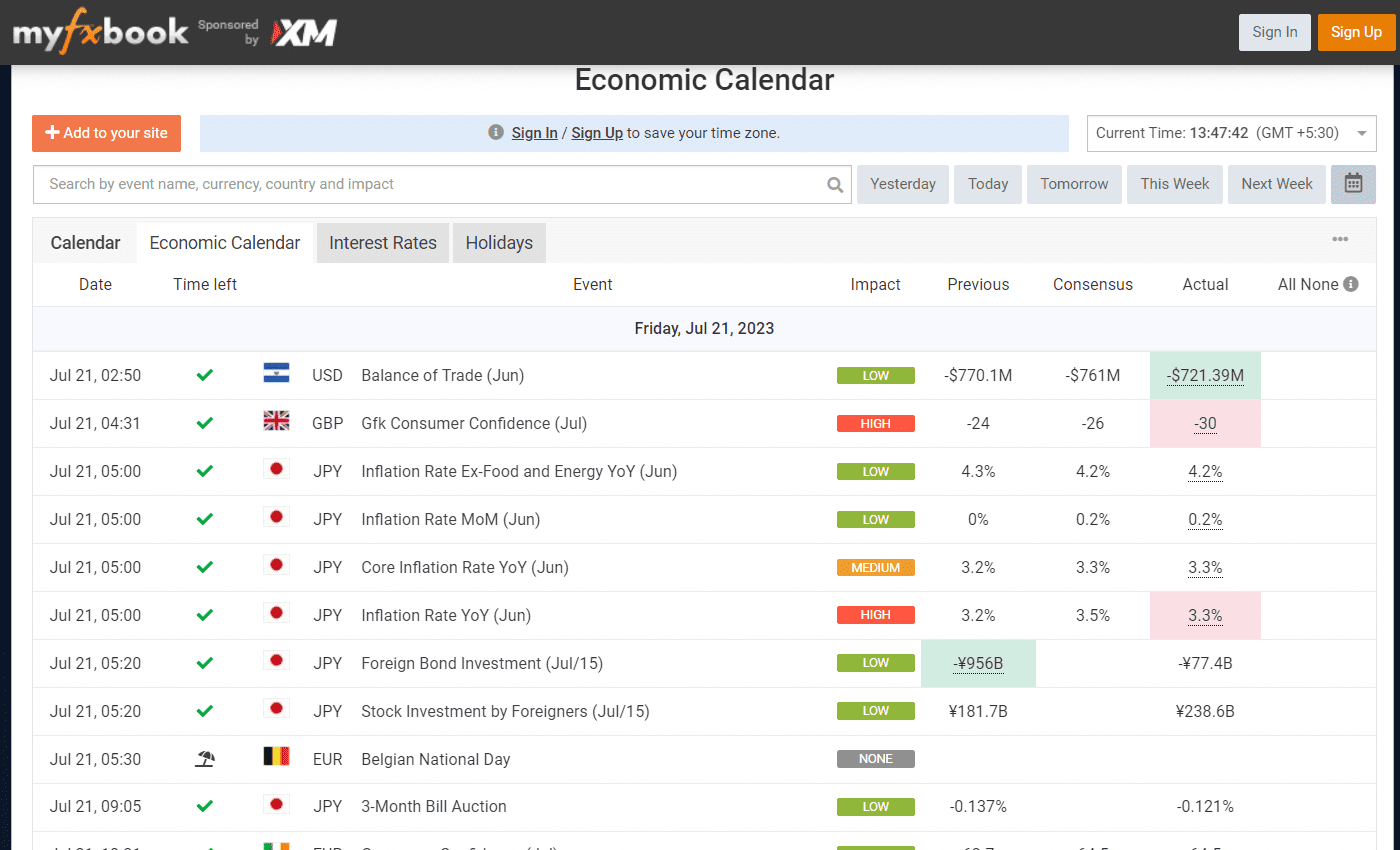

· Economic Calendar

Keeping an eye on economic calendars is essential for traders. Events like central bank announcements, GDP releases, and employment reports can cause significant market movements.

Sources from myfxbook.com

Utilizing Fundamental Analysis

· Digging into Fundamentals

Fundamental analysis involves evaluating economic, social, and political factors that influence currency values. By understanding a country's economic health, fiscal policies, and geopolitical events, traders can predict currency movements.

· Interest Rate Differentials

Interest rate differentials between two countries impact the exchange rate of their currencies. Traders use this information to make carry trade decisions.

· Political Stability and Economic Performance

A stable political environment and strong economic performance attract foreign investors, bolstering the currency's value.

· Risk Appetite

Investor risk appetite affects the demand for safe-haven currencies during times of uncertainty.

Technical Analysis for Currency Evaluation

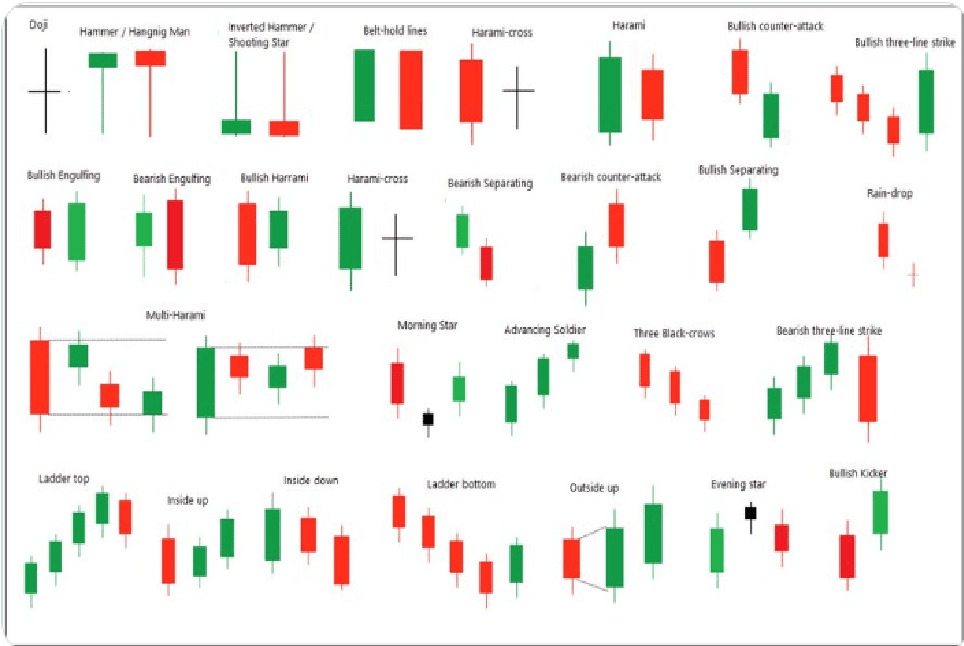

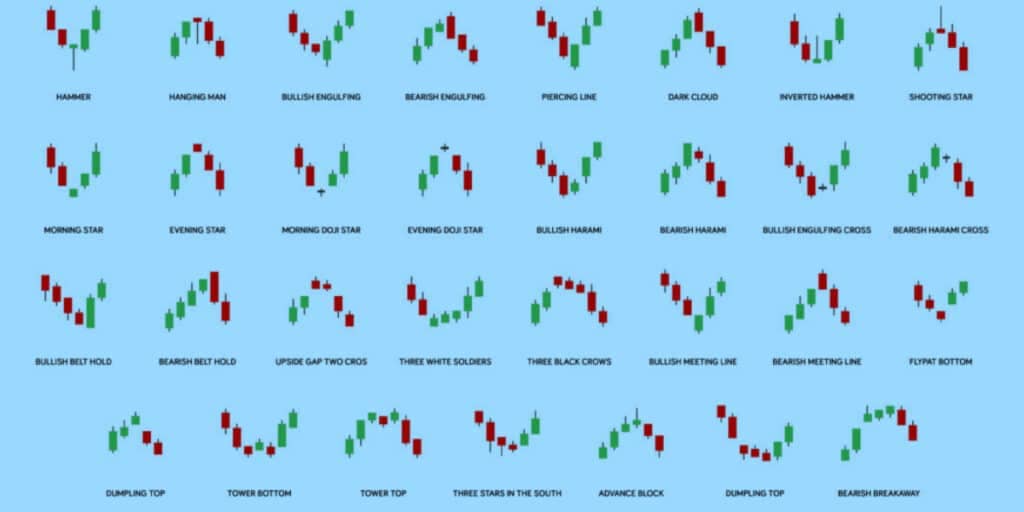

· Candlestick Patterns

Candlestick patterns offer valuable insights into market sentiment and potential trend reversals.

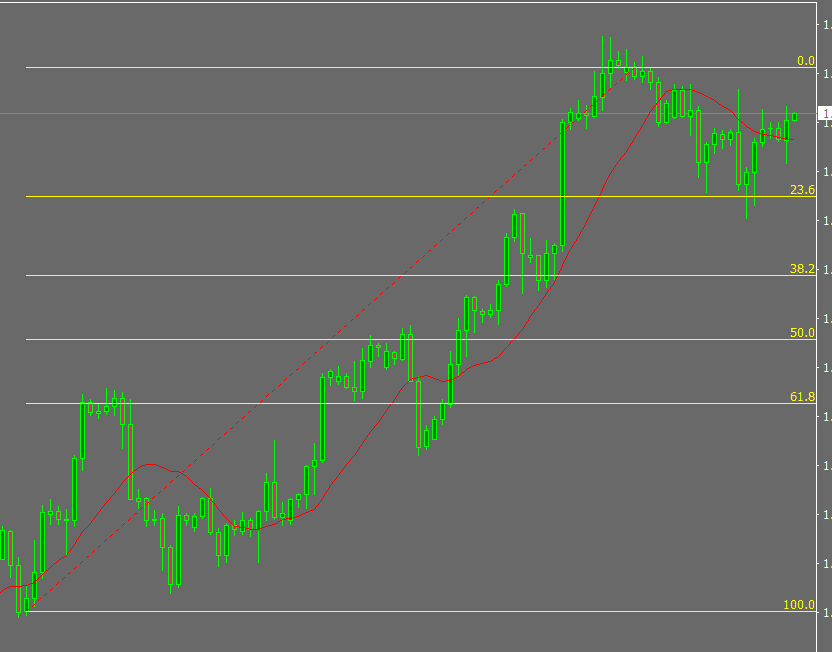

· Fibonacci Retracement

Traders use Fibonacci retracement levels to identify potential support and resistance levels.

· Chart Patterns

Patterns like head and shoulders, double tops, and triangles help traders forecast future price movements.

Risk Management and Currency Evaluation

· Importance of Risk Management

Successful trading requires effective risk management strategies. Understanding currency strength helps traders make calculated risks.

· Position Sizing

Determining the appropriate position size based on currency strength and market conditions helps manage risk.

· Stop-Loss Orders

Placing stop-loss orders helps limit potential losses in volatile markets.

Footnote

In Summary, evaluating currency strength is a fundamental skill for forex traders seeking success in the dynamic global market. By analyzing economic data, utilizing key indicators, conducting fundamental and technical analysis, and implementing robust risk management, traders can make well-informed decisions and maximize their profits.

FAQs

- What is the significance of currency strength in forex trading?

- Currency strength directly impacts international trade, foreign investment, and a country's economic stability, making it crucial for traders to assess and understand.

- How do economic indicators influence currency strength?

- Economic indicators like GDP growth, employment rates, inflation, and interest rates affect currency strength differently, providing valuable insights for traders.

- What are currency indices, and how are they calculated?

- Currency indices offer a broader perspective of a currency's performance against a basket of other currencies and are calculated based on weighted averages of exchange rates.

- Which technical indicators are commonly used to evaluate currency strength?

- Traders often use indicators like RSI, moving averages, Bollinger Bands, and economic calendars to assess currency strength.

- Why is risk management essential in forex trading?

- Effective risk management strategies, including position sizing and stop-loss orders, help traders mitigate potential losses and safeguard their capital.

Discussion